Earnings summaries and quarterly performance for SOUTH PLAINS FINANCIAL.

Executive leadership at SOUTH PLAINS FINANCIAL.

Board of directors at SOUTH PLAINS FINANCIAL.

Research analysts who have asked questions during SOUTH PLAINS FINANCIAL earnings calls.

BR

Brett Rabatin

Hovde Group, LLC

7 questions for SPFI

Also covers: BOKF, BPOP, CADE +20 more

Joseph Yanchunis

Raymond James

6 questions for SPFI

Also covers: AMTB, CASH, FINW +5 more

SS

Stephen Scouten

Piper Sandler & Co.

6 questions for SPFI

Also covers: ABCB, AMTB, AUB +24 more

WL

Woody Lay

Keefe, Bruyette & Woods (KBW)

5 questions for SPFI

Also covers: AMTB, BKU, BMRC +15 more

WL

Wood Lay

Keefe, Bruyette & Woods

3 questions for SPFI

Also covers: AMTB, BKU, BMRC +14 more

JY

Joe Yanchunas

Raymond James

2 questions for SPFI

Also covers: FINW, HBCP, TBBK +1 more

Recent press releases and 8-K filings for SPFI.

South Plains Financial Reports Q4 2025 Results and Provides 2026 Outlook

SPFI

Earnings

M&A

Dividends

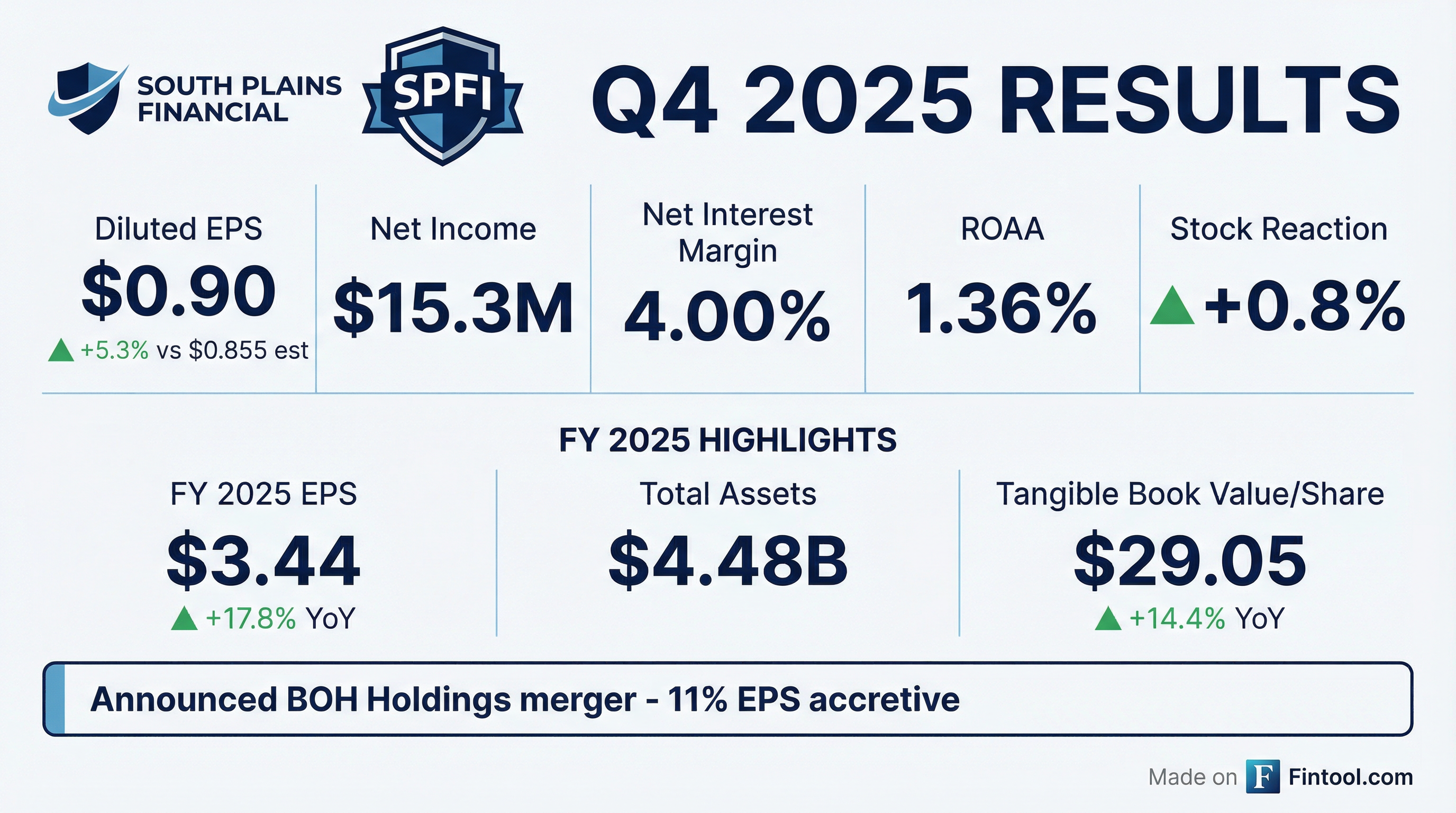

- South Plains Financial reported diluted earnings per share of $0.90 for Q4 2025, contributing to a 17.8% increase in diluted EPS for the full year 2025. Tangible Book Value per share grew over 14% for the full year to $29.05 as of December 31, 2025.

- The company's Net Interest Margin (NIM) was 4% in Q4 2025, a slight decrease from 4.05% in the prior quarter, with the cost of deposits decreasing by 9 basis points to 2.01%. Management anticipates a modest decline in cost of funds in Q1 2026 but expects potential NIM compression in 2026 due to competitive pressures.

- The acquisition of BOH Holdings and Bank of Houston is expected to close early in Q2 2026, projected to be 11% accretive to earnings in 2027 with a tangible book value earned back in less than three years. The company also expects loan growth to accelerate to a mid to high single-digit rate in 2026 and authorized a $0.17 per share quarterly dividend.

Jan 26, 2026, 10:00 PM

South Plains Financial, Inc. Reports Q4 and Full Year 2025 Results and Announces Merger

SPFI

Earnings

M&A

- South Plains Financial, Inc. reported diluted earnings per share of $0.90 for Q4 2025 and $3.44 for the full year 2025, with net income of $15.3 million for the quarter and $58.5 million for the full year.

- The company achieved full-year 2025 organic loan growth of 2.9% and ended the year with total assets of $4.48 billion, total deposits of $3.87 billion, and loans held for investment of $3.14 billion.

- Tangible book value per share increased by 14.4% to $29.05 at December 31, 2025, compared to $25.40 at December 31, 2024.

- SPFI announced a definitive merger agreement with BOH Holdings, Inc. on December 1, 2025, which is expected to be 11% accretive to EPS with tangible book value earnback under 3 years.

Jan 26, 2026, 10:00 PM

SPFI Reports Strong Full-Year 2025 Results and Provides 2026 Loan Growth Outlook

SPFI

Earnings

M&A

Guidance Update

- For the full-year 2025, diluted earnings per share increased by 17.8%, and tangible book value per share grew over 14% to $29.05. Diluted earnings per share for Q4 2025 were $0.90, with a net interest margin of 4%.

- The company entered a definitive agreement to acquire BOH Holdings (Bank of Houston), with the merger expected to close early in the second quarter of 2026. This acquisition is projected to be approximately 11% accretive to earnings in 2027 with a tangible book value earnback of less than three years.

- Loan growth is anticipated to accelerate to a mid to high single-digit growth rate in 2026, supported by new lender recruitment and the BOH acquisition. Deposits remained steady at $3.87 billion at the end of Q4 2025.

Jan 26, 2026, 10:00 PM

South Plains Financial Delivers Strong 2025 Performance and Details Bank of Houston Acquisition

SPFI

Earnings

M&A

Guidance Update

- South Plains Financial reported a 17.8% increase in diluted earnings per share and over 14% growth in tangible book value per share to $29.05 for the full year 2025.

- For Q4 2025, diluted earnings per share were $0.90, net interest income was $43 million, and net interest margin was 4%. Loans held for investment increased by $91 million to $3.14 billion.

- The company expects to close its acquisition of Bank of Houston in early Q2 2026, which is projected to be approximately 11% accretive to earnings in 2027 with a tangible book value earned back of less than three years. Bank of Houston had $772 million in assets, $633 million in loans, and $629 million in deposits as of September 30, 2025.

- Management anticipates loan growth to accelerate to a mid to high single-digit rate in 2026, driven by the Bank of Houston acquisition and new lender hires, though they expect loan yields to moderate and net interest margin to potentially face some compression.

Jan 26, 2026, 10:00 PM

South Plains Financial, Inc. Reports Q4 and Full Year 2025 Results, Announces Acquisition

SPFI

Earnings

M&A

Guidance Update

- South Plains Financial, Inc. reported net income of $15.3 million and diluted earnings per share of $0.90 for the fourth quarter of 2025, with full-year 2025 net income of $58.5 million and diluted EPS of $3.44.

- For Q4 2025, the company's net interest margin (tax-equivalent) was 4.00% and its return on average assets was 1.36%. Tangible book value per share increased to $29.05 as of December 31, 2025, up from $25.40 at December 31, 2024.

- Loans held for investment grew 2.9% during 2025 to $3.14 billion at December 31, 2025, and total assets reached $4.48 billion.

- On December 1, 2025, South Plains Financial, Inc. entered into a definitive agreement to acquire BOH Holdings, Inc., which had approximately $772 million in assets, $633 million in loans, and $629 million in deposits as of September 30, 2025.

Jan 26, 2026, 9:30 PM

South Plains Financial, Inc. Reports Fourth Quarter and Year-End 2025 Financial Results and Announces Acquisition

SPFI

Earnings

M&A

Guidance Update

- South Plains Financial, Inc. reported Q4 2025 net income of $15.3 million and diluted EPS of $0.90, with full-year 2025 net income at $58.5 million and diluted EPS at $3.44, representing 17.8% diluted EPS growth.

- As of December 31, 2025, total assets were $4.48 billion and tangible book value per share was $29.05, reflecting over 14% year-over-year growth in tangible book value per share.

- The company's net interest margin was 4.00% for Q4 2025, and the average cost of deposits decreased to 201 basis points.

- South Plains Financial, Inc. entered into a definitive agreement on December 1, 2025, to acquire BOH Holdings, Inc., which had approximately $772 million in assets at September 30, 2025.

Jan 26, 2026, 9:15 PM

South Plains Financial, Inc. to Acquire BOH Holdings, Inc.

SPFI

M&A

- South Plains Financial, Inc. (SPFI) announced a definitive merger agreement to acquire BOH Holdings, Inc. (BOH) in an all-stock transaction valued at approximately $105.9 million.

- The acquisition is expected to close in the second quarter of 2026, with BOH shareholders owning approximately 14.5% of the combined company.

- As of September 30, 2025, BOH had approximately $772 million in assets, $633 million in loans, and $629 million in deposits. Upon closing, the pro forma company will have approximately $5.4 billion in assets, $3.8 billion in loans, and $4.6 billion in deposits.

- The transaction is projected to be 11% accretive to SPFI's earnings per share in 2027 with a tangible book value per share earnback of less than 3.0 years.

Dec 1, 2025, 9:38 PM

South Plains Financial, Inc. to Acquire BOH Holdings, Inc.

SPFI

M&A

New Projects/Investments

Guidance Update

- South Plains Financial, Inc. (SPFI) announced a definitive merger agreement to acquire BOH Holdings, Inc. in an all-stock transaction valued at approximately $105.9 million.

- The proposed transaction is expected to be 11% accretive to SPFI’s earnings per share in 2027.

- Based on September 30, 2025, figures, the pro forma company will have approximately $5.4 billion in assets, $3.8 billion in loans, and $4.6 billion in deposits, and will operate 26 branches across Texas.

- SPFI expects to issue approximately 2.8 million shares of its common stock, with former BOH shareholders owning approximately 14.5% of the combined company.

- The transaction is anticipated to close in the second quarter of 2026, subject to customary closing conditions, including regulatory and BOH shareholder approvals.

Dec 1, 2025, 9:34 PM

South Plains Financial Reports Q3 2025 Results

SPFI

Earnings

Hiring

M&A

- For Q3 2025, South Plains Financial reported diluted earnings per share of $0.96, an increase from $0.86 in the linked quarter, primarily due to a reduction in provision for credit losses and increased net interest income. Net interest income was $43 million, with a net interest margin (tax-equivalent) of 4.05%.

- The company maintained strong capital levels as of September 30, 2025, with a consolidated Common Equity Tier 1 risk-based capital ratio of 14.41% and a Tier 1 leverage ratio of 12.37%. Tangible common equity to tangible assets stood at 10.25%, and tangible book value per share increased to $28.14.

- Loans held for investment decreased by $45.5 million to $3.05 billion in Q3 2025, mainly driven by a $46.5 million decrease in multifamily property loans. To counter this, the company is actively recruiting lenders, aiming to grow its lending platform by up to 20%, and anticipates loan growth to accelerate to a mid to high single-digit rate through 2026.

- The Board of Directors authorized a $0.16 per share quarterly dividend and continues to have a share buyback program in place. Additionally, the company redeemed $50 million in subordinated debt at the end of Q3 2025 and is exploring accretive M&A opportunities with potential target banks.

Oct 23, 2025, 9:00 PM

South Plains Financial Reports Strong Q3 2025 Earnings and Strategic Growth Initiatives

SPFI

Earnings

M&A

Hiring

- South Plains Financial reported diluted earnings per share of $0.96 for the third quarter of 2025, an increase from $0.86 in the linked quarter, primarily due to a reduction in provision for credit losses and an increase in net interest income.

- The company's net interest income was $43 million for Q3 2025, with a net interest margin (NIM) of 4.05%. Excluding one-time items, the NIM increased by nine basis points to 3.99% from the linked quarter.

- Deposits grew by $142.2 million to $3.88 billion, and non-interest-bearing deposits increased by $50.7 million, contributing to a four basis point decline in the cost of deposits to 210 basis points.

- As of September 30, 2025, SPFI maintained strong capital with a consolidated common equity Tier 1 risk-based capital ratio of 14.41% and a Tier 1 leverage ratio of 12.37%. The Board authorized a $0.16 per share quarterly dividend, and the company redeemed $50 million in subordinated debt.

- SPFI is focused on accelerating asset growth through organic initiatives, including increasing its lending team by up to 20% (already over 10% achieved), and exploring accretive M&A opportunities, with expectations for loan growth to accelerate to a mid to high single-digit rate through 2026.

Oct 23, 2025, 9:00 PM

Quarterly earnings call transcripts for SOUTH PLAINS FINANCIAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more