Earnings summaries and quarterly performance for SUPERNUS PHARMACEUTICALS.

Executive leadership at SUPERNUS PHARMACEUTICALS.

Jack Khattar

President, Chief Executive Officer and Secretary

Frank Mottola

Chief Technical Operations Officer

Jonathan Rubin

Senior Vice President, Chief Medical Officer, Research and Development

Padmanabh Bhatt

Senior Vice President of Intellectual Property, Chief Scientific Officer

Timothy Dec

Senior Vice President, Chief Financial Officer

Board of directors at SUPERNUS PHARMACEUTICALS.

Research analysts who have asked questions during SUPERNUS PHARMACEUTICALS earnings calls.

Stacy Ku

TD Cowen

6 questions for SUPN

David Amsellem

Piper Sandler Companies

5 questions for SUPN

Kristen Kluska

Cantor Fitzgerald

4 questions for SUPN

Jack Padovano

Stifel

3 questions for SUPN

Jack

Cantor Fitzgerald

2 questions for SUPN

Jon Cox

Kepler Cheuvreux

2 questions for SUPN

Pavan Patel

Bank of America

2 questions for SUPN

Alex Riesemann

Piper Sandler Companies

1 question for SUPN

Andrew Tsai

Jefferies

1 question for SUPN

John Cox

Jefferies

1 question for SUPN

Linda Tsai

Jefferies

1 question for SUPN

Recent press releases and 8-K filings for SUPN.

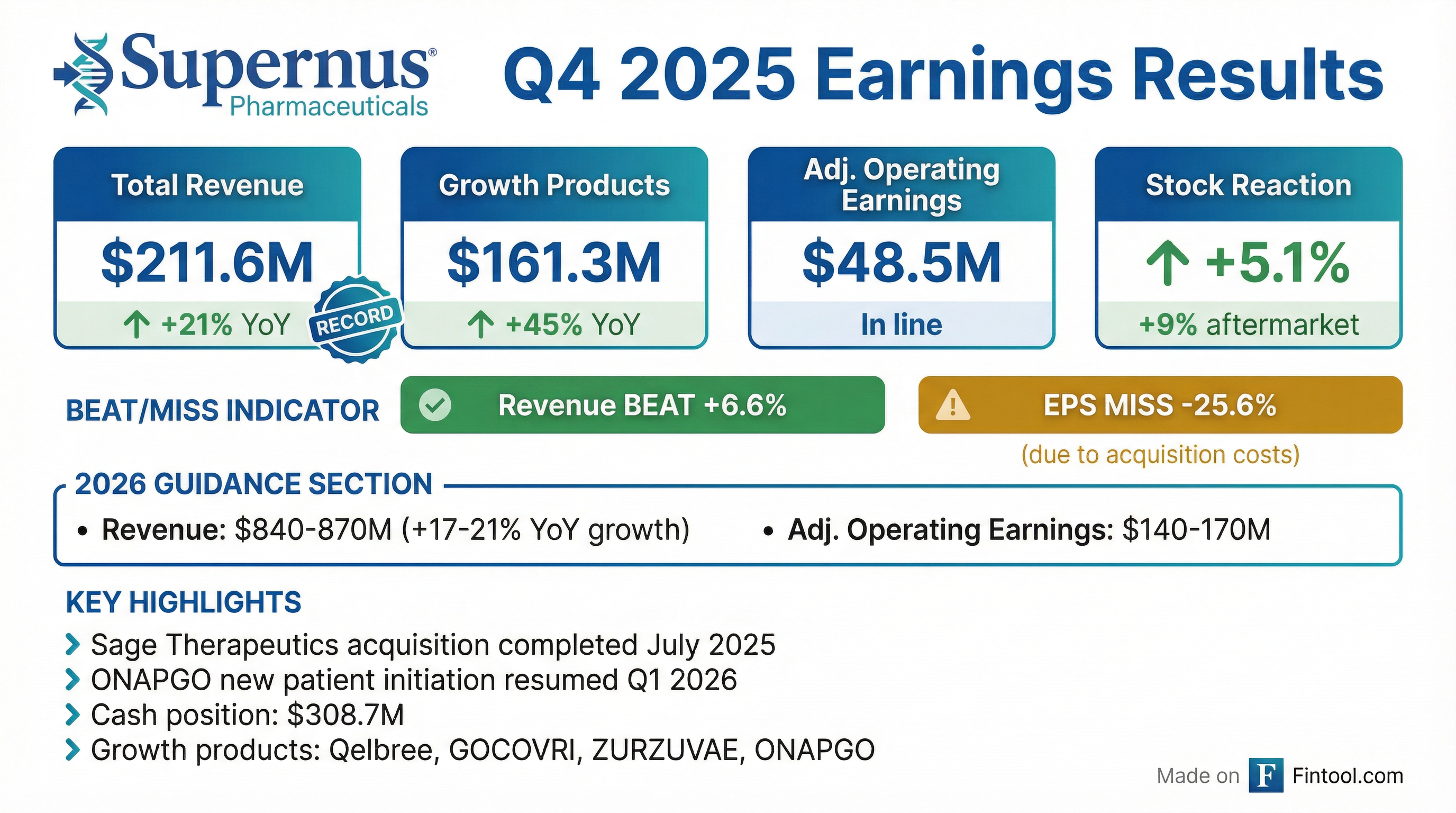

- Supernus Pharmaceuticals achieved record total revenues of $719 million for the full year 2025 and $211.6 million for Q4 2025, representing a 21% increase over the prior year quarter. The company reported a GAAP net loss of $4.1 million or $0.07 per diluted share for Q4 2025 and a GAAP net loss of $38.6 million or $0.68 per diluted share for the full year.

- The company's four growth products (Qelbree, GOCOVRI, Zurzuvae, and ONAPGO) accounted for approximately 76% of total revenues in Q4 2025, demonstrating a successful transition from legacy products.

- ONAPGO generated $8.9 million in net sales for Q4 2025, contributing to $17.3 million in total net sales for its first year, and the company has resolved supply constraints, resuming new patient initiations. The 2026 sales guidance for ONAPGO is $45 million-$70 million.

- Qelbree exceeded $300 million in net sales for 2025, a 26% growth over 2024, and Zurzuvae collaboration revenues were $32.8 million in Q4 2025, with U.S. sales increasing 187% compared to Q4 2024.

- Supernus Pharmaceuticals achieved record total revenue of $211.6 million for the fourth quarter of 2025, a 21% increase compared to the same quarter last year, and $719 million for the full year 2025, representing a 27% increase excluding net product sales of TRUCENDA XR and AXTELLO XR.

- The company reported a GAAP net loss of $4.1 million, or $0.07 per diluted share, for Q4 2025, and a GAAP net loss of $38.6 million, or $0.68 per diluted share, for the full year 2025, primarily due to higher operating costs and incremental intangible asset amortization related to the Sage acquisition.

- For the full year 2026, Supernus expects total revenues to range from $840 million to $870 million, with combined R&D and SG&A expenses projected between $620 million and $650 million.

- New patient initiations for ONAPGO began in Q1 2026 following the resolution of supply constraints, and the company assumes $45 million to $70 million of net sales from ONAPGO for the full year 2026.

- As of December 31, 2025, Supernus had approximately $309 million in cash equivalents and marketable securities and no debt, providing financial flexibility for potential M&A and other growth opportunities.

- Supernus Pharmaceuticals achieved record total revenues of $719 million for the full year 2025 and $211.6 million for the fourth quarter of 2025, marking a 21% increase compared to the same quarter last year.

- The company's four growth products (Qelbree, Proquarius, Zurzuvae, and ONAPGO) contributed significantly, accounting for approximately 76% of total revenues in Q4 2025. Qelbree exceeded $300 million in net sales for 2025, and ONAPGO generated $8.9 million in net sales in Q4 2025, concluding its first year with $17.3 million in total net sales.

- Supernus has made progress in resolving ONAPGO supply constraints, resuming new patient initiation, and expects $45 million-$70 million in net sales from ONAPGO for the full year 2026.

- For the full year 2026, Supernus anticipates total revenues to range from $840 million-$870 million and non-GAAP operating earnings to range from $140 million-$170 million.

- Supernus Pharmaceuticals, Inc. announced record total revenues of $211.6 million for Q4 2025, a 21% increase year-over-year, and $719.0 million for the full year 2025, up 9%.

- The company reported a net loss of $4.1 million ($0.07 diluted loss per share) for Q4 2025 and a net loss of $38.6 million ($0.68 diluted loss per share) for the full year 2025.

- Cash, cash equivalents, and current marketable securities stood at $308.7 million as of December 31, 2025.

- For full year 2026, Supernus provided guidance projecting total revenues of $840 million to $870 million and adjusted operating earnings (non-GAAP) of $140 million to $170 million.

- Combined revenues of growth products (Qelbree®, GOCOVRI®, ZURZUVAE®, and ONAPGO™) increased significantly to $161.3 million in Q4 2025 and $521.8 million for the full year 2025, showing year-over-year growth of 45% and 40%, respectively.

- Newron Pharmaceuticals announced the publication of peer-reviewed data highlighting evenamide's clinically meaningful and sustained benefits as an adjunctive treatment for schizophrenia, particularly for patients with inadequate response or treatment-resistant schizophrenia (TRS).

- Evenamide is a novel glutamate modulator that targets the hippocampus, offering a distinct mechanism of action compared to existing antipsychotics.

- Clinical studies demonstrated that over half of patients with treatment-resistant schizophrenia (TRS) treated with evenamide improved to the extent that they no longer met severity criteria for TRS after long-term adjunctive treatment, with approximately one-quarter achieving remission.

- Newron is advancing evenamide through the ENIGMA-TRS Phase III clinical program, which includes ENIGMA-TRS 1 (initiated August 2025) and ENIGMA-TRS 2 (initiated December 2025).

- Newron Pharmaceuticals announced that the European Patent Office (EPO) granted a new composition of matter patent (EP4615820) for its lead development compound, evenamide.

- This patent is expected to extend evenamide's asset exclusivity in the EU into 2044, strengthening the company's intellectual property.

- Evenamide, a first-in-class glutamate modulator for treatment-resistant schizophrenia, is currently in a global Phase III development program with topline results expected in Q4-2026.

- Health Canada has authorized ZURZUVAE™ (zuranolone), making it the first and only treatment indicated for adults with moderate or severe postpartum depression (PPD) in Canada.

- ZURZUVAE is a once-daily, 14-day oral single course treatment designed to offer relief from depressive symptoms as early as Day 3.

- This approval addresses a significant unmet medical need, as PPD affects up to one in five Canadian women.

- Supernus Pharmaceuticals, Inc. (SUPN) became Biogen's collaboration partner for ZURZUVAE in the U.S. after acquiring Sage Therapeutics, Inc., the drug's discoverer, in July 2025.

- Supernus is tracking ahead on the integration of the Sage acquisition, anticipating achieving up to $200 million in annualized synergies within the first year, primarily from SG&A and R&D program evaluation.

- Qelbree, the company's ADHD treatment, continues to demonstrate robust growth, with pediatric prescriptions increasing by approximately 19% and adult prescriptions by 32% during the last back-to-school season, annualizing at over 1 million prescriptions a year.

- The company is actively addressing supply constraints for Apokyn by working with its current third-party supplier and exploring an alternative European supplier, with traditional timelines for bringing a new supplier online potentially taking up to a year, though expedited options are being discussed with the FDA.

- For Zurzuvae, a treatment for postpartum depression, the market is in early development, with only an estimated 45%-50% of the 500,000 women who experience the condition annually currently being diagnosed, highlighting significant potential for market building and growth.

- Supernus is on track to achieve up to $200 million in annualized synergies from the Sage acquisition, with significant portions coming from SG&A and R&D program evaluation.

- Qelbree demonstrated robust growth in Q3, with pediatric prescriptions increasing by 19% and adult prescriptions by 32%, annualizing at over 1 million prescriptions.

- The company is actively addressing Apokyn supply constraints by pushing the current supplier for more batches and exploring an alternative European supplier, with FDA approval for a new facility potentially taking up to a year.

- Gocovri continues to differentiate itself by treating both dyskinesia and off-episodes, benefiting from the Medicare redesign which has helped more patients stay on the product with lower copays.

- Supernus Pharmaceuticals is actively working to resolve ONAPGO supply constraints, which are due to a capacity issue with the current manufacturer. The company is exploring options including increasing capacity with the current supplier and qualifying an alternative European supplier, though onboarding a new supplier could take several months to a year.

- Despite supply interruptions, ONAPGO has experienced overwhelming demand, with physicians continuing to submit patient enrollment forms. Supernus plans to revisit its initial $200 million-$300 million US peak sales assumptions for ONAPGO after resolving the supply situation, given the strong market interest.

- For ZURZUVAE, the market for postpartum depression is estimated at 500,000 women annually, with over 100,000 treated patients. Approximately 14,000 patients have been on the product since launch, indicating significant growth potential.

- Supernus is on track to achieve up to $200 million in annualized synergies from the Sage acquisition, expected to be realized between August 2025 and August 2026. The company's M&A strategy continues to prioritize commercial-stage assets and later-stage development programs (post-Phase II, early-Phase III).

Quarterly earnings call transcripts for SUPERNUS PHARMACEUTICALS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more