Earnings summaries and quarterly performance for UNITED MICROELECTRONICS.

Research analysts who have asked questions during UNITED MICROELECTRONICS earnings calls.

Brad Lin

Bank of America

4 questions for UMC

Charlie Chan

Morgan Stanley

4 questions for UMC

Gokul Hariharan

JPMorgan Chase & Co

4 questions for UMC

Laura Chen

Citigroup

3 questions for UMC

Sunny Lin

UBS

3 questions for UMC

Jason Zhang

CLSA

2 questions for UMC

Alex Chang

Exane BNP Paribas

1 question for UMC

Bruce Lu

Goldman Sachs

1 question for UMC

Chia Yi Chen

Citigroup

1 question for UMC

Felix Pan (Junhong Pan)

KGI Securities

1 question for UMC

Jason Tsang

CLSA

1 question for UMC

Randy Abrams

UBS Group AG

1 question for UMC

Ted Lin

HSBC

1 question for UMC

Timm Schulze-Melander

Rothschild & Co Redburn

1 question for UMC

Tim Schultz

Redburn

1 question for UMC

Zheng Lu

Goldman Sachs

1 question for UMC

Recent press releases and 8-K filings for UMC.

- United Microelectronics Corporation (UMC) reported net sales of NT$20,862,150 thousand for January 2026.

- This represents a 5.33% increase in net sales compared to January 2025.

- The announcement was made on February 5, 2026.

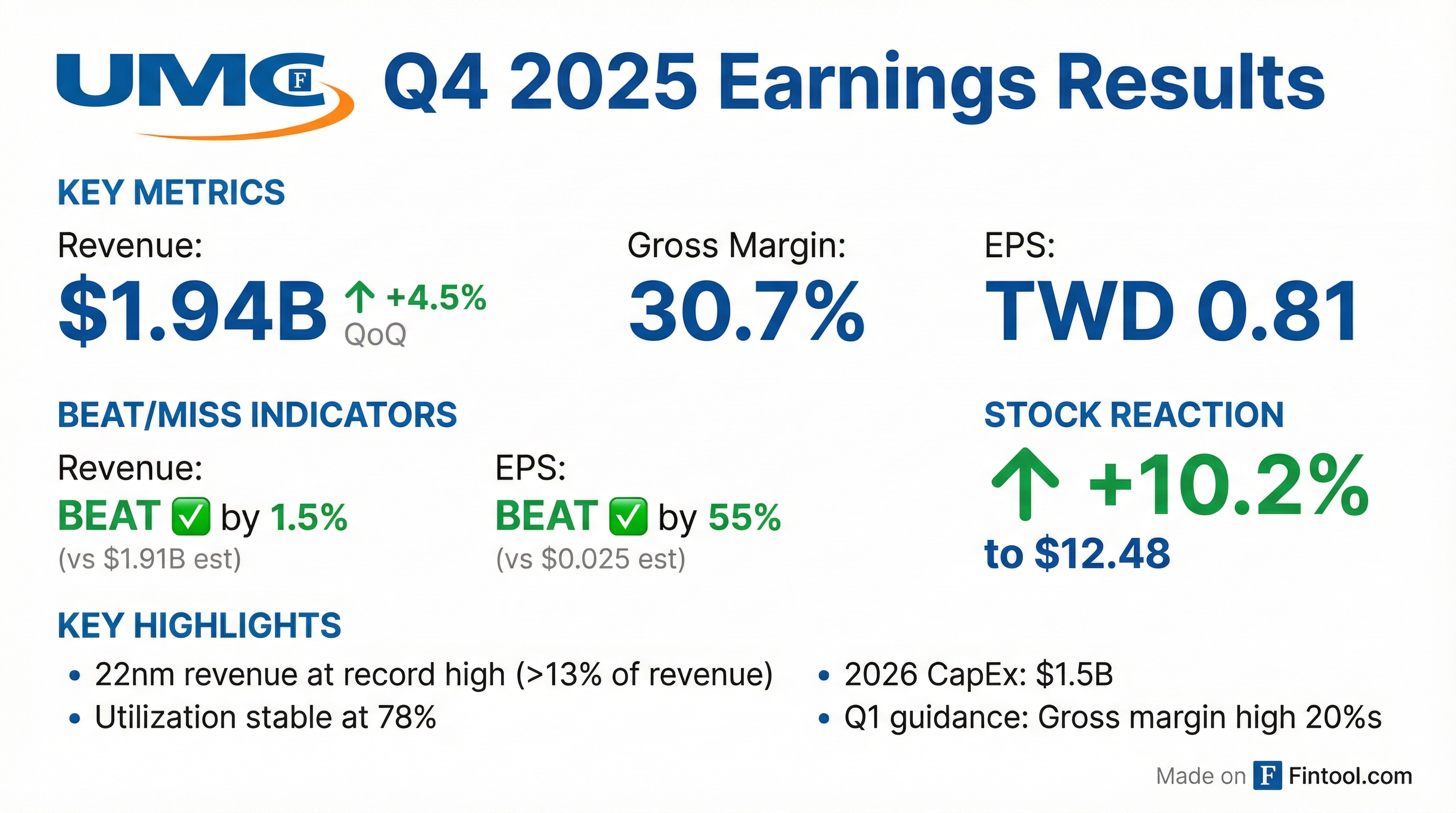

- United Microelectronics Corporation (UMC) reported Q4 2025 revenue of NT$61.81 billion (US$1.97 billion), a 4.5% sequential increase, with a gross margin of 30.7% and earnings per share of NT$0.81. Full-year 2025 earnings per share was NT$3.34.

- The company's 22nm revenue grew 93% year-over-year for the full year 2025, reaching a record high in Q4 2025 and accounting for over 13% of total Q4 revenue.

- For Q1 2026, UMC anticipates flat wafer shipments, firm ASP in USD, and a gross profit margin in the high-20% range, with a projected 2026 CAPEX of US$1.5 billion.

- UMC is investing in future growth by completing its new Phase 3 facility at Singapore Fab 12i and forming partnerships, including a 12nm collaboration with Intel and an MOU with Polar Semiconductor.

- UMC reported Q4 2025 revenue of NT$61.81 billion (US$1.97 billion), a 4.5% sequential increase, with a gross margin of 30.7% and earnings per share of NT$0.81.

- For the full year 2025, earnings per share were NT$3.34, and revenue in US dollars increased 5.3% year-over-year.

- The 22/28nm segment grew to 36% of wafer revenue in Q4 2025, driven by a 31% quarter-on-quarter increase in 22nm revenue.

- For Q1 2026, UMC anticipates a gross profit margin in the high-20% range, mid-70% capacity utilization, and 2026 CAPEX of US$1.5 billion.

- Strategic developments include the completion of the Singapore Fab 12i Phase 3 facility and new partnerships, such as a 12nm collaboration with Intel and an MOU with Polar Semiconductor, to support future growth and supply chain diversification.

- For Q1 2026, UMC guides for flat wafer shipments, firm ASPs in U.S. dollars, a gross margin in the high 20% range, and a capacity utilization rate in the mid-70% range. The 2026 cash-based CapEx budget is $1.5 billion.

- UMC expects 2026 to be a growth year, projecting to outperform its addressable market's low single-digit % growth. The company anticipates a more favorable ASP environment in 2026 compared to 2025.

- Advanced packaging and silicon photonics are identified as new growth catalysts for 2026 and beyond. UMC expects over 20 new advanced packaging tape-outs in 2026, with significant revenue growth anticipated in 2027, and 12-inch silicon photonics programmable products expected to ramp in 2026.

- The company forecasts a 1.2% year-over-year capacity increase for 2026 and a low teens annual increase in full-year depreciation expenses for 2026.

- UMC reported Q4 2025 consolidated revenue of TWD 61.81 billion and a gross margin of 30.7%, with net income attributable to the parent at TWD 10.06 billion and EPS of 0.81 NT dollars.

- For the full year 2025, revenue reached TWD 237.5 billion, with a gross margin rate of 29% and EPS of 3.34 NT dollars, a decline from 3.8 NT dollars in 2024.

- For Q1 2026, UMC expects wafer shipments to remain flat, ASP in US dollars to remain firm, gross margin to be approximately in the high 20% range, and capacity utilization in the mid-70% range.

- The company anticipates 2026 to be another growth year, with a more favorable ASP environment compared to 2025, and projects its growth to outperform its addressable market.

- UMC's 2026 CapEx plan is set at $1.5 billion, a slight decrease from $1.6 billion in 2025, with strategic focus on advanced packaging and silicon photonics, expecting significant revenue growth from advanced packaging in 2027 and 12-inch PIC programmable products to ramp in 2026.

- UMC reported Q4 2025 EPS of 0.81 and a gross margin of 30.7%, contributing to a full-year 2025 EPS of 3.34, a decline from 3.8 in 2024.

- For Q1 2026, UMC anticipates flat wafer shipments, firm ASPs, and a gross margin in the high 20% range, with capacity utilization in the mid-70% range.

- The company projects a $1.5 billion CapEx budget for 2026, a slight decrease from $1.6 billion in 2025, and expects a more favorable ASP environment, with UMC's growth outperforming its low single-digit % addressable market growth.

- Key growth drivers include the accelerating 22-nanometer platform, with 22- and 28-nanometer revenue accounting for 36% of Q4 2025 total revenue, and strategic investments in advanced packaging and silicon photonics, with significant revenue growth from advanced packaging expected in 2027.

- United Microelectronics Corporation reported net sales of NT$19,280,724 thousand for December 2025, an increase of 1.66% compared to December 2024.

- Year-to-Date net sales for 2025 reached NT$237,553,199 thousand, representing a 2.26% increase from the previous year.

- As of the period end, the company reported no funds lent to other parties and a zero balance for endorsements and guarantees.

- United Microelectronics Corporation (UMC) announced the acquisition of machinery and equipment for a total transaction price of NT$1,259,089,982.

- The acquisition, which occurred between January 7, 2025, and December 19, 2025, is intended for production and R&D.

- The counterparty for this non-related party transaction was Applied Materials South East Asia Pte. Ltd..

- United Microelectronics Corp.'s board of directors approved a capital budget execution of NT$ 30,096 million for capacity deployment.

- The company will participate in the capital increase of its associate, Unimicron Technology Corp., by subscribing to new shares not exceeding 6,034,482 shares at a unit price of NTD 116, for a total amount not exceeding NTD 700,000,000.

- This strategic investment will add to UMC's current cumulative holding of 204,912,528 shares in Unimicron, representing 13.01% of holdings with a monetary value of NTD 14,292,544,874.

- United Microelectronics Corp (UMC) and U.S.-based Polar Semiconductor have signed a memorandum of understanding to collaborate on expanding 8-inch wafer production at Polar's Minnesota facility.

- This partnership aims to meet growing domestic demand and strengthen U.S. semiconductor supply chain resilience, leveraging UMC's advanced 8-inch process technologies and global customer network.

- UMC, Taiwan's second-largest semiconductor foundry, holds a 5% market share in the global dedicated chip foundry market in 2024, making it the world's third-largest.

- The company reported a 5.91% increase in net sales for November 2025 compared to the previous year.

Quarterly earnings call transcripts for UNITED MICROELECTRONICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more