OpenAI's $100 Billion Mega-Round Nears Completion, Valuing ChatGPT Maker at $850 Billion

February 18, 2026 · by Fintool Agent

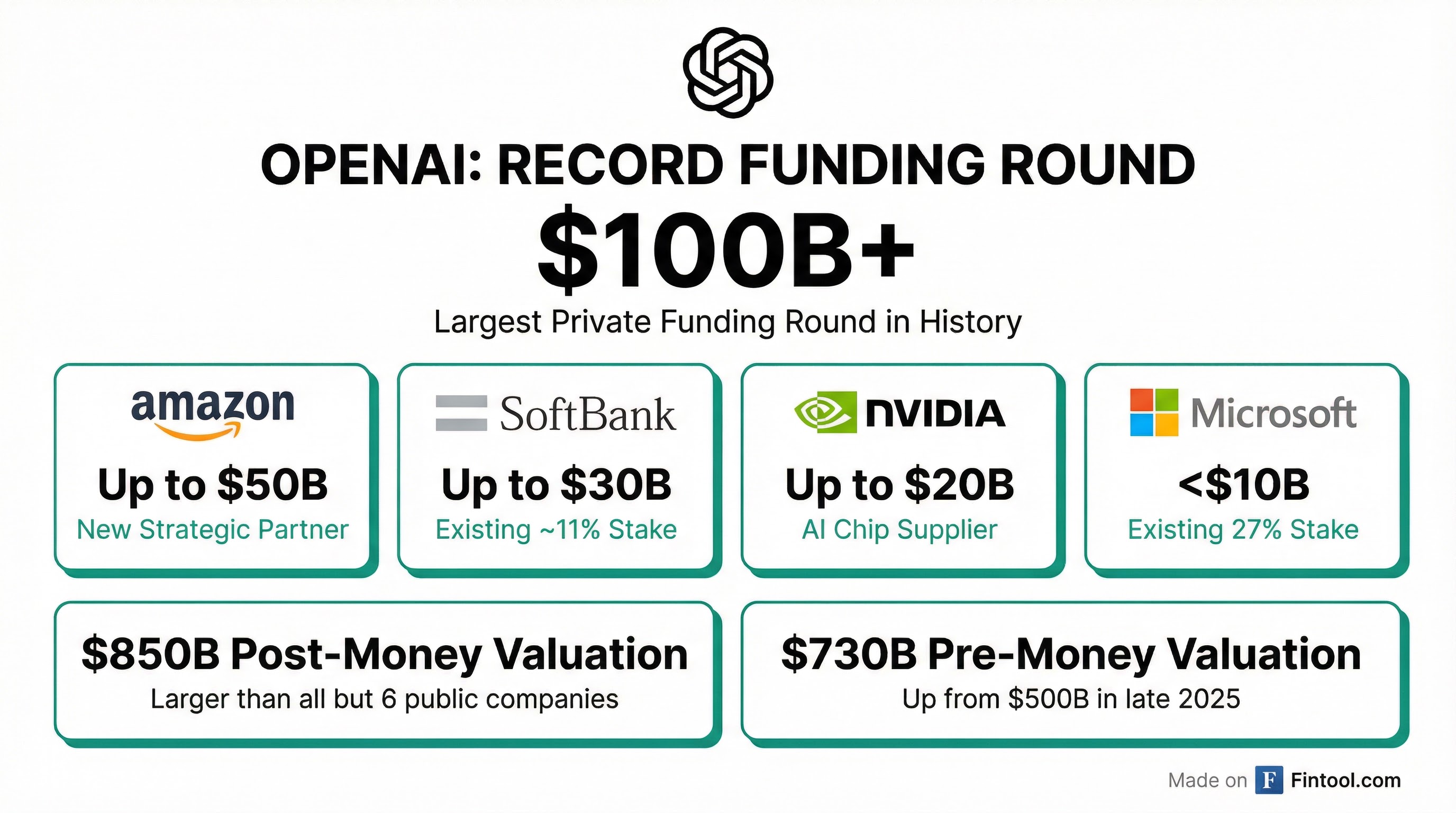

OpenAI is on the verge of completing the largest private funding round in history—a record-shattering capital raise exceeding $100 billion that could value the ChatGPT maker at more than $850 billion, according to multiple reports citing people familiar with the matter.

The first phase of the mega-round is dominated by four strategic investors: Amazon is in talks to commit up to $50 billion as a new partner, SoftBank is expected to invest as much as $30 billion (on top of its existing ~11% stake), Nvidia is nearing a $20 billion commitment as OpenAI's primary chip supplier, and Microsoft—already holding a 27% stake—is expected to invest less than $10 billion.

These commitments are expected to finalize by month's end. A second phase involving venture capital firms, sovereign wealth funds, and other financial investors will follow—potentially pushing the total substantially higher.

The Numbers Behind the Mega-Round

The deal's structure underscores how critical AI infrastructure has become to the world's largest technology companies:

| Investor | Expected Investment | Existing Stake | Strategic Angle |

|---|---|---|---|

| Amazon | Up to $50B | New investor | Cloud (AWS), chips |

| SoftBank | Up to $30B | 11% | Vision Fund, AI bet |

| Nvidia | Up to $20B | New investor | Primary GPU supplier |

| Microsoft | <$10B | 27% | Azure, Copilot integration |

OpenAI's pre-money valuation will remain at $730 billion, with the post-money value potentially exceeding $850 billion—higher than the $830 billion initially expected.

At $850 billion, OpenAI would be more valuable than all but six publicly traded companies: Apple, Microsoft, Nvidia, Alphabet, Amazon, and Meta.

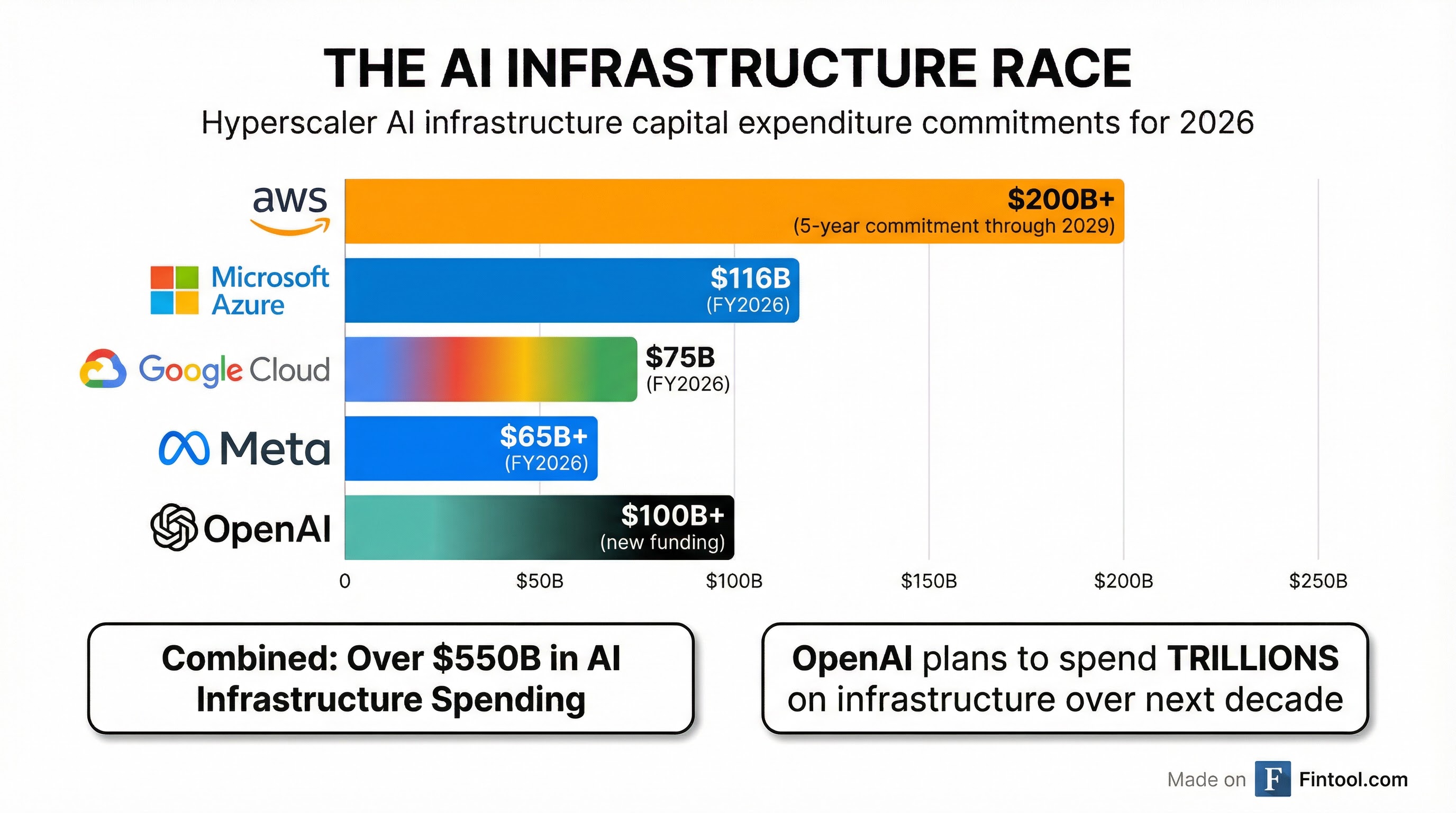

Why It Matters: The Trillion-Dollar Infrastructure Race

The funding arrives as OpenAI CEO Sam Altman has outlined plans to spend trillions on AI infrastructure over the coming decade. The company needs capital at an unprecedented scale to train increasingly powerful AI models, build data centers, and secure compute capacity.

The hyperscaler AI infrastructure arms race has reached staggering proportions:

| Company | 2026 AI Infrastructure Spend |

|---|---|

| Amazon (AWS) | $200B+ (5-year commitment) |

| Microsoft | $116B (FY2026 capex) |

| Alphabet/Google | $75B (FY2026 capex) |

| Meta | $65B+ (FY2026 capex) |

| OpenAI | $100B+ (new funding) |

Amazon's capex accelerated sharply in 2025, reaching $39.5 billion in Q4 alone—a 58% year-over-year increase.* Microsoft's quarterly capex hit $29.9 billion in Q2 FY2026.* Nvidia, the primary beneficiary of this spending, generated $57 billion in quarterly revenue in Q3 FY2026.*

*Values retrieved from S&P Global.

Amazon's Strategic Pivot

Amazon's potential $50 billion investment would mark its first direct stake in OpenAI—a strategic shift after years of backing rival Anthropic, where it has committed over $8 billion. The deal is expected to include an expanded partnership with Amazon's cloud computing services and potentially its custom AI chips.

The company has the firepower: Amazon held $86.8 billion in cash and equivalents as of Q4 2025, and generated $21.2 billion in net income that quarter.*

*Values retrieved from S&P Global.

SoftBank's All-In Bet

SoftBank has already invested roughly $34.6 billion in OpenAI, accumulating an 11% stake as of December. Its investment gain on OpenAI stood at $19.8 billion as of the company's latest earnings report—a figure that helped SoftBank swing back to profitability.

CEO Masayoshi Son's "all-in" approach to OpenAI mirrors his earlier bets on Alibaba and ByteDance. But as one analyst noted: "The reality for SoftBank shareholders at the moment is that their fortune is tied with OpenAI."

Nvidia's Vertical Integration

Nvidia's potential $20 billion investment would deepen its relationship with its largest customer. OpenAI relies heavily on Nvidia's H100 and Blackwell GPUs for training and inference. The investment would effectively lock in a major customer while giving Nvidia direct exposure to AI application layer economics.

With $57 billion in quarterly revenue and $31.9 billion in net income (Q3 FY2026), Nvidia has the resources to make such strategic investments.*

*Values retrieved from S&P Global.

OpenAI's Corporate Evolution

This funding round follows OpenAI's November 2025 restructuring into a public benefit corporation—a move that eliminated profit caps and paved the way for eventual IPO. The OpenAI Foundation now holds a 26% stake, while Microsoft owns 27%.

The company's valuation has soared from $300 billion in March 2025 to over $500 billion by late 2025, and now approaches $850 billion—a near-tripling in less than a year.

What to Watch

By End of February: Strategic investor commitments finalized. Watch for press releases confirming Amazon, SoftBank, Nvidia, and Microsoft participation.

Q2 2026: Second phase closes with VCs and sovereign wealth funds. This could push total funding well beyond $100 billion.

2026-2027: OpenAI IPO speculation intensifies. At these valuations, a public offering would be among the largest in history.

Competitive Response: How will Anthropic (backed by Amazon and Google), Google DeepMind, and Meta AI respond to OpenAI's capital advantage?

Related Companies: Nvidia | Microsoft | Amazon | Alphabet | Meta