Earnings summaries and quarterly performance for Ermenegildo Zegna.

Research analysts who have asked questions during Ermenegildo Zegna earnings calls.

Anthony Charchafji

BNP Paribas

9 questions for ZGN

Chris Huang

Morgan Stanley

7 questions for ZGN

Adrien Duverger

Goldman Sachs

6 questions for ZGN

Oliver Chen

TD Cowen

6 questions for ZGN

Daria Nasledysheva

Bank of America

5 questions for ZGN

Chiara Battistini

JPMorgan Chase & Co.

4 questions for ZGN

Bhumi Kanabar

Jefferies

2 questions for ZGN

Bunmi Kanabar

Jefferies

2 questions for ZGN

Louise Singlehurst

Goldman Sachs

2 questions for ZGN

Maria Meita

Bernstein

2 questions for ZGN

Natasha Bonnet

Morgan Stanley

2 questions for ZGN

Adrian Diverger

Goldman Sachs Group

1 question for ZGN

Kathryn Hallberg

TD Cowen

1 question for ZGN

Matthew Garland

Deutsche Bank

1 question for ZGN

Nicholas Sylvia

TD Cowen

1 question for ZGN

Nicole Silvia

TD Cowen

1 question for ZGN

Tom Nass

TD Cowen

1 question for ZGN

Recent press releases and 8-K filings for ZGN.

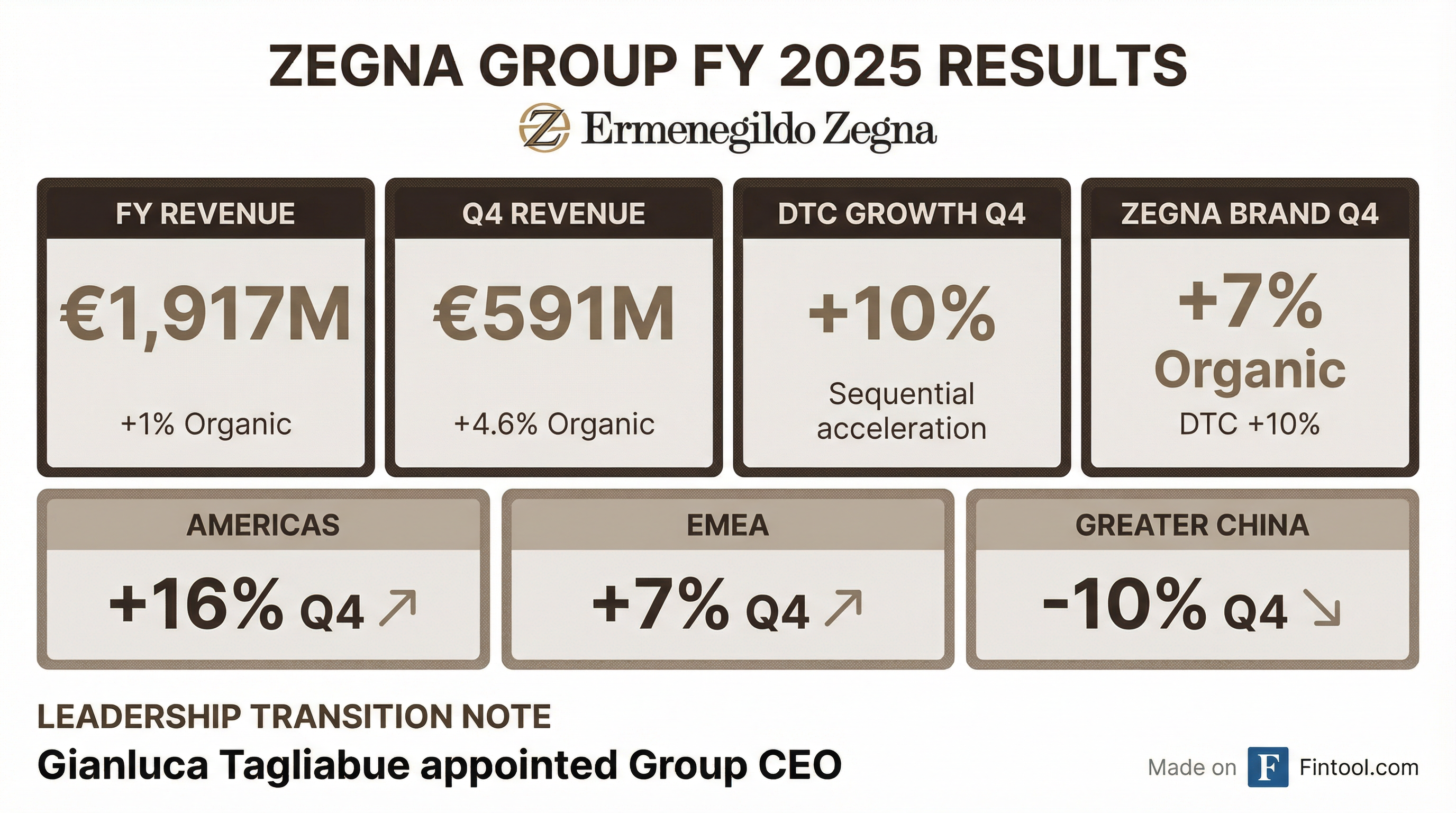

- Zegna Group reported EUR 1,917 million in revenues for full year 2025, an increase of +1% organically, with Q4 2025 revenues reaching EUR 591 million, up +4.6% organically.

- The Direct-to-Consumer (DTC) channel was a significant growth driver, accelerating to +10% in Q4 2025 at the group level and contributing 82% of branded revenues for the full year.

- The company is continuing its strategy to rationalize the wholesale channel, which saw a -14% decline for Thom Browne in Q4 and -40% for the full year 2025, with expectations for continued high single-digit negative performance at the group level in 2026.

- Geographically, the Americas region demonstrated strong growth with a +16% increase in Q4 2025, while the Greater China Region experienced a -10% decrease in Q4 and is expected to remain volatile, with plans for store rationalization.

- Zegna Group is closely monitoring the Saks Global Chapter 11 bankruptcy, which has a low single-digit incidence on group revenues, and is considering a potential bad debt accrual that could affect 2025 EBIT.

- Zegna Group reported total revenue of EUR 1.9 billion for 2025, with the Zegna brand reaching EUR 1.2 billion.

- In Q4 2025, both Group DTC and Zegna DTCs delivered 10% organic growth, primarily driven by strong performance in the Americas and EMEA, while China showed slight improvement but remained volatile.

- The company anticipates a 2.6% currency headwind for 2026 and expects EBIT margins to move sideways.

- A new leadership structure was announced in November 2025, appointing Gianluca Tagliabue as Group CEO and Edoardo and Angelo Zegna as Co-CEOs of the Zegna brand.

- Zegna is continuing its strategic shift towards a more retail-focused model and less wholesale across its brands, with the Zegna brand approaching 90% retail versus wholesale.

- For fiscal year 2025, Ermenegildo Zegna Group reported consolidated revenues of €1,917 million, a 1.5% decrease year-on-year but a 1.1% organic growth.

- In Q4 2025, consolidated revenues reached €591 million, showing 0.3% year-on-year growth and 4.6% organic growth.

- The Direct-to-Consumer (DTC) channel was a significant driver, achieving 10% organic revenue growth at the Group level in Q4 2025, with the ZEGNA brand's DTC growing 10.3% organically.

- Regional performance in Q4 2025 showed strong organic revenue growth in Americas (+16%) and EMEA (+7%), while the Greater China Region declined by 10% organically.

- Zegna Group reported full year 2025 revenues of EUR 1.917 billion and Q4 2025 revenues of EUR 591 million, up 4.6% organically. The Zegna brand achieved EUR 1.2 billion in full year 2025 revenue and EUR 362 million in Q4, growing 7%.

- The Direct-to-Consumer (DTC) channel was a primary growth driver, with both Group and Zegna DTC achieving 10% organic growth in Q4 2025. DTC represented 82% of the group's branded revenues in full year 2025.

- Geographically, Americas revenues increased by 16% in Q4 2025, while the Greater China Region (GCR) experienced a 10% revenue decrease in Q4 2025 and is anticipated to remain volatile.

- The company is actively rationalizing its wholesale channel, leading to a 17% decline in Zegna brand wholesale revenues in Q4 2025 and a 40% decline for Thom Browne in full year 2025. Wholesale is projected to be high single-digit negative for the group in 2026.

- Zegna Group is monitoring the Saks Global Chapter 11 bankruptcy, noting its limited impact on group revenues but acknowledging potential bad debt accruals for 2025 EBIT.

- Ermenegildo Zegna Group reported FY 2025 revenues of €1,916.9 million, marking a -1.5% YoY decrease but achieving +1.1% organic growth. Q4 2025 revenues reached €591.0 million, with +0.3% YoY and +4.6% organic growth.

- The Q4 2025 revenue improvement was primarily driven by the Direct-to-Consumer (DTC) channel, which saw +3.9% YoY and +9.6% organic growth, with the ZEGNA brand's DTC accelerating with +5.2% YoY and +10.3% organic growth.

- A new leadership structure became effective January 1, 2026, with Ermenegildo "Gildo" Zegna assuming the role of Group Executive Chairman, Gianluca Tagliabue as Group CEO, and Edoardo and Angelo Zegna appointed as Co-CEOs of the ZEGNA brand.

- Saks Global filed for Chapter 11 bankruptcy protection on January 13, 2026, and is currently negotiating terms with vendors, including the Ermenegildo Zegna Group.

- Ermenegildo Zegna Group reported FY 2025 revenues of €1,916.9 million, a 1.5% decrease year-over-year but a 1.1% organic increase.

- Q4 2025 revenues improved to €591.0 million, marking a 0.3% year-over-year increase and 4.6% organic growth, primarily driven by a 9.6% organic growth in the Direct-to-Consumer (DTC) channel.

- A new leadership structure became effective January 1, 2026, with Gianluca Tagliabue appointed Group CEO and Gian Franco Santhià as Group CFO.

- Saks Global filed for Chapter 11 bankruptcy on January 13, 2026, and is negotiating terms with vendors, including Ermenegildo Zegna Group.

- Ermenegildo Zegna Group reported H1 2025 revenues of €927.7 million, a 3.4% year-on-year decrease (2.0% organic decrease), with Q2 2025 revenues at €468.9 million, down 5.7% year-on-year (2.6% organic decrease).

- The Group's Direct-to-Consumer (DTC) channel showed strong organic growth, with H1 2025 DTC revenues up 6.1% organically and Q2 2025 DTC revenues up 7.5% organically, driven by positive performance across all brands.

- Conversely, wholesale branded revenues declined significantly, down 26.5% organically in H1 2025 and 32.5% organically in Q2 2025, reflecting a strategic decision to reduce exposure in this channel.

- Geographically, the Americas outperformed with 9.8% organic revenue growth in Q2 2025, while the Greater China Region saw a significant organic decline of 17.1% in Q2 2025 due to a subdued consumer environment.

- In corporate news, Temasek invested in the Group, acquiring a 10% stake in the Company's ordinary share capital on July 29, 2025, and Sam Lobban was appointed CEO of Thom Browne, effective September 2, 2025.

- Ermenegildo Zegna N.V. announced that all resolutions submitted to its Annual General Meeting held on June 26, 2025, were adopted.

- This includes the approval of a dividend distribution of EUR 0.12 per ordinary share, corresponding to a total dividend distribution of approximately EUR 30 million.

- For ordinary shares listed on the New York Stock Exchange, the ex-date and record date for the dividend are July 7, 2025, with the payment date set for July 29, 2025.

- ZEGNA FRIENDS program to drive growth, focusing on high-spend customers (>€10k) accounting for up to 80% of industry growth through 2027

- Personalization outreach generates >50% of ZEGNA retail revenues, with tailored communications and AI-enabled clienteling expanding service offerings

- Middle East direct-to-consumer revenues have grown >4x from 2019 to 2024 and network in the region is set to expand from 15 to ~20 stores

- Group confirms 2027 targets of €2.2–2.4 bn in revenues and €250–300 m in adjusted EBIT, with a 200–300 bps margin improvement goal

- Q1 2025 group revenues reached €459m (range: €458.8m–€459m), reflecting roughly a 1% YoY decline

- The Direct-to-Consumer (DTC) channel outperformed, achieving +5% organic growth and generating €345m in revenues, significantly supporting key brands

- Key strategic initiatives included new product launches (summer drop collection), planned mid-single digit pricing adjustments to offset a 10% tariff impact, and efforts to convert wholesale stores to DTC outlets

- The ZEGNA brand delivered +3% organic growth, while Thom Browne experienced notable declines (down 9% and down 19% organic )

- Geographically, the Americas enjoyed double-digit growth for Zegna, whereas the Greater China region faced a 12% decline amid a cautious approach, with early signs of retail recovery

- Several store openings for ZEGNA, Thom Browne, and TOM FORD FASHION enhanced brand visibility in key markets

Quarterly earnings call transcripts for Ermenegildo Zegna.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more