Death Penalty Dismissed Against Luigi Mangione as UNH Stock Languishes 53% Below Pre-Shooting Levels

January 31, 2026 · by Fintool Agent

Federal prosecutors suffered a major setback Friday when U.S. District Judge Margaret Garnett dismissed the death penalty-eligible charges against Luigi Mangione, the 27-year-old accused of assassinating Unitedhealthcare CEO Brian Thompson in December 2024.

The ruling removes capital punishment from the table in a case that has become a referendum on America's healthcare system—and contributed to Unitedhealth Group's stock losing more than half its value since the killing.

The Ruling: A Technical Victory

Judge Garnett's 39-page opinion dismissed two of four federal counts against Mangione: murder through use of a firearm (the death penalty-eligible charge) and a related firearms offense.

The dismissal hinged on statutory interpretation. Federal law requires that a murder be committed during a "crime of violence" for death penalty eligibility. Prosecutors argued Mangione's alleged stalking of Thompson met that standard. The judge disagreed.

"The analysis contained in the balance of this Opinion may strike the average person—and indeed many lawyers and judges—as tortured and strange," Garnett wrote. "But it represents the Court's committed effort to faithfully apply the dictates of the Supreme Court to the charges in this case."

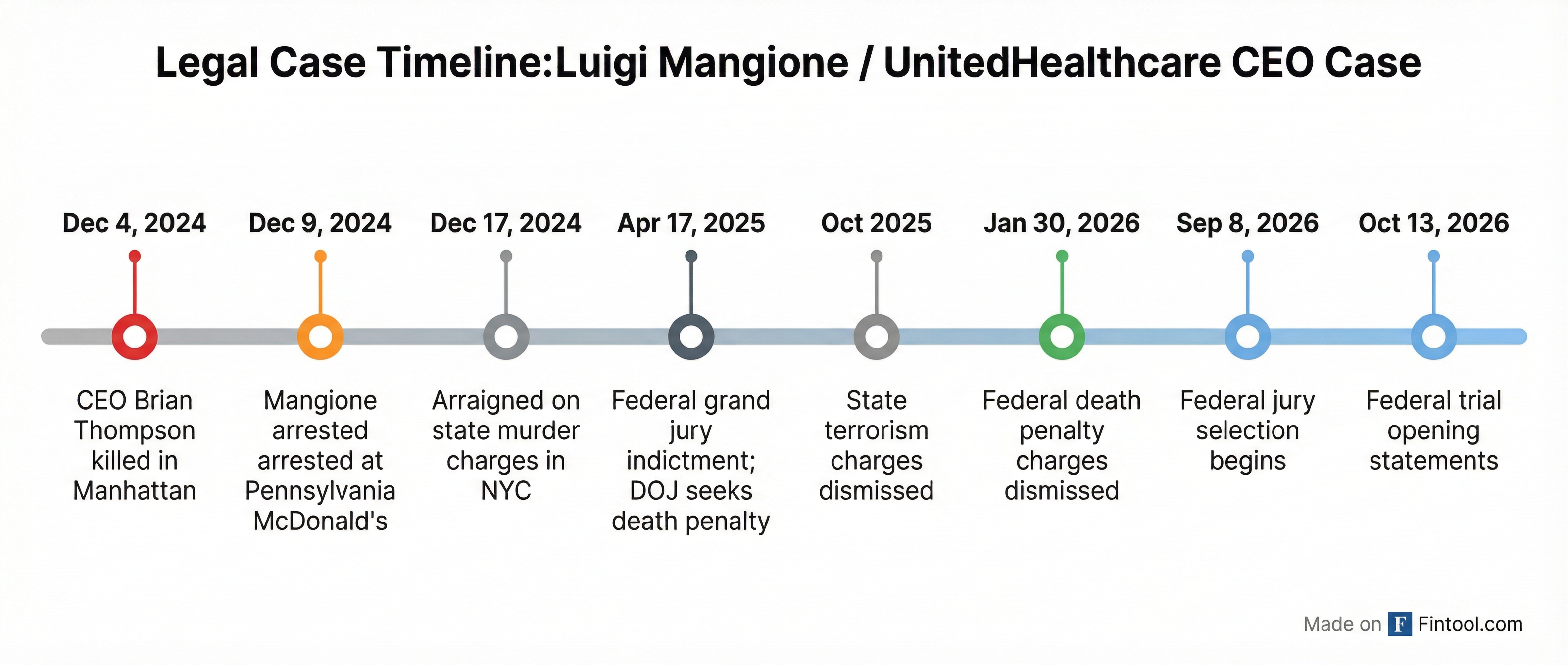

Timeline: From Assassination to Trial

Two federal stalking charges remain, carrying a maximum sentence of life in prison without parole. Prosecutors have until February 27 to decide whether to appeal.

Mangione's defense attorney Karen Agnifilo called it an "incredible decision" outside the courthouse. "We're all very relieved. We're prepared and have been prepared to fight this case."

Key Evidence Survives: In a win for prosecutors, Judge Garnett ruled that evidence seized from Mangione's backpack—including the alleged murder weapon, fake IDs, and a notebook reportedly containing his grievances against the healthcare system—will be admissible at trial.

The Stock Impact: UNH's 53% Decline

The shooting and its aftermath have devastated UnitedHealth's stock. Since the day before Thompson's killing, UNH shares have plunged 52.6%—from $605.23 to $286.93—dramatically underperforming managed care peers.

| Metric | Dec 3, 2024 | Jan 30, 2026 | Change |

|---|---|---|---|

| UNH Stock Price | $605.23 | $286.93 | -52.6% |

| Market Cap | $560B | $265B | -$295B |

| 52-Week Low | — | $234.60 (Aug 1, 2025) | — |

The stock barely moved on Friday's ruling, falling 1.8% to $286.93—a muted reaction that suggests investors had already priced out the death penalty scenario.

| Company | Dec 3, 2024 | Jan 30, 2026 | Change |

|---|---|---|---|

| Unitedhealth (unh) | $605.23 | $286.93 | -52.6% |

| Humana (hum) | $291.13 | $195.20 | -33.0% |

| Cigna (ci) | $334.90 | $274.11 | -18.2% |

| Elevance (elv) | $408.07 | $345.74 | -15.3% |

| CVS Health (cvs) | $59.19 | $74.52 | +25.9% |

UNH's underperformance reflects more than the Thompson tragedy. The company has faced a confluence of pressures: elevated medical costs, Medicare Advantage headwinds, and the 2024 Change Healthcare cyberattack that cost nearly $1 billion in business disruption.

UnitedHealth's Response

On its first earnings call following the shooting, CEO Andrew Witty addressed the tragedy head-on: "I'd like to start by expressing a sincere thank you from my colleagues and from me for the overwhelming expressions of condolence and support following the murder of our friend, Brian Thompson."

Witty acknowledged the broader healthcare criticism that Thompson's killing amplified: "The task in front of us, all of us, health care providers, payers, employers, drug companies and policymakers is to continue improving quality and health outcomes for individuals and their families, while lowering costs for everyone."

The company has since committed to reducing prior authorization requirements for Medicare Advantage patients—a direct response to criticism that insurers use administrative barriers to deny care.

What Comes Next

Federal Trial: Jury selection begins September 8, 2026, with opening statements on October 13, 2026. The timeline could shift if prosecutors appeal the death penalty ruling.

State Trial: Manhattan prosecutors want a July 1, 2026 trial start—before the federal case. No date has been set. Mangione faces second-degree murder charges carrying 25 years to life. New York does not have the death penalty.

For Investors: The legal proceedings will keep UnitedHealth in headlines through 2026. With the death penalty off the table, the case's symbolic power may diminish—but the fundamental issues it exposed about healthcare industry practices remain.

| Upcoming Dates | Event |

|---|---|

| Feb 27, 2026 | DOJ deadline to appeal death penalty dismissal |

| July 1, 2026 (proposed) | State trial start (pending judge ruling) |

| Sep 8, 2026 | Federal jury selection begins |

| Oct 13, 2026 | Federal trial opening statements |

The Bigger Picture

Thompson's killing—allegedly motivated by grievances against the healthcare system—struck a nerve with millions of Americans frustrated by claim denials and coverage battles. The words "delay, deny, depose" written on the ammunition referenced a common criticism of insurer practices.

That public sentiment, combined with regulatory pressure on Medicare Advantage and rising medical costs, has created a challenging environment for managed care. UNH delivered $400 billion in 2024 revenue and adjusted EPS of $27.66, but its 2024 medical care ratio came in 150 basis points above original guidance—a nearly $5 billion gap before accounting for cyberattack costs.

For now, Mangione awaits trial while the industry he allegedly targeted faces its own reckoning with public trust. The death penalty is off the table, but the questions Thompson's killing raised about American healthcare remain unanswered.

Related

- Unitedhealth Group (unh) — Company Profile

- Elevance Health (elv) — Company Profile

- Cigna Group (ci) — Company Profile

- Humana (hum) — Company Profile

- CVS Health (cvs) — Company Profile