China Sanctions 20 US Defense Firms Over Record $11.1B Taiwan Arms Deal

December 26, 2025 · by Fintool Agent

China struck back at the United States on Friday, announcing sanctions against 20 American defense companies and 10 executives in retaliation for Washington's record $11.1 billion arms sale to Taiwan—the largest weapons package ever approved for the self-governed island.

The sanctions freeze any Chinese assets held by the targeted firms, ban domestic organizations and individuals from doing business with them, and bar the executives from entering China. But for defense contractors that don't sell weapons to Beijing anyway, the measures amount to political theater rather than economic warfare—a familiar pattern in the escalating US-China standoff over Taiwan.

The Sanctions List: From Giants to Drone Startups

The 20 sanctioned companies span the defense industrial base, from subsidiaries of major prime contractors to emerging drone and defense tech startups:

Prime Contractor Units:

- Northrop Grumman+1.81% Systems Corporation

- L3harris+2.17% Maritime Services

- Boeing+2.57% (St. Louis defense operations)

- Gibbs & Cox, Inc. (naval architecture)

- Advanced Acoustic Concepts

Drone & Defense Tech:

- Red Cat Holdings+11.67% (Nasdaq: RCAT)

- Teal Drones (Red Cat subsidiary)

- Epirus, Inc. (directed energy weapons)

- Dedrone Holdings (counter-drone)

- Area-I, Blue Force Technologies, Dive Technologies

Other Defense Suppliers:

- VSE Corporation, Sierra Technical Services, ReconCraft

- High Point Aerotechnologies, Vantor, Intelligent Epitaxy Technology

- Rhombus Power Inc., Lazarus Enterprises Inc.

The executive sanctions target Palmer Luckey—founder of Oculus VR and Anduril Industries, the $14 billion defense tech unicorn—along with nine senior executives from L3Harris, VSE Corporation, Teal Drones, Rhombus Power, Vantor, Dedrone, High Point Aerotechnologies, and ReconCraft. All are banned from entering China, including Hong Kong and Macau.

The Trigger: America's Largest-Ever Taiwan Arms Package

The sanctions followed Washington's December 17 announcement of an $11.1 billion weapons sale to Taiwan—nearly matching the $18.3 billion in total arms sales Trump approved during his entire first term.

| Weapons System | Value | Quantity |

|---|---|---|

| M142 HIMARS rocket systems | $4B | 82 systems |

| M57 ATACMS missiles | Included | 420 missiles |

| M109A7 self-propelled howitzers | $4B | 60 systems |

| Altius loitering munitions (drones) | $1B | Unknown |

| Javelin anti-tank missiles | $700M | Unknown |

| TOW anti-armor missiles | Included | Unknown |

| Military software & equipment | $1B | — |

The package emphasizes "asymmetric warfare" capabilities—mobile, smaller weapons designed to complicate any Chinese amphibian invasion rather than match Beijing's conventional military might. The HIMARS and ATACMS can strike PLA positions on the mainland coast and across the 150-200km Taiwan Strait, potentially disrupting China's ability to concentrate forces for an invasion.

"The Taiwan issue is the core of China's core interests and the first red line that cannot be crossed in China-US relations," China's Foreign Ministry declared. "Any provocative actions that cross the line on the Taiwan issue will be met with a strong response from China."

A Pattern of Symbolic Retaliation

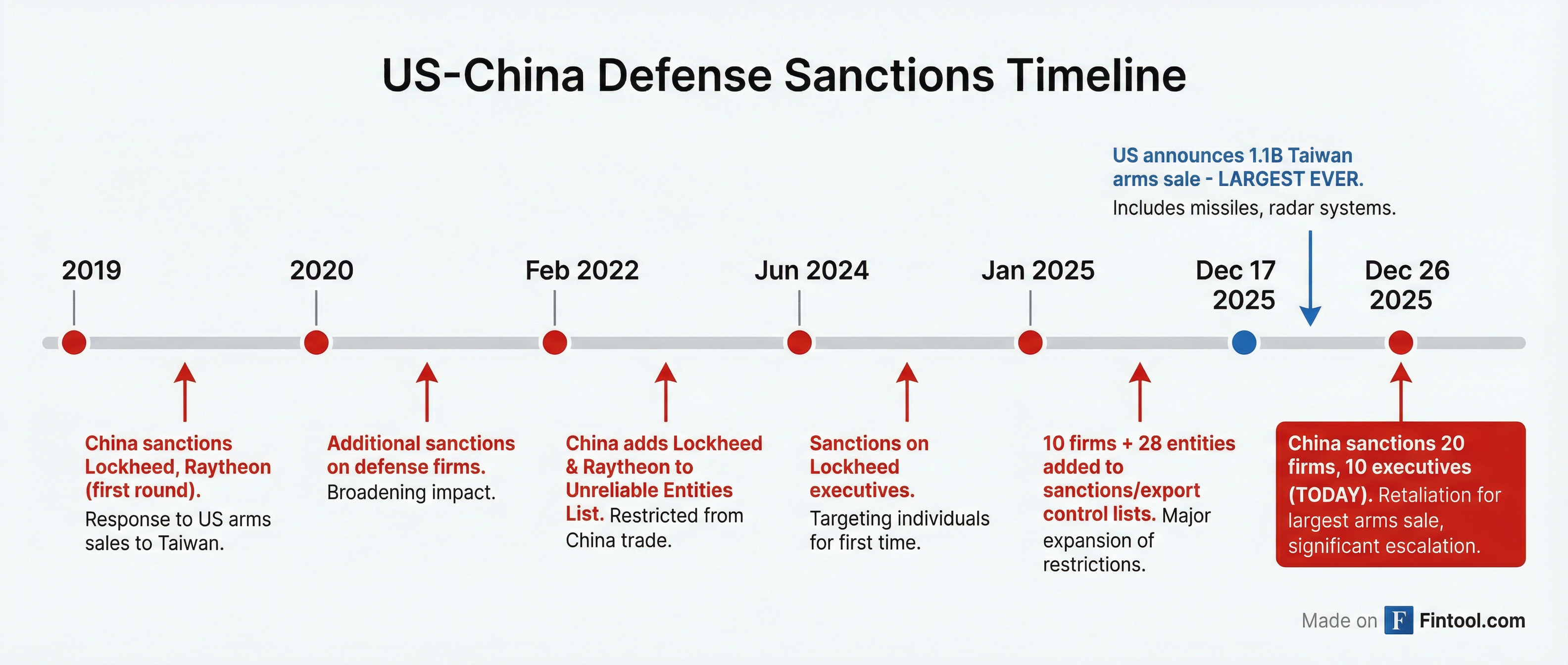

China has sanctioned US defense companies over Taiwan arms sales at least seven times since 2019—targeting Lockheed Martin+2.36%, Raytheon+1.37% (now RTX), Northrop Grumman+1.81%, Boeing+2.57%, and General Dynamics+2.28% on multiple occasions.

The practical impact? Minimal. "These are symbolic measures and unnecessary—that's how we view them," the White House said after a 2023 round of sanctions.

The math is simple: US defense contractors don't sell weapons to China. Export controls and national security restrictions have prohibited such sales for decades. The sanctions primarily affect commercial relationships—and even there, the exposure is limited.

Boeing: The Exception That Proves the Rule

Boeing+2.57% is the one company with significant commercial China exposure, but the sanctions target only its St. Louis-based defense operations—not the commercial aviation business.

Boeing's latest 10-Q acknowledges the tension: "China is a significant market for commercial aircraft and we have long-standing relationships with our Chinese customers. Overall, the U.S.-China trade relationship is challenged due to tariffs, export restrictions and related supply chain constraints, and other economic and national security concerns."

The company noted that Chinese customers briefly paused commercial aircraft deliveries in April 2025 amid tariff disputes but resumed accepting them in June. The defense-focused sanctions shouldn't directly affect that commercial business.

| Company | Market Cap | China Defense Exposure | Key Products in Taiwan Package |

|---|---|---|---|

| Boeing (ba)+2.57% | $166B | None (defense) | — |

| Northrop Grumman (noc)+1.81% | $83B | None | — |

| L3harris (lhx)+2.17% | $56B | None | — |

| Red Cat (rcat)+11.67% | $1.1B | None | Teal drones (Altius competitor) |

Red Cat: Small-Cap in the Crosshairs

The inclusion of Red Cat Holdings+11.67% and its Teal Drones subsidiary is notable. The $1.1 billion market cap drone maker has been a market darling in 2025, with shares surging over 900% in 13 months after winning the US Army's Short Range Reconnaissance (SRR) contract to supply up to 5,880 Black Widow drones.

The company reported Q3 2025 revenue of $9.6 million (+646% YoY) and guides to $34.5-$37.5 million for full-year 2025. With $206 million in cash and a recently expanded $35 million Army contract, the Chinese sanctions are unlikely to meaningfully impact operations—Red Cat's business is overwhelmingly US government-focused.

Palmer Luckey: The Billionaire Who Can't Visit China

Among the sanctioned executives, Palmer Luckey stands out. The 32-year-old billionaire founded Oculus VR (sold to Meta for $2 billion) before launching Anduril Industries in 2017. Anduril has grown into one of the most prominent defense tech startups, valued at $14 billion, specializing in autonomous systems, AI-powered surveillance, and counter-drone technology.

Luckey has been outspoken about US-China competition and his company's focus on deterrence. The personal sanctions—banning him from China and freezing any hypothetical Chinese assets—underscore Beijing's frustration with the new generation of defense tech entrepreneurs challenging its military ambitions.

What's Next for Defense Investors

The sanctions won't change the fundamental dynamics:

For Large Primes: Boeing, Northrop, L3Harris, and others have weathered multiple rounds of Chinese sanctions without material impact. Their stock prices have historically shrugged off these announcements.

For Defense Tech Startups: Red Cat and peers like Anduril are purpose-built to serve US national security interests. Chinese sanctions may actually burnish their credentials with Pentagon procurement officers.

For Taiwan Arms Sales: The Congressional pipeline remains robust. Taiwan has committed to raising defense spending to 3.3% of GDP in 2026 and 5% by 2030, with a $40 billion special defense budget for 2026-2033 focused on asymmetric capabilities.

The real risk remains geopolitical escalation rather than sanctions enforcement. As Boeing noted in its latest filings: "The current state of U.S.-China relations remains an ongoing watch item."

Markets will be closed for the holiday shortened week, but expect thin trading to continue when they reopen. Defense stocks have largely priced in heightened US-China tensions—Friday's sanctions add noise, not signal.