Molina Healthcare Crashes 33% on 63% EPS Guidance Miss, Exits Medicare Advantage Part D

February 05, 2026 · by Fintool Agent

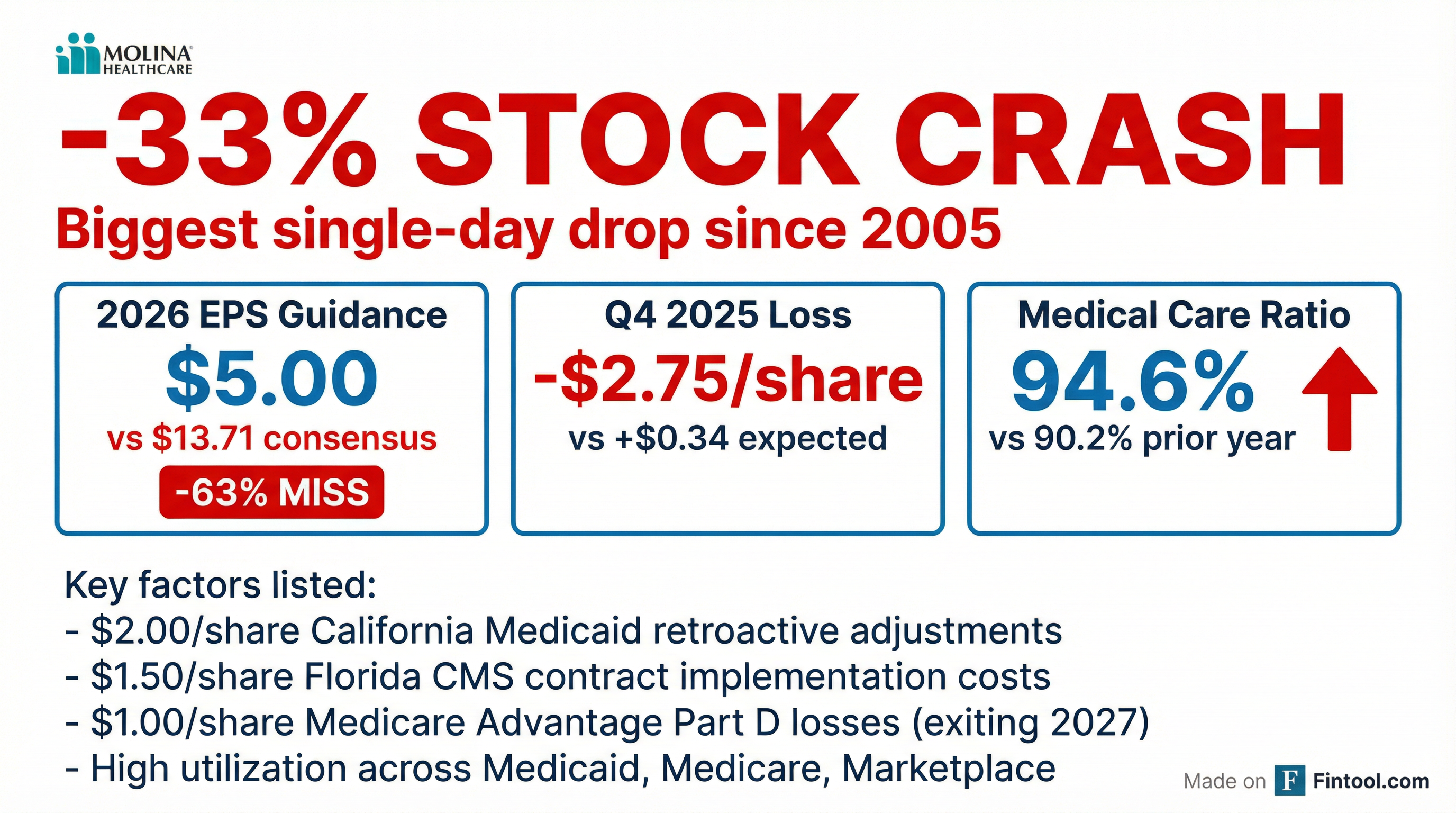

Molina Healthcare shares plunged 33% in after-hours trading Thursday after the managed care provider issued 2026 earnings guidance that missed Wall Street expectations by 63% and announced it would exit its Medicare Advantage Part D business for 2027.

The stock's decline would mark its biggest single-day drop since July 2005 if the move holds—wiping out approximately $4.6 billion in market value and raising fresh concerns about the state of the managed care industry.

The Numbers: A Guidance Miss for the Ages

Molina guided full-year 2026 adjusted EPS to "at least $5.00" versus the consensus estimate of $13.71—a stunning 63% miss that blindsided investors.

The company also reported a surprise Q4 2025 loss:

| Metric | Q4 2025 Actual | Q4 2025 Expected | Variance |

|---|---|---|---|

| Adjusted EPS | -$2.75 | +$0.34 | -909% |

| GAAP EPS | -$3.15 | — | — |

| Revenue | $11.38B | $10.88B | +4.6% |

| Medical Care Ratio | 94.6% | — | +440 bps YoY |

What Went Wrong: A Perfect Storm of Headwinds

Management attributed the guidance miss to a combination of factors that will burden 2026 earnings by $2.50 per share:

Florida CMS Medicaid Contract Implementation ($1.50/share) The company's new Florida contract, while strategically valuable long-term, requires significant upfront investment and operational costs that will pressure near-term margins.

Medicare Advantage Part D Underperformance ($1.00/share) Molina's traditional Medicare Advantage Part D product—generating approximately $1 billion in annual premiums—has failed to meet profitability targets. The company will exit the MAPD product entirely for 2027, pivoting to focus exclusively on its $5 billion dual-eligible Medicare business.

California Medicaid Retroactive Adjustments ($2.00/share) Q4 results specifically were hammered by unfavorable retroactive premium adjustments related to Molina's California Medicaid business.

Elevated Medical Costs Across All Segments Medical care ratios deteriorated across the board in 2025:

| Segment | FY 2025 MCR | FY 2024 MCR | Change |

|---|---|---|---|

| Medicaid | 91.8% | 90.3% | +150 bps |

| Medicare | 92.4% | 89.1% | +330 bps |

| Marketplace | 90.6% | 75.4% | +1,520 bps |

The Marketplace segment stands out as a particular concern—utilization has vastly exceeded risk adjustment revenue, compressing margins by over 15 percentage points year-over-year.

"2026 is a Trough Year": CEO Zubretsky's Defense

Despite the carnage, CEO Joseph Zubretsky struck a confident tone, framing 2026 as a cyclical low point rather than a structural problem.

"We remain confident in our durable and sustaining operating platform. We believe that the imbalance between rates and trend marks 2026 as a trough year for Medicaid industry margins. Even at this low point in the cycle, we continue to produce positive pretax margins in Medicaid."

Zubretsky pointed to the company's "new store embedded earnings" of over $11.00 per diluted share—incremental earnings expected between 2027 and 2029 from newly awarded contracts and recent acquisitions.

These include new Medicaid contracts in California, Iowa, Nebraska, New Mexico, Texas, Georgia, and Florida, plus Medicare Duals contracts in Idaho, Illinois, Massachusetts, Michigan, and Ohio.

2026 Guidance: The Full Picture

Molina's full-year 2026 outlook reveals a company in retrenchment:

| Metric | 2026 Guidance | 2025 Actual | YoY Change |

|---|---|---|---|

| Premium Revenue | $42.2B | $43.1B | -2% |

| Total Revenue | $44.5B | $45.4B | -2% |

| GAAP EPS | ≥$3.20 | $8.92 | -64% |

| Adjusted EPS | ≥$5.00 | $11.03 | -55% |

| Total Membership | 5.1M | 5.5M | -7% |

| Consolidated MCR | 92.6% | 91.7% | +90 bps |

The planned Marketplace segment reduction will drive membership lower, partially offset by growth from the Florida CMS contract.

Financial Health: Cash Flow Concerns

Beyond earnings, the company's cash position has deteriorated meaningfully:

- Operating cash flow swung to an outflow of $535 million in 2025, compared to an inflow of $644 million in 2024—a $1.2 billion swing.

- Parent company cash dropped to $223 million from $445 million at year-end 2024.

- Long-term debt increased to $3.77 billion from $2.92 billion.

The cash flow deterioration was driven by Medicaid risk corridor settlement activity, timing of tax payments, and lower operating performance in H2 2025.

Sector Implications: A Warning Shot for Managed Care

Molina's implosion has broader implications for the managed care sector, which has been grappling with elevated utilization post-pandemic and state Medicaid budget pressures.

Key peer stocks showed mixed reactions to the news:

| Company | Today's Change | After-Hours Move |

|---|---|---|

| Molina Healthcare (MOH) | +0.1% | -33% |

| Elevance Health (ELV) | -2.5% | -1.7% |

| Unitedhealth Group (UNH) | — | — |

| Centene (CNC) | — | — |

| Humana (HUM) | — | — |

Investors should watch for whether Molina's comments about "trough year" Medicaid margins prove prophetic or if peers echo similar pressures when they report. The Medicare Advantage Part D exit decision—following chronic underperformance—may signal broader industry challenges with drug benefit economics.

What to Watch

Conference Call (February 6, 8:00 AM ET): Management will host its Q4 call Friday morning. Key questions include:

- Rate restoration timing expectations for Medicaid contracts

- Florida contract ramp-up trajectory and breakeven timeline

- Marketplace segment strategy—does Molina follow Humana in further pullback?

- Capital allocation priorities given stressed balance sheet

2027 Embedded Earnings: Can Molina deliver on its $11+ per share embedded earnings promise as new contracts ramp?

Sector Contagion: Will peers show similar margin pressures, or is Molina's execution-specific?