IMF Upgrades 2026 Global Growth Forecast to 3.3% as AI Boom Offsets Tariff Shock

January 19, 2026 · by Fintool Agent

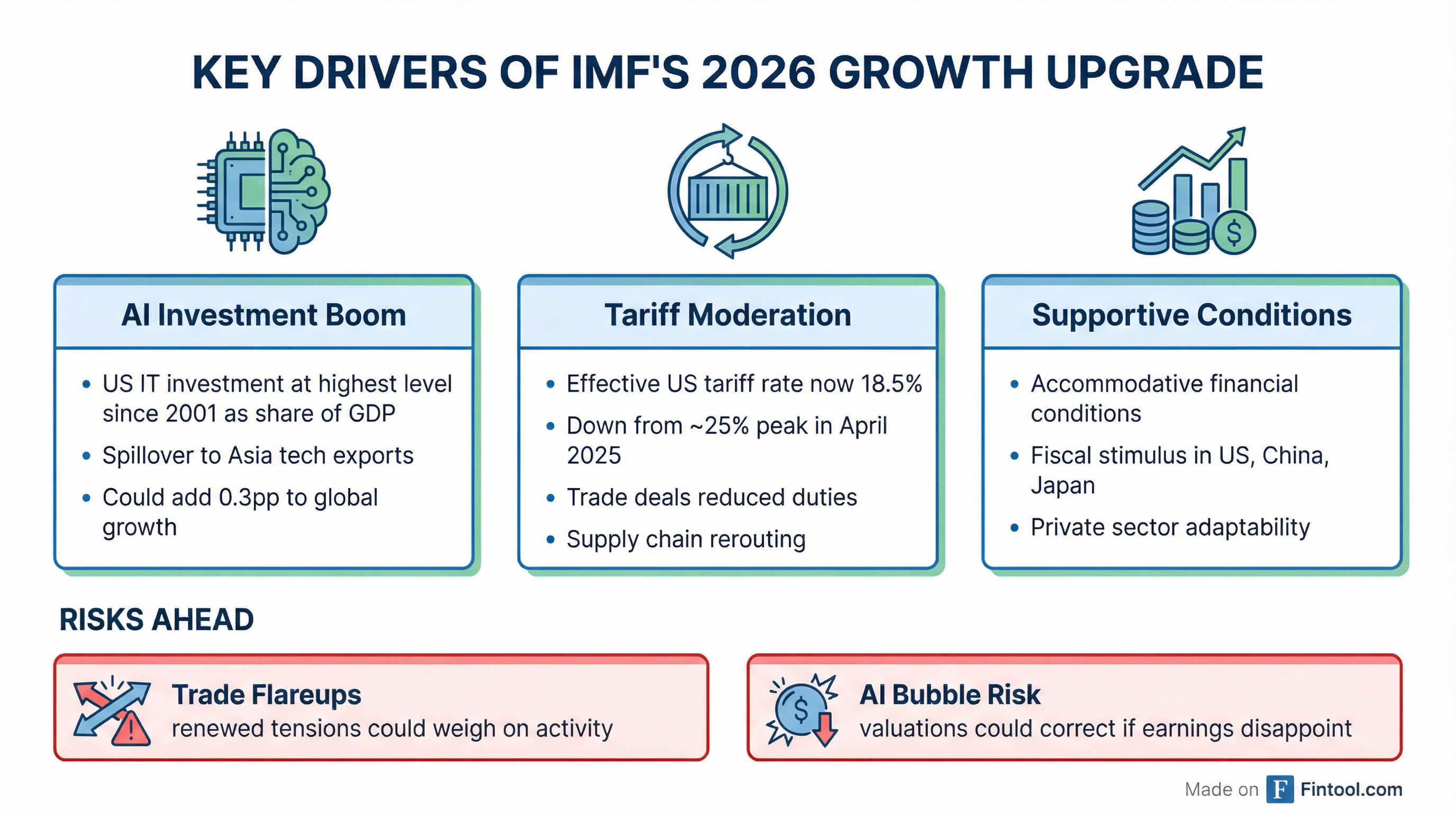

The International Monetary Fund raised its 2026 global growth forecast to 3.3%—up 0.2 percentage points from October—as a historic surge in artificial intelligence investment offsets the drag from trade disruptions. The upgrade marks a striking turnaround: just one year ago, economists feared President Trump's tariff regime would derail the global expansion. Instead, the Fund now says the world economy is "shaking off the tariff shock."

"Current projections are broadly unchanged from a year earlier," IMF Chief Economist Pierre-Olivier Gourinchas told reporters Monday. "In a sense, the global economy is shaking off the trade and tariff disruptions of 2025 and is coming out ahead of what we were expecting before it all started."

The AI Investment Surge

The primary driver of the upgraded outlook is a boom in technology investment—particularly in artificial intelligence infrastructure—that has reached levels not seen since the dot-com era. US information technology investment as a share of economic output has surged to its highest level since 2001, the IMF said, providing a major tailwind to overall business activity.

The investment wave extends beyond US borders. Asian technology exports have benefited from spillover demand as hyperscalers like Microsoft+1.90%, Alphabet-2.53%, Meta-1.31%, and Amazon-5.55% race to build data center capacity. Nvidia+7.87%, the dominant supplier of AI chips, has seen its market capitalization climb past $3 trillion as the infrastructure buildout accelerates.

The IMF's upside scenario suggests that if AI delivers on its productivity promises more quickly than expected, global growth could exceed the baseline by 0.3 percentage points this year alone. Over the medium term, depending on the pace of adoption across economies, AI-driven productivity gains could add between 0.1 and 0.8 percentage points annually to global output.

Tariff Shock Absorbed

Perhaps more surprising than the AI tailwind is how effectively the global economy has absorbed Trump's tariff regime. The effective US tariff rate has fallen to 18.5%—down from roughly 25% at its April 2025 peak—as trade deals, exemptions, and negotiated resets have chipped away at the initial shock.

| Country/Region | 2026 Growth Forecast | Change from October |

|---|---|---|

| Global | 3.3% | +0.2pp |

| United States | 2.4% | +0.3pp |

| China | 4.5% | +0.3pp |

| Euro Area | 1.3% | +0.1pp |

| Japan | 0.9% | +0.1pp |

| UK | 1.3% | Unchanged |

| Brazil | 1.6% | -0.3pp |

Source: IMF World Economic Outlook Update, January 2026

Businesses have proven more adaptable than anticipated. Companies have rerouted supply chains to avoid tariff exposure, while China has successfully redirected exports to non-US markets. The IMF credited this private sector agility—along with accommodative financial conditions globally—for cushioning the blow.

"The trade shock itself has been lower than initially projected," Gourinchas said.

Regional Breakdown

United States: The US economy is forecast to grow 2.4% in 2026, up 0.3 percentage points from October. The upgrade reflects massive AI infrastructure investment, new tax cuts under the Trump administration, and lower interest rates. Growth is expected to moderate to 2.0% in 2027.

China: Growth is projected at 4.5% for 2026—down from the better-than-expected 5.0% achieved in 2025 but 0.3 percentage points higher than the October forecast. Lower tariff rates and fiscal stimulus from Beijing are supporting activity, though the struggling property sector and weak consumer sentiment continue to weigh on the outlook.

Euro Area: The eurozone sees a modest upgrade to 1.3% growth, driven by increased public spending in Germany and stronger performances in Spain and Ireland. Defense spending increases announced by European governments are expected to provide additional support in later years.

Brazil: The notable outlier is Brazil, which saw its forecast cut by 0.3 percentage points to 1.6% growth. The downgrade reflects tighter monetary policy needed to combat an inflation flare-up in 2025.

The Risks Ahead

Despite the constructive headline, the IMF emphasized that risks remain tilted to the downside. Two scenarios warrant particular investor attention:

Trade Flareups: While the immediate tariff shock has been absorbed, the situation remains volatile. President Trump's threats this week to impose 25% tariffs on European countries opposing his Greenland ambitions underscore how quickly tensions can escalate. A prolonged trade conflict could weigh on business investment and consumer confidence.

AI Bubble Risk: The Fund explicitly warned that AI companies "could fail to deliver earnings commensurate with their lofty valuations." A moderate correction in AI stock valuations—combined with tightening financial conditions—could reduce global growth by 0.4 percentage points versus the baseline, according to scenarios modeled in the October World Economic Outlook. A sharper correction triggering reduced real investment in technology sectors could have far-reaching consequences, particularly for tech-heavy regions like the United States and Asia.

Central Bank Independence Under Threat

In a pointed message to Washington, the IMF underscored the critical importance of central bank independence. The warning comes as the Trump administration has launched an investigation into Federal Reserve Chair Jerome Powell and publicly pressured the Fed to cut interest rates more aggressively.

"Central bank independence is absolutely paramount when it comes to maintaining macroeconomic stability, financial stability and providing an anchor for sustainable growth," Gourinchas said. "It's even more important that somehow the Federal Reserve be able to do its job and do it well."

The IMF's own projections assume global headline inflation will continue to ease—from 4.1% in 2025 to 3.8% in 2026 and 3.4% in 2027—but this trajectory depends on central banks maintaining credibility and flexibility in their policy responses.

What It Means for Investors

The IMF's upgraded outlook validates the market's bet on AI as a transformational growth driver, but also highlights the concentration risk in that theme. Key takeaways:

-

AI infrastructure spending remains the dominant macro narrative. Companies with exposure to data center buildouts—from chipmakers to power utilities to cooling technology—continue to benefit from a multi-year capital expenditure cycle.

-

Trade risk hasn't disappeared—it's dormant. The effective tariff rate at 18.5% is still historically elevated, and any escalation could quickly sour the outlook. Diversified supply chains remain a competitive advantage.

-

Valuations matter. The IMF's explicit warning about AI stocks failing to meet earnings expectations should focus investor attention on fundamentals. Companies that can demonstrate actual revenue and profit growth from AI—not just promise it—will be better positioned if sentiment turns.

-

Watch central banks. The interaction between monetary policy independence and political pressure could become a source of market volatility. Treasury markets and the dollar are particularly sensitive to perceptions of Fed credibility.