Earnings summaries and quarterly performance for StoneX Group.

Executive leadership at StoneX Group.

Philip Smith

Chief Executive Officer

Aaron Schroeder

Chief Accounting Officer

Abbey Perkins

Chief Information Officer

Charles Lyon

President

Diego Rotsztain

Chief Governance and Legal Officer

Mark Maurer

Chief Risk Officer

Stuart Davison

Chief Operating Officer

William Dunaway

Chief Financial Officer

Board of directors at StoneX Group.

Research analysts who have asked questions during StoneX Group earnings calls.

Daniel Fannon

Jefferies Financial Group Inc.

5 questions for SNEX

Dan Fannon

Jefferies & Company Inc.

3 questions for SNEX

Jeff Schmitt

William Blair & Company, L.L.C.

3 questions for SNEX

Lukas Jaeger

Liberty One Investment Management

2 questions for SNEX

Jeffrey Schmitt

William Blair

1 question for SNEX

Recent press releases and 8-K filings for SNEX.

- StoneX Digital, a division of StoneX Group Inc. (NASDAQ: SNEX), has launched a digital asset lending capability as of February 26, 2026.

- This new capability expands the firm's existing brokerage and financing services for institutional clients, connecting them to digital asset markets through spot execution, listed products, and financing solutions.

- The service aims to support clients seeking additional liquidity and capital efficiency while maintaining exposure to digital assets within broader trading and investment strategies.

- The initial collateral for this program will be Bitcoin, with plans to extend eligibility to additional large-cap digital assets over time.

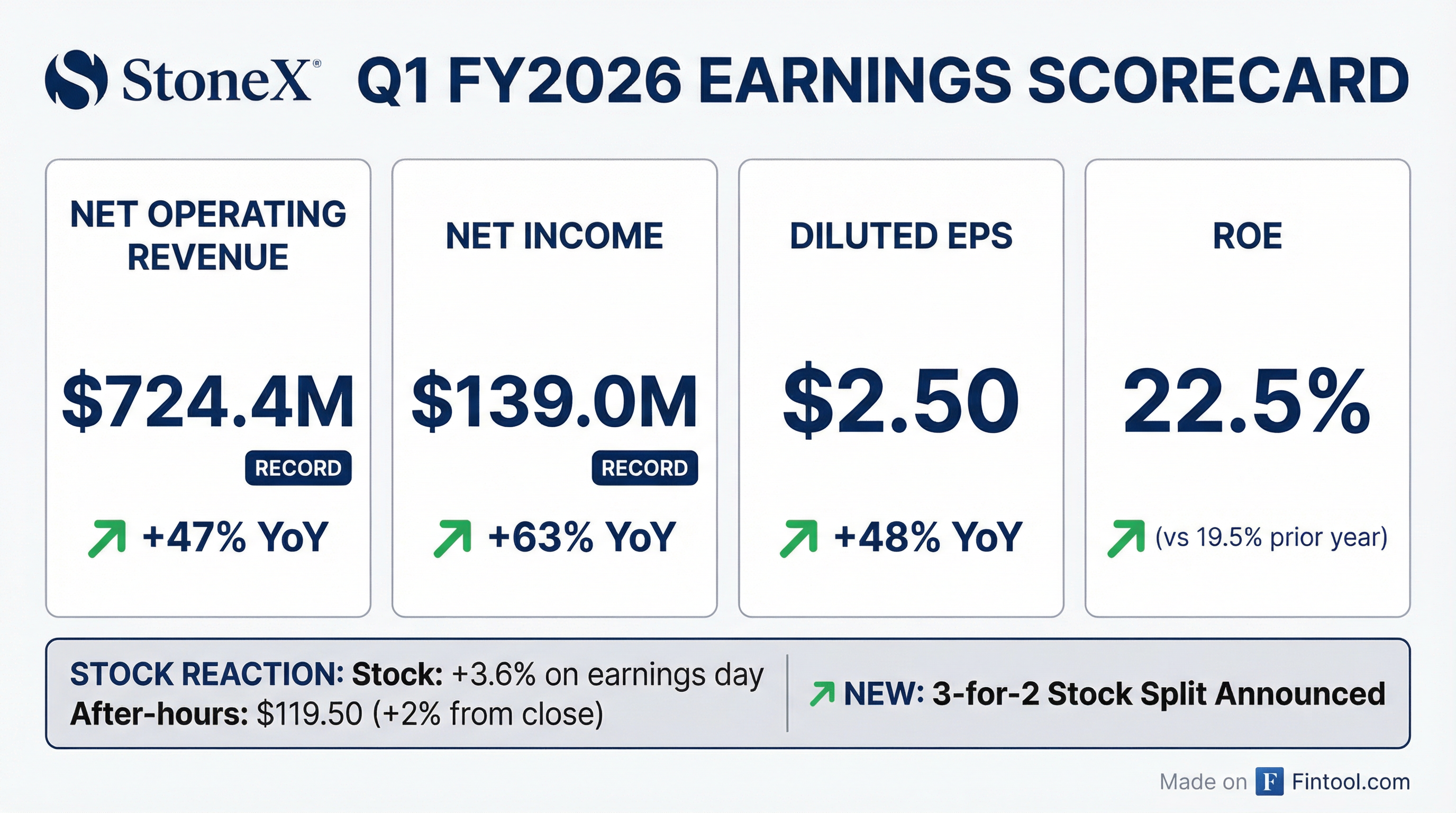

- StoneX Group Inc. reported robust financial performance for Q1 2026, with Operating Revenues reaching $1,438.2 million, marking a 52% increase, and Net Income growing 63% to $139.0 million year-over-year. Diluted EPS also saw a 48% increase, reaching $2.50.

- The company achieved a Return on Equity of 22.5% in Q1 2026, an increase from 19.5% in Q1 2025, and its book value per share rose 30% to $48.17 compared to the prior year.

- Key product operating revenues demonstrated significant growth, with Listed Derivatives up 141% to $269.1 million, OTC Derivatives up 72% to $63.1 million, and Interest/Fees Earned on Client Balances increasing 61% to $173.7 million in Q1 2026.

- The integration of RJO is progressing as planned, with approximately $21 million in annual expense synergies currently realized towards a target of $50 million, and $20 million in capital released from the UK business, contributing to an overall expected $55-65 million in capital synergies.

- StoneX Group Inc. reported a record first quarter for fiscal year 2026, with net income of $139 million and diluted earnings per share of $2.50, representing 63% and 48% growth respectively compared to the prior year. The company also achieved a 22.5% Return on Equity (ROE).

- Operating revenues reached over $1.4 billion, an increase of 52% versus the prior year, while net operating revenues grew 47%. This growth was significantly driven by record listed derivatives volumes and an exceptional performance in global metals, particularly precious metals, which generated $75 million in segment income.

- The acquisition of R.J. O'Brien played a substantial role, contributing $28.5 million in pre-tax net income and $63.8 million to interest and fee income on client float. Integration efforts are on track, with the consolidation of the R.J. O'Brien U.K. entity completed in early January 2026, releasing $20 million in capital.

- The Commercial segment's net operating revenues increased 65% and segment income rose 72%, while the Institutional segment saw record net operating revenues (up 86%) and segment income (up 78%). Conversely, the Self-Directed Retail segment experienced a 34% decline in net operating revenues and a 67% decrease in segment income.

- StoneX Group Inc. reported a record first quarter of fiscal 2026, achieving net income of $139 million and diluted earnings per share of $2.50, marking 63% and 48% growth respectively over the prior year.

- Net operating revenues increased 47% versus the prior year, reaching $1.4 billion, primarily driven by strong performance in listed derivatives and physical contracts, with the precious metals business generating $75 million in segment income.

- The acquisition of R.J. O'Brien significantly contributed to the results, adding $28.5 million in pre-tax net income, and its integration is on track, including the successful migration of the UK entity which released $20 million in capital.

- The company's board of directors approved a 3-for-2 stock split of its common stock, to be distributed as a stock dividend after the close of trading on March 20, 2026, with trading on a split-adjusted basis beginning March 23, 2026.

- StoneX Group Inc. reported a record start to fiscal year 2026, achieving record net operating revenues, net income, and EPS.

- Net income reached $139 million with diluted earnings per share of $2.50, and the company delivered a 22.5% Return on Equity (ROE) for the quarter.

- The acquisition of R.J. O'Brien (RJO) significantly contributed to these results, enhancing listed derivatives volumes and average client equity, and boosting the institutional segment's performance. RJO and Benchmark together contributed $33.1 million in pre-tax net income.

- The Board of Directors approved a 3-for-2 stock split of its common stock, to be effected as a stock dividend, with distribution after March 20, 2026.

- The integration of RJO is on track, with the R.J. O'Brien U.K. entity successfully migrated into StoneX U.K., which released $20 million in capital.

- StoneX Group Inc. reported record quarterly net operating revenues of $724.4 million, a 47% increase compared to the prior year, and record quarterly net income of $139.0 million for the fiscal first quarter ended December 31, 2025.

- The company achieved diluted EPS of $2.50 per share and a quarterly Return on Equity (ROE) of 22.5%.

- These strong financial results were driven by robust performances in the Commercial and Institutional segments, particularly Global Metals and Securities businesses, and the first full quarter of contributions from the acquired RJO and Benchmark businesses.

- The Board of Directors approved a three-for-two stock split of its common stock, to be effected as a stock dividend, with additional shares distributed after March 20, 2026, to stockholders of record on March 10, 2026.

- StoneX Group Inc. reported record quarterly net operating revenues of $724.4 million, a 47% increase, and record net income of $139.0 million, with diluted EPS of $2.50, for the fiscal first quarter ended December 31, 2025.

- The company achieved a quarterly Return on Equity (ROE) of 22.5% for the fiscal first quarter ended December 31, 2025.

- StoneX Group's Board of Directors approved a three-for-two stock split, to be distributed as a stock dividend after close of trading on March 20, 2026.

- StoneX Group Inc. and Enhanced Digital Group Inc. (EDG) have formed a strategic partnership to expand their respective digital asset offerings.

- As part of this partnership, StoneX led EDG's Series A funding round, acquiring a minority stake in the company.

- The collaboration will enable StoneX Digital to offer digital asset options trading and structured products to its institutional client base, leveraging EDG's expertise.

- In turn, EDG will utilize StoneX's robust digital asset spot and futures offering to deliver more holistic treasury management and solutions to its clients.

- StoneX reported strong financial results for Q4 2025, with operating revenues of $1,202.3 million, up 31%, net income of $85.7 million, up 12%, and diluted EPS of $1.57, up 1%. For the full fiscal year 2025, operating revenues reached $4,126.9 million, up 20%, and net income was $305.9 million, up 17%.

- The company's Return on Equity was 15.2% for Q4 2025 and 15.6% for the full fiscal year, with book value per share increasing 27% year-over-year to $45.56.

- The RJO transaction closed, positioning StoneX as the largest non-bank FCM in the US with $13.7 billion in required client segregated/secured assets, and is projected to yield $50 million in expense synergies and $50 million in capital synergies. The Benchmark acquisition also closed and is accretive to earnings.

- Significant growth was observed in key areas, including Listed Derivatives operating revenue, up 76% to $207.6 million, and Listed Derivatives Client Equity, up 71% to $11,321 million in Q4 2025. The Institutional segment's revenue also saw a substantial increase of 67% to $292 million in Q4 2025.

- StoneX anticipates a more volatile economic environment, which is expected to benefit its business, and highlighted significant growth in client assets as a source of stable recurring income.

- For Q4 2025, StoneX (SNEX) reported net income of $85.7 million and diluted earnings per share (EPS) of $1.57, with operating revenues of just over $1.2 billion, representing a 31% increase year-over-year.

- The company achieved record net income of $305.9 million and EPS of $5.89 for the full fiscal year 2025, with operating revenues exceeding $4 billion.

- The acquisition of RJ O'Brien (RJO) in 2025 was a significant factor, contributing $22.1 million to Q4 pre-tax net income (excluding acquired intangible amortization) and establishing StoneX as the largest non-bank FCM in the United States.

- Integration efforts for RJO have already resulted in approximately $20 million in annualized cost savings within four months, with additional capital synergies of $20 million-$30 million anticipated in Q2 2026 and north of $30 million in Q4 2026.

Quarterly earnings call transcripts for StoneX Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more