Talen Energy Bets $3.45 Billion on AI Power Demand With PJM Gas Plant Acquisition

January 15, 2026 · by Fintool Agent

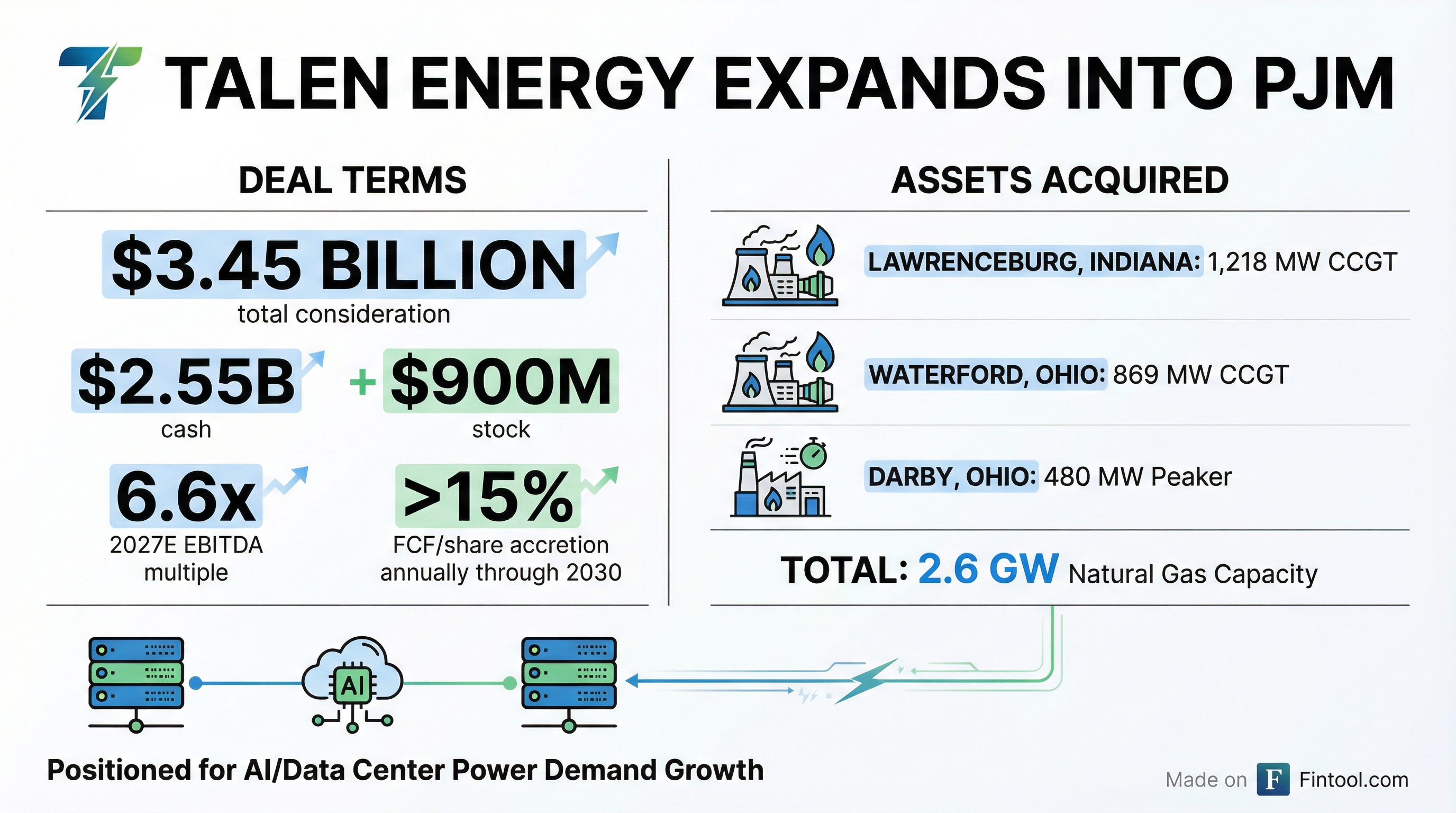

Talen Energy is doubling down on the AI power boom. The independent power producer announced today it will acquire 2.6 gigawatts of natural gas generation capacity from Energy Capital Partners for $3.45 billion—a deal that roughly doubles Talen's annual output and positions it squarely in the path of surging data center demand across the PJM Interconnection.

Shares surged as much as 10% in early trading before settling up 3.2% at $419.07, adding roughly $500 million to Talen's market capitalization and pushing the stock within striking distance of its 52-week high.

The Deal

Talen is paying approximately $2.55 billion in cash and issuing $900 million worth of stock—roughly 2.4 million shares—to ECP, which will own approximately 5% of the combined company at closing. The price implies a valuation of 6.6x projected 2027 adjusted EBITDA, a modest premium to recent power sector transactions but well below the multiples commanded by nuclear operators.

| Metric | Value |

|---|---|

| Total Consideration | $3.45B |

| Cash Component | $2.55B |

| Stock Component | $900M (2.4M shares) |

| EV/2027E EBITDA | 6.6x |

| FCF/Share Accretion | >15% annually through 2030 |

| Unlevered FCF Conversion | 85% |

The assets include three facilities in Ohio and Indiana:

- Lawrenceburg, Indiana: 1,218 MW combined-cycle gas turbine (CCGT)

- Waterford, Ohio: 869 MW CCGT

- Darby, Ohio: 480 MW peaking unit

All three facilities benefit from direct pipeline access to low-cost Marcellus and Utica shale gas, with heat rates averaging approximately 7,000 Btu/kWh and capacity factors exceeding 80% for the baseload units.

The "Talen Flywheel"

CEO Mac McFarland framed the acquisition as another turn of what he calls the "Talen flywheel"—a strategy of acquiring efficient gas generation at attractive multiples, using the cash flows to deleverage, and reinvesting in both organic growth and new data center contracting opportunities.

"This acquisition further diversifies Talen's generation portfolio by adding both baseload capacity and strong cash flow contribution and enhances our presence in the western PJM market, which has significant data center tailwinds," McFarland said on an investor call Thursday morning.

The deal follows Talen's 2025 acquisitions of the Freedom and Guernsey power plants, continuing a pattern of geographic and fuel diversification. When asked about pipeline for new data center agreements, McFarland indicated the company is working on additional contracts: "The budgets for AI and data centers continue to grow, not contract. We're seeing new announcements and different types of strategies to meet growing data center demand."

Why Data Centers Matter

The western PJM market—spanning Ohio, Indiana, and parts of West Virginia—has emerged as a hotspot for hyperscale data center development. Tech giants including Amazon, Microsoft, and Alphabet have announced major data center investments in the region, drawn by relatively affordable land, favorable tax incentives, and access to multiple fiber routes.

But data centers are voracious consumers of electricity. A single hyperscale facility can require 100+ MW of continuous power, with AI training workloads pushing demand even higher. Grid operators have warned that data center growth could strain existing transmission infrastructure, creating premium value for generators with proximity to load centers.

Talen's expanded PJM footprint gives it 2.6 GW of additional capacity to offer hyperscale customers seeking "behind-the-meter" or grid-supported power purchase agreements. The company's existing nuclear facilities at Susquehanna in Pennsylvania—which generated controversy last year through a data center co-location deal—provide carbon-free baseload, while the new gas assets offer flexible, dispatchable capacity.

The Independent Power Play

Talen's bet mirrors the broader thesis playing out across independent power producers (IPPs). Vistra Corp.—which jumped 6.6% today on the AI power theme—has emerged as the poster child for the trade, with shares up more than 100% over the past year. Constellation Energy, the nation's largest nuclear operator, has similarly benefited from data center demand, though its premium valuation reflects the zero-carbon profile of its fleet.

| Company | Today's Move | 6-Month Return | EV/EBITDA |

|---|---|---|---|

| Talen Energy (TLN) | +3.2% | +50% | 8x |

| Vistra Corp. (VST) | +6.6% | +99% | 10x |

| Constellation Energy (CEG) | +3.3% | +112% | 14x |

The key differentiator is fuel mix. Nuclear operators like Constellation command premium multiples due to their carbon-free generation and long-duration baseload characteristics. Gas-heavy portfolios like Talen's trade at discounts but offer upside if data center operators prove willing to contract for flexible, dispatchable capacity alongside intermittent renewables.

Financing and Balance Sheet

Talen expects to issue new debt to fund the $2.55 billion cash portion, likely through a combination of term loans and bonds. The company said it anticipates robust pro forma cash flows will enable rapid deleveraging, targeting net leverage of 3.5x or below by year-end 2026.

The 85% unlevered free cash flow conversion rate on the acquired assets—before any tax benefits—suggests the plants will generate roughly $440 million in annual FCF at current power prices, providing substantial debt service capacity even in a softer pricing environment.

RBC Capital Markets advised Talen on the transaction, with Kirkland & Ellis and White & Case serving as legal counsel. Jefferies and PEI Global Partners advised ECP, with Milbank as legal counsel.

What to Watch

The deal faces standard regulatory hurdles before its expected early H2 2026 close:

- Hart-Scott-Rodino: Antitrust clearance typically takes 30-60 days absent a second request

- FERC: Federal Energy Regulatory Commission approval for wholesale power market implications

- Indiana Utility Regulatory Commission: State-level review for the Lawrenceburg facility

- PJM Integration: Grid operator approval for capacity market participation

Investors should also monitor Talen's progress on new data center contracts, which management indicated could be announced in coming months. Any large-scale PPA with a hyperscaler would likely send shares materially higher, given the premium the market places on contracted cash flows.

The Bottom Line

Talen's $3.45 billion acquisition is a bet that AI-driven power demand will remain robust and that efficient gas generation can capture a share of that growth. At 6.6x forward EBITDA with 15%+ annual FCF accretion, the deal terms appear favorable—though execution risk remains as Talen integrates its third major acquisition in two years while pursuing additional data center contracts.

For investors, the stock's 50% run over the past six months raises the question of how much good news is already priced in. But with hyperscale data center buildouts showing no signs of slowing and grid constraints limiting new supply, the independent power trade may have further to run.

Related Companies: Talen Energy · Vistra Corp. · Constellation Energy · NRG Energy