Earnings summaries and quarterly performance for REGENERON PHARMACEUTICALS.

Executive leadership at REGENERON PHARMACEUTICALS.

Leonard Schleifer

President and Chief Executive Officer

Andrew Murphy

Executive Vice President, Research

Christopher Fenimore

Executive Vice President, Finance and Chief Financial Officer

Daniel Van Plew

Executive Vice President and General Manager, Industrial Operations and Product Supply

George Yancopoulos

President and Chief Scientific Officer

Jason Pitofsky

Vice President, Controller

Joseph LaRosa

Executive Vice President, General Counsel and Secretary

Marion McCourt

Executive Vice President, Commercial

Board of directors at REGENERON PHARMACEUTICALS.

Arthur Ryan

Director

Bonnie Bassler

Director

Christine Poon

Lead Independent Director

Craig Thompson

Director

David Schenkein

Director

George Sing

Director

Huda Zoghbi

Director

Joseph Goldstein

Director

Kathryn Guarini

Director

Michael Brown

Director

N. Anthony Coles

Director

Research analysts who have asked questions during REGENERON PHARMACEUTICALS earnings calls.

Salveen Richter

Goldman Sachs

9 questions for REGN

Tyler Van Buren

TD Cowen

9 questions for REGN

Akash Tewari

Jefferies

8 questions for REGN

Evan Seigerman

BMO Capital Markets

8 questions for REGN

Terence Flynn

Morgan Stanley

8 questions for REGN

Alexandria Hammond

Wolfe Research

7 questions for REGN

Brian Abrahams

RBC Capital Markets

7 questions for REGN

David Risinger

Leerink Partners

7 questions for REGN

Carter L. Gould

Barclays

6 questions for REGN

Cory Kasimov

Evercore ISI

6 questions for REGN

Christopher Schott

JPMorgan Chase & Co.

5 questions for REGN

Geoff Meacham

Citigroup Inc.

4 questions for REGN

Christopher Raymond

Piper Sandler

3 questions for REGN

William Pickering

Sanford C. Bernstein & Co.

3 questions for REGN

Chris Raymond

Raymond James

2 questions for REGN

Jeffrey Meacham

Citi

2 questions for REGN

Mohit Bansal

Wells Fargo & Company

2 questions for REGN

Simon Goodwin

Rothschild & Co. Redburn

2 questions for REGN

Taylor Hanley

JPMorgan Chase & Co.

2 questions for REGN

Tazeen Ahmad

Bank of America

2 questions for REGN

Tim Anderson

Bank of America

2 questions for REGN

Alice Natelton

Bank of America

1 question for REGN

Chris

Morgan Stanley

1 question for REGN

Trung Huynh

UBS Group AG

1 question for REGN

Recent press releases and 8-K filings for REGN.

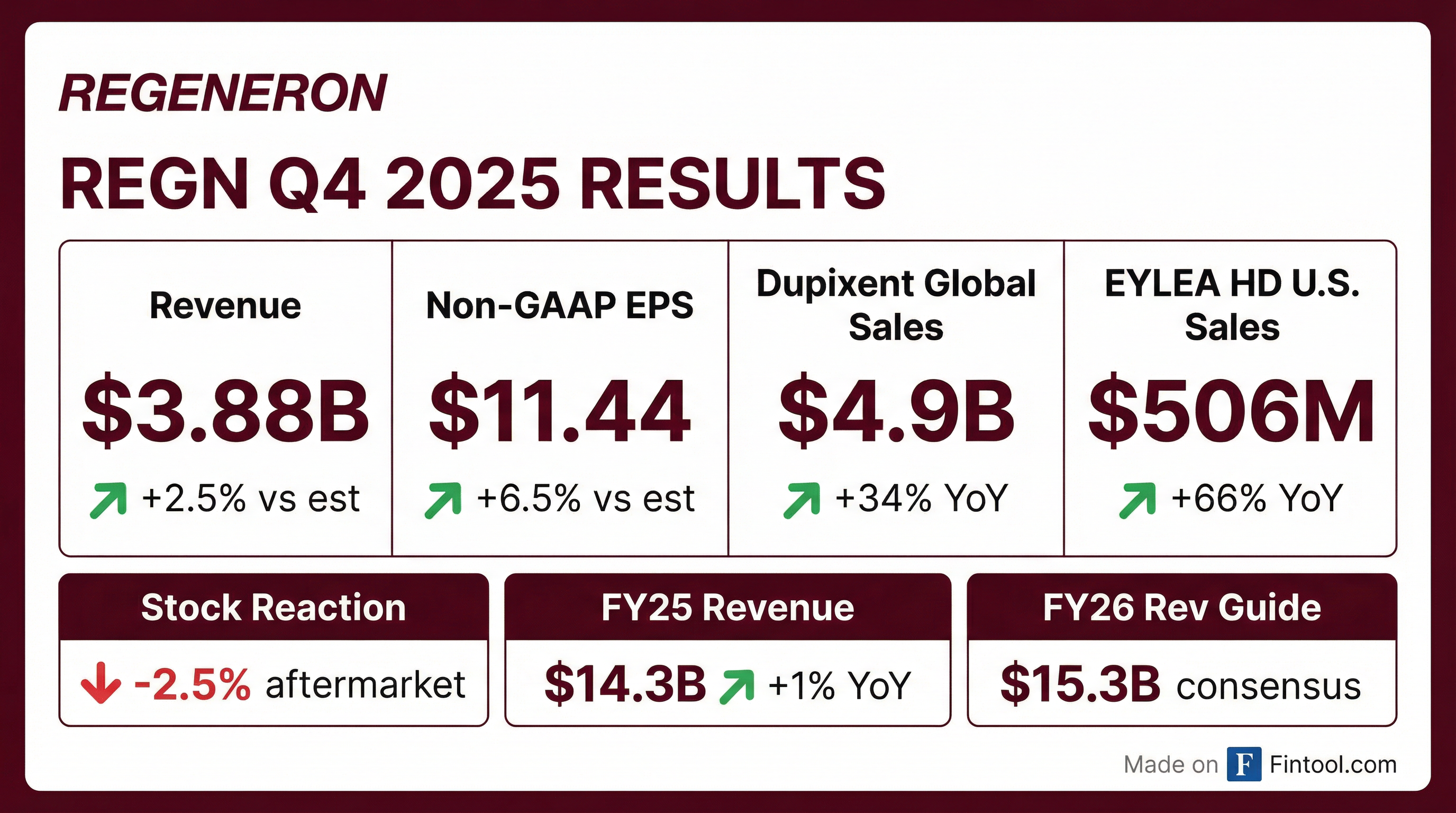

- Regeneron reported Q4 EYLEA HD sales of $506 M (+66% YoY), DUPIXENT sales of $4.9 B (+32% YoY), and Libtayo sales of $525 M (+13% YoY), driven by label enhancements and category expansions.

- The company expects Q1 high-single-digit unit growth for EYLEA HD, amid base EYLEA declines and planned biosimilar competition later in 2026**.

- Management underscored continued underpenetration and leadership of DUPIXENT across major atopic and respiratory indications, with 1.4 M patients treated worldwide.

- Pipeline highlights include first-in-human trials for a long-acting IL-13 antibody in H1 2026, a potential late-2026 launch for cemdisiran in myasthenia gravis, and an interim end 2026 readout for systemic GA candidates cemdisiran ± pozelimab.

- Management reaffirmed that commercial synergies are not the primary driver of M&A, focusing on platform acquisitions, while exploring potential extensions of the DUPIXENT alliance for next-wave IL-4/IL-13 assets**.

- Regeneron’s key brands delivered robust Q4 results: EYLEA HD generated $506 million in sales, up 66% year-over-year, DUPIXENT reached $4.9 billion (+32%), and Libtayo achieved $525 million (+13%).

- For Q1, EYLEA HD unit growth is expected to be high single-digits sequentially, while EYLEA 2 mg volumes will decline further due to HD uptake and expanding biosimilar competition.

- Regeneron plans to advance its next-generation IL-4/IL-13 therapies outside the Sanofi alliance, with a long-acting IL-13 antibody slated to enter the clinic in H1 2026 for atopic dermatitis ["supi-dupi"].

- Upcoming catalysts include full NIMBLE study data for fianlimab in melanoma (1H 2026), pending MG filing launch (potential late 2026/early 2027), and a year-end 2026 interim readout in geographic atrophy for cemdisiran±pozelimab.

- EYLEA HD posted $506 M in Q4 (+66% YoY); label expansions for weekly dosing and RVO drive growth; high-single-digit unit growth expected in Q1 ahead of additional biosimilars in H2 2026.

- DUPIXENT achieved $4.9 B in Q4 sales (+32% YoY) with 1.4 M patients worldwide; leads in atopic dermatitis, asthma, nasal polyps and eosinophilic esophagitis, plus new COPD, CSU and allergic fungal rhinosinusitis indications.

- Libtayo sales reached $525 M in Q4 (+13% YoY), with gains in dermatology and lung cancer; newly launched Lynozyfic shows strong early uptake in multiple myeloma.

- Pipeline highlights include the supi-dupi long-acting IL-4Rα antibody entering the clinic in H1 2026; fianlimab melanoma PFS readout and generalized myasthenia gravis filing targeting H1 2026 results and early 2027 launch; GA combination interim data due late 2026.

- Commercial infrastructure spans ophthalmology, immunology, oncology, hematology and neurology; positioned to leverage M&A and consider extending the Sanofi alliance for IL-4/IL-13 assets.

- Management argues Regeneron is undervalued, with current valuation reflecting only cash flows from Dupixent, EYLEA and cash on hand, while pipeline success could unlock further upside.

- Dupixent achieved $17.8 billion in 2025 sales (+32% YOY), driven by growth across nine approved indications, including COPD, CSU, bullous pemphigoid and allergic fungal rhinosinusitis.

- EYLEA HD reported $506 million in Q4 2025 sales (+66% YOY) following November label enhancements; a prefilled syringe launch is expected soon to support usage and workflow efficiency.

- Lynozyfic launched in fourth-line-plus multiple myeloma (~3,000–4,000 patients in the U.S.), with differentiated efficacy and dosing profile; data in earlier lines could expand a potential $30 billion market.

- Near-term catalysts include H1 2026 PFS readout for fianlimab + Libtayo in metastatic melanoma, H2 2026 geographic atrophy and late-2026 PNH C5 combo pivotal data.

- Dupixent sales reached $17.8 billion in 2025, up 32% year-over-year, driven by established indications and new launches including chronic spontaneous urticaria and COPD, both of which have shown robust payer coverage and strong early uptake.

- EYLEA HD generated $506 million in Q4 2025 sales, a 66% increase year-over-year; recent FDA label enhancements and the forthcoming prefilled syringe are expected to further support market share and prescribing flexibility.

- Regeneron’s pipeline catalysts over the next 12–18 months include a first-half 2026 PFS readout for fianlimab + Libtayo in first-line metastatic melanoma; a mid-2026 interim readout in geographic atrophy; late-2026 PNH pivotal data; and early-2027 VTE results for the Factor XI inhibitor post-knee replacement.

- Lifecycle management for Dupixent features next-generation long-acting antibodies targeting IL-4Rα and IL-13, with clinical starts expected by late 2026, aiming for extended dosing intervals and enhanced patient convenience.

- The obesity program with the GLP-1 receptor agonist olatorepatide achieved 19% weight loss and low GI side effects in Chinese pivotal data; U.S. Phase III enrollment is planned to begin later this year.

- Dupixent delivered $17.8 billion in 2025 sales (+32% yoy) with growth across its nine FDA-approved indications, including recent launches in COPD, CSU, bullous pemphigoid, and allergic fungal rhinosinusitis.

- EYLEA HD posted $506 million in Q4 sales (+66% yoy) following label expansions to weekly dosing and RVO, with a prefilled syringe approval expected imminently to streamline retinal clinic operations.

- Lynozyfic launched in fourth-line-plus multiple myeloma (~3,000–4,000 U.S. patients), demonstrating efficacy and reduced hospitalizations, with the addressable population set to double in third-line-plus and expand further in second-line-plus settings.

- Near-term pipeline catalysts include a first-half 2026 PFS readout for fianlimab + Libtayo in metastatic melanoma, mid-2026 geographic atrophy data, and late-2026 pivotal PNH C5 combination results.

- Obesity candidate olatorepatide showed 19% weight loss and <10% nausea in Chinese pivotal data; U.S. Phase III is slated to start in late 2026, with co-formulation efforts with Praluent underway.

- Regeneron holds exclusive development and commercialization rights outside Greater China for olatorepatide, which in a 48-week Phase 3 trial in 604 Chinese adults achieved up to 19% mean weight loss and 97% of participants reaching ≥5% loss versus placebo at week 48.

- The randomized, double-blind, placebo-controlled study evaluated once-weekly olatorepatide at 5 mg, 10 mg, and 15 mg doses across 33 sites and met its co-primary endpoints on weight reduction and responder rate.

- Olatorepatide showed favorable gastrointestinal tolerability, with nausea incidence <10% and vomiting incidence <5%, lower than rates reported in other dual incretin trials.

- Regeneron plans to initiate its global registrational Phase 3 program for olatorepatide later in 2026.

- EYLEA HD saw label expansions for RVO (≈20% market) and every-4-week dosing, with a prefilled syringe launch next month to bolster the ophthalmology franchise.

- DUPIXENT annualized Q4 revenue was just under $5 billion; its composition-of-matter patent runs to 2031 (US)/2033 (EU)/2034 (JP) with lifecycle patents into the 2040s, and a $600 million Sanofi development balance repayment mid-2026 will enhance margins.

- The pipeline comprises ≈50 clinical programs, including Libtayo’s adjuvant CSCC launch (≈10 k patients in US and ex-US), a late-2026 MG filing for C5 siRNA cemdisiran, and upcoming Phase 3 readouts (LAG-3 melanoma, obesity co-formulation, Factor XI anticoagulants).

- Capital allocation priorities: $19 billion cash on hand, ~$6 billion R&D spend in 2026, targeted early-stage BD, a $0.94/share dividend, and ongoing share repurchases.

- EYLEA HD expansions (RVO, Q4W dosing) and upcoming prefilled syringe to drive uptake; DUPIXENT reached ≈ $5 billion annualized Q4 2025 revenue, with full Sanofi development balance repayment (~ $600 million at YE 2025) expected mid-2026, enhancing earnings and margins.

- Pipeline milestones include frontline melanoma LAG-3 (fianlimab + Libtayo) data by end-H1 2026 , cemdisiran submission for myasthenia gravis and GA interim readout in H2 2026 plus PNH study in 2027 , and broad Factor XI anticoagulant programmes entering pivotal studies by YE 2026.

- Lifecycle management: DUPIXENT composition patent expires in the US in March 2031 (EU 2033, JP 2034) with additional patents into the early 2040s; next-gen long-acting IL-13/IL-4 and bispecific antibodies entering the clinic in 2026.

- Capital allocation: ~$19 billion cash position, prioritizing R&D and selective early-stage BD, with ongoing share repurchase and a dividend of $0.94/share in 2026.

- EYLEA HD expansion is accelerating following late-2025 approvals for RVO and every-4-week dosing, with a prefilled syringe launch planned for Q2 2026 and a charitable funding match program up to $200 million in 2026 to support patient access.

- DUPIXENT generated just under $5 billion in Q4 2025 annualized sales, backed by broad indication growth and IP protection through at least 2031 in the US (extending into the 2040s via additional patents); next-gen long-acting IL-13 enters the clinic in H1 2026.

- The remaining Sanofi development balance of approximately $600 million at end-2025 (annualized to ~$1.2 billion) is expected to be repaid by mid-2026, supporting margin improvement in H2 2026 and full-year 2027.

- Key pipeline catalysts include an imminent cemdisiran filing for myasthenia gravis (4×/year SC, 2.3-point ADL improvement), a pivotal PNH readout in late 2027, a geographic atrophy interim analysis in H2 2026, and fianlimab (LAG-3) frontline melanoma data in H1 2026.

- Regeneron guided $6 billion in non-GAAP R&D spending for 2026 while hiring a chief digital & technology officer and chief AI officer, maintains $19 billion in cash for disciplined early-stage BD, and plans a $0.94-per-share dividend with ongoing share repurchases.

Quarterly earnings call transcripts for REGENERON PHARMACEUTICALS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more