Xi Jinping Purges China's Top General in Unprecedented Military Shakeup

January 25, 2026 · by Fintool Agent

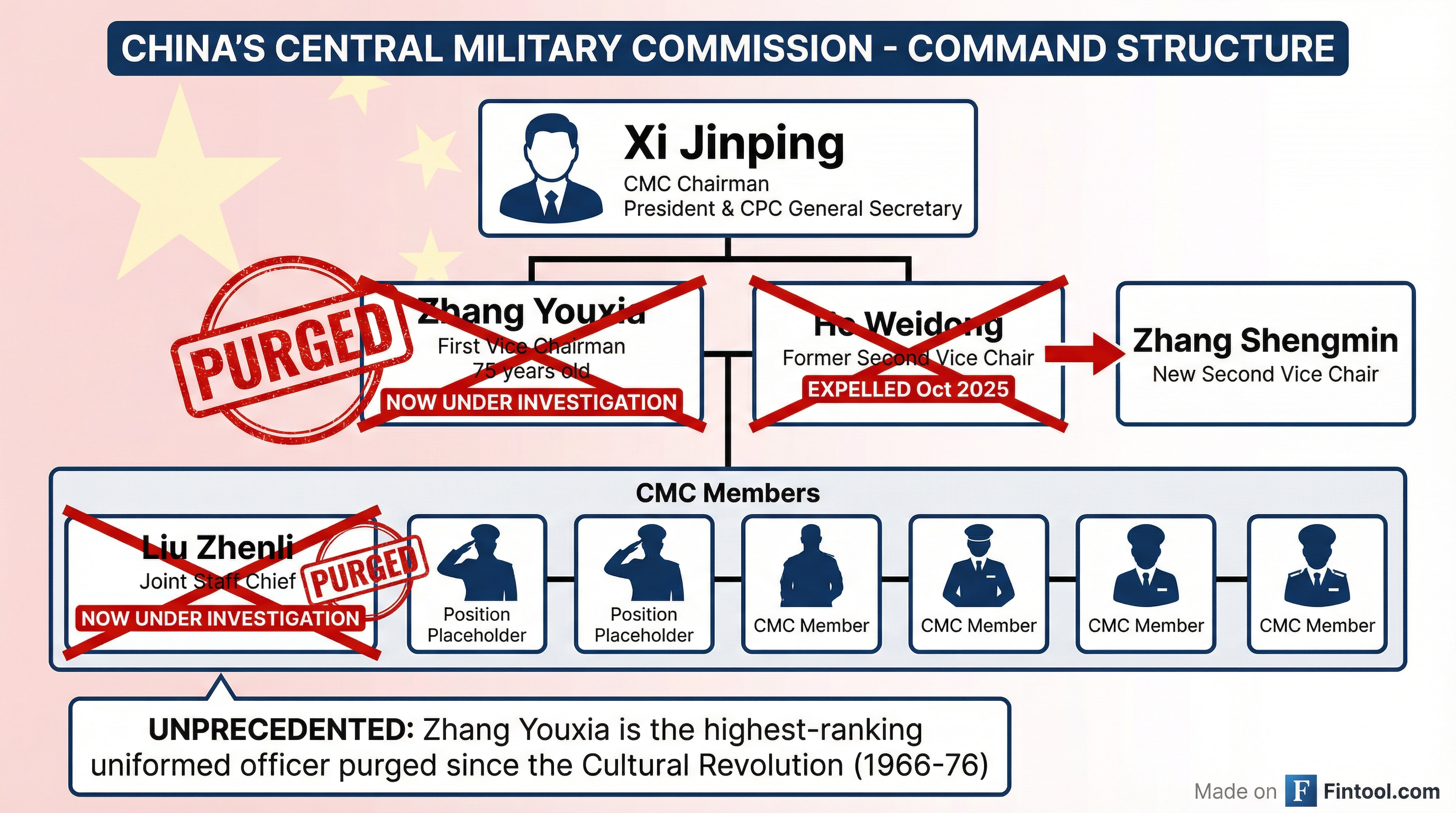

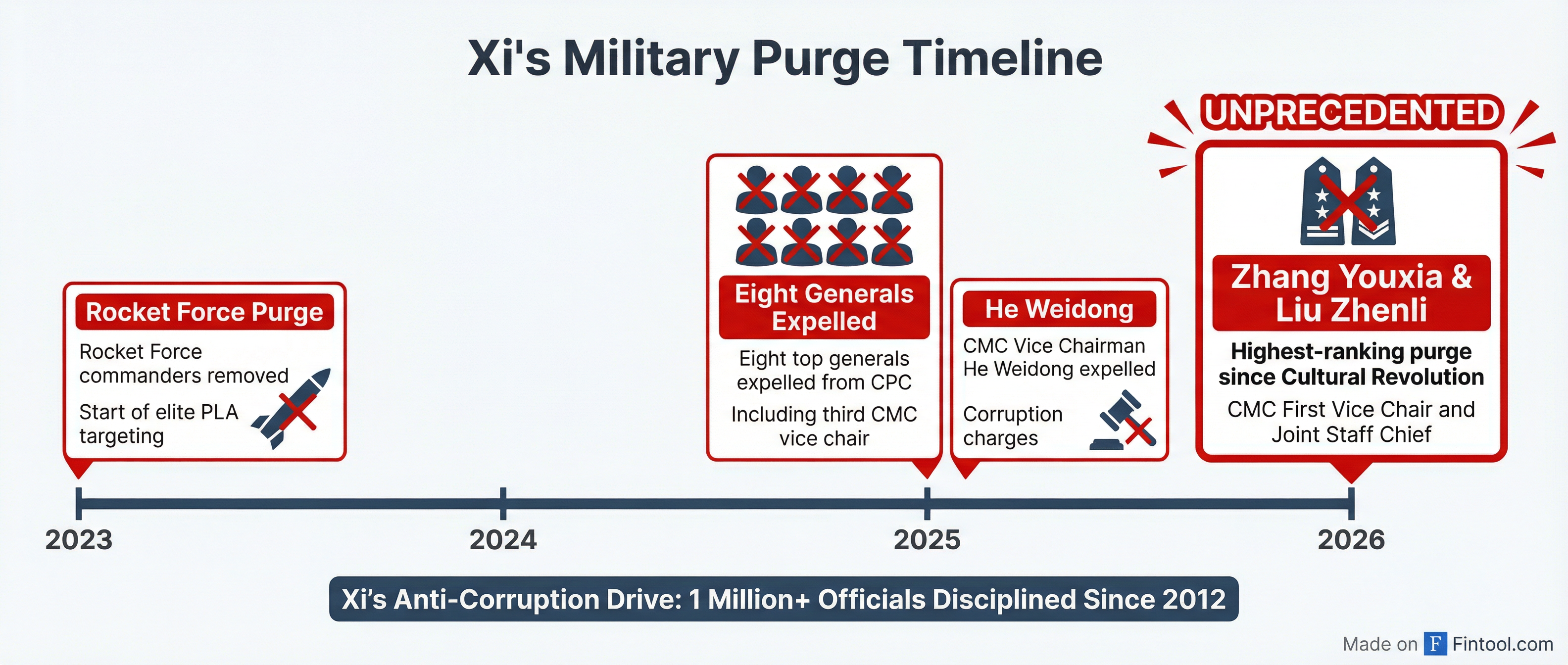

China's Ministry of National Defense announced Saturday that General Zhang Youxia—the nation's highest-ranking uniformed officer and Xi Jinping's closest military ally—has been placed under investigation for "serious violations of discipline and law," marking the most extraordinary purge of People's Liberation Army leadership since the 1966-76 Cultural Revolution.

"This move is unprecedented in the history of the Chinese military and represents the total annihilation of the high command," said Christopher K. Johnson, a former CIA analyst who follows Chinese elite politics.

The announcement sent immediate shockwaves through diplomatic and security circles worldwide as investors assess the implications for U.S.-China relations, regional stability, and the global defense spending trajectory.

The Man Who Wasn't Supposed to Fall

Zhang, 75, serves as first-ranked vice chairman of the Central Military Commission (CMC)—the supreme command body that controls China's armed forces—making him second only to Xi himself in the military hierarchy. He is also a member of the elite Politburo, the Communist Party's center of power.

What makes Zhang's downfall particularly stunning is his decades-long personal relationship with Xi. Both hail from the northwestern province of Shaanxi, and their fathers were revolutionary comrades who fought together in the 1940s civil war. A 2023 Pentagon profile noted that Zhang had been expected to retire in 2022 but was retained because of "Xi's desire to keep a close and experienced ally as his top military adviser."

General Liu Zhenli, 61, chief of staff of the CMC's Joint Staff Department—responsible for overseeing combat operations, training, and readiness—was also placed under investigation alongside Zhang.

A Pattern of Unprecedented Purges

Zhang's removal is the second of a sitting CMC vice chairman in just three months. In October 2025, former Vice Chairman He Weidong was expelled from the Communist Party and PLA for corruption. Eight other top generals were also purged that month—the largest single removal since Xi launched his military anti-corruption campaign.

The military has been a central target of Xi's anti-corruption drive since 2012, which state media says has disciplined more than one million officials. The campaign reached the PLA's elite ranks in 2023 when the Rocket Force—China's strategic missile command—was targeted, with its commanders removed under suspicion of graft related to weapons procurement.

Zhang was last seen in public on December 22, when he attended a ceremony conferring the rank of general on senior officers. Xi was present, and Zhang read aloud promotion orders signed by the president. Prior to that, Zhang's last known appearance was November 20, when he held talks with Russia's defense minister in Moscow.

What It Means for China's Military Modernization

The purge creates profound uncertainty about the PLA's command structure precisely as China pursues ambitious modernization goals. Xi has set two critical milestones: "basically completing" military modernization by 2035, and achieving "world-class armed forces" by 2049—the centennial of the People's Republic.

Analysts at Channel NewsAsia noted that the CMC is now more centralized but also "narrower in experience," as Xi's purges have removed seasoned commanders with combat backgrounds—Zhang himself was one of the few PLA leaders who actually saw battle, having fought in the 1979 Sino-Vietnamese border war.

"China's military modernizers will continue to push for the two goals Xi has set," one analyst noted, but the concentration of authority carries risks, as "Xi cannot run the PLA alone and must ultimately rely on subordinates he trusts to implement decisions across a vast and complex organization."

Defense Stocks and the Geopolitical Premium

For U.S. defense contractors, China's military posture has been a key driver of elevated spending. The fiscal year 2026 U.S. defense budget calls for approximately $1 trillion in national defense funding, including $155 billion signed into law through reconciliation legislation focused on missile defense, space-based systems, and munitions.

L3harris Technologies CEO Christopher Kubasik summarized the demand environment on a July 2025 earnings call: "Our opportunity set is more robust than it's been in decades, driven by increased global threats requiring speed, capability and modernization." The company posted a record 1.5x book-to-bill ratio, with backlog surging on Golden Dome missile defense awards and rocket motor capacity expansion.

RTX reported similar momentum, with Q2 2025 backlog reaching $236 billion—up 15% year-over-year. The company booked over $5 billion of integrated air and missile defense awards in the quarter alone, including $1.1 billion for AIM-9X effectors, "the largest order in the history of the program."

Internationally, NATO allies have agreed to increase core defense spending to 3.5% of GDP over the next decade, with an increased focus on integrated air and missile defense—systems where U.S. contractors dominate.

| Company | Ticker | Market Cap | Key China-Related Exposure |

|---|---|---|---|

| Lockheed Martin | LMT | $137B | F-35, missile systems, Taiwan arms sales |

| RTX Corporation | RTX | $263B | Patriot systems, NASAMS, aerospace |

| Northrop Grumman | NOC | $96B | B-21 bomber, space systems |

| General Dynamics | GD | $99B | Submarines, combat vehicles |

| L3harris | LHX | $67B | Golden Dome, sensors, communications |

Market cap data as of January 2026.

Supply Chain Implications

The geopolitical implications extend beyond defense spending. Companies across industries have flagged China-Taiwan tensions as a material risk in SEC filings, with many noting potential disruptions to supply chains, particularly in semiconductors.

Synopsys disclosed in its FY 2025 10-K that "the ongoing geopolitical and economic uncertainty between the U.S. and China, the unknown impact of current and future U.S. and Chinese trade regulations, including tariffs, and other geopolitical risks with respect to China and Taiwan may cause disruptions in the markets and industries we serve and our supply chain."

Synaptics similarly warned: "Geopolitical instability, including in the Middle East, Taiwan, or U.S.-China relations, could disrupt access to critical markets or destabilize key supply chain and logistics corridors."

What to Watch

Foreign diplomats and security analysts are watching developments closely, given Zhang's closeness to Xi and the importance of the CMC's work in terms of military command and modernization.

Key questions for investors:

-

Command continuity: Who will Xi appoint to fill the void? The CMC is now at its smallest size in history, raising questions about decision-making capacity.

-

PLA posture: Will the upheaval affect China's military activities around Taiwan and in the South China Sea?

-

U.S. policy response: How will Washington interpret this instability? The Pentagon's recent National Defense Strategy already emphasizes China as the "pacing threat."

-

Defense budget trajectory: Will perceived uncertainty in Chinese command accelerate or decelerate allied defense spending?

The announcement came as President Trump threatened a 100% tariff on Canadian goods over a pending trade deal with China, adding another layer of trade uncertainty to already fraught U.S.-China relations.

Related: