Earnings summaries and quarterly performance for Vestis.

Research analysts who have asked questions during Vestis earnings calls.

Ronan Kennedy

Barclays

6 questions for VSTS

Shlomo Rosenbaum

Stifel, Nicolaus & Company, Incorporated

5 questions for VSTS

Andrew Steinerman

JPMorgan Chase & Co.

4 questions for VSTS

George Tong

Goldman Sachs

4 questions for VSTS

Stephanie Moore

Jefferies

4 questions for VSTS

Andrew J. Wittmann

Robert W. Baird & Co.

3 questions for VSTS

Andrew J. Wittmann

Robert W. Baird & Co

2 questions for VSTS

Anna

Wolfe Research

2 questions for VSTS

Heri Lonto

Jefferies

2 questions for VSTS

Ludwig Fadenauer

William Blair

2 questions for VSTS

Tim Mulrooney

William Blair

2 questions for VSTS

Anna Wu

Goldman Sachs

1 question for VSTS

Benjamin Luke McFadden

William Blair

1 question for VSTS

Harold Antor

Jefferies Financial Group Inc.

1 question for VSTS

John Ronan Kennedy

Barclays PLC

1 question for VSTS

Keen Fai Tong

Goldman Sachs Group Inc.

1 question for VSTS

Luke McFadden

William Blair & Company

1 question for VSTS

Manav Patnaik

Barclays

1 question for VSTS

Oliver Davies

Redburn Atlantic

1 question for VSTS

Timothy Mulrooney

William Blair & Company

1 question for VSTS

Recent press releases and 8-K filings for VSTS.

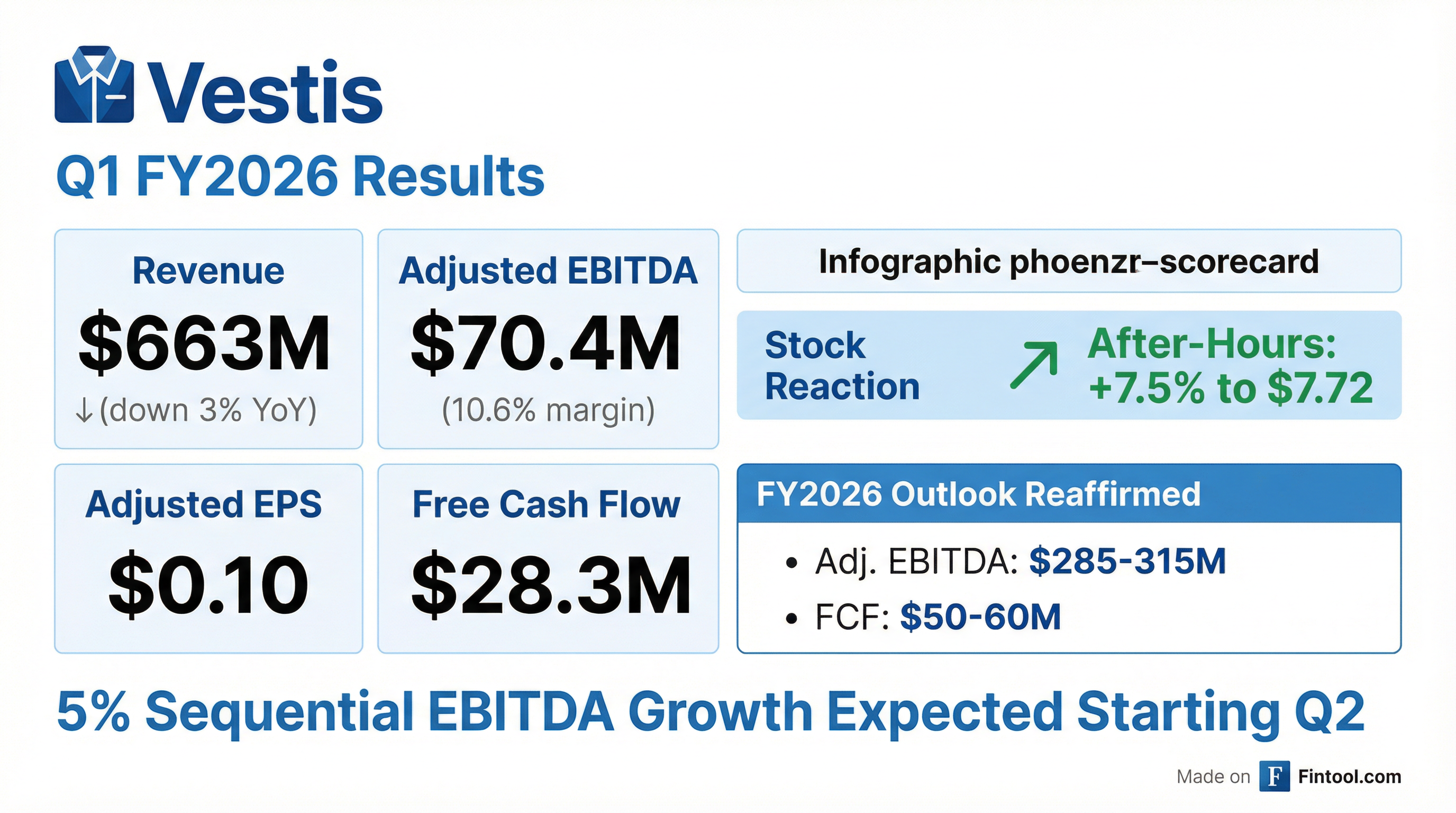

- Vestis Corporation reported Q1 2026 revenue of $663.4 million, a 3% decline versus Q1 2025, and Adjusted EBITDA of $70.4 million, representing a 10.6% margin.

- The company's business transformation showed early progress in Q1 2026, with on-time delivery improving 300 basis points, plant productivity up 7%, and customer complaints declining 12% year-over-year. This led to a $0.02 improvement in cost per pound, equating to approximately $10 million in Adjusted EBITDA.

- Vestis generated $38 million in operating cash flow and $28 million in free cash flow in Q1 2026, and is actively marketing non-core properties for sale with proceeds intended for debt repayment.

- The company reaffirmed its fiscal 2026 guidance, projecting revenue to be flat to down 2% and Adjusted EBITDA between $285 million and $315 million, with 5% successive quarterly improvements starting in Q2.

- Vestis Corporation reported Q1 2026 revenue of $663.4 million, a 3% decline year-over-year, primarily attributed to a shift in product mix towards lower revenue quality despite stable overall volume.

- Adjusted EBITDA was $70.4 million (10.6% margin) for Q1 2026, showing sequential improvement from Q4 2025, driven by a $0.02 improvement in cost per pound.

- The company reaffirmed its fiscal 2026 guidance, projecting revenue to be flat to down 2% and Adjusted EBITDA between $285 million and $315 million, with 5% successive quarterly improvements starting in Q2.

- Operating cash flow was $38 million and free cash flow was $28 million for the quarter. Vestis ended Q1 2026 with $1.29 billion in net debt and $317 million in available liquidity.

- The ongoing business transformation is expected to deliver an in-year benefit of $40 million for FY26, with proceeds from non-core property sales intended for debt repayment.

- Vestis reported Q1 2026 revenue of $663 million, a 3% decrease year-over-year on consistent total volume, with Adjusted EBITDA of $70.4 million and Adjusted EPS of $0.10 per diluted share.

- The company generated Free Cash Flow of $28.3 million and Adjusted Free Cash Flow of $42.9 million in Q1 2026, ending the quarter with $316.7 million in total available liquidity as of January 2, 2026.

- Vestis reaffirmed its Fiscal Year 2026 outlook, projecting revenue to be flat to down 2% versus FY 2025, Adjusted EBITDA in the range of $285 million to $315 million, and Free Cash Flow between $50 million and $60 million.

- Strategic business transformation efforts resulted in operational improvements, including a 7% increase in plant productivity, a 3% improvement in on-time deliveries, and a 12% reduction in customer complaints compared to FQ1 2025, with annual expected cost savings of at least $75 million by the end of FY 2026.

- Vestis Corporation reported Q1 2026 revenue of $663.4 million, a 3% decline compared to Q1 2025, and Adjusted EBITDA of $70.4 million, representing a 10.6% margin.

- The company demonstrated early progress in its business transformation, with Adjusted EBITDA improving sequentially from Q4 2025, and operational metrics showing improvement, including a 7% increase in plant productivity and a $0.02 improvement in cost per pound year-over-year.

- Vestis generated $38 million in operating cash flow and $28 million in free cash flow in Q1 2026.

- The company reaffirmed its fiscal 2026 guidance, expecting revenue to be flat to down 2%, Adjusted EBITDA in the range of $285 million to $315 million with 5% successive quarterly improvements starting Q2, and free cash flow between $50 million and $60 million.

- Vestis reported Q1 2026 revenue of $663.4 million, a 3.0% decrease year over year, with a net loss of $6.4 million or $(0.05) per diluted share, and Adjusted EBITDA of $70.4 million.

- The company reaffirmed its Fiscal 2026 outlook, projecting revenue to be flat to down 2%, Adjusted EBITDA between $285 million and $315 million, and Free Cash Flow in the range of $50 million to $60 million.

- Cash flow provided by operating activities for Q1 2026 was $37.7 million, with Free Cash Flow of $28.3 million.

- The strategic business transformation plan, launched in Q1 2026, is on track, showing improvements such as a 7% increase in plant productivity and a 12% reduction in customer complaints compared to Q1 2025.

- Vestis reported First Quarter 2026 revenue of $663.4 million, a net loss of $6.4 million (or $(0.05) per diluted share), and Adjusted EBITDA of $70.4 million.

- The company launched a strategic business transformation plan in Q1 2026, targeting at least $75 million in annual operating cost savings by the end of fiscal 2026.

- Vestis reaffirmed its fiscal 2026 outlook, projecting revenue to be flat to down 2%, Adjusted EBITDA between $285 million and $315 million, and Free Cash Flow between $50 million and $60 million.

- Kelly Janzen, Executive Vice President and Chief Financial Officer of Vestis, will depart the company by the end of calendar year 2025 to pursue other opportunities.

- Adam K. Bowen, Vestis's Vice President of Financial Planning & Analysis, has been appointed Interim Chief Financial Officer. Mr. Bowen joined Vestis in February 2025 and previously served as Chief Accounting Officer at Sonder, Inc. and BlueLinx Holdings Inc..

- Vestis has engaged an executive search firm to conduct a comprehensive search for a permanent Chief Financial Officer.

- The company reaffirmed its full-year 2026 financial guidance, which was previously announced on December 1, 2025.

- Vestis Corporation reported Q4 2025 normalized revenue of $660 million, a 3.5% year-over-year decrease, and normalized adjusted EBITDA of $65 million with a 9.8% margin.

- The company launched a multi-year business transformation plan, expected to be substantially completed by the end of fiscal 2027, aiming for at least $75 million in run-rate operating cost savings by the end of 2026.

- For fiscal 2026, Vestis expects revenue to be flat to down 2% compared to normalized fiscal 2025, and adjusted EBITDA to be in the range of $285 million to $315 million.

- Management believes Q4 2025 represents the low point for profitability and anticipates steady, measurable progress through 2026 as the transformation plan is executed.

- Vestis reported Q4 2025 revenue of $712 million and a net loss of $12.5 million, with Adjusted EBITDA at $65 million. For the full fiscal year 2025, revenue was $2.7 billion and net loss was $40 million, with Adjusted EBITDA of $257 million.

- Free Cash Flow for Q4 2025 was $16 million, contributing to a full fiscal year 2025 Free Cash Flow of $5.8 million. The company maintained liquidity of $298 million and a net leverage ratio of 4.72x as of October 3, 2025.

- Vestis is initiating a multi-year strategic business transformation that is projected to generate annual cost savings of $75 million by the end of fiscal 2026.

- For Fiscal Year 2026, Vestis anticipates revenue to be flat to down 2% versus normalized FY 2025 revenue, Adjusted EBITDA in the range of $285 million to $315 million, and Free Cash Flow in the range of $50 million to $60 million.

- Vestis reported Q4 2025 normalized revenue of $660 million, a 3.5% decrease year-over-year, and normalized adjusted EBITDA of $65 million with a 9.8% margin. The company generated $16 million in free cash flow during the quarter.

- For fiscal 2026, Vestis projects revenue between flat and down 2% compared to normalized fiscal 2025, with adjusted EBITDA in the range of $285 million to $315 million. Free cash flow is anticipated to be between $50 million and $60 million.

- The company launched a multi-year business transformation plan, expected to be substantially completed by the end of fiscal 2027, aiming to generate at least $75 million in run-rate operating cost savings by the end of 2026. This plan addresses past issues such as prioritizing revenue growth without sufficient focus on quality and an unbalanced product mix.

- Management stated that Q4 2025 represents the low point for profitability, anticipating steady progress through 2026 as the transformation plan, built on commercial excellence, operational excellence, and asset/network optimization, is executed.

Quarterly earnings call transcripts for Vestis.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more