Earnings summaries and quarterly performance for QIAGEN.

Research analysts who have asked questions during QIAGEN earnings calls.

Casey Woodring

JPMorgan Chase & Co.

6 questions for QGEN

Michael Ryskin

Bank of America Merrill Lynch

6 questions for QGEN

Tycho Peterson

Jefferies

5 questions for QGEN

Aisyah Noor

Morgan Stanley

4 questions for QGEN

Doug Schenkel

Wolfe Research LLC

4 questions for QGEN

Jack Meehan

Nephron Research LLC

4 questions for QGEN

Daniel Brennan

TD Cowen

3 questions for QGEN

Harry Gillis

Berenberg

3 questions for QGEN

Matthew Sykes

Goldman Sachs Group Inc.

3 questions for QGEN

Odysseas Manesiotis

Berenberg

3 questions for QGEN

Patrick Donnelly

Citi

3 questions for QGEN

Dan Brennan

UBS

2 questions for QGEN

Douglas Schenkel

Wolfe Research, LLC

2 questions for QGEN

Hugo Solvet

BNP Paribas

2 questions for QGEN

Jan Koch

Deutsche Bank AG

2 questions for QGEN

Kavya Deshpande

UBS

2 questions for QGEN

Andrew Brackmann

William Blair & Company, L.L.C.

1 question for QGEN

Catherine Schulte

Baird

1 question for QGEN

Daniel Arias

Stifel, Nicolaus & Company, Incorporated

1 question for QGEN

Daniel Leonard

Stifel Financial Corp.

1 question for QGEN

Dan Leonard

UBS Group AG

1 question for QGEN

Salem Salem

Barclays

1 question for QGEN

Recent press releases and 8-K filings for QGEN.

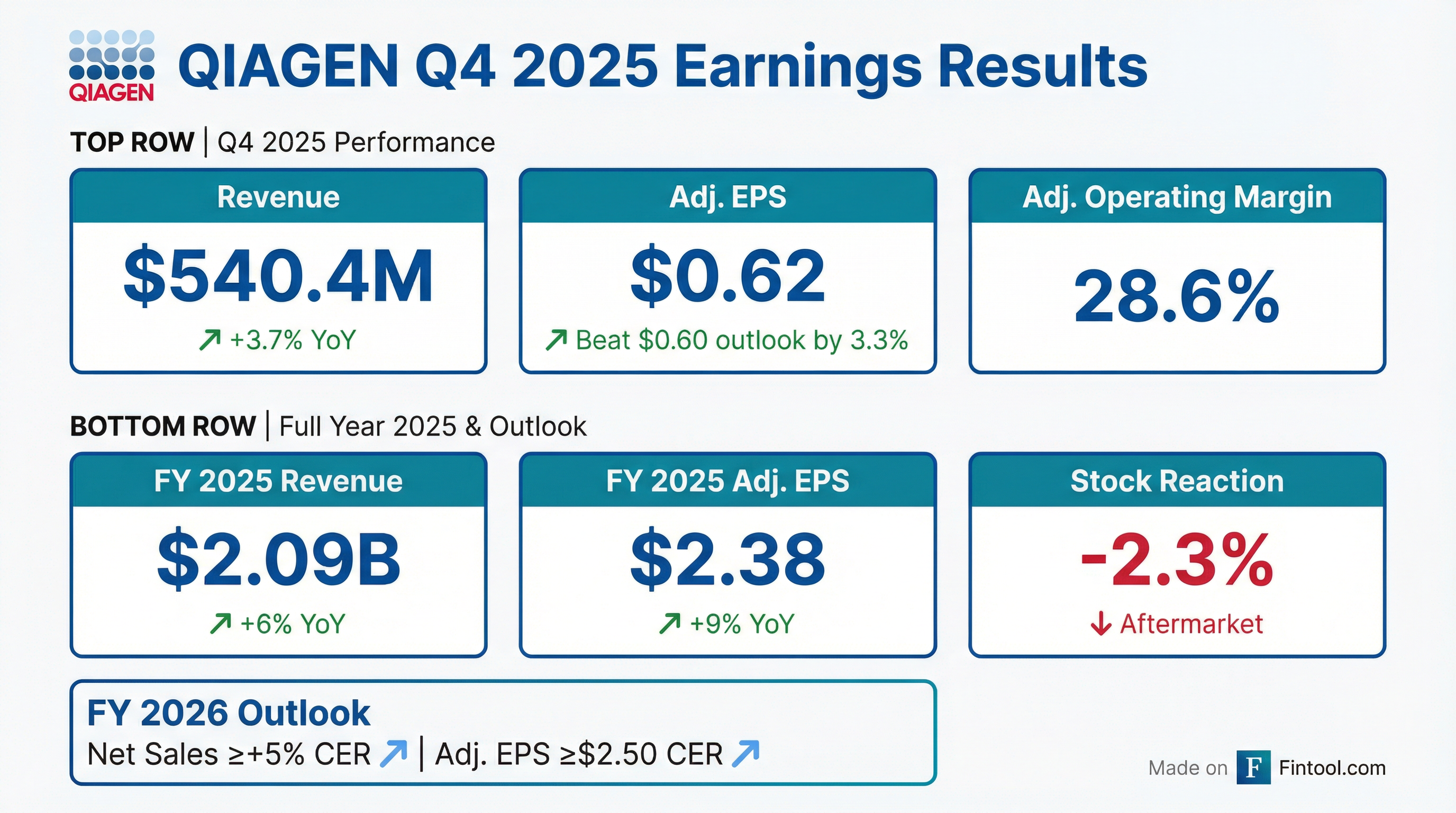

- QIAGEN N.V. exceeded its Q4 2025 outlook, reporting net sales of $540 million (+1% at constant exchange rates (CER)) and adjusted diluted EPS of $0.62. For the full year 2025, net sales reached $2.09 billion (+5% CER) and adjusted diluted EPS was $2.40 CER, both at the high end or ahead of outlook.

- In 2025, growth pillars contributed $1.49 billion CER in sales, achieving 8% CER growth, and the adjusted operating income margin rose 80 basis points to 29.5%.

- For 2026, QIAGEN expects net sales growth of at least 5% CER and adjusted diluted EPS of at least $2.50 CER, with growth pillars projected to contribute approximately $1.64 billion CER.

- The company returned over $1.1 billion to shareholders to date, including a $500 million synthetic share repurchase in January 2026, and completed the Parse acquisition in December 2025.

- QIAGEN reported Q4 2025 net sales of $540 million and adjusted diluted EPS of $0.62, with full-year 2025 net sales reaching $2.090 billion and adjusted diluted EPS at $2.38.

- The company achieved +1% CER growth in Q4 2025 and +5% CER growth for FY 2025, alongside an improved FY 2025 adjusted operating income margin of 29.5%.

- For 2026, QIAGEN anticipates net sales growth of at least +5% CER and adjusted diluted EPS of at least $2.50 CER.

- Key developments included the acquisition of Parse to expand Sample technologies into single-cell workflows, +5% CER growth for QuantiFERON in Q4 2025, and +15% CER growth for QIAstat-Dx in Q4 2025.

- QIAGEN generated $654 million in operating cash flow for FY 2025.

- QIAGEN exceeded its Q4 2025 outlook, reporting net sales of $540 million (up 1% CER) and adjusted diluted EPS of $0.62 at CER. For the full year 2025, net sales reached $2.09 billion (up 5% CER) and adjusted diluted EPS was $2.40 at CER.

- The company's growth pillars (Sample Technologies, QuantiFERON, QIAstat-Dx, QIAcuity, and QIAGEN Digital Insights) achieved $1.49 billion in combined sales at CER in 2025, growing 8% at CER, and are projected to reach at least $2 billion by 2028.

- For the full year 2026, QIAGEN initiated an outlook for sales growth of at least 5% CER and adjusted EPS of at least $2.50 at CER. The adjusted operating income margin increased 80 basis points to 29.5% in 2025 and is expected to remain around this level in 2026, despite headwinds.

- QIAGEN generated $453 million in free cash flow in 2025 and has returned over $1.1 billion to shareholders since 2024, while also completing the acquisition of Parse Biosciences in December 2025.

- QIAGEN delivered a solid finish to 2025, with net sales of $540 million in Q4 2025, growing 1% at constant exchange rate (CER), and $2.09 billion for the full year, up 5% at CER. Adjusted diluted EPS was $0.62 in Q4 and $2.40 for the full year, both at CER.

- The company's growth pillars achieved combined sales of $1.49 billion at CER in 2025, delivering 8% growth at CER, and are on track for at least $2 billion by 2028. For 2026, these pillars are targeting around 9% growth at CER, with specific sales targets including Sample technologies at approximately $720 million and QuantiFERON at approximately $535 million.

- For the full year 2026, QIAGEN initiated an outlook for sales growth of at least 5% CER and adjusted EPS of at least $2.50 CER. The adjusted operating income margin is expected to remain at about 29.5% in 2026.

- QIAGEN generated $453 million in free cash flow in 2025 and has returned more than $1.1 billion to shareholders since 2024, including completing a $500 million share repurchase at the beginning of 2026 and introducing an annual dividend payment.

- Strategic acquisitions in 2025 included Parse Biosciences, extending Sample technologies into single-cell analysis, and Genoox, strengthening QIAGEN Digital Insights' clinical interpretation offering.

- QIAGEN reported Q4 2025 net sales of $540 million, an increase of 1% at CER, and adjusted diluted EPS of $0.62 at CER, both exceeding its outlook. For the full year 2025, net sales reached $2.09 billion, up 5% at CER, and adjusted diluted EPS was $2.40 at CER.

- The company's adjusted operating income margin increased 80 basis points to 29.5% in 2025 compared to 2024, and it generated $453 million in free cash flow.

- QIAGEN's growth pillars (Sample Technologies, QuantiFERON, QIAstat-Dx, QIAcuity, and QIAGEN Digital Insights) achieved combined sales of $1.49 billion at CER in 2025, growing 8% at CER, and are on track to reach at least $2 billion by 2028.

- For full-year 2026, QIAGEN initiated an outlook for sales growth of at least 5 percentage points CER and adjusted EPS of at least $2.50 at CER.

- QIAGEN has returned more than $1.1 billion to shareholders since 2024, including a $500 million share repurchase completed at the beginning of 2026, and welcomed Mark Stevenson to its supervisory board in January.

- QIAGEN has set priorities for 2026, including new product launches and regulatory milestones, to support its goal of achieving at least $2 billion in total annual sales by 2028 across its five growth drivers.

- The acquisition of Parse Biosciences in December 2025 is projected to contribute approximately $40 million in revenue in 2026, expanding QIAGEN's sample technologies into single-cell analysis.

- For 2026, QIAGEN plans to introduce three new sample preparation systems (QIAsymphony Connect, QIAsprint Connect, and QIAmini) and expand the QIAstat-Dx menu with new blood culture identification panels submitted for regulatory approval.

- By the end of 2025, the company had installed over 5,200 QIAstat-Dx devices and over 3,200 QIAcuity digital PCR systems worldwide, strengthening its installed base for recurring consumables and software revenue.

- QIAGEN Digital Insights (QDI) aims to introduce at least 14 AI-enabled software solutions by 2028, with new AI functionalities for pharmaceutical R&D and clinical reporting planned for 2026.

- QIAGEN expects 5%-6% core growth (CER) and $2.38 EPS for full year 2025, and anticipates 5%-7% revenue growth in 2026, including $40 million from the Parse Biosciences acquisition.

- The company is on track to achieve its 2028 targets, including 7% CAGR sales growth, 31% EBIT margin (with potential to exceed), and at least $1 billion in capital returns to shareholders.

- QIAGEN is launching three new sample technology instruments in 2026, and continues to see double-digit growth in QuantiFERON and QIAcuity (digital PCR), with QIAstat-Dx maintaining a solid number two position in syndromic testing.

- Recent strategic acquisitions include Parse Biosciences (December) and Genoox (summer 2025), complementing its focus on bolt-on M&A, alongside an active share repurchase program and a new recurring dividend policy.

- QIAGEN's CEO expressed confidence in the company's Q4 and full year 2025 performance, aligning with guidance of 5% to 6% core growth (CER) and $2.38 EPS.

- For 2026, QIAGEN anticipates 5%-7% revenue growth, which includes approximately $40 million from the Parse Biosciences acquisition. The company expects a more favorable market environment, with capital expenditures improving in the second half of the year.

- The company is launching three new instruments in sample technology in 2026 (QIAsymphony Connect, QIAsprint Connect, QIAmini). Key growth pillars like QuantiFERON, QIAcuity, and QIAstat-Dx are projected to maintain double-digit growth.

- QIAGEN recently completed the acquisitions of Parse Biosciences and Genoox. The company has exceeded its commitment to return at least $1 billion to shareholders by 2028, including a recent $500 million share buyback and the introduction of a recurring dividend policy.

- QIAGEN expects to achieve its 2025 guidance of 5%-6% core growth (CER) and $2.38 EPS, and anticipates 5%-7% revenue growth in 2026, with Parse Biosciences contributing $40 million. The company also reiterated its 2028 targets of 7% CAGR, $2.6 billion in total revenues, and an EBIT margin of at least 31%.

- The company continues its capital allocation strategy, recently completing a $500 million share buyback and returning another $500 million to shareholders in January, alongside a recurring dividend policy introduced in 2025.

- Strategic acquisitions in 2025 included Parse Biosciences and Genoox, aimed at enhancing sample technology and bioinformatics portfolios. Additionally, QIAGEN plans to launch three new sample technology instruments in 2026: QIAsymphony Connect, QIAsprint Connect, and QIAmini.

- QIAGEN announced details for the completion of its synthetic share repurchase of approximately $500 million, which is expected to conclude on or around January 7, 2026.

- This program combines an immediate capital return with a reverse stock split, aiming to increase earnings per share (EPS) and reduce outstanding shares by approximately 5%.

- The share consolidation will convert 20 existing QIAGEN shares into 19 new QIAGEN shares, leading to a reduction of about 10.9 million shares from the 217.7 million outstanding as of December 18, 2025, and a capital repayment of $2.29 per pre-split share.

- With this completion, QIAGEN will fulfill its commitment to return $1 billion to shareholders by the end of 2028 significantly earlier than planned.

Quarterly earnings call transcripts for QIAGEN.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more