PepsiCo Slashes Snack Prices Up to 15%, Admits 'Affordability Limitations' Hurt Sales

February 3, 2026 · by Fintool Agent

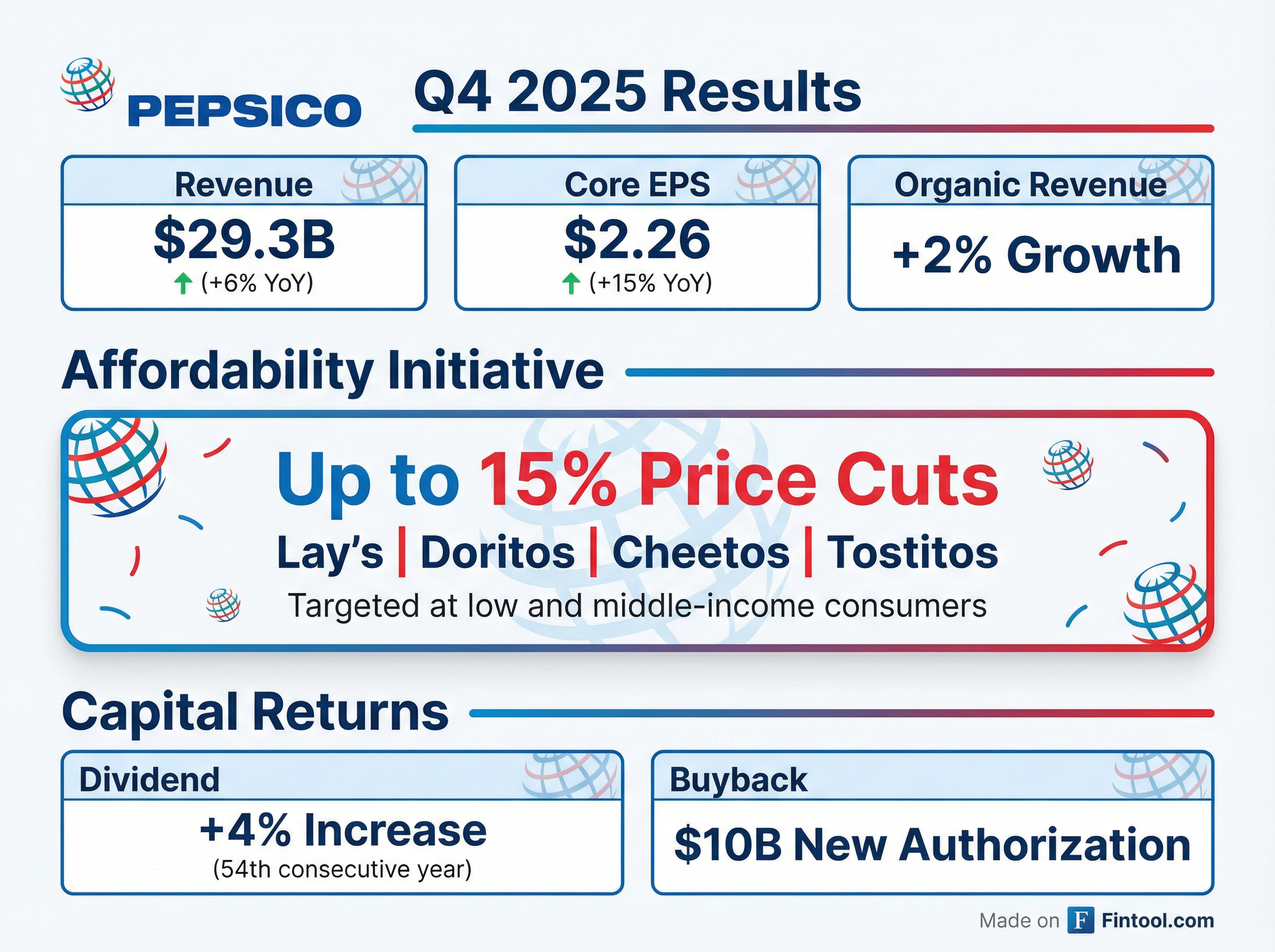

Pepsico is cutting prices by up to 15% on its most iconic snack brands—including Lay's, Doritos, Cheetos, and Tostitos—in a dramatic admission that years of price increases have priced out low and middle-income consumers.

The announcement, made alongside Q4 2025 earnings that beat expectations, marks the first major rollback in snack pricing from a leading CPG company since the post-pandemic inflation surge. PepsiCo shares rose more than 3% in early trading on the news.

"For some consumers, low and middle-income consumers, the biggest friction they have today in our category for faster penetration is affordability," CEO Ramon Laguarta said on the earnings call.

The Numbers Behind the Cut

PepsiCo's Frito-Lay North America business has been under pressure. Volume declined 2% in both Q4 2025 and full-year 2025, even as the company pushed through "effective net pricing" of 1% in the quarter. The trade-off is clear: consumers are buying fewer bags of chips at higher price points.

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Revenue ($B) | $29.3 | $27.8 | +6% |

| Core EPS | $2.26 | $1.96 | +15% |

| PFNA Volume | -2% | — | — |

| Organic Revenue Growth | +2% | — | — |

The price cuts will be "surgical"—targeting specific brands, formats, and channels where affordability is the primary barrier to purchase. Laguarta emphasized this isn't a blanket markdown but a tested strategy with "very good ROI" from pilot programs.

The Shelf Space Trade-Off

In exchange for the price cuts, PepsiCo is securing something valuable: double-digit shelf space gains from retailers.

"The average space gain for Frito-Lay in the new resets of both the main aisle and the perimeter will be double-digit," Laguarta said. "This is a good return for us and a great return for the category as well. This category needs to grow. It's very relevant for our partners."

The timing isn't coincidental. Retailers reset their store layouts in March and April, and the Super Bowl—the biggest snacking day of the year—is just days away. The price cuts give PepsiCo a promotional hook and strengthen its negotiating position with grocers.

Why This Matters for the Sector

PepsiCo's admission that affordability is constraining growth has implications far beyond Frito-Lay:

For other CPG companies: Mondelez, General Mills, and Kellogg face similar consumer dynamics. If PepsiCo's price cuts drive volume recovery, competitors may follow suit.

For retailers: Grocery chains have pushed back against manufacturer price increases. PepsiCo's concession provides leverage in ongoing negotiations.

For the Fed: Consumer pushback on elevated prices is the disinflationary pressure policymakers have been waiting for. Voluntary price cuts—not just slowing price increases—signal that pricing power has limits.

Brand Restages and Healthier Positioning

Beyond pricing, PepsiCo is restaging its biggest brands to attract health-conscious consumers:

- Lay's: New packaging emphasizing "freshness, farmers, simple ingredients, no artificials"

- Versions with avocado oil and olive oil

- Gatorade and Quaker relaunches later in 2026 with low-sugar, no-artificial formulations

- Portion control focus: 70%+ of U.S. food business is already single-serve

Laguarta directly addressed the GLP-1 weight-loss drug threat: "Families with GLP continue to engage in our category, but they do it in smaller portions."

Capital Returns Signal Confidence

Despite the pricing pressure, PepsiCo announced:

- 4% dividend increase to $5.92 per share annualized—the 54th consecutive annual increase

- $10 billion share repurchase authorization through February 2030

- 2026 guidance affirmed: 2-4% organic revenue growth, 4-6% core constant currency EPS growth

The message: management believes the affordability investments will pay off without sacrificing profitability. CFO Steve Schmitt noted that "productivity progress" will help fund the price cuts while still expanding operating margins.

What to Watch

- Q1 2026 volume: The true test of whether price cuts translate to unit growth

- Gross margin trajectory: Can productivity savings offset lower prices?

- Competitive response: Will Mondelez, Hershey, or private-label brands match?

- Retailer negotiations: How much shelf space does PepsiCo actually gain?

- Consumer sentiment: Low-income spending trends through grocery scanner data