Earnings summaries and quarterly performance for Patria Investments.

Research analysts who have asked questions during Patria Investments earnings calls.

Ricardo Buchpiguel

BTG Pactual

6 questions for PAX

Craig Siegenthaler

Bank of America

4 questions for PAX

Guilherme Grespan

JPMorgan Chase & Co.

3 questions for PAX

William Buonsanti Barranjard

Itaú Corretora de Valores S.A.

3 questions for PAX

Beatriz Bomfim de Abreu

Goldman Sachs Group, Inc.

2 questions for PAX

Carlos Gomez-Lopez

HSBC

2 questions for PAX

Fernanda Sayão

JPMorgan Chase & Co.

2 questions for PAX

Lindsey Shemma

Goldman Sachs

2 questions for PAX

Nicolas Bacellar

BNP Paribas

2 questions for PAX

Tito Labarta

Goldman Sachs

2 questions for PAX

Rodrigo Ferreira

Bank of America

1 question for PAX

William Barranjard

Itaú BBA

1 question for PAX

Recent press releases and 8-K filings for PAX.

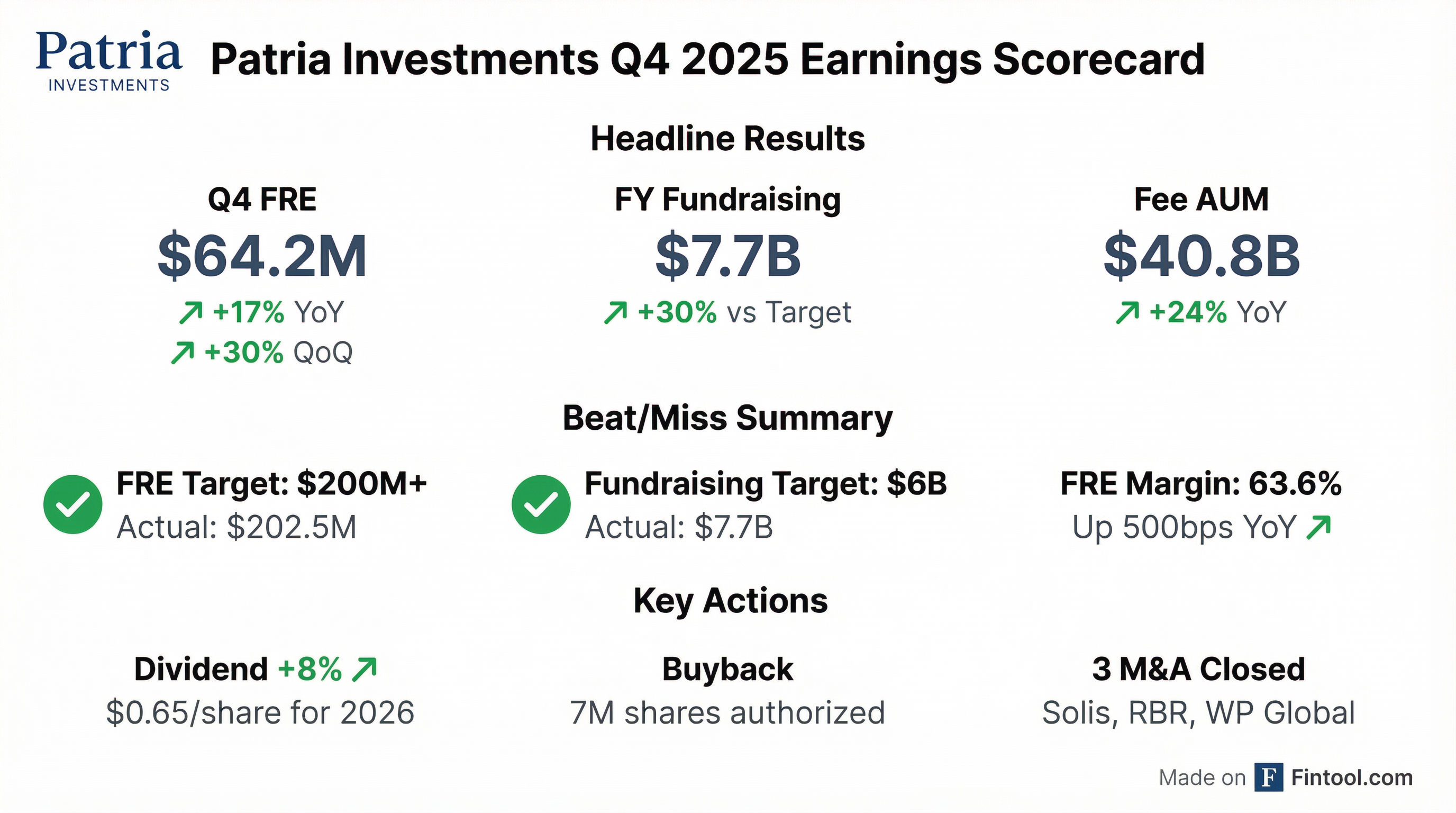

- Patria (PAX) reported record organic fundraising of $7.7 billion for the full year 2025, exceeding its revised target, and achieved $202.5 million in fee-related earnings (FRE), up 19% year-over-year. Distributable earnings per share reached $1.27 for 2025.

- The company announced several strategic acquisitions, including a majority stake in Solis, REITs from RBR, and WP Global Partners, which are expected to significantly increase its pro forma fee earning AUM to approximately $47.4 billion at year-end 2025.

- PAX provided a positive outlook, maintaining its 2026 FRE target of $225 million-$245 million and 2027 target of $260 million-$290 million, alongside unchanged fundraising targets of $7 billion for 2026 and $8 billion for 2027.

- Capital management initiatives include an increase in the fixed dividend policy to $0.65 per share for 2026 and the approval of an additional 3 million share buyback program, bringing the total potential repurchase to 7 million shares.

- Patria (PAX) reported strong financial results for Q4 and full-year 2025, with organic fundraising of $7.7 billion for the full year, exceeding its revised target, and fee-related earnings of $202.5 million, up 19% year-over-year.

- The company's fee earning AUM reached $41 billion as of Q4 2025, with pro forma fee earning AUM of approximately $47.4 billion after recently announced acquisitions.

- PAX announced several strategic acquisitions, including a 51% stake in Solis, the acquisition of REITs from RBR, and an agreement to acquire WP Global Partners, significantly expanding its private credit, real estate, and global private markets solutions capabilities.

- Patria provided 2026 fee-related earnings guidance of $225 million-$245 million and increased its 2026 dividend to $0.65 per share.

- The board approved an additional 3 million share buyback program, bringing the total available for repurchase to 7 million shares, and CFO Ana Russo will be stepping down by the end of April 2026.

- Patria reported record organic fundraising of $7.7 billion for full-year 2025 and $1.7 billion in Q4 2025, exceeding its target. Fee-related earnings (FRE) reached $202.5 million in 2025, up 19% year-over-year, meeting the $200 million+ objective, and total fee earning AUM grew to $41 billion as of Q4 2025, with pro forma AUM of approximately $47.4 billion including announced acquisitions.

- The company announced several strategic acquisitions, including a 51% stake in Solis (Brazilian private credit manager), the purchase of REITs from RBR (Brazilian real estate), and an agreement to acquire WP Global Partners (U.S.-based private equity solutions manager), significantly expanding its capabilities and fee earning AUM.

- Patria provided 2026 FRE guidance of $225 million-$245 million and 2027 FRE guidance of $260 million-$290 million, projecting a share count of around 158-160 million shares for these periods.

- The board approved an additional 3 million share buyback program, and Patria Partners intends to purchase up to 2.5 million PAX shares, allowing for a total potential purchase of up to 7 million shares. Additionally, the company increased its dividend by $0.05 per share for 2026, targeting an expected payment of $100 million.

- Patria Investments Limited reported net income attributable to Patria of $34.5 million for Q4 2025 and $85.6 million for the full year 2025.

- Fee Related Earnings (FRE) increased 17% year-over-year to $64.3 million in Q4 2025 and 19% to $202.5 million for the full year 2025.

- Fee Earning Assets Under Management (FEAUM) grew 24% to $40.8 billion by year-end 2025, with organic fundraising reaching a record $7.7 billion for the year.

- The company announced three acquisitions, including a 51% stake in Solis, Brazilian REIT manager RBR, and the pending acquisition of WP Global Partners, collectively adding $6.6 billion in FEAUM.

- Patria declared a quarterly dividend of $0.15 per share, payable on March 12, 2026.

- Patria Investments reported Fee Related Earnings of $202.5 million for the full year 2025, a 19% year-over-year increase, and $64.3 million for Q4 2025, up 17% from Q4 2024.

- The company achieved record organic fundraising of $7.7 billion for the full year 2025, with Fee Earning Assets Under Management (FEAUM) reaching $40.8 billion, a 24% increase compared to year-end 2024.

- Patria announced three acquisitions: a 51% stake in Solis (adding $3.5 billion FEAUM), Brazilian REIT manager RBR (adding $1.3 billion permanent capital), and the pending acquisition of WP Global Partners (adding $1.8 billion FEAUM).

- A quarterly dividend of $0.15 per share was declared, payable on March 12th, 2026.

- Patria Investments Limited (PAX) announced an agreement to acquire WP Global Partners, a U.S. based private equity solutions manager focused on the lower-middle-market.

- The acquisition is expected to increase Patria's pro-forma Global Private Markets Solutions (GMPS) Fee Earning Assets under Management (FEAUM) to over $13.3 billion as of Q3 2025, with WP contributing approximately US$1.8 billion.

- The transaction involves an all-cash base price equivalent to 1.7% of FEAUM and an all-cash earn-out in 2029, and is anticipated to be accretive to both FRE and DE in the first year.

- This strategic move strengthens Patria's U.S. presence and capabilities in middle-market private equity, aligning with its global diversification strategy.

- Patria Investments Limited (PAX) announced an agreement to acquire WP Global Partners, a U.S. based private equity solutions manager focused on the lower-middle-market.

- The acquisition is expected to strengthen Patria’s local presence and investment capacity in North America, enhancing its middle-market primaries and co-investment private equity capabilities in the U.S..

- Pro-forma for the transaction, Patria’s Global Private Markets Solutions (GMPS) Fee Earning Assets under Management (FEAUM) will be more than $13.3 billion as of 3Q25, with WP contributing approximately US$1.8 billion of FEAUM.

- The transaction involves an all-cash base price equivalent to 1.7% of FEAUM and an all-cash earn-out in 2029, and is expected to be accretive to both FRE and DE in the first year.

- Latin America is characterized by a $7.3 trillion economy as of 2024, with 662 million people, and a unique combination of robust domestic markets (nearly half of the population is middle class) and rich natural resources, attracting 14% of global net Foreign Direct Investment (FDI).

- The region is experiencing a political shift towards market-friendly administrations, which is expected to drive economic growth, fight inflation, and accelerate private investment, impacting asset performance positively.

- Capital markets in Latin America are deepening, with increasing interest in alternative assets from both institutional and individual investors, supported by pension reforms and regulatory changes.

- Significant infrastructure investment opportunities are available in Latin America, with over $100 billion in equity checks projected for 2026-2030 in areas like power, logistics, transportation, digital/tech services (data centers), and sanitation.

- Global investors, including those from Asia and North America, are showing increased interest in Latin America, driven by factors such as U.S. dollar depreciation and the region's strong performance in 2025, with listed equities returning 54.8% and corporate bonds 33.6%.

- Latin America's economy reached $7.3 trillion in 2024, with 14% of global net FDI and nearly half of its 662 million people classified as middle class, indicating robust domestic markets and a welcoming environment for long-term foreign direct investment.

- The region is experiencing a political shift towards market-friendly administrations, which has contributed to Latin American listed equities returning 54.8% and corporate bonds returning 33.6% last year, significantly outperforming US markets.

- Capital markets are deepening, with increasing demand for alternative investments like private equity, infrastructure, and structured credit, driven by regulatory changes, pension reforms, and global investors seeking diversification from high US dollar exposure.

- Significant infrastructure investment opportunities exist, including over $100 billion in equity checks for actionable theses from 2026 to 2030 in areas like power generation, logistics, and data centers, with strong demand from both local economies and global hyperscalers.

- Latin America's economy reached $7.3 trillion GDP in 2024, representing 7% of global GDP and 14% of global net FDI, with projected GDP growth close to 3% in 2026-2027. The region is characterized by robust domestic markets and rich natural resources.

- A wave of market-friendly administrations is emerging across Latin America, contributing to significant asset appreciation, with listed equities returning 54.8% in USD and corporate bonds returning 33.6% last year, outperforming US markets.

- The region is experiencing a deepening of capital markets, driven by pension reforms and regulatory changes, leading to increased demand for alternative assets like private equity, infrastructure, and structural credit, which is an under-penetrated asset class in Latin America.

- Significant infrastructure investment opportunities exist, particularly in Brazil's privatization and concession programs, offering over $100 billion in equity checks for 2026-2030, and strong demand for data centers, which Patria is actively developing.

Quarterly earnings call transcripts for Patria Investments.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more