Earnings summaries and quarterly performance for REGENERON PHARMACEUTICALS.

Executive leadership at REGENERON PHARMACEUTICALS.

Leonard Schleifer

President and Chief Executive Officer

Andrew Murphy

Executive Vice President, Research

Christopher Fenimore

Executive Vice President, Finance and Chief Financial Officer

Daniel Van Plew

Executive Vice President and General Manager, Industrial Operations and Product Supply

George Yancopoulos

President and Chief Scientific Officer

Jason Pitofsky

Vice President, Controller

Joseph LaRosa

Executive Vice President, General Counsel and Secretary

Marion McCourt

Executive Vice President, Commercial

Board of directors at REGENERON PHARMACEUTICALS.

Arthur Ryan

Director

Bonnie Bassler

Director

Christine Poon

Lead Independent Director

Craig Thompson

Director

David Schenkein

Director

George Sing

Director

Huda Zoghbi

Director

Joseph Goldstein

Director

Kathryn Guarini

Director

Michael Brown

Director

N. Anthony Coles

Director

Research analysts who have asked questions during REGENERON PHARMACEUTICALS earnings calls.

Salveen Richter

Goldman Sachs

9 questions for REGN

Tyler Van Buren

TD Cowen

9 questions for REGN

Akash Tewari

Jefferies

8 questions for REGN

Evan Seigerman

BMO Capital Markets

8 questions for REGN

Terence Flynn

Morgan Stanley

8 questions for REGN

Alexandria Hammond

Wolfe Research

7 questions for REGN

Brian Abrahams

RBC Capital Markets

7 questions for REGN

David Risinger

Leerink Partners

7 questions for REGN

Carter L. Gould

Barclays

6 questions for REGN

Cory Kasimov

Evercore ISI

6 questions for REGN

Christopher Schott

JPMorgan Chase & Co.

5 questions for REGN

Geoff Meacham

Citigroup Inc.

4 questions for REGN

Christopher Raymond

Piper Sandler

3 questions for REGN

William Pickering

Sanford C. Bernstein & Co.

3 questions for REGN

Chris Raymond

Raymond James

2 questions for REGN

Jeffrey Meacham

Citi

2 questions for REGN

Mohit Bansal

Wells Fargo & Company

2 questions for REGN

Simon Goodwin

Rothschild & Co. Redburn

2 questions for REGN

Taylor Hanley

JPMorgan Chase & Co.

2 questions for REGN

Tazeen Ahmad

Bank of America

2 questions for REGN

Tim Anderson

Bank of America

2 questions for REGN

Alice Natelton

Bank of America

1 question for REGN

Chris

Morgan Stanley

1 question for REGN

Trung Huynh

UBS Group AG

1 question for REGN

Recent press releases and 8-K filings for REGN.

- The EMA’s CHMP adopted a positive opinion recommending approval of Dupixent for children aged 2 to 11 years with moderate-to-severe chronic spontaneous urticaria inadequately controlled by H1 antihistamines in the EU.

- This recommendation is based on data from the LIBERTY-CUPID clinical program, including two Phase 3 trials in 6- to 11-year-olds and the CUPIDKids trial in 2- to 11-year-olds with CSU.

- A final decision by the European Commission is expected in the coming months.

- In the U.S., a supplemental BLA for Dupixent in this pediatric CSU population has been accepted, with an FDA decision due by April 2026.

- ARCALYST net product revenue of $202.1 million in Q4 and $677.6 million for full year 2025; 2026 guidance of $900–920 million.

- Net income of $14.2 million in Q4 vs. a net loss of $8.9 million in Q4 2024; $59.0 million net income for full year vs. a $43.2 million loss in 2024.

- Cash, cash equivalents and short-term investments increased by $170.4 million to $414.1 million as of Dec 31, 2025, with no debt.

- Clinical pipeline progress: KPL-387 Phase 2 recurrent pericarditis data expected in 2H 2026; KPL-1161 Phase 1 trial planned by end 2026.

- The FDA accepted Regeneron’s Biologics License Application for garetosmab to treat fibrodysplasia ossificans progressiva (FOP) and granted Priority Review, with a target action date in August 2026.

- If approved, garetosmab would be the first therapy shown to reduce the number and volume of new heterotopic bone lesions in adults with FOP.

- In the Phase 3 OPTIMA trial, the 3 mg/kg dose achieved a 94% reduction in new lesions and the 10 mg/kg dose a 90% reduction versus placebo; both doses showed over 99% reduction in lesion volume at 56 weeks.

- Safety data at 56 weeks reported serious treatment-emergent adverse events in 1 patient (3 mg/kg), 2 patients (10 mg/kg), and 2 placebo patients; common adverse reactions (≥30%) were epistaxis, increased hair growth, abscess, and acne.

- Regeneron will present 36 abstracts on its immunology and inflammation portfolio and pipeline at the 2026 AAAAI Annual Meeting, including first-time Phase 3 data for novel cat and birch allergen-blocking antibodies.

- Separate Phase 3 “ocular challenge” trials targeting FelD1 (cat) and BetV1 (birch) demonstrated reduced ocular itch, conjunctival redness and skin prick reactivity versus placebo, with additional registration-enabling studies starting this year.

- New Dupixent® (dupilumab) analyses will highlight its clinical and real-world impact across dermatological, respiratory and gastrointestinal diseases, including IgE-mediated food allergy sensitization in children with atopic dermatitis.

- Late-breaking data from the Phase 3 AIMS trial in allergic fungal rhinosinusitis supported a supplemental BLA in the U.S., currently under Priority Review with a target action date of February 28, 2026.

- Regeneron will showcase new Phase 3 results for EYLEA HD (aflibercept 8 mg) at the Angiogenesis meeting on February 7, 2026, highlighting its unparalleled durability and comparable efficacy/safety to EYLEA 2 mg with fewer injections.

- Data from the QUASAR trial will include final long-term outcomes through 64 weeks, confirming the first every-two-month treatment option for RVO patients who previously required monthly injections.

- ELARA Phase 3b interim data will be presented, showing that patients switched to monthly EYLEA HD from other anti-VEGF therapies experienced improved visual acuity and better anatomic control.

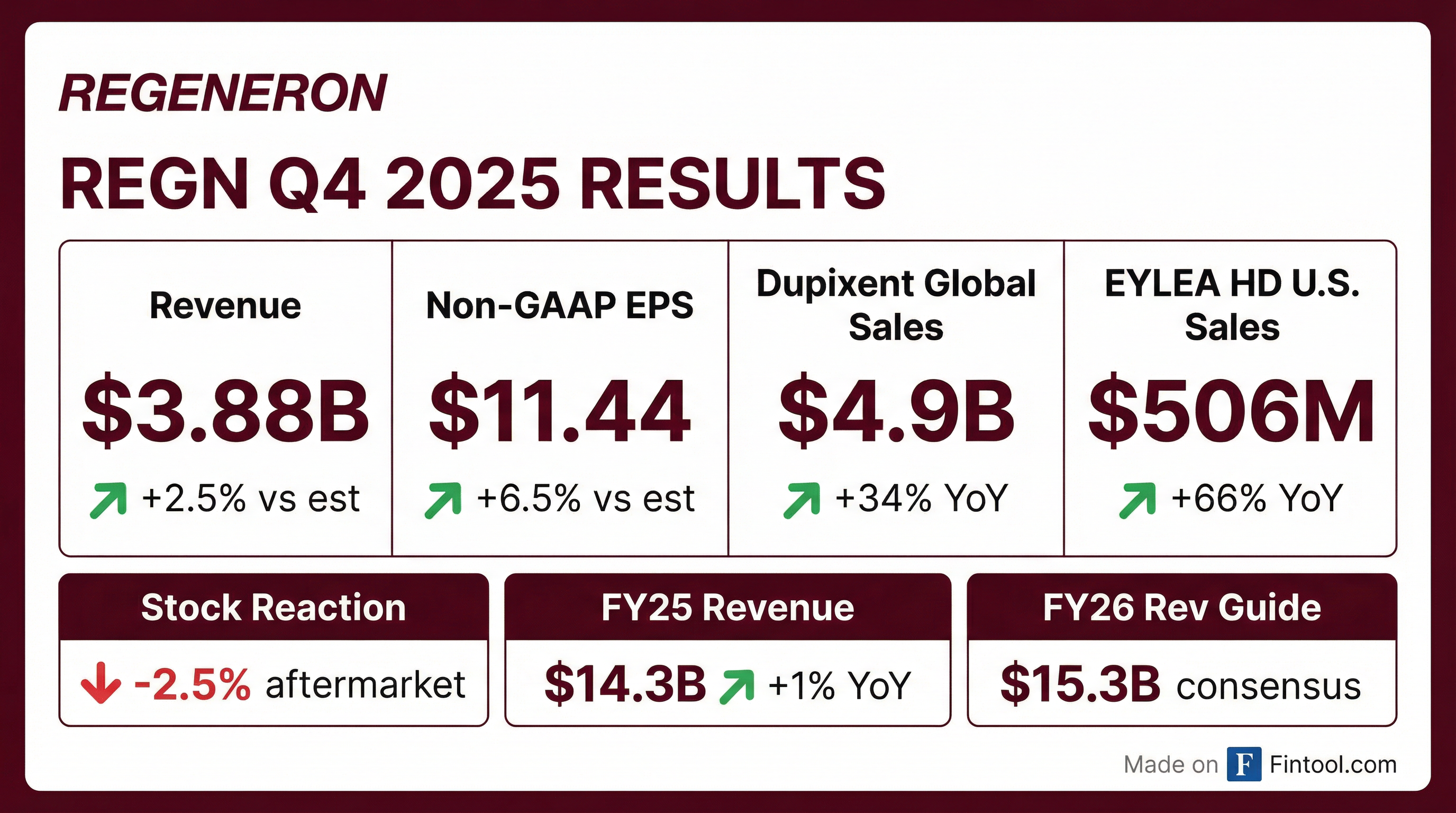

- Q4 total revenues of $3.9 billion, up 3% year-over-year; diluted EPS of $11.44 on net income of $1.2 billion.

- Key product sales: Libtayo net sales of $425 million; EYLEA HD net sales of $506 million (combined U.S. EYLEA franchise of $1.1 billion); DUPIXENT global net sales of $4.9 billion.

- Generated $4.1 billion in free cash flow; cash and marketable securities less debt of $16.2 billion; returned $3.8 billion to shareholders (including $3.4 billion in share repurchases) and declared a quarterly dividend of $0.94 per share (annualized $3.76).

- 2026 guidance: R&D spend of $5.9–6.1 billion; SG&A of $2.5–2.65 billion; gross margin 83–84%; capex $1.1–1.3 billion; effective tax rate 13–15%.

- Regeneron posted Q4 2025 total revenues of $3.9 B and non-GAAP EPS of $11.44.

- Dupixent net sales of $4.9 B in 4Q25 (+32% YoY), with >1.4 M patients on therapy; approvals in CSU (EU) and pediatric asthma (Japan) broaden label.

- LIBTAYO sales rose 13% YoY to $425 M in Q4, driven by adjuvant CSCC and NSCLC uptake.

- Key pipeline milestones: sBLA priority review for AFRS (PDUFA Feb 2026), BLA submission for DB-OTO in genetic hearing loss (decision 1H 2026), garetosmab FOP submissions.

- Q4 2025 total revenue was $3.9 billion, up 3% year-over-year; diluted EPS of $11.44 on net income of $1.2 billion.

- Key product sales in Q4 2025: Dupixent $4.9 billion (+32% YoY), EYLEA HD US net sales $506 million (+66%), Libtayo $425 million (+13%).

- Generated $4.1 billion free cash flow in 2025 and returned $3.8 billion to shareholders via $3.4 billion in share repurchases (with $1.5 billion remaining authorization) and a $0.94/share quarterly dividend.

- 2026 guidance: R&D spend of $5.9–6.1 billion, SG&A $2.5–2.65 billion, gross margin 83–84%, CapEx $1.1–1.3 billion, and effective tax rate 13–15%.

- Pipeline outlook includes at least four FDA approvals (three new molecular entities plus EYLEA HD prefilled syringe) and initiation of 18 Phase 3 studies (targeting ~35,000 patients).

- Regeneron delivered $3.9 billion in Q4 2025 revenues, up 3% year-over-year, with non-GAAP diluted EPS of $11.44.

- Dupixent Q4 net sales reached $4.9 billion (+32% yoy), Eylea HD US net sales were $506 million (+66% yoy), and Libtayo net sales were $425 million (+13% yoy).

- 2026 guidance expects R&D spend of $5.9 billion–$6.1 billion and SG&A of $2.5 billion–$2.65 billion.

- Returned $3.8 billion to shareholders in 2025 (share repurchases of $3.4 billion, dividends of $400 million) and initiated a quarterly dividend of $0.94 per share.

- Fourth quarter 2025 revenues increased 3% to $3.9 billion, and full year revenues rose 1% to $14.3 billion; Q4 GAAP EPS was $7.86 and non-GAAP EPS $11.44, while FY GAAP EPS was $41.48 and non-GAAP EPS $44.31

- Dupixent global net sales reached $4.9 billion in Q4 (+34%) and $17.8 billion for the year (+26%); EYLEA HD U.S. net sales grew 66% to $506 million in Q4

- The company repurchased $671 million of stock in Q4 and $3.5 billion in FY 2025, with $1.5 billion remaining under its buyback program

- 2026 guidance includes GAAP R&D of $6.45 billion–$6.68 billion, GAAP gross margin on net product sales of 79%–80%, and capital expenditures of $1.1 billion–$1.3 billion

- A cash dividend of $0.94 per share was declared, payable March 5, 2026

Quarterly earnings call transcripts for REGENERON PHARMACEUTICALS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more