Earnings summaries and quarterly performance for STEWART INFORMATION SERVICES.

Executive leadership at STEWART INFORMATION SERVICES.

Frederick H. Eppinger, Jr.

Chief Executive Officer

Brad A. Rable

Group President, Technology and Operations

David C. Hisey

Chief Financial Officer and Treasurer

Elizabeth K. Giddens

Chief Legal Officer and Corporate Secretary

Emily A. Kain

Chief Human Resources Officer

Erin E. Sheckler

Group President

Iain M. Bryant

Group President

Ryan M. Swed

Group President

Board of directors at STEWART INFORMATION SERVICES.

C. Allen Bradley, Jr.

Director

Deborah J. Matz

Director

Helen Vaid

Director

Karen R. Pallotta

Director

Manolo Sánchez

Director

Matthew W. Morris

Director

Robert L. Clarke

Director

Thomas G. Apel

Chairman of the Board

William S. Corey, Jr.

Director

Research analysts who have asked questions during STEWART INFORMATION SERVICES earnings calls.

Bose George

Keefe, Bruyette & Woods

8 questions for STC

Geoffrey Dunn

Dowling & Partners

4 questions for STC

John Campbell

Stephens Inc.

3 questions for STC

Oscar Nieves

Stephens

2 questions for STC

Jeffrey Dunn

Dowling & Partners

1 question for STC

Recent press releases and 8-K filings for STC.

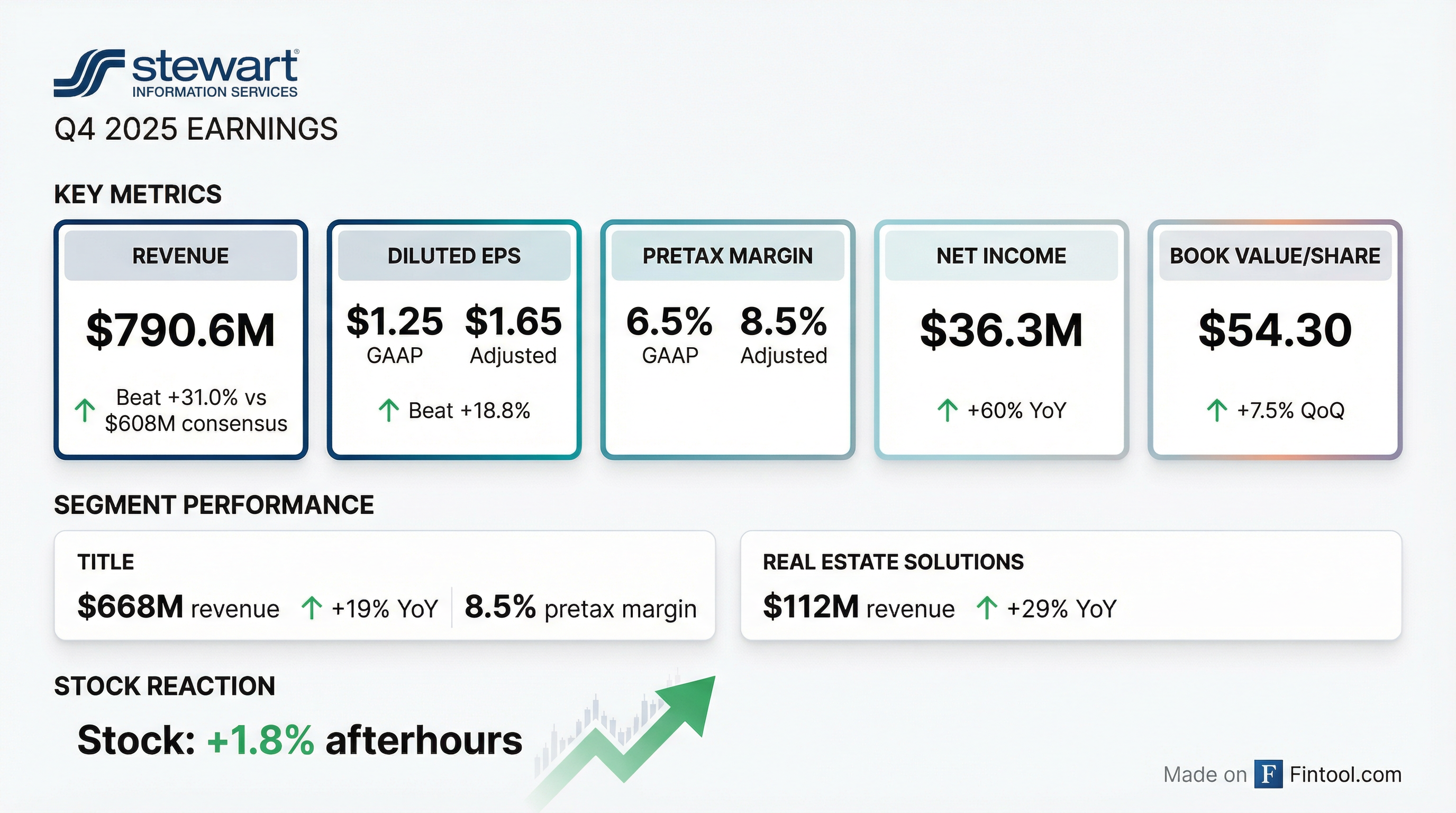

- Stewart Information Services Corporation (STC) reported strong Q4 2025 results, with revenue up 20% and adjusted net income up 52% year-over-year, reaching $791 million and $48 million respectively. For the full year 2025, revenues grew 18%, net income grew 48%, and adjusted EPS grew 46%, with the adjusted pre-tax margin improving to 6.8%.

- In 2025, STC acquired Mortgage Contracting Services (MCS), which is expected to contribute approximately $165 million in annual revenue and $40 million in EBITDA. The company also enhanced financial flexibility by upsizing its credit facility by $100 million to $300 million and executing an equity offering that raised $140 million.

- Management expresses cautious optimism for modest housing market improvements in 2026. STC plans to deploy approximately $300 million for acquisitions in the direct channel over the next three years to enhance structural margins, with increased optimism for these transactions to begin in 2026.

- Stewart Information Services Corporation (STC) reported strong financial results for full year 2025, with revenues growing 18%, net income increasing 48%, and adjusted EPS rising 46%. For Q4 2025, revenue grew 20% and adjusted net income increased 52% compared to Q4 2024.

- The company enhanced its financial flexibility by upsizing its credit facility by $100 million to $300 million and completing an equity offering that raised $140 million. Additionally, STC increased its annual dividend from $2 to $2.10 per share for the fifth consecutive year.

- At the end of 2025, STC acquired Mortgage Contracting Services (MCS), which is expected to contribute approximately $165 million in annual revenue and around $40 million in EBITDA.

- Management expressed cautious optimism for the housing market in 2026, anticipating modest improvements after two years of the lowest existing home sales in 30 years, noting that 30-year mortgage rates were stable in Q4 2025 between 6.1%-6.35%.

- Stewart Information Services Corporation (STC) reported strong financial results for full year 2025, with revenues growing 18%, net income by 48%, and adjusted EPS by 46%, while the adjusted pre-tax margin improved to 6.8%. For Q4 2025, revenue grew 20% and adjusted net income increased 52% year-over-year, with adjusted diluted EPS at $1.65.

- The company saw significant growth in key segments, with domestic commercial revenues increasing 34% for the full year and National Commercial Services growing 49% in Q4 2025. Real Estate Solutions revenues also grew 22% for the year and 29% in Q4.

- STC enhanced its financial flexibility by upsizing its credit facility by $100 million to $300 million and raising $140 million through an equity offering of 2.2 million shares. The company also acquired Mortgage Contracting Services (NCS) to expand its Lender Services portfolio.

- The annual dividend was increased for the fifth consecutive year, from $2 to $2.10 per share. Management anticipates modest market improvements in existing home sales in 2026, following two years of historically low sales.

- Stewart Information Services Corporation reported total revenues of $790.6 million ($794.4 million on an adjusted basis) for Q4 2025, an increase from $665.9 million ($664.2 million on an adjusted basis) in Q4 2024. Full year 2025 revenues reached $2.9 billion, up from $2.5 billion in 2024, with the CEO noting continued progress as the market begins to slowly improve.

- For Q4 2025, net income attributable to Stewart was $36.3 million ($47.9 million on an adjusted basis) and diluted EPS was $1.25 ($1.65 on an adjusted basis), compared to $22.7 million ($31.5 million on an adjusted basis) and $0.80 ($1.12 on an adjusted basis) respectively in Q4 2024.

- For the full year 2025, net income attributable to Stewart was $115.5 million ($139.6 million on an adjusted basis) and diluted EPS was $4.05 ($4.89 on an adjusted basis), increasing from $73.3 million ($94.4 million on an adjusted basis) and $2.61 ($3.35 on an adjusted basis) in 2024.

- The Title segment's operating revenues increased by 19% to $668.4 million, and its pretax income grew by 28% to $58.0 million in Q4 2025. The Real Estate Solutions segment also saw significant growth, with total revenues rising 29% to $111.9 million and pretax income increasing 317% to $3.9 million for the same quarter.

- Stewart Information Services Corporation reported total revenues of $790.6 million for the fourth quarter 2025, an increase from $665.9 million in the prior year quarter, and full year 2025 revenues of $2.9 billion, up from $2.5 billion in 2024.

- Net income attributable to Stewart for the fourth quarter 2025 grew to $36.3 million (or $47.9 million on an adjusted basis) from $22.7 million (or $31.5 million on an adjusted basis) in the fourth quarter 2024.

- Diluted EPS for the fourth quarter 2025 was $1.25 (or $1.65 on an adjusted basis), compared to $0.80 (or $1.12 on an adjusted basis) in the prior year quarter.

- For the full year 2025, diluted EPS was $4.05 (or $4.89 on an adjusted basis), an increase from $2.61 (or $3.35 on an adjusted basis) in 2024.

- The CEO noted strong fourth quarter results and continued progress across all lines of business as the market begins to slowly improve.

- Stewart Information Services Corporation (STC) entered into an underwriting agreement on December 10, 2025, to issue and sell common stock.

- The company initially agreed to sell 1,900,000 shares of common stock to the underwriters.

- On December 11, 2025, the underwriters exercised their option in full to purchase an additional 285,000 shares.

- The offering, totaling 2,185,000 shares, closed on December 12, 2025, with a purchase price of $64.77 per share for the underwriters.

- Stewart Information Services Corporation (STC) announced the pricing of its public offering of 1,900,000 shares of common stock.

- The shares are priced at $68.00 per share, with all shares being offered by Stewart.

- The offering is anticipated to close on December 12, 2025, and underwriters have an option to purchase up to an additional 285,000 shares.

- Gross proceeds from the offering are expected to be approximately $129.2 million, potentially reaching $148.6 million if the underwriters' option is fully exercised.

- Stewart Information Services Corporation plans to acquire Mortgage Contracting Services (MCS) for $330 million in cash.

- The acquisition, which will be funded by Stewart's available resources, is expected to close by the end of 2025 and be immediately accretive.

- This strategic move aims to expand Stewart's real estate services portfolio by adding property preservation to its lender and servicer offerings, enhancing its overall lender services.

- Stewart Information Services Corp. (STC), through its wholly-owned subsidiary SISCO Holdings, LLC, announced its intent to acquire Mortgage Contracting Services (MCS), a property preservation services provider.

- The acquisition is for a purchase price of $330 million in cash, which will be funded with available company resources.

- The transaction is expected to close before the end of 2025, subject to customary closing conditions and regulatory approvals, and is anticipated to be immediately accretive.

- MCS will continue to operate as a standalone company within Stewart's Real Estate Solutions business, expanding Stewart's lender services to include property preservation.

- Stewart Information Services Corporation (NYSE:STC) announced its intent to acquire the mortgage services of Mortgage Contracting Services (MCS), a property preservation services provider.

- The acquisition is valued at $330 million and will be funded with Stewart's available company resources.

- The transaction is expected to be immediately accretive and is anticipated to close before the end of the year.

- This acquisition aims to strengthen Stewart's Real Estate Services Portfolio by adding property preservation services for its lender and servicer customers.

Quarterly earnings call transcripts for STEWART INFORMATION SERVICES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more