Earnings summaries and quarterly performance for TOYOTA MOTOR CORP/.

Research analysts who have asked questions during TOYOTA MOTOR CORP/ earnings calls.

Nagai

TV Tokyo

2 questions for TM

Sato

JPMorgan Security

2 questions for TM

Takao Tsuchioka

Nikkei Cross Tech

2 questions for TM

Taniga

Car Watch

2 questions for TM

Taruno Akira

NHK

2 questions for TM

Yao

Nikkei newspapers

2 questions for TM

Fukui

Nikkan Jidosha Newspaper

1 question for TM

Fukuyi

Nikkan Jidosha Shimbun

1 question for TM

Ikeda Mio

Sankei Newspaper

1 question for TM

Inagaki

Indiscernible

1 question for TM

Mr. Ikeda

Not Disclosed

1 question for TM

Mr. Yao

Not Disclosed

1 question for TM

Tsuyoshi Inajima

Bloomberg

1 question for TM

Unknown Analyst

Morgan Stanley

1 question for TM

Recent press releases and 8-K filings for TM.

- For the first nine months of FY2026 (April 1, 2025, through December 31, 2025), Toyota Motor Corporation reported sales revenues of 38,087.6 billion yen, an increase of 6.8% year-over-year. Operating income decreased by 13.1% to 3,196.7 billion yen, and net income attributable to Toyota Motor Corporation decreased by 26.1% to 3,030.8 billion yen.

- The company's full-year FY2026 forecast projects sales revenues of 50,000.0 billion yen, operating income of 3,800.0 billion yen, and net income attributable to Toyota Motor Corporation of 3,570.0 billion yen. Basic earnings per share are forecasted at 273.91 yen.

- The FY2026 operating income forecast includes a significant 1,450.0 billion yen negative impact from U.S. tariffs.

- At the end of FY2026 third quarter, total assets increased by 8,743.2 billion yen to 102,344.5 billion yen, and shareholders’ equity increased by 3,113.6 billion yen to 39,992.5 billion yen. The forecast for dividend per share for FY2026 is 90 yen.

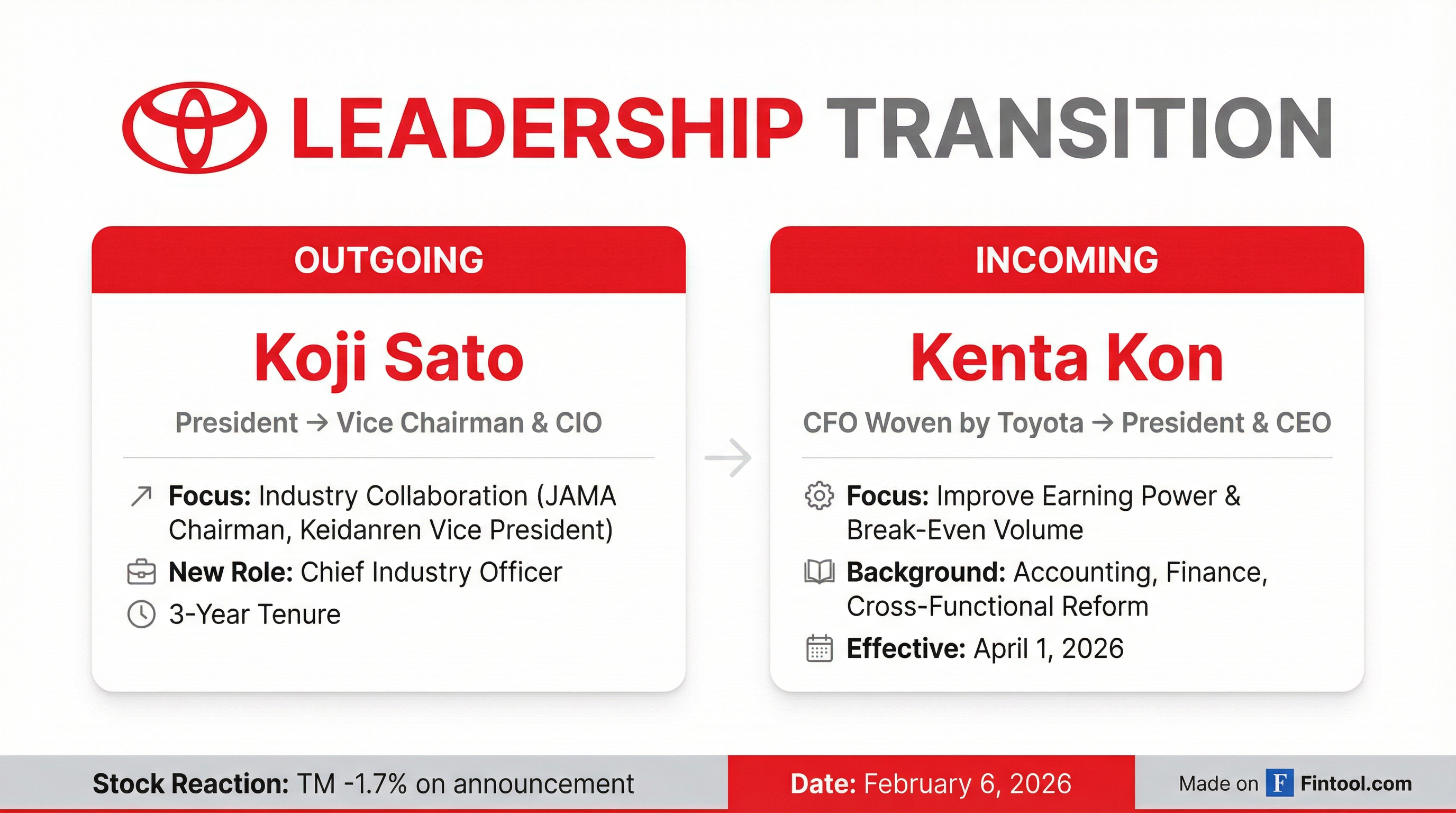

- Toyota will appoint Kenta Kon as president and CEO on April 1, with Koji Sato transitioning to vice chairman and a newly created chief industry officer role.

- The management reshuffle, which also includes Yoichi Miyazaki becoming CFO, aims to accelerate decision-making and sharpen profitability amidst intensifying competition and a shifting EV landscape.

- Kon, known for his strict cost control and finance-first mindset, is expected to focus on internal management, earnings improvement, and lowering break-even volumes.

- Toyota raised its full-year operating profit forecast to ¥3.8 trillion and net profit to ¥3.57 trillion for the year ending March 2026, while projecting sales of about ¥50 trillion.

- Despite the updated forecasts, the net profit still reflects a roughly 25% year-on-year decline, largely attributed to an estimated ¥1.2–1.45 trillion impact from U.S. tariffs.

- The company also increased its EPS guidance to approximately ¥273.91 from the previous ¥224.81.

- For the first nine months of FY2026, operating income was ¥3,196.7 billion (down ¥482.7 billion year-on-year) and net income was ¥3,030.8 billion (down ¥1,069.4 billion), with the operating margin decreasing to 8.4% from 10.3%.

- Consolidated vehicle sales for the first nine months rose about 3.4% to roughly 8.3 million units, with strong performance in North America and 150% year-over-year growth in BEV sales.

- Koji Sato will step down as CEO of Toyota and become vice chairman and chief industry officer, with Chief Financial Officer Kenta Kon succeeding him as CEO and president effective April 1.

- The management reshuffle is intended to accelerate decision-making, splitting responsibilities so Kon handles internal management while Sato focuses on broader industry matters.

- Toyota reported a quarterly net profit decline of approximately 43% to 1.257 trillion yen (about $8 billion) for the three months ended December.

- Despite the profit decline, Toyota boosted its full-year profit outlook by nearly 12%.

- Toyota Motor Corp (TM) announced a leadership transition effective April 1st, with Kenta Kon appointed as the new President and CEO, and the current president, Sato-san, moving to Vice Chairman and Chief Industry Officer.

- Kenta Kon, with a background in accounting and finance, will focus internally on enhancing the company's earning power and financial foundation.

- Sato-san's new role as Vice Chairman and Chief Industry Officer will concentrate on accelerating broader industry collaboration to maintain the car industry's international competitiveness.

- The organizational change aims to address management challenges by improving productivity and fostering collaboration, while upholding the core mission of "making ever better cars".

- Toyota Motor Corporation announced executive changes on February 6, 2026, effective April 1, with Kenta Kon appointed as the new President and CEO.

- Koji Sato, the outgoing CEO, will transition to Vice Chairman and Chief Industry Officer (CIO), focusing on broader industry collaboration.

- The executive restructuring is designed to address management challenges by enhancing the company's earning power and accelerating industry collaboration.

- Kon, with his background in accounting and finance, will focus internally on driving initiatives to improve earning power, while Sato will concentrate on external industry roles.

- The company's strategy includes reducing break-even volume points to maintain revenue stability even in challenging environments.

- Toyota Motor Corporation (TM) announced executive changes effective April 1st, with Koji Sato transitioning from President and CEO to Vice Chairman and Chief Industry Officer, and Kenta Kon (CFO of Woven by Toyota) appointed as the new President and CEO.

- The organizational change aims to address management challenges by enhancing the company's earning power and accelerating industry collaboration.

- Kenta Kon will focus internally on driving initiatives to strengthen the financial foundation and enable investments in future technologies, leveraging his expertise in accounting and finance.

- Koji Sato will concentrate his efforts on broader industry engagement, including the Japan Automobile Manufacturers Association and Keidanren, to accelerate the pace of collaboration.

- Both leaders affirmed that Toyota's core vision of "ever better car making" and "Fun to Drive" will continue to be strongly promoted under the new leadership.

- Toyota sold a record 11.3 million vehicles in 2025, marking a 4.6% increase and securing its position as the world's top-selling automaker for the sixth consecutive year.

- This sales growth was primarily driven by strong demand in the U.S. and Japan, robust sales of hybrids (accounting for approximately 42% of parent-brand sales), and contributions from Lexus and subsidiaries.

- Global production climbed approximately 5.7% year-on-year to roughly 11.22 million units in 2025, as Toyota recovered from prior certification and recall disruptions.

- U.S. tariff policy, including a 25% tariff on Japanese automobiles imposed in April 2025 (later reduced to 15% in September), weighed on Toyota's profitability.

- Battery-electric vehicles still represent a small share of parent-brand sales, making up about 1.9% of Toyota's global vehicle sales.

- Toyota's plan to take Toyota Industries private with an offer of ¥18,800 per share, valuing the company at approximately $27.8 billion, is being challenged.

- Activist investor Elliott Investment Management, which holds 6.7% of Toyota Industries, argues the offer undervalues the company by about 40%.

- Elliott may need an additional 7% of votes to block the transaction by the Feb. 12 tender deadline, as passive index holders (about 19% of voting rights) could refuse to tender at the current price.

- The dispute is seen as a test of evolving corporate governance in Japan, with Elliott potentially increasing its stake or mounting a counterbid.

- Elliott Investment Management is opposing the Toyota Group’s proposed ¥6.1 trillion ($39 billion) take-private of Toyota Industries, urging minority shareholders not to tender their shares.

- Elliott, now the largest minority investor with a stake above 5%, argues the revised offer of ¥18,800 per share significantly undervalues the company, estimating its intrinsic net asset value at approximately ¥26,000–¥26,134 per share.

- The hedge fund has proposed a standalone plan that it believes could lift Toyota Industries' valuation to more than ¥40,000 per share by 2028.

- Elliott warned that allowing the revised tender offer to succeed would negatively impact Japan’s corporate governance reforms and investor interest.

Fintool News

In-depth analysis and coverage of TOYOTA MOTOR CORP/.

Toyota Names CFO Kenta Kon as CEO After Profit Slumps 43% on Tariff Impact

Elliott Calls Toyota's $39B Take-Private 40% Undervalued, Proposes Path to Double Value

Japan's Takaichi Calls Snap Election as Bond Yields Hit 27-Year Highs

Toyota Raises Buyout Offer to $35 Billion After Elliott Pressure

Quarterly earnings call transcripts for TOYOTA MOTOR CORP/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more