S&P 500 Crosses 7,000 for the First Time in 68-Year History

January 28, 2026 · by Fintool Agent

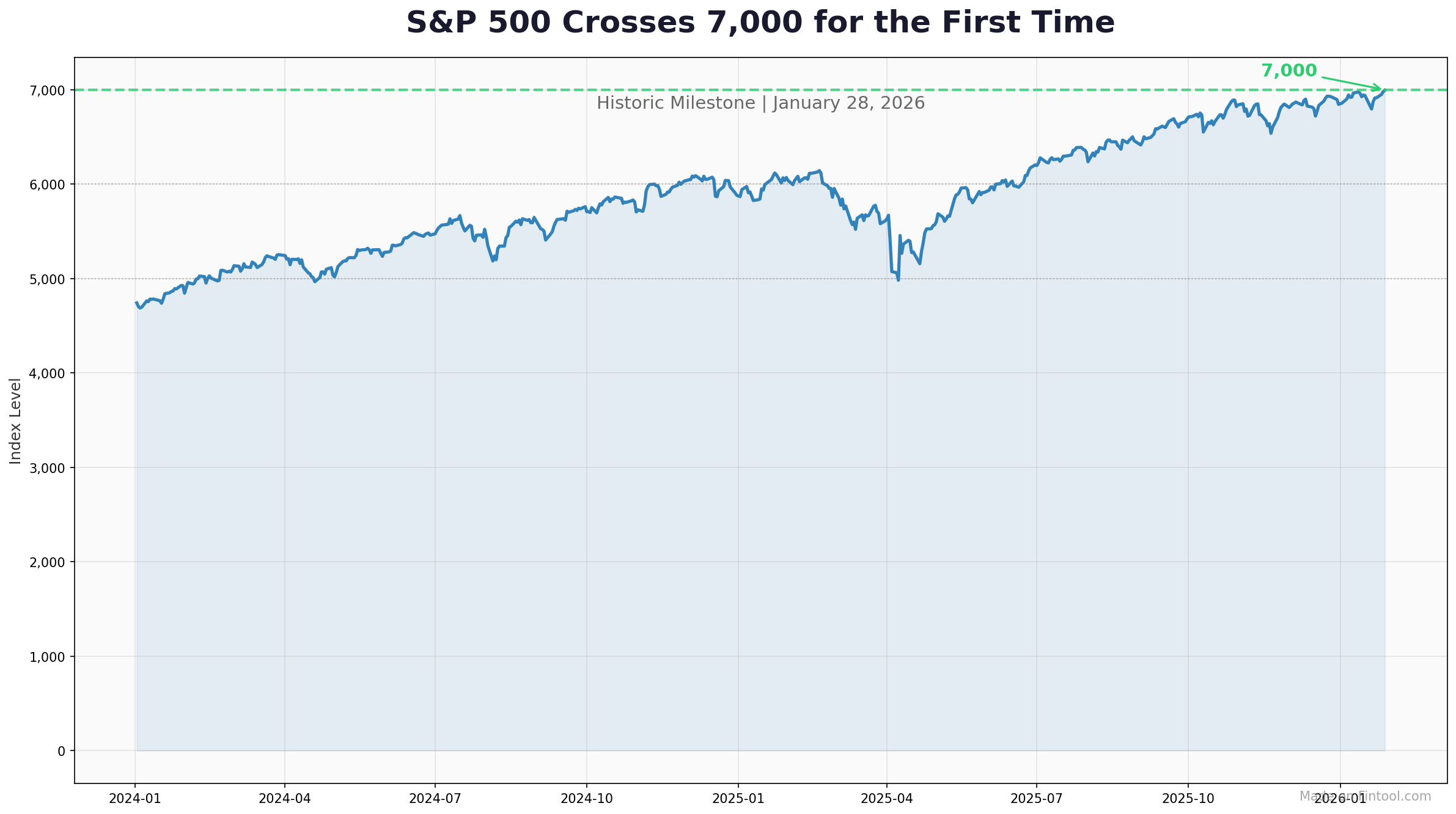

The S&P 500 crossed the 7,000-point threshold for the first time in its 68-year history on Wednesday, opening at 7,002 and touching an intraday high of 7,002.28 before pulling back slightly. The milestone caps a powerful rally driven by unrelenting optimism over artificial intelligence and high expectations for Big Tech earnings later this week.

The benchmark index joins the Dow Jones Industrial Average above the psychologically significant round number, as investors gear up for a pivotal Federal Reserve rate decision and a wave of mega-cap earnings reports from Meta, Microsoft, and Tesla after today's close.

ASML Ignites the AI Trade

The catalyst for Wednesday's breakout came from Asml, the Dutch semiconductor equipment giant whose fourth-quarter results far exceeded expectations. The company reported record bookings that sent shares surging more than 5% in Amsterdam, reigniting enthusiasm for the AI infrastructure buildout.

ASML's results provided fresh fuel to a trade that has propelled markets higher for over two years. The company's extreme ultraviolet lithography machines are essential for producing the most advanced AI chips, making its order book a bellwether for semiconductor capex and, by extension, the broader AI investment cycle.

Nvidia shares rose 1.8% in early trading to $191.88, extending the chipmaker's dominant position as the market's most valuable company with a $4.67 trillion market capitalization. The AI leader has benefited enormously from the infrastructure spending wave, with its data center revenue roughly doubling year-over-year in recent quarters.

The Path from 6,000 to 7,000

| Milestone | Date | Days Between | Cumulative Return |

|---|---|---|---|

| 5,000 | Feb 9, 2024 | - | - |

| 6,000 | Nov 8, 2024 | 272 | +20.0% |

| 7,000 | Jan 28, 2026 | 446 | +16.7% |

The S&P 500 first crossed 6,000 on November 8, 2024, meaning the journey to 7,000 took approximately 14 months—a solid pace for a market that has seen its share of volatility.

Notably, the percentage gain required to reach each successive thousand-point milestone shrinks as the index grows. While the move from 5,000 to 6,000 required a 20% advance, the 6,000 to 7,000 leg needed just 16.7%. This mathematical reality means milestone crossings will become increasingly frequent in a sustained bull market—and less significant in isolation.

| Timeframe | S&P 500 Return |

|---|---|

| 2026 YTD | +2.1% |

| 1 Year | +15.4% |

| 2 Years | +42.1% |

The Fed Factor

The milestone arrives on the same day the Federal Reserve delivers its first interest rate decision of 2026. Markets widely expect the central bank to hold rates steady, but investors will parse Chair Jerome Powell's commentary for signals about the path forward.

Despite President Trump's public pressure for rate cuts, Fed officials have emphasized a data-driven approach. The economy continues to display exceptional strength, giving policymakers little urgency to ease monetary conditions.

"With the economy still displaying exceptional strength, the Fed's messaging is likely to emphasize a data-driven approach to future policy decisions," noted Chris Brigati at SWBC.

Big Tech on Deck

The sustainability of the rally faces an immediate test with Meta, Microsoft, and Tesla all reporting fourth-quarter results after today's close. Investors are particularly focused on AI capital expenditure plans and how companies are monetizing their investments in the technology.

| Company | Price | Change | Market Cap |

|---|---|---|---|

| Nvda | $191.88 | +1.78% | $4.67T |

| Googl | $336.16 | +0.48% | $4.06T |

| Aapl | $255.63 | -1.02% | $3.78T |

| MSFT | $480.97 | +0.08% | $3.58T |

| Meta | $676.69 | +0.55% | $1.71T |

| Tsla | $437.00 | +1.42% | $1.45T |

Meta's soaring AI capex plans and Microsoft's cloud growth trajectory are top of mind for Wall Street. Tesla, meanwhile, faces questions about vehicle sales trends and its AI roadmap as the EV pioneer continues to position itself as an AI and robotics company.

Rally Breadth Expands

Perhaps most encouraging for bulls, the rally that pushed the S&P 500 to 7,000 has shown signs of broadening beyond the mega-cap technology stocks that dominated 2024 and 2025. While AI-related names continue to lead, other sectors including industrials and financials have participated in the January advance.

The S&P 500 Equal Weight Index, which gives each constituent the same weight regardless of market cap, has also reached record territory—a signal that the bull market's foundation may be firmer than skeptics suggest.

What to Watch

The 7,000 milestone, while psychologically significant, tells investors little about where markets are headed next. As Fisher Investments noted when the index crossed 6,000: "These landmarks reflect where stocks have been, but don't overrate their meaning."

Key catalysts ahead:

- Fed Decision (Today): Rate decision and Powell press conference

- Big Tech Earnings (Today after close): Meta, Microsoft, Tesla Q4 results

- Apple Earnings (Thursday): iPhone maker reports amid demand questions

- January Jobs Report (Friday): Labor market health check

The bull market that began in October 2022 has now produced dozens of record highs and delivered cumulative returns exceeding 70% from its lows. Whether 7,000 marks just another milestone on a longer journey—or a peak that will be tested—depends on whether the AI promise translates into sustained earnings growth across the economy.

Related Companies: Asml | Nvda | MSFT | Meta | Tsla | Aapl | Googl