Cardinal Health Raises FY26 Guidance Above Consensus as Specialty Pharma Surges

January 13, 2026 · by Fintool Agent

Cardinal Health raised fiscal 2026 earnings guidance to at least $10.00 per share—exceeding the $9.83 analyst consensus and marking the company's second guidance increase this fiscal year—as specialty pharmaceutical revenues accelerate toward $50 billion on surging demand for its MSO platforms and biopharma solutions.

Shares rose approximately 2.7% in premarket trading following the announcement at the J.P. Morgan Healthcare Conference.

"Our team's execution against our strategic growth plan continues to deliver meaningful results, and as a demonstration of our confidence and momentum, we are pleased to again raise our expectations for fiscal year 2026," said CEO Jason Hollar.

The Numbers

The guidance raise represents meaningful upside from where the company started the year:

| Metric | Previous Guidance | New Guidance | Change |

|---|---|---|---|

| FY26 Non-GAAP EPS | $9.65 - $9.85 | At least $10.00 | +7% from midpoint |

| Specialty Revenue | >$45B implied | >$50B | 16% 3-yr CAGR |

| BioPharma Solutions Growth | 30%+ | 30%+ | On track |

For context, Cardinal Health began fiscal 2026 in October guiding to $8.85-$9.00 EPS, raised to $9.65-$9.85 after Q1 results, and is now raising again to $10+—a trajectory reflecting broad-based strength across all five operating segments.

The new guidance exceeds analyst consensus of $9.83 EPS for fiscal 2026, with 14 analysts covering the stock.*

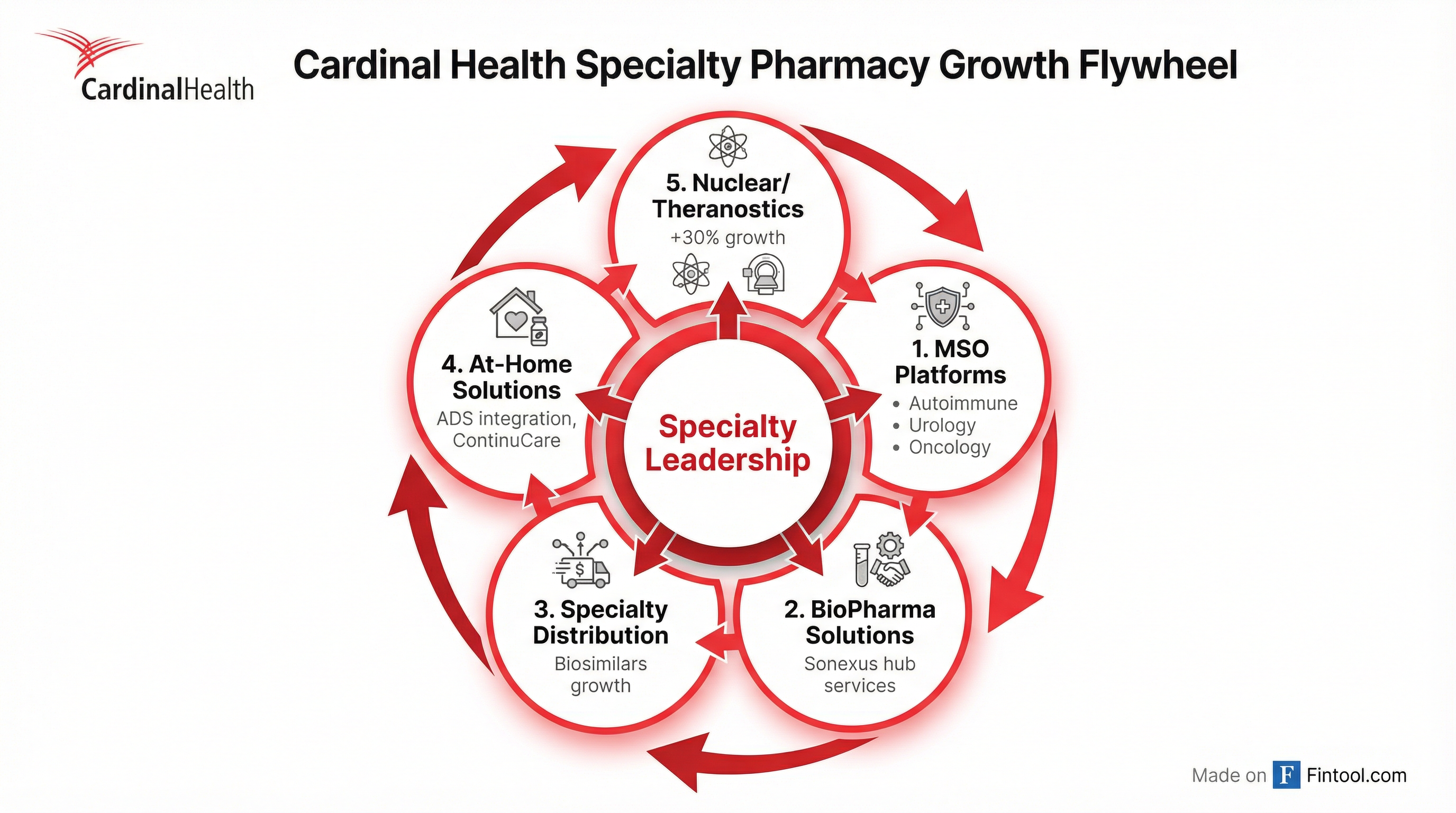

Specialty Pharma: The Growth Engine

Cardinal Health's pivot toward specialty pharmaceuticals is paying off at an accelerating rate. Specialty revenues will surpass $50 billion in fiscal 2026, marking a 16% compound annual growth rate over three years—a pace that exceeds what management laid out at last year's Investor Day.

Three engines are driving this growth:

MSO Platforms: Cardinal Health now serves approximately 3,000 specialty providers across 32 states through its Specialty Alliance platform, with particular strength in autoimmune, urology, and oncology. The pending Solaris Health acquisition—which the company expects to close shortly—will add the nation's largest urology MSO with over 750 providers.

BioPharma Solutions: The upstream business, which includes the Sonexus Access and patient support hub services, is tracking toward 30%+ revenue growth this fiscal year. Recent wins include the transition of Sanofi and Regeneron's Dupixent My Way patient support program—one of the largest in the industry—to the Sonexus platform, collectively serving over 1 million patients.

Specialty Distribution: Strong underlying demand continues across therapeutic areas, with biosimilars representing a growing tailwind. Management noted the next three years should see elevated levels of new loss of exclusivity on branded products converting to generic and biosimilar alternatives.

Navigating the IRA

A key overhang has been lifted: Cardinal Health confirmed it has successfully transitioned all manufacturer distribution service agreements for branded pharmaceutical products impacted by the 2026 Medicare Drug Price Negotiation Program ahead of the January 1 implementation date.

This matters because the Inflation Reduction Act's drug pricing provisions created uncertainty about how pharmaceutical distributors would be compensated when negotiated drugs see lower prices. Cardinal Health now expects to "continue to be appropriately compensated for its critical role in healthcare of safely, securely and efficiently delivering pharmaceuticals to end customers across the country."

Leerink Partners analyst Michael Cherny called the update "another strong update for a company that has been delivering on improved growth under the current leadership."

New Initiatives: ContinuCare Pathway

Beyond the guidance raise, Cardinal Health unveiled a new diabetes supply management program called ContinuCare Pathway, designed to simplify insurance navigation for pharmacies and patients seeking home delivery of diabetes supplies like continuous glucose monitors.

The initiative leverages Cardinal Health's 2024 acquisition of Advanced Diabetes Supply (ADS). Publix Super Markets has enrolled its entire pharmacy network of nearly 1,400 pharmacies in the program, bringing total retail and grocery pharmacy participants to over 11,000.

Financial Trajectory

Cardinal Health's financial turnaround has been dramatic. The company swung from a GAAP net loss of $938 million in FY22 (driven by a goodwill impairment charge) to $1.56 billion in net income in FY25.*

| Metric | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|---|

| Revenue ($B) | $181.3 | $205.0 | $226.8 | $222.6 |

| GAAP Diluted EPS | $(3.37) | $1.26 | $3.45 | $6.45 |

| Gross Margin (%) | 3.58% | 3.35% | 3.27% | 3.67% |

The company generated $1.3 billion in adjusted free cash flow in Q1 alone and ended the quarter with $4.6 billion in cash.

What to Watch

Cardinal Health will provide additional details on its Q2 earnings call scheduled for February 5, 2026. Key items to monitor:

-

Solaris Health integration progress — The urology MSO acquisition should close imminently, with potential upside from drug distribution not yet in guidance.

-

Q2 GMPD profitability — Management warned that the Global Medical Products & Distribution segment will not see year-over-year profit growth in Q2 due to elevated tariff costs, though Q4 should be the segment's strongest quarter.

-

GLP-1 contribution — GLP-1 sales contributed approximately 6 percentage points of pharma revenue growth in Q1; continued strength here is embedded in guidance.

-

Theranostics momentum — Nuclear and Precision Health Solutions delivered over 30% theranostics revenue growth in Q1, with expanded PET network investments of $150 million over three years.

*Values retrieved from S&P Global