Earnings summaries and quarterly performance for VERISIGN INC/CA.

Executive leadership at VERISIGN INC/CA.

Board of directors at VERISIGN INC/CA.

Research analysts who have asked questions during VERISIGN INC/CA earnings calls.

Robert Oliver

Robert W. Baird & Co.

7 questions for VRSN

Also covers: AMPL, ASAN, AZPN +17 more

Ygal Arounian

Citigroup

6 questions for VRSN

Also covers: ANGI, BARK, BMBL +13 more

AG

Alexei Gogolev

JPMorgan Chase & Co.

2 questions for VRSN

Also covers: ALKT, BABA, BSY +15 more

Jamesmichael Sherman-Lewis

Citigroup Inc.

2 questions for VRSN

Also covers: CARG, KIND, LAD

RO

Rob Oliver

Baird

2 questions for VRSN

Also covers: ASAN, TEAM

MM

Max Moore

Citigroup

1 question for VRSN

Recent press releases and 8-K filings for VRSN.

Verisign reports Q4 2025 results and 2026 guidance

VRSN

Earnings

Guidance Update

Dividends

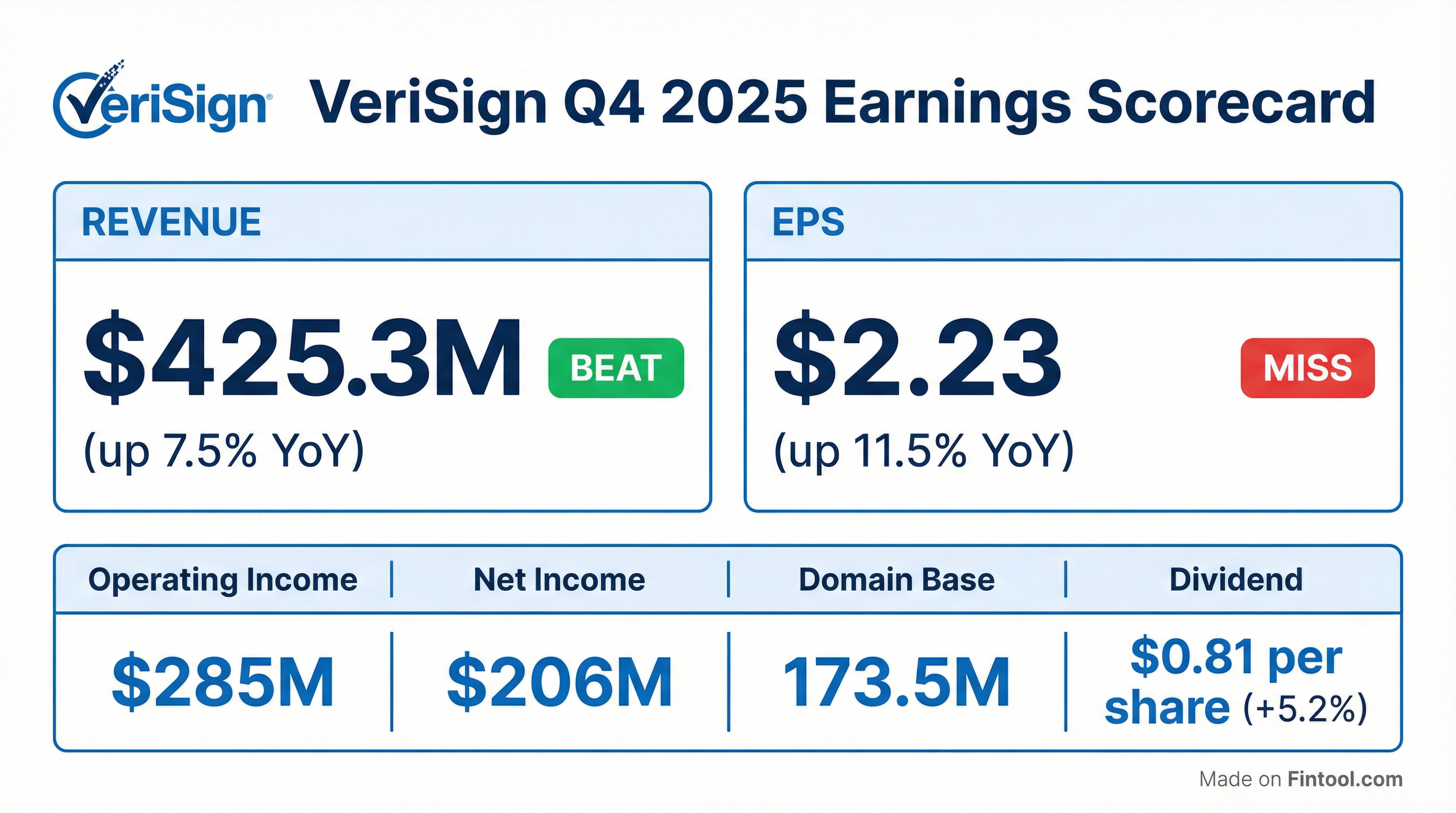

- Verisign delivered Q4 2025 revenue of $425 million (+7.5% YoY) and full-year revenue of $1.66 billion (+6.4% YoY); Q4 2025 EPS was $2.23 and FY 2025 EPS was $8.81; FY 2025 free cash flow totaled $1.07 billion.

- The domain base ended 2025 at 173.5 million names (+2.6% YoY) following Q4 net adds of 1.58 million names and 2025 new registrations of 41.7 million.

- At year-end, Verisign held $581 million in cash, cash equivalents, and marketable securities, with $1.08 billion remaining under its share repurchase program; the Board declared a Q1 2026 dividend of $0.81/share (+5.2%).

- For 2026, Verisign forecasts revenue of $1.715–1.735 billion, operating income of $1.16–1.18 billion, and domain base growth of 1.5–3.5%.

1 day ago

Verisign reports Q4 2025 earnings

VRSN

Earnings

Guidance Update

Share Buyback

- Verisign reported Q4 2025 revenue of $425 million (+7.5% Y/Y) and operating income of $285 million (+7.9% Y/Y), with EPS of $2.23.

- The domain name base reached 173.5 million names at end of Q4 2025 (+2.6% Y/Y), including 161.0 million .com and 12.5 million .net names.

- In 2025, the company deployed $859 million in share repurchases and paid $215 million in dividends, generating $1.068 billion in free cash flow; cash and investments were $581 million at Dec. 31, 2025.

- For full-year 2026, Verisign forecasts domain base growth of 1.5%–3.5%, revenue of $1.715–1.735 billion, and operating income of $1.160–1.180 billion.

1 day ago

Verisign reports Q4 and full-year 2025 results

VRSN

Earnings

Dividends

Share Buyback

- Verisign reported Q4 revenue of $425 million, a 7.5% increase YoY, and diluted EPS of $2.23 (vs. $2.00 in Q4 2024).

- For full-year 2025, revenue was $1.66 billion, up 6.4%, with diluted EPS of $8.81 (vs. $8.00 in 2024).

- The Board approved a 5.2% increase in the quarterly dividend to $0.81 per share, payable February 27, 2026.

- During Q4, Verisign repurchased 1.0 million shares for $251 million and 3.4 million shares for $859 million in 2025, with $1.08 billion remaining under the program.

- Verisign ended Q4 with 173.5 million .com/.net registrations, up 2.6% YoY, adding 1.58 million registrations in the quarter.

1 day ago

Verisign reports Q4 and full year 2025 results

VRSN

Earnings

Dividends

Share Buyback

- In Q4 2025, Verisign reported $425 M in revenue (up 7.5% YoY), $206 M in net income, and $2.23 diluted EPS; for full-year 2025, revenue was $1.66 B (up 6.4%), net income $826 M, and EPS $8.81

- Operating cash flow was $290 M in Q4 and $1.091 B for 2025, and year-end cash, cash equivalents, and marketable securities totaled $581 M

- The board approved a 5.2% dividend increase to $0.81 per share, payable February 27, 2026

- Repurchased 1.0 M shares for $251 M in Q4, totaling 3.4 M shares for $859 M in 2025

- Domain base grew to 173.5 M .com/.net registrations (up 2.6%), with 10.7 M new registrations processed in Q4

1 day ago

VeriSign reports Q3 2025 domain registration growth

VRSN

- Total TLD registrations reached 378.5 million as of Q3 2025, up 6.8 million QoQ (+1.8%) and 16.2 million YoY (+4.5%)

- Combined .com and .net base was 171.9 million, a 1.4 million QoQ (+0.8%) and 2.4 million YoY (+1.4%) increase

- New .com/.net registrations totaled 10.6 million in Q3 2025, compared to 9.3 million in Q3 2024

- ccTLD registrations stood at 144.8 million, up 1.4 million QoQ (+1.0%) and 4.8 million YoY (+3.4%), led by .cn, .de, .uk, .ru, .nl, .br, .au, .fr, .in and .eu

Oct 24, 2025, 1:35 PM

VeriSign reports Q3 2025 domain name registration totals

VRSN

- Total domain registrations reached 378.5 million at 2025 Q3 end, up 6.8 million (1.8%) QoQ and 16.2 million (4.5%) YoY

- .com/.net registrations totaled 147.19 million, increasing 0.8% QoQ and 1.4% YoY; base .com = 145.94 million, .net = 125.00 million

- New .com/.net registrations were 10.6 million in Q3 2025 versus 9.30 million in Q3 2024

- ccTLD registrations totaled 144.80 million, a 1.0% QoQ and 3.4% YoY gain; top 10 ccTLDs include .cn, .de, .uk, .ru, .nl, .br, .au, .fr, .in, .eu

Oct 24, 2025, 6:27 AM

VeriSign reports Q3 2025 results

VRSN

Earnings

Dividends

Share Buyback

- VeriSign’s Q3 2025 revenue rose 7.3% year-over-year to $419 million.

- Net profit was $213 million, with operating income up 5.6% to $284 million.

- Processed 10.6 million new domain registrations; domain base grew by 1.45 million to 171.9 million names, and raised full-year growth guidance to 2.2%–2.5%.

- Declared a $0.77 per share cash dividend and $215 million in share repurchases.

- Beat EPS expectations ($2.27 vs. $2.25) but stock fell 0.54% to $251.50 in after-hours trading.

Oct 24, 2025, 2:10 AM

VeriSign stake sale by Berkshire Hathaway reduces ownership below 10%

VRSN

- Berkshire Hathaway filed to sell 4.3 million shares of its 14.2% VeriSign stake at $285–$290 per share to lower its holding below 10%.

- The remaining shares will be locked up for 365 days, and JPMorgan Securities holds a 30-day option to purchase an additional 515,032 shares.

- VeriSign will receive no proceeds from the offering, which led to a 6%–7.5% drop in its stock price in after-hours trading.

- Berkshire’s remaining position, valued at over $4 billion before the sale, remains intact as a long-term investment.

Jul 28, 2025, 9:31 PM

VeriSign Announces Amendment and Proxy Vote Outcomes

VRSN

Proxy Vote Outcomes

- Amendment Adoption: Stockholders approved an amendment to the Restated Certificate of Incorporation to limit the liability of directors and officers under Delaware law, effective upon filing.

- Proxy Vote Results: At the 2025 annual meeting, stockholders cast votes on five proposals including director elections, executive compensation advisory, auditor ratification, and a stockholder proposal.

- Filing Details: The 8-K document was filed on May 22, 2025, consolidating these corporate actions and related exhibits.

May 22, 2025, 12:00 AM

VeriSign Q1 2025 Financial, Capital & Leadership Update

VRSN

Earnings

Dividends

CFO Change

Guidance Update

Share Buyback

- Q1 2025 performance: Reported $402M in revenue, $271M operating income (4.7% YoY) and $199M net income, demonstrating modest growth

- Capital allocation: Executed share repurchase of 1M shares for $230M, initiated a quarterly dividend of $0.77 per share and delivered $907M free cash flow TTM

- Debt management: Issued $500M of 5.25% Senior Notes due 2032 and repaid $500M Senior Notes due 2025 using cash on hand

- Full-year guidance: Revised 2025 outlook with revenue guidance of $1.635B–$1.650B and operating income guidance of $1.110B–$1.125B amid macroeconomic uncertainty

- CFO transition: John Calys is set to assume the CFO role following George Kilguss’s retirement at the end of May

Apr 24, 2025, 8:31 PM

Quarterly earnings call transcripts for VERISIGN INC/CA.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more