Earnings summaries and quarterly performance for WSFS FINANCIAL.

Executive leadership at WSFS FINANCIAL.

Rodger Levenson

Chief Executive Officer

Arthur Bacci

Chief Operating Officer

Christine Davis

Chief Risk Officer

David Burg

Chief Financial Officer

James Wechsler

Chief Commercial Banking Officer

Jamie Hopkins

Chief Wealth Officer

Lisa Brubaker

Chief Human Resources Officer

Shari Kruzinski

Chief Consumer Banking Officer

Board of directors at WSFS FINANCIAL.

Anat Bird

Director

Christopher Gheysens

Lead Independent Director

David Turner

Director

Eleuthère du Pont

Director

Francis Brake

Director

Jennifer Davis

Director

Karen Dougherty Buchholz

Director

Lynn McKee

Director

Michael Donahue

Director

Michelle Hong

Director

Nancy Foster

Director

Research analysts who have asked questions during WSFS FINANCIAL earnings calls.

Russell Gunther

Stephens Inc.

8 questions for WSFS

Manuel Navas

D.A. Davidson & Co.

5 questions for WSFS

Christopher Marinac

Janney Montgomery Scott LLC

4 questions for WSFS

Janet Lee

TD Cowen

4 questions for WSFS

Kelly Motta

Keefe, Bruyette & Woods

4 questions for WSFS

Frank Schiraldi

Piper Sandler

3 questions for WSFS

Kelly Mota

KBW

2 questions for WSFS

Charlie Driscoll

Keefe, Bruyette & Woods

1 question for WSFS

Kate Ashley

KBW

1 question for WSFS

Sharanjit Cheema

D.A. Davidson & Co.

1 question for WSFS

Recent press releases and 8-K filings for WSFS.

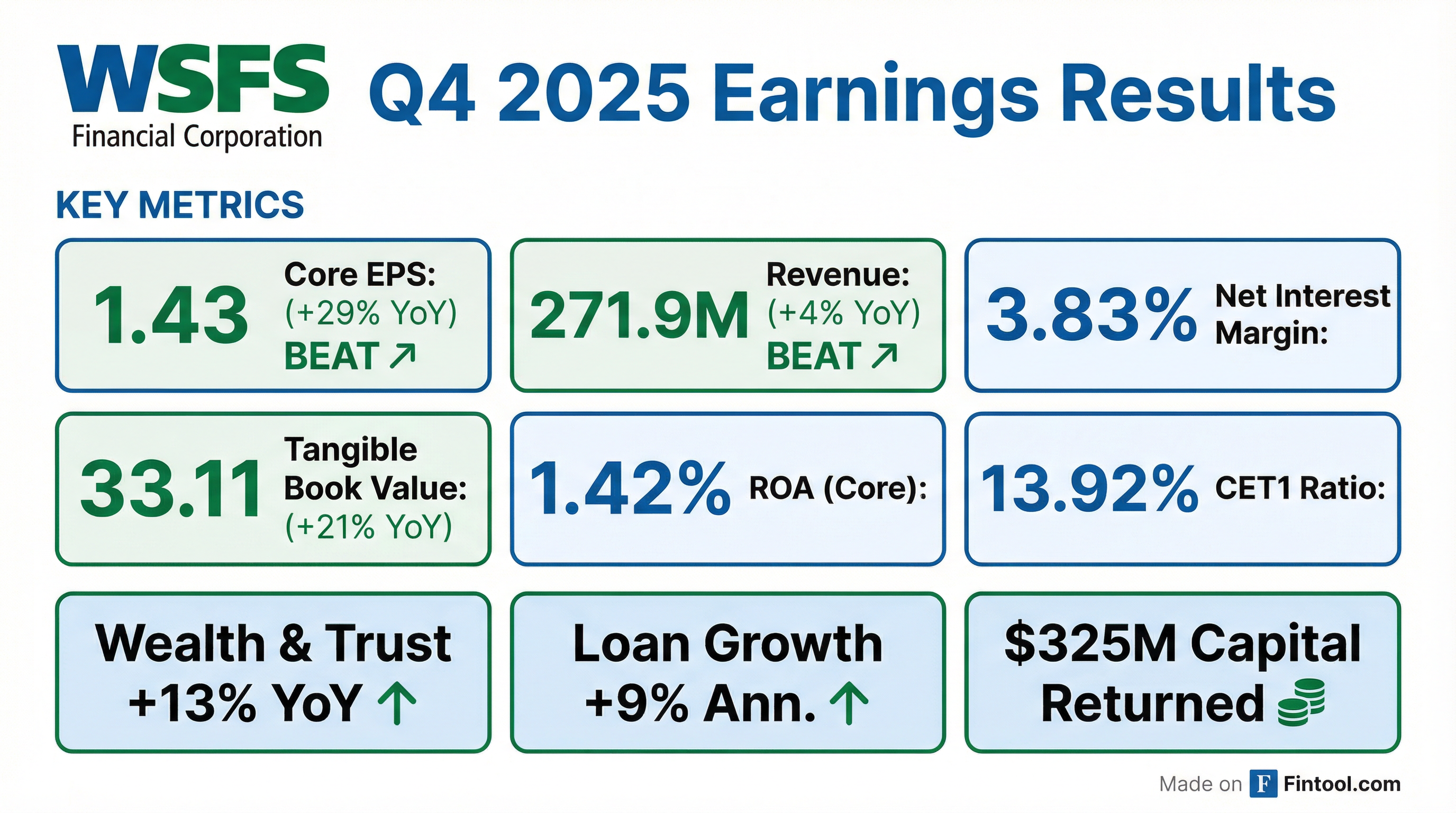

- WSFS Financial Corporation reported core earnings per share of $1.43 for Q4 2025 and a full-year core EPS of $5.21 for 2025, with a core return on tangible common equity of 18% for both periods.

- Total gross loans grew 2% linked quarter (or 9% annualized), and total client deposits increased 2% linked quarter (or 10% annualized) in Q4 2025, with non-interest-bearing deposits representing 32% of total client deposits. The net interest margin (NIM) was 3.83% for the quarter.

- The company returned $119 million of capital in Q4 2025, including $109 million in buybacks, bringing total buybacks for 2025 to $288 million, representing over 9% of outstanding shares.

- For 2026, WSFS expects double-digit growth in core EPS and a full-year core ROA of approximately 1.40%, based on an assumption of three 25 basis point rate cuts.

- The 2026 outlook projects mid-single-digit loan growth and mid-single-digit deposit growth from Q4 levels, with a full-year NIM of approximately 3.80%.

- WSFS Financial Corporation reported Q4 2025 EPS of $1.34 and FY 2025 EPS of $5.09, with Net Income of $72.7 million for Q4 2025 and $287.3 million for FY 2025.

- The company achieved significant balance sheet growth in Q4 2025, with total gross loans increasing 9% quarter-over-quarter to $13,323 million and total client deposits growing 10% quarter-over-quarter to $17,642 million.

- WSFS returned substantial capital to shareholders in 2025, totaling $324.7 million, which included $287.5 million in share repurchases (9.3% of outstanding shares).

- The Wealth and Trust segment demonstrated strong growth, generating $171.4 million in fee revenue for 2025, an increase of 16% compared to 2024.

- Looking ahead to 2026, WSFS anticipates a Full-Year Core ROA Outlook of +/-1.40% and double-digit EPS growth, supported by projected mid-single-digit loan and deposit growth.

- WSFS reported strong Q4 2025 core EPS of $1.43 and full-year 2025 core EPS of $5.21, with full-year EPS increasing 19% over the prior year.

- The company achieved a Q4 2025 core ROA of 1.42% and a full-year core ROA of 1.39%, alongside a core return on tangible common equity of 18% for both periods.

- Operational highlights include 2% linked-quarter growth in total gross loans and total client deposits, with non-interest-bearing deposits growing 6% linked quarter. Core fee revenue increased 8% year-over-year, driven by double-digit growth in wealth and trust.

- WSFS returned $119 million in capital during Q4 2025, including $109 million in buybacks, bringing total buybacks for the year to $288 million. The company plans to maintain an elevated level of buybacks, returning approximately 100% of net income annually.

- For 2026, WSFS expects a full-year core ROA of approximately 1.40% and double-digit core EPS growth, with mid-single-digit loan and deposit growth, and a Net Interest Margin (NIM) of approximately 3.80%.

- WSFS delivered strong Q4 2025 core earnings per share of $1.43 and a full-year core EPS of $5.21, representing a 19% increase over the prior year. The net interest margin (NIM) for Q4 was 3.83%, and total client deposits grew 2% linked quarter or 10% annualized.

- In Q4 2025, WSFS returned $119 million of capital, including $109 million in buybacks, bringing the total for 2025 to $288 million, or over 9% of outstanding shares. The company intends to maintain an elevated level of buybacks in 2026.

- For 2026, WSFS projects double-digit core EPS growth, a full-year core ROA of approximately 1.40%, and mid-single-digit loan and deposit growth, based on an assumption of three 25 basis point rate cuts. The NIM outlook for the year is approximately 3.80%.

- WSFS Financial Corporation reported Q4 2025 diluted earnings per share (EPS) of $1.34 and full-year 2025 diluted EPS of $5.09. Core EPS for Q4 2025 was $1.43, and full-year core EPS was $5.21.

- The company achieved a Q4 2025 return on average assets (ROA) of 1.33% and a full-year 2025 ROA of 1.36%. Core ROA was 1.42% for Q4 2025 and 1.39% for the full year.

- Results were driven by 2% quarter-over-quarter loan growth and 2% quarter-over-quarter client deposit growth, with 13% year-over-year growth in Wealth and Trust.

- WSFS returned $118.5 million to stockholders in Q4 2025, comprising $109.3 million in share repurchases and $9.2 million in quarterly dividends. The Board of Directors approved a quarterly cash dividend of $0.17 per share.

- Tangible book value per share increased 21% year-over-year to $33.11 as of December 31, 2025.

- WSFS Financial Corporation completed a public offering of $200 million aggregate principal amount of its 5.375% Fixed-to-Floating Rate Senior Unsecured Notes due 2035 on December 11, 2025.

- The notes will bear a fixed interest rate of 5.375% per annum from December 11, 2025, to December 15, 2030, after which the rate will reset quarterly to an annual floating rate equal to the Three-Month Term SOFR plus 189 basis points.

- The company intends to use the net proceeds from this offering to repay $150 million aggregate principal amount of its outstanding 2.75% Fixed-to-Floating Rate Senior Unsecured Notes due 2030 and for general corporate purposes.

- These notes are senior unsecured indebtedness and rank equally with other senior unsecured indebtedness. As of September 30, 2025, WSFS had $148.8 million in senior unsecured debt.

- WSFS Financial Corporation has completed a public offering of $200 million aggregate principal amount of its 5.375% Fixed-to-Floating Rate Senior Unsecured Notes due 2035.

- The Notes will bear a fixed interest rate of 5.375% per annum until December 15, 2030, after which the rate will reset quarterly at an annual floating rate equal to a benchmark rate (expected to be Three-Month Term SOFR) plus 189 basis points.

- The net proceeds from the offering will be used to repay $150 million of outstanding Fixed-to-Floating Rate Senior Unsecured Notes due 2030 and for general corporate purposes.

- David Burg, Executive Vice President and CFO, stated that the transaction terms reflect the strength of WSFS's franchise, capital, liquidity, and credit profile.

- WSFS Financial Corporation announced the pricing of a public offering of $200 million aggregate principal amount of its Fixed-to-Floating Rate Senior Unsecured Notes due 2035.

- The Notes will bear a fixed interest rate of 5.375% per annum from December 15, 2025, to December 15, 2030, and then a floating rate equal to the Three-Month Term SOFR plus 189 basis points until December 15, 2035.

- WSFS Financial Corporation plans to use the net proceeds to repay $150 million of its outstanding Fixed-to-Floating Rate Senior Unsecured Notes due 2030 and for general corporate purposes.

- The offering is expected to close on or about December 11, 2025.

- WSFS Financial Corporation is proposing to offer and sell $150 million of new Fixed-to-Floating Rate Senior Unsecured Notes due 2035, with proceeds intended to redeem existing notes due 2030 and for general corporate purposes.

- As of September 30, 2025, the company reported a Core Return on Assets (ROA) of 1.48% and a Net Interest Margin (NIM) of 3.91%.

- Year-to-date September 30, 2025, Core EPS was $3.79, marking a 16% increase compared to YTD 2024.

- The company maintained a strong capital position with a Common Equity Tier 1 (CET1) ratio of 14.39% and a 75% gross loan-to-deposit ratio as of September 30, 2025.

- WSFS Financial Corporation reported YTD'25 Core EPS of $3.79, marking a 16% increase from YTD'24, and achieved a Core ROA of 1.39% for the same period. In Q3 2025, Core EPS was $1.40 and Core ROA reached 1.48%.

- As of September 30, 2025, the company held $20.8 billion in assets and $17.2 billion in client deposits, with a CET1 Capital Ratio of 14.39%.

- Fee revenue represented 32% of total revenue YTD'25, with the Wealth and Trust franchise contributing $125.7 million in fee revenue, a 16% increase year-over-year.

- The company demonstrated strong liquidity with a 75% loan-to-deposit ratio and $7.9 billion in readily available/secured wholesale funding as of September 30, 2025. WSFS also repurchased 1.5% of outstanding shares in Q3 2025 and 5.8% year-to-date.

Quarterly earnings call transcripts for WSFS FINANCIAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more