Meta Commits to $135 Billion AI Bet, Shattering CapEx Records as Q4 Earnings Soar

January 28, 2026 · by Fintool Agent

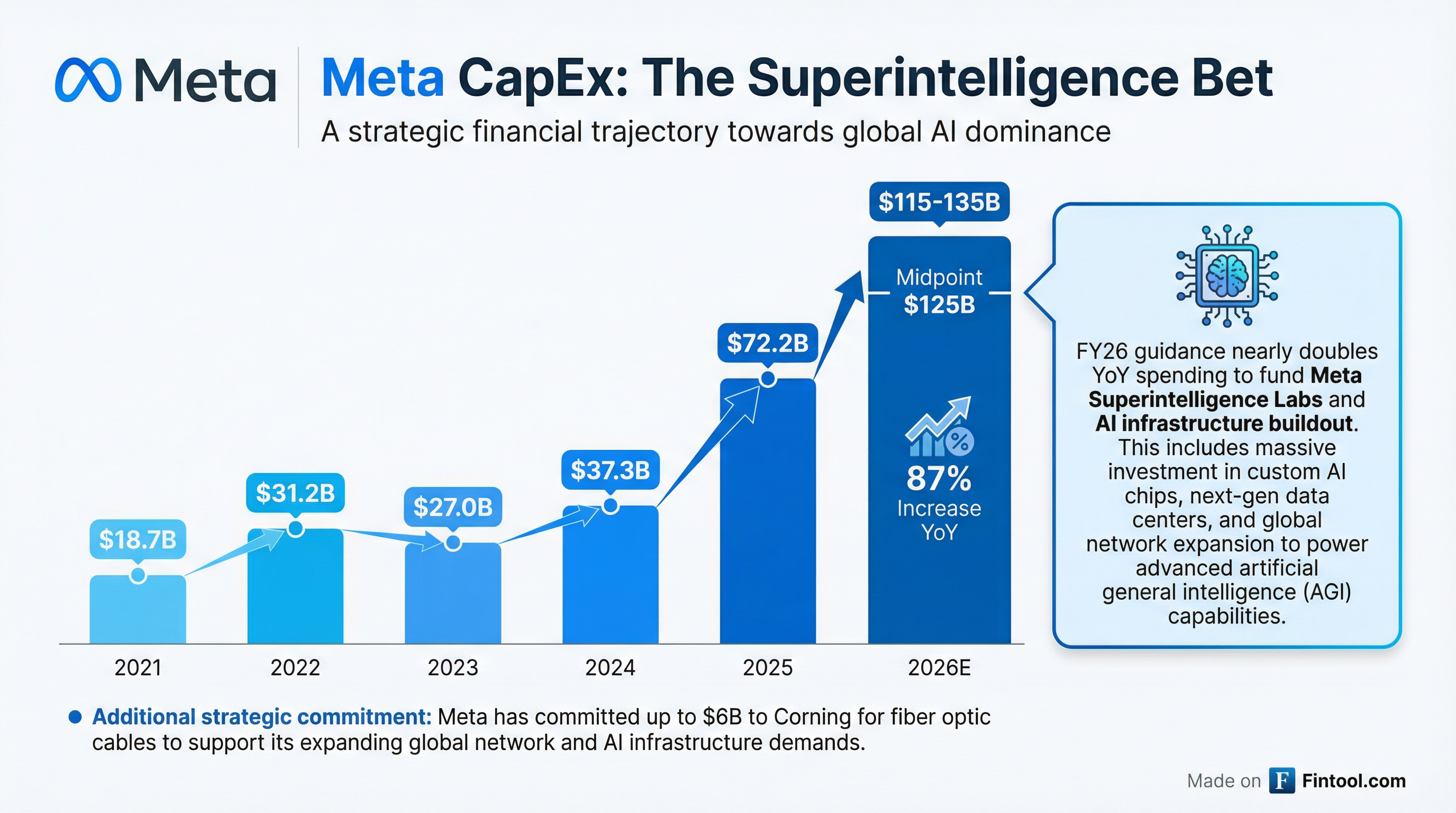

Meta Platforms is staking its future on artificial intelligence with the largest single-year capital expenditure increase in Big Tech history, guiding to $115-135 billion in 2026 spending—nearly double 2025's $72.2 billion.

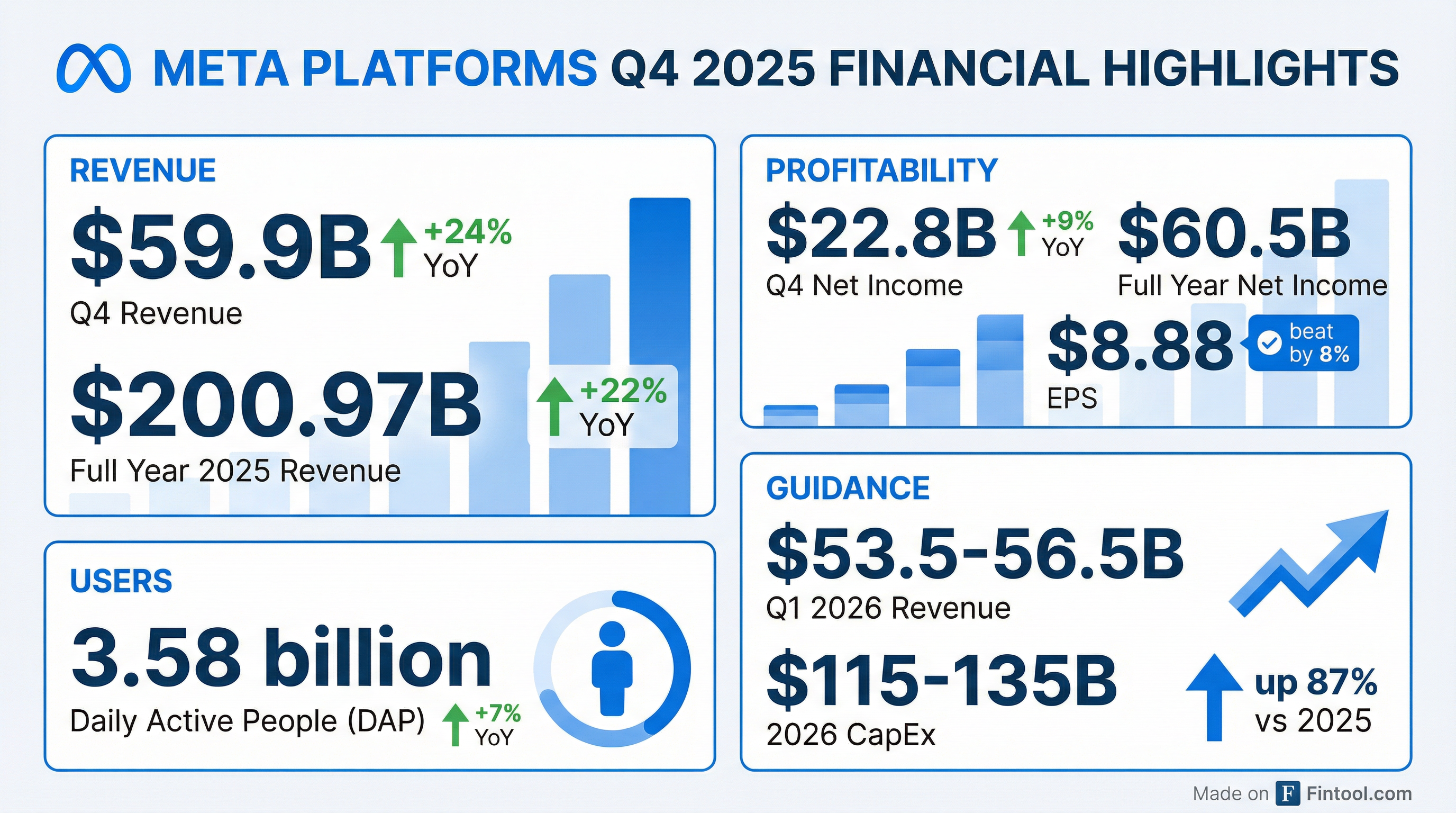

The announcement came alongside record quarterly results that beat Wall Street expectations, with Q4 revenue of $59.89 billion (up 24% year-over-year) and earnings per share of $8.88 versus consensus estimates of $8.16-8.21. Shares initially rose 3.8% in after-hours trading as investors digested the blockbuster quarter against the massive spending commitment.

"We had strong business performance in 2025," CEO Mark Zuckerberg said. "I'm looking forward to advancing personal superintelligence for people around the world in 2026."

The Numbers

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Revenue | $59.89B | $48.39B | +24% |

| Net Income | $22.77B | $20.84B | +9% |

| EPS (Diluted) | $8.88 | $8.02 | +11% |

| Operating Margin | 41% | 48% | -700bps |

| Family DAP | 3.58B | 3.35B | +7% |

For the full year, Meta generated $200.97 billion in revenue—crossing the $200 billion threshold for the first time—representing 22% growth over 2024's $164.5 billion.

The CapEx Surge: Funding the Superintelligence Race

The $115-135 billion CapEx guidance represents the most aggressive AI infrastructure buildout in corporate history. At the midpoint of $125 billion, Meta's 2026 capital spending would exceed the GDP of over 120 countries.

"We anticipate 2026 capital expenditures, including principal payments on finance leases, to be in the range of $115-135 billion, with year-over-year growth driven by increased investment to support our Meta Superintelligence Labs efforts and core business," CFO Susan Li said.

The spending will fund:

- AI infrastructure: Data centers, GPUs, and computing capacity

- Third-party cloud spend: Additional capacity from external providers

- Higher depreciation: Reflecting accelerated infrastructure buildout

- Technical talent: Investments in AI researchers and engineers

Despite the "meaningful step up in infrastructure investment," Meta expects to deliver operating income above 2025 levels in 2026.

The Corning Deal: Securing Supply Chains

The day before earnings, Meta announced a multiyear deal worth up to $6 billion with Corning for fiber-optic cables to support its AI data center buildout.

"Building the most advanced data centers in the U.S. requires world-class partners and American manufacturing," said Joel Kaplan, Meta's Chief Global Affairs Officer. "This collaboration will help create good-paying, skilled U.S. jobs, strengthen local economies, and help secure the U.S. lead in the global AI race."

Corning will expand its North Carolina manufacturing facility to build what will become the largest fiber-optic cable plant in the world, supporting a 15-20% increase in the company's workforce in the state.

Reality Labs: Persistent Losses, Strategic Pivot

The metaverse continues to bleed cash. Reality Labs posted a $6.02 billion operating loss on just $955 million in revenue for Q4, bringing full-year 2025 losses to $19.19 billion.

| Segment | Q4 2025 Revenue | Q4 2025 Op Income/(Loss) | FY 2025 Op Income/(Loss) |

|---|---|---|---|

| Family of Apps | $58.94B | $30.77B | $102.47B |

| Reality Labs | $955M | ($6.02B) | ($19.19B) |

| Total | $59.89B | $24.75B | $83.28B |

Meta expects Reality Labs operating losses to remain similar to 2025 levels in 2026. Earlier this month, the company laid off approximately 1,500 employees—about 10% of the Reality Labs headcount—as it pivots away from "metaverse" and VR products toward AI-powered smart glasses.

The strategic shift is clear: Meta is doubling down on AI while containing metaverse losses. The $14.3 billion acquisition of 49% of Scale AI and hiring of CEO Alexandr Wang as Meta's chief AI officer earlier in 2025 underscored the company's AI-first pivot.

Advertising Engine Keeps Humming

Meta's core advertising business continues to deliver despite regulatory headwinds and competition concerns. Ad impressions increased 18% year-over-year in Q4, while average price per ad rose 6%.

Full-year advertising revenue reached $196.18 billion, up 22% from 2024's $160.63 billion. The Family of Apps—Facebook, Instagram, Messenger, and WhatsApp—now reaches 3.58 billion daily active users, up 7% year-over-year.

The guidance for Q1 2026 revenue of $53.5-56.5 billion exceeded consensus estimates of $51.4 billion, suggesting continued advertising momentum despite macroeconomic uncertainty.

What to Watch

Near-term catalysts:

- EU regulatory developments: Meta aligned with the European Commission on changes to its Less Personalized Ads offering, rolling out this quarter. However, "legal and regulatory headwinds in the EU and the U.S. could significantly impact our business," the company warned.

- Youth-related litigation: Meta has "a number of trials scheduled for this year in the U.S., which may ultimately result in a material loss."

- Llama 4 progress: Reports of delays to Meta's Llama 4 Behemoth model raise questions about its ability to keep pace with Google's Gemini 3 and OpenAI.

Valuation check: Consensus analyst price target stands at $833, implying approximately 24% upside from current levels.* Wall Street remains largely bullish despite the massive spending commitment, viewing Meta's AI infrastructure investment as a necessary bet to remain competitive.

*Values retrieved from S&P Global

The Bottom Line

Meta's Q4 earnings demonstrate the company's core advertising business remains healthy, with record revenue and continued user growth. But the real story is the 87% increase in CapEx guidance—a bet that "personal superintelligence" will define the next decade of technology.

The spending puts Meta squarely in competition with Microsoft, Google, and Amazon in the AI infrastructure arms race. Whether this massive capital deployment generates returns or becomes the next metaverse-style money pit will depend on whether Zuckerberg can execute where he struggled with VR—and whether the AI models Meta trains justify the Manhattan-sized data centers housing them.

For now, Wall Street is giving Meta the benefit of the doubt. The company has the cash flow to fund the buildout—$115.8 billion in operating cash flow in 2025 alone —and the advertising engine shows no signs of slowing. The question is whether AI can generate the returns to justify becoming one of the largest capital projects in corporate history.

Related: