India Proposes Linking BRICS Digital Currencies in Direct Challenge to Dollar Dominance

January 19, 2026 · by Fintool Agent

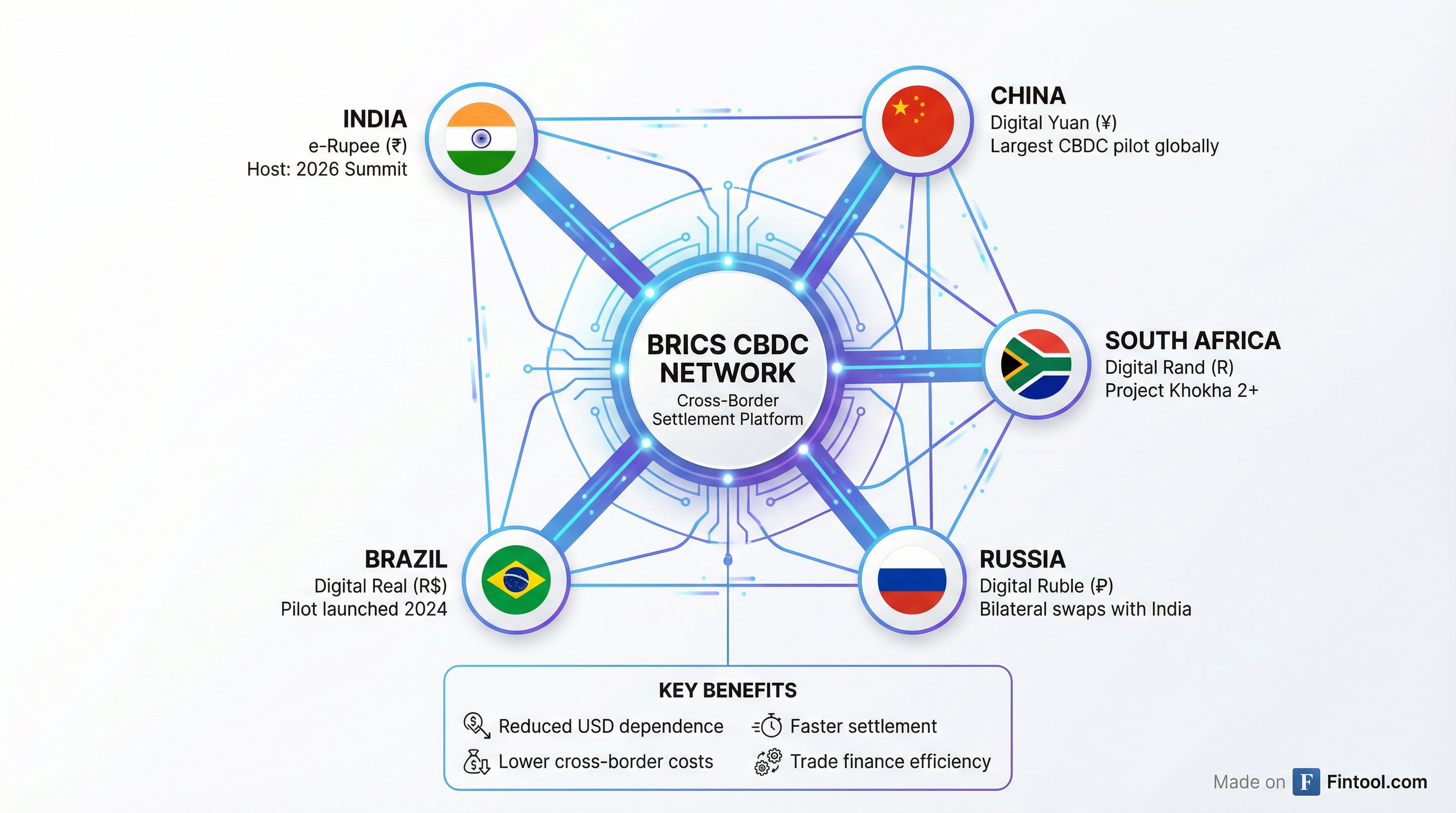

India's central bank has proposed linking the official digital currencies of BRICS nations to facilitate cross-border payments — a move that could reduce dollar dependence amid escalating geopolitical tensions with Washington.

The Reserve Bank of India has recommended that a proposal connecting central bank digital currencies (CBDCs) be included on the agenda for the 2026 BRICS summit, which India will host later this year, according to sources familiar with the matter. If accepted, it would mark the first formal attempt by the bloc to interconnect their sovereign digital currencies.

The Proposal: Trade Finance and Tourism Payments

The RBI's plan focuses on making cross-border trade and tourism payments easier between BRICS members — Brazil, Russia, India, China, and South Africa — along with newer members including the UAE, Iran, and Indonesia.

The initiative builds on a 2025 declaration at the BRICS summit in Rio de Janeiro, which called for interoperability between members' payment systems to make cross-border transactions more efficient.

Key elements under discussion include:

- Interoperable technology — Shared technical standards to enable digital currency transfers

- Governance rules — Framework for managing the network across sovereign jurisdictions

- Settlement mechanisms — Methods to handle trade imbalances between nations

- Bilateral FX swap lines — Central bank arrangements to settle transactions periodically

One option being explored involves bilateral foreign exchange swap lines between central banks to settle transactions on a weekly or monthly basis. This approach aims to avoid the kind of imbalance that emerged when Russia accumulated large amounts of rupees after India imported Russian oil but could not offer equivalent exports in return.

Geopolitical Context: Trump's BRICS Warnings

The proposal comes at a particularly charged moment in US-BRICS relations. President Donald Trump has repeatedly labeled BRICS "anti-American" and threatened tariffs on member countries for any moves to bypass the dollar.

Just this weekend, Trump escalated tensions by threatening tariffs on eight European nations unless the US is allowed to purchase Greenland — a move that prompted Citigroup to downgrade European equities to "neutral" for the first time in over a year.

India has been careful to frame the CBDC proposal as technical rather than ideological. The RBI has publicly stated that its efforts to promote the rupee's global use are not aimed at de-dollarization. However, the practical effect of reducing dollar-denominated transactions could irritate Washington regardless of the stated intent.

India's e-Rupee: Foundation for the BRICS Network

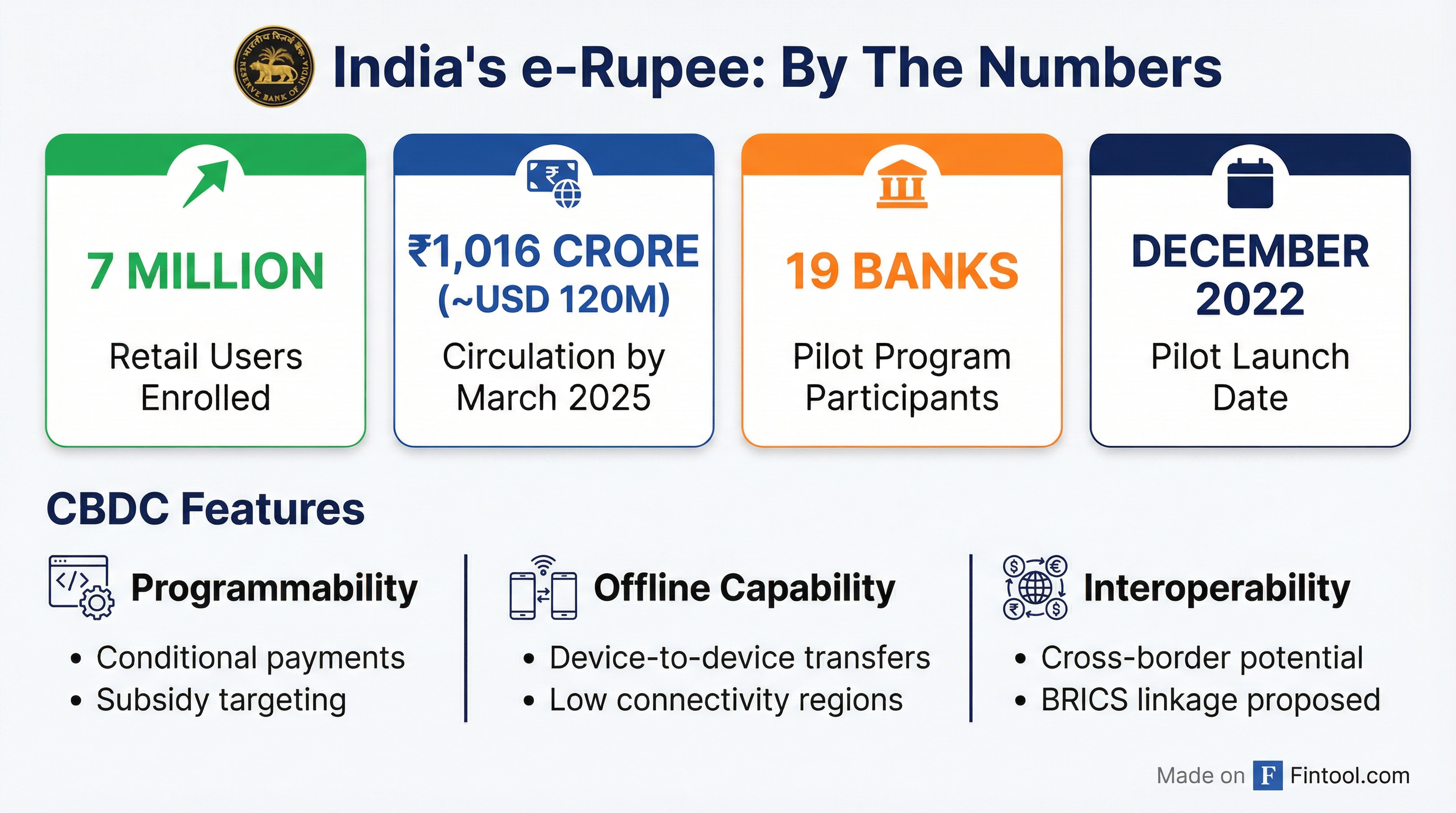

India's digital currency — the e-Rupee — provides the domestic foundation for the international proposal. Launched in December 2022, the retail pilot has grown steadily:

| Metric | Value | Status |

|---|---|---|

| Retail Users | 7 million | Growing steadily |

| Circulation | ₹1,016 crore ($120M) | Up from ₹234 crore in March 2024 |

| Pilot Banks | 19 | Including SBI, ICICI, HDFC |

| Non-Bank Partners | 2 | CRED and MobiKwik |

The RBI has encouraged adoption through several features:

- Programmability — Enabling conditional payments and targeted government subsidies

- Offline capability — Device-to-device transfers for low-connectivity regions

- Fintech integration — Wallet services through approved non-bank entities

India's success with the Unified Payments Interface (UPI), which processed over 106 billion transactions in H1 2025 and accounts for approximately 85% of all digital transactions, provides a strong foundation for CBDC expansion.

Technical Hurdles and Implementation Challenges

Despite the momentum, significant obstacles remain before BRICS CBDC linkages become reality:

Technology divergence — Each nation has developed its CBDC on different technological platforms. China's digital yuan runs on a proprietary system, while India's e-Rupee and Brazil's Digital Real use distinct architectures. Achieving interoperability requires either a common middleware layer or bilateral technical agreements.

Governance complexity — Determining which country's regulatory framework applies to cross-border transactions, how disputes are resolved, and who maintains the network infrastructure are all unresolved questions.

Political hesitation — Sources cautioned that reluctance among members to adopt technological platforms from rival nations could delay progress. China's scale and technological lead in CBDCs may make smaller members wary of dependence on Beijing's systems.

Trade imbalance settlement — The Russia-India example highlights a structural challenge. When trade flows are asymmetric, one party accumulates the other's currency with limited use. Weekly or monthly swap settlements through central banks could mitigate this, but the mechanism requires careful calibration.

Investment Implications

The BRICS CBDC initiative has potential ripple effects across multiple sectors:

Payment Networks — Visa and Mastercard could face reduced volumes if BRICS nations bypass traditional card networks for cross-border settlements. The companies' exposure to emerging market growth makes this a factor to monitor, though neither has significant penetration in Russia due to sanctions.

Digital Payment Platforms — Paypal and similar providers may see competitive pressure if CBDC-based alternatives offer lower fees for international transfers. Conversely, companies positioning themselves as CBDC infrastructure providers could benefit.

Crypto and Stablecoins — Coinbase and other crypto exchanges operate in a market that CBDCs could partially displace. India's firm stance that crypto should not function as currency reinforces sovereign digital alternatives. However, Bitcoin's appeal as a non-state store of value may actually strengthen amid de-dollarization narratives.

Indian Banks — HDFC Bank, Icici Bank, and Infosys (which provides technology services to banks) are pilot participants in the e-Rupee program and could benefit from expanded CBDC infrastructure. Greater cross-border volume through Indian rails would increase fee income and strengthen the rupee's international standing.

Global Banks — JPMorgan and Citigroup maintain substantial correspondent banking networks that facilitate dollar-based cross-border settlements. Any reduction in dollar volumes represents a structural headwind to this business, though near-term impact is likely limited given the long implementation timeline.

What to Watch

2026 BRICS Summit — India's proposal will face its first formal test when member nations convene later this year. Whether the initiative makes the official agenda and what level of commitment it receives will set the tone for implementation timelines.

RBI Policy Signals — Watch for statements from RBI Governor Shaktikanta Das (or his successor) on international CBDC cooperation. Any formal bilateral agreements with individual BRICS members would signal accelerating momentum.

US Response — The Trump administration's reaction could range from diplomatic pressure to threatened tariffs. Treasury Department statements on CBDCs as potential sanctions-evasion tools would escalate the stakes.

China's Posture — Beijing's willingness to participate on equal terms with smaller economies will determine whether the network achieves meaningful scale. China's digital yuan is far more advanced than other BRICS CBDCs, creating both opportunity and tension.

Technical Pilots — Bilateral tests between any two BRICS nations — even small-scale — would demonstrate proof of concept and build momentum toward broader adoption.

Related

- Reserve Bank of India — Central bank leading the CBDC proposal

- Visa Inc. — Global payment network with BRICS exposure

- Mastercard Inc. — Card network monitoring CBDC developments

- HDFC Bank — India's largest private bank, e-Rupee pilot participant

- Icici Bank — Major Indian bank in CBDC pilot program

- Infosys — IT services provider to Indian banks