Earnings summaries and quarterly performance for QIAGEN.

Research analysts who have asked questions during QIAGEN earnings calls.

Casey Woodring

JPMorgan Chase & Co.

6 questions for QGEN

Michael Ryskin

Bank of America Merrill Lynch

6 questions for QGEN

Tycho Peterson

Jefferies

5 questions for QGEN

Aisyah Noor

Morgan Stanley

4 questions for QGEN

Doug Schenkel

Wolfe Research LLC

4 questions for QGEN

Jack Meehan

Nephron Research LLC

4 questions for QGEN

Daniel Brennan

TD Cowen

3 questions for QGEN

Harry Gillis

Berenberg

3 questions for QGEN

Matthew Sykes

Goldman Sachs Group Inc.

3 questions for QGEN

Odysseas Manesiotis

Berenberg

3 questions for QGEN

Patrick Donnelly

Citi

3 questions for QGEN

Dan Brennan

UBS

2 questions for QGEN

Douglas Schenkel

Wolfe Research, LLC

2 questions for QGEN

Hugo Solvet

BNP Paribas

2 questions for QGEN

Jan Koch

Deutsche Bank AG

2 questions for QGEN

Kavya Deshpande

UBS

2 questions for QGEN

Andrew Brackmann

William Blair & Company, L.L.C.

1 question for QGEN

Catherine Schulte

Baird

1 question for QGEN

Daniel Arias

Stifel, Nicolaus & Company, Incorporated

1 question for QGEN

Daniel Leonard

Stifel Financial Corp.

1 question for QGEN

Dan Leonard

UBS Group AG

1 question for QGEN

Salem Salem

Barclays

1 question for QGEN

Recent press releases and 8-K filings for QGEN.

- QIAGEN is undergoing a CEO transition, with an announcement for a new CEO expected in Q2 2026. Concurrently, the board is reviewing strategic alternatives, including organic growth, bolt-on acquisitions, or a potential transaction to enhance shareholder value, and has hired advisors.

- The company maintains its full-year goal of 5% growth rate despite ongoing macro challenges, particularly affecting mid- and long-term investments in automation. QIAGEN anticipates growth acceleration in the second half of 2026, driven by the fading impact of NeuMoDx and QIAstat-Dx discontinuation (adding 200 basis points) and new product launches (adding 150 basis points from sample prep and 50 basis points from other launches).

- QIAGEN has launched new sample prep instruments, including the QIAsymphony Connect (for liquid biopsy with 30% more capacity) and QIAsprint Connect (high-throughput for research, expected to have the largest financial impact on sample prep), with the QIAmini expected by year-end for 2027 revenue contribution. Sample prep is projected to grow 9-10% this year (including $40 million from Parse acquisition) and is a highly profitable segment.

- The company aims for a 31% adjusted EBIT margin by 2028, driven by gross margin improvement from consumable growth and 40 QIA efficiency initiatives. However, the Parse acquisition is currently dilutive (Q1 dilution of $0.02) as QIAGEN is doubling down on R&D in this high-growth single-cell research market.

- QIAGEN is currently in the middle of a CEO search, with an announcement anticipated in Q2. The board is also actively reviewing all strategic alternatives, including organic growth, bolt-on acquisitions, and potential transactions to create additional shareholder value, and has engaged advisors to assist in this process.

- The company maintains a full-year growth rate goal of 5% despite ongoing macro challenges, particularly affecting automation sales. An acceleration in the second half of the year is expected due to the fading impact of NeuMoDx and QIAstat-Dx discontinuations, and contributions from new product launches.

- QIAGEN has launched QIAsymphony Connect for liquid biopsy and clinical applications, and QIAsprint Connect for high-throughput research, with QIAmini expected to launch by year-end to automate manual work. These new instruments are projected to significantly impact sample prep growth and profitability.

- The recent Parse acquisition is performing well in the single-cell research market, though it is dilutive in Q1 due to increased R&D investment. QIAGEN has a midterm target of achieving a 31% adjusted EBIT margin by 2028, driven by expected gross margin improvements and various efficiency initiatives.

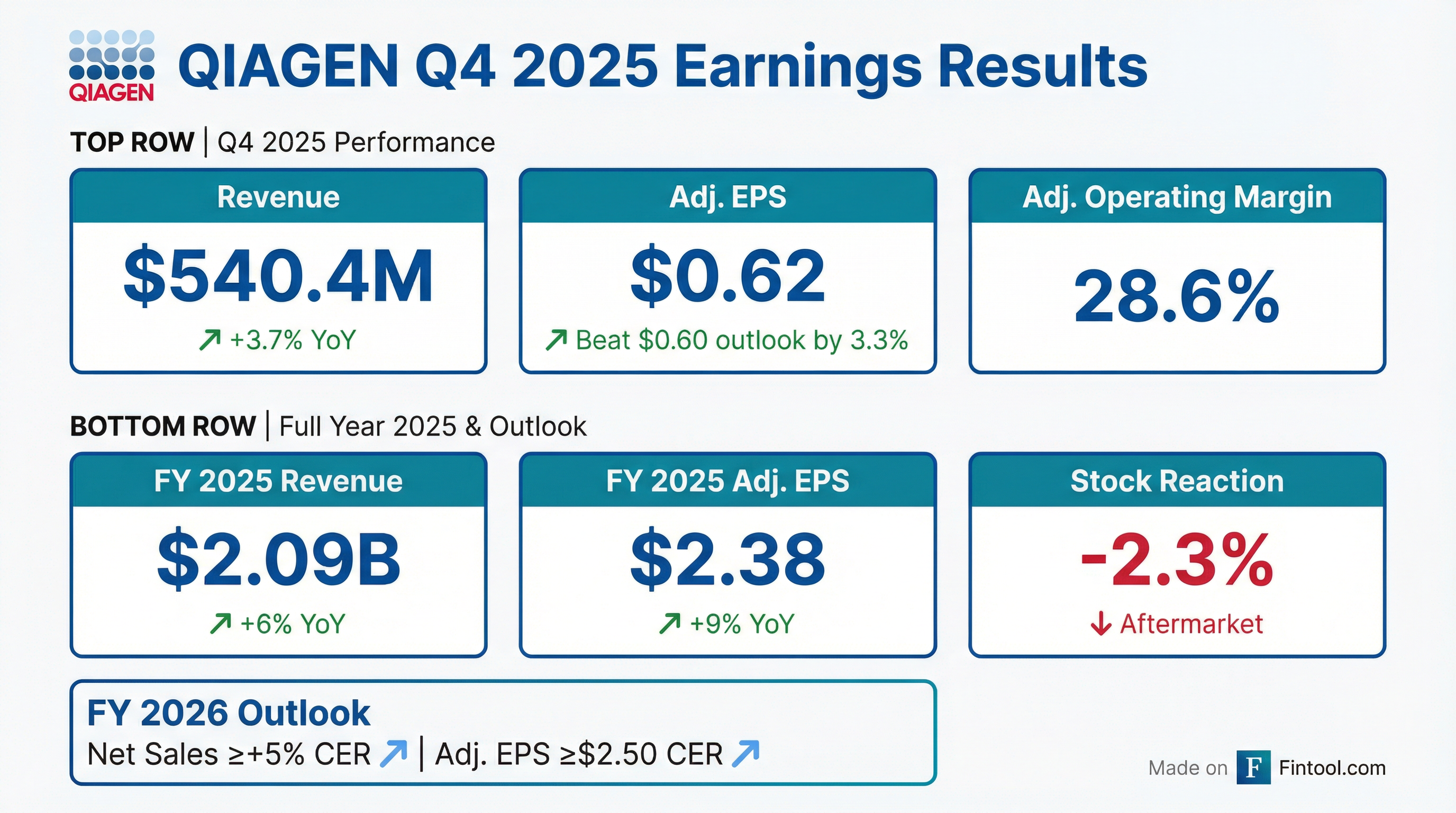

- QIAGEN reported FY 2025 net sales of $2.090 billion (+$5% CER growth) and adjusted diluted EPS of $2.38 ($2.40 CER), meeting or exceeding its outlook.

- For Q4 2025, net sales were $540 million (+$1% CER growth) and adjusted diluted EPS was $0.62 ($0.62 CER), exceeding the outlook.

- The company provided a 2026 outlook for net sales growth of ≥+5% CER and adjusted diluted EPS of ≥$2.50 CER.

- QIAGEN reaffirmed its 2028 targets, aiming for ≥$2 billion CER sales from growth pillars, a ~7% net sales CER CAGR (2024-2028), and ≥31% adjusted operating income margin CER.

- Key developments included the launch of the next-generation LIAISON QuantiFERON-TB Gold Plus II in the EU and the launch of QIAsymphony Connect.

- QIAGEN is undergoing a CEO transition, with an announcement anticipated in Q2, and the board is actively reviewing all strategic alternatives, including potential acquisition opportunities.

- The company targets a 5% growth rate for the full year 2026, anticipating 200 basis points more growth in the second half as headwinds from discontinued products subside.

- Recent product launches, such as QIAsymphony and QIAsprint, are expected to significantly contribute to revenue, with sample prep projected to grow 9-10% this year, including $40 million from the Parse acquisition.

- QIAGEN aims for a 31% adjusted EBIT margin by 2028, driven by expected gross margin improvements from consumable growth, QIAstat, and various efficiency initiatives.

- Investment in the Parse acquisition will lead to doubled R&D efforts and a flat adjusted operating income margin in 2026, with a $0.02 dilution in Q1.

- QIAGEN is exploring strategic options, including potential M&A with larger companies, during a CEO transition period, with a new CEO expected to be announced in Q2 2026.

- The company projects 1% organic growth in Q1 2026 and 5% for the full year 2026, driven by the discontinuation of certain businesses, new product launches, and accelerated growth from the Parse acquisition, which is expected to generate at least $40 million in 2026.

- QIAGEN is launching three new instrumentation platforms in 2026: QIAsymphony Connect (mid-2026), QIAsprint Connect (recently launched), and QIAmini (Fall 2026). The company also noted that the NIH budget is growing 1%, and its consumable business remains resilient despite some confidence issues in the U.S. academic instrumentation market.

- Following a $500 million share buyback completed in January, QIAGEN plans to propose another share buyback and an increased dividend at its upcoming annual general meeting.

- QIAGEN is open to discussions regarding strategic options, including potential combinations with larger companies, to create shareholder value, with a new CEO expected to be announced in Q2 2026.

- The company forecasts 1% organic growth in Q1 2026 and 5% for the full year 2026, anticipating a significant second-half ramp driven by the discontinuation of headwinds from two businesses, new product launches, and the Parse acquisition.

- New instrumentation platforms, including QIAsymphony Connect, QIAsprint Connect, and QIAmini, are launching in 2026, while the Parse acquisition is expected to generate at least $40 million in 2026 and become margin accretive next year.

- QIAGEN recently completed a $500 million share buyback in January and plans to propose another share buyback and an increase in dividend payment at the upcoming annual general meeting.

- QIAGEN is open to discussions regarding strategic options and anticipates announcing a new CEO in the second quarter of 2026.

- The company projects 1% organic growth in Q1 2026 and 5% for the full year, with a significant second-half ramp driven by new product launches, the discontinuation of two businesses, and the Parse acquisition.

- QIAGEN completed a $500 million share buyback in January and plans to propose another share buyback and an increase in dividend payment at the upcoming annual general meeting.

- The Parse acquisition is expected to generate over $40 million in revenue for 2026, an increase from $20 million in 2024, and is projected to become margin accretive by next year despite a $0.02 dilution in Q1 2026 due to R&D investments.

- QIAGEN's CEO, Thierry Bernard, announced that the board is in the final steps of the CEO search process, with an announcement expected in Q2 2026 and a new CEO on board by the end of Q2 2026.

- The company is actively reviewing strategic alternatives to enhance shareholder value, working with advisors Moelis and Goldman Sachs, a process that runs in parallel with the CEO search.

- QIAGEN is focused on increasing profitability, aiming for a 30% EBIT margin, and is executing on 7% sales growth and over 31% operating margin, having already returned over $1 billion to shareholders.

- The company anticipates stronger growth in H2 2026 compared to H1, driven by new product launches in Sample technologies (expected to generate $15 million in sales from new launches), new panels for QIAstat, new assays for QIAcuity, and the Parse acquisition (expected to contribute over $40 million in revenues).

- QIAGEN's board and management are in the final steps of selecting a new CEO, with an announcement anticipated in Q2 2026 and the new leader expected to be on board by the end of Q2.

- The company is actively reviewing strategic alternatives to enhance shareholder value, working with advisors Moelis and Goldman Sachs, a process running in parallel with the CEO search.

- Management expects stronger growth in the second half of 2026 compared to the first half, driven by new product launches in Sample technologies (expected $15 million in sales), the Parse acquisition (projected over $40 million in revenues for 2026), and favorable base effects.

- QIAGEN is executing on its Capital Markets Day targets, including 7% sales growth and an operating margin of 31% or above, while also returning over $1.1 billion to shareholders through buybacks and dividends.

- QIAGEN N.V. exceeded its Q4 2025 outlook, reporting net sales of $540 million (+1% at constant exchange rates (CER)) and adjusted diluted EPS of $0.62. For the full year 2025, net sales reached $2.09 billion (+5% CER) and adjusted diluted EPS was $2.40 CER, both at the high end or ahead of outlook.

- In 2025, growth pillars contributed $1.49 billion CER in sales, achieving 8% CER growth, and the adjusted operating income margin rose 80 basis points to 29.5%.

- For 2026, QIAGEN expects net sales growth of at least 5% CER and adjusted diluted EPS of at least $2.50 CER, with growth pillars projected to contribute approximately $1.64 billion CER.

- The company returned over $1.1 billion to shareholders to date, including a $500 million synthetic share repurchase in January 2026, and completed the Parse acquisition in December 2025.

Quarterly earnings call transcripts for QIAGEN.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more