Earnings summaries and quarterly performance for VIASAT.

Executive leadership at VIASAT.

Mark Dankberg

Chief Executive Officer

Craig Miller

Senior Vice President and President, Government

Garrett Chase

Senior Vice President and Chief Financial Officer

Girish Chandran

Corporate Chief Technology Officer and Senior Vice President, Engineering

Shawn Duffy

Senior Vice President and Chief Accounting Officer

Board of directors at VIASAT.

Research analysts who have asked questions during VIASAT earnings calls.

Ryan Koontz

Needham & Company, LLC

7 questions for VSAT

Sebastiano Petti

JPMorgan Chase & Co.

7 questions for VSAT

Edison Yu

Deutsche Bank

6 questions for VSAT

Ric Prentiss

Raymond James

6 questions for VSAT

Colin Canfield

Cantor Fitzgerald

5 questions for VSAT

Mike Crawford

B. Riley Securities

3 questions for VSAT

Brent Penter

Raymond James Financial

2 questions for VSAT

Justin Lang

Morgan Stanley

2 questions for VSAT

Louie DiPalma

William Blair

2 questions for VSAT

Michael Crawford

B. Riley Securities, Inc.

2 questions for VSAT

Simon Flannery

Morgan Stanley

2 questions for VSAT

Xin Yu

Deutsche Bank

2 questions for VSAT

Christopher Quilty

Quilty Space

1 question for VSAT

Matthew Cavanagh

Needham & Company

1 question for VSAT

Mike Raffert

Wolfe Research

1 question for VSAT

Nikhil Aluru

JPMorgan Chase & Co.

1 question for VSAT

Recent press releases and 8-K filings for VSAT.

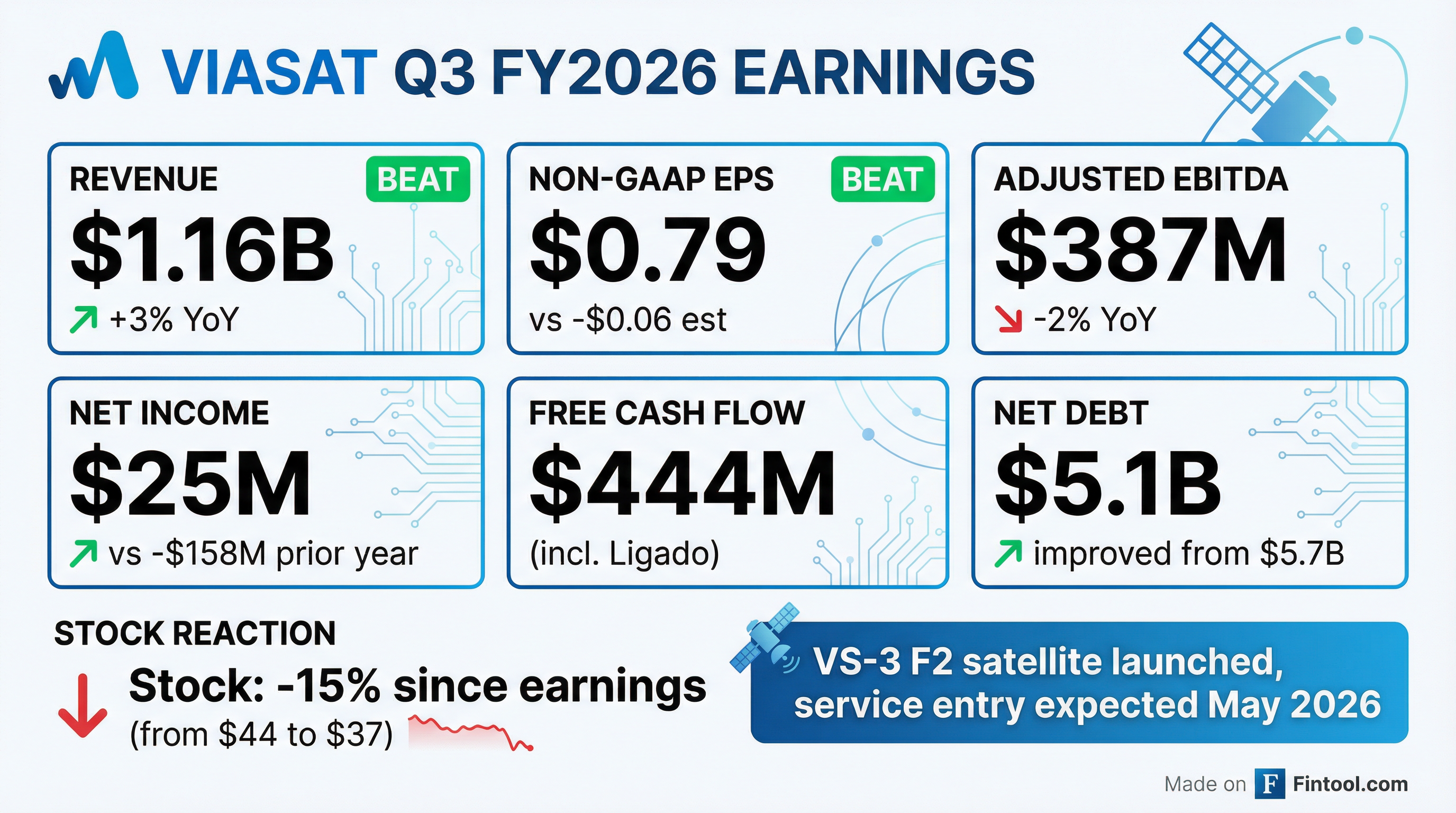

- Viasat reported Q3 FY2026 revenue of $1.2 billion, an increase of approximately 3%, and Adjusted EBITDA of $387 million, a 2% decrease. The company achieved positive free cash flow of $444 million (or $24 million excluding the Ligado payment) and reduced its net debt to trailing 12-month Adjusted EBITDA to 3.25 times.

- For FY2026, Viasat expects low single-digit revenue growth and flat Adjusted EBITDA. Capital expenditures guidance was revised down by $100 million-$200 million to a range of $1 billion-$1.1 billion, and the company anticipates positive free cash flow for FY2026 and beyond.

- ViaSat-3 Flight 2 is expected to commence services by May, with Flight 3 anticipated to launch shortly after Flight 2's final deployments and enter service by late summer. These satellites are crucial for future growth in aviation, maritime, government SATCOM, and residential services.

- The company's strategic review committee continues to evaluate options, including the potential separation of its government and commercial businesses, aiming to enhance shareholder value and competitive positioning.

- Viasat reported Q3 FY 2026 revenue of $1.2 billion, a 3% increase, and Adjusted EBITDA of $387 million, a 2% decrease, achieving a 33% Adjusted EBITDA margin.

- The company generated $444 million in free cash flow in Q3 FY 2026 (or $24 million excluding a Legato lump sum payment) and projects positive free cash flow for fiscal 2026, 2027, and beyond.

- ViaSat-3 Flight 2 is expected to commence services by May, with Flight 3 launching shortly after and entering service by late summer, both crucial for future growth.

- Viasat is making substantial progress towards its target of below 3.0 net leverage and has lowered its FY 2026 CapEx guidance to $1 billion-$1.1 billion.

- An ongoing strategic review continues to evaluate options, including a potential separation of government and commercial businesses, with key dependencies on ViaSat-3 service entry, deleveraging, and free cash flow generation.

- Viasat reported Q3 FY2026 revenue of $1.2 billion, a 3% increase, and Adjusted EBITDA of $387 million, a 2% decrease. The company generated $444 million in free cash flow (or $24 million excluding a Legato lump sum payment) and reduced its net debt to trailing twelve-month adjusted EBITDA to 3.25 times, progressing towards its sub-3.0 target.

- The company provided updates on its ViaSat-3 constellation, with Flight 2 anticipated to commence services by May, and Flight 3 expected to launch shortly after Flight 2's final deployments, with estimated service entry by late summer.

- For fiscal year 2026, Viasat reiterates expectations for low single-digit revenue growth and flat Adjusted EBITDA. Fiscal 2026 CapEx guidance was revised downwards by $100 million-$200 million to a range of $1 billion-$1.1 billion, and the company now expects positive free cash flow for FY2026, FY2027, and beyond.

- Viasat's board continues its strategic review, evaluating options including the potential separation of its government and commercial businesses, with key considerations being the successful deployment of ViaSat-3, continued deleveraging, and free cash flow generation.

- Viasat reported Q3 FY2026 revenue of $1,157.0 million, a 3% year-over-year increase, and net income of $25.0 million, improving from a net loss of $158.4 million in Q3 FY2025.

- Adjusted EBITDA for Q3 FY2026 was $387.0 million, a 2% decrease year-over-year.

- The company is progressing with its ViaSat-3 (VS-3) F2 satellite, with service entry expected by May, and anticipates VS-3 F3 to launch shortly after F2's final deployments, with service entry by late summer.

- Viasat ended the quarter with $5.1 billion in net debt and $2.5 billion in available liquidity, generating $24 million in free cash flow (excluding the Ligado lump sum payment).

- For FY2026, the company expects low single-digit year-over-year revenue growth and flat year-over-year Adjusted EBITDA, with capital expenditures projected between $1.0 billion and $1.1 billion.

- Viasat, Inc., as Guarantor, and its subsidiary ViaSat Technologies Limited, as Borrower, entered into a Credit Agreement dated January 21, 2026, with J.P. Morgan Securities LLC and the Export-Import Bank of the United States.

- The Total Commitment Amount under this agreement is U.S.$188,730,259, which includes a Financed Portion Amount of U.S.$175,872,731 and an Exposure Fee Amount of U.S.$12,857,528.

- A Commitment Fee of 0.50% per annum will accrue from February 20, 2023, on the uncancelled and undisbursed amount of the Total Commitment Amount, with principal repayment scheduled in sixteen semi-annual installments.

- The agreement also stipulates that Viasat, Inc. must deliver quarterly and annual consolidated financial statements and backlog reports.

- The maritime satellite communication market is projected to grow from an estimated $4.84 billion in 2026 to $6.27 billion by 2030, at a Compound Annual Growth Rate of 6.7%.

- This market expansion is primarily driven by the proliferation of satellite networks, rising adoption of Very Small Aperture Terminal (VSAT) systems, and increased demand for maritime voice and data services.

- Viasat Inc. strengthened its market position through the acquisition of Inmarsat in May 2023, expanding its capabilities to meet growing demands for swift, reliable, and secure satellite connectivity.

- While North America was the largest region in 2025, Asia-Pacific is anticipated to be the fastest-growing region in the maritime satellite communication market.

- Viasat announced the unification of its Ka-band satellites, the Global Xpress fleet, and select partner satellites into a single, integrated global Ka-band satellite communications network for government and military users.

- This evolved network provides seamless global, multi-orbit Ka-band connectivity with increased performance, expanded coverage, and greater resiliency, and is fully interoperable with MILSATCOM Ka-band networks.

- The network offers data rates up to 200 Mbps and incorporates ultra-high-capacity ViaSat-3 satellites, including the recently launched ViaSat-3 F2 and planned ViaSat-3 F3 for enhanced coverage and resilience.

- Designed for national security, the network includes features for increased resilience against jamming, interference, and denial attacks in contested environments.

- Viasat announced the successful launch and initial signal acquisition of its ViaSat-3 Flight 2 (F2) satellite on November 13, 2025, at 10:04 p.m. EST.

- The ViaSat-3 F2 satellite will provide services over the Americas region and is anticipated to double the overall bandwidth capacity of Viasat's entire existing fleet.

- This launch represents a significant step for Viasat's global, multi-orbit network roadmap, with service entry anticipated for early 2026 following in-orbit testing and network integration.

- Viasat (VSAT) reported Q2 FY2026 revenue of $1.1 billion, an increase of 2% year-over-year, and an adjusted EBITDA of $385 million, up 3%. The net loss improved to $61 million from $138 million in the second quarter of FY2025.

- The company generated $69 million in free cash flow for the quarter, contributing to $130 million year-to-date, marking three consecutive quarters of positive free cash flow.

- Viasat plans to repay $300 million of debt from the Inmarsat Terminal B facility, saving approximately $23 million annually in cash interest, following a $420 million lump sum payment received from Legato.

- The launch of Viasat 3, Flight 2, was delayed by approximately a week due to a rocket issue, with Flight 3 also progressing. The company anticipates negative free cash flow in H2 FY2026 due to remaining capital expenditures for Viasat 3 completion but expects positive free cash flow in FY2027.

- For fiscal year 2026, Viasat maintains its outlook for revenue to be up low single digits year-over-year with flattish adjusted EBITDA.

- Viasat reported Q2 Fiscal Year 2026 revenues of $1.1 billion, a 2% year-over-year increase, and a net loss of $61 million, an improvement from a net loss of $138 million in Q2 FY2025.

- Adjusted EBITDA for Q2 FY2026 grew 3% year-over-year to $385 million.

- For FY2026, the company continues to expect low single-digit year-over-year revenue growth and flattish year-over-year Adjusted EBITDA, with capital expenditures of approximately $1.2 billion.

- Viasat anticipates positive free cash flow for FY2027 and received a $420 million Ligado lump sum payment in October 2025.

- Key operational milestones include the impending launch of ViaSat-3 F2, soon to be followed by ViaSat-3 F3, which are expected to significantly increase global capacity.

Quarterly earnings call transcripts for VIASAT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more