Trump Media Bets $6 Billion on Fusion Power in Surprise TAE Technologies Merger

December 18, 2025 · by Fintool Agent

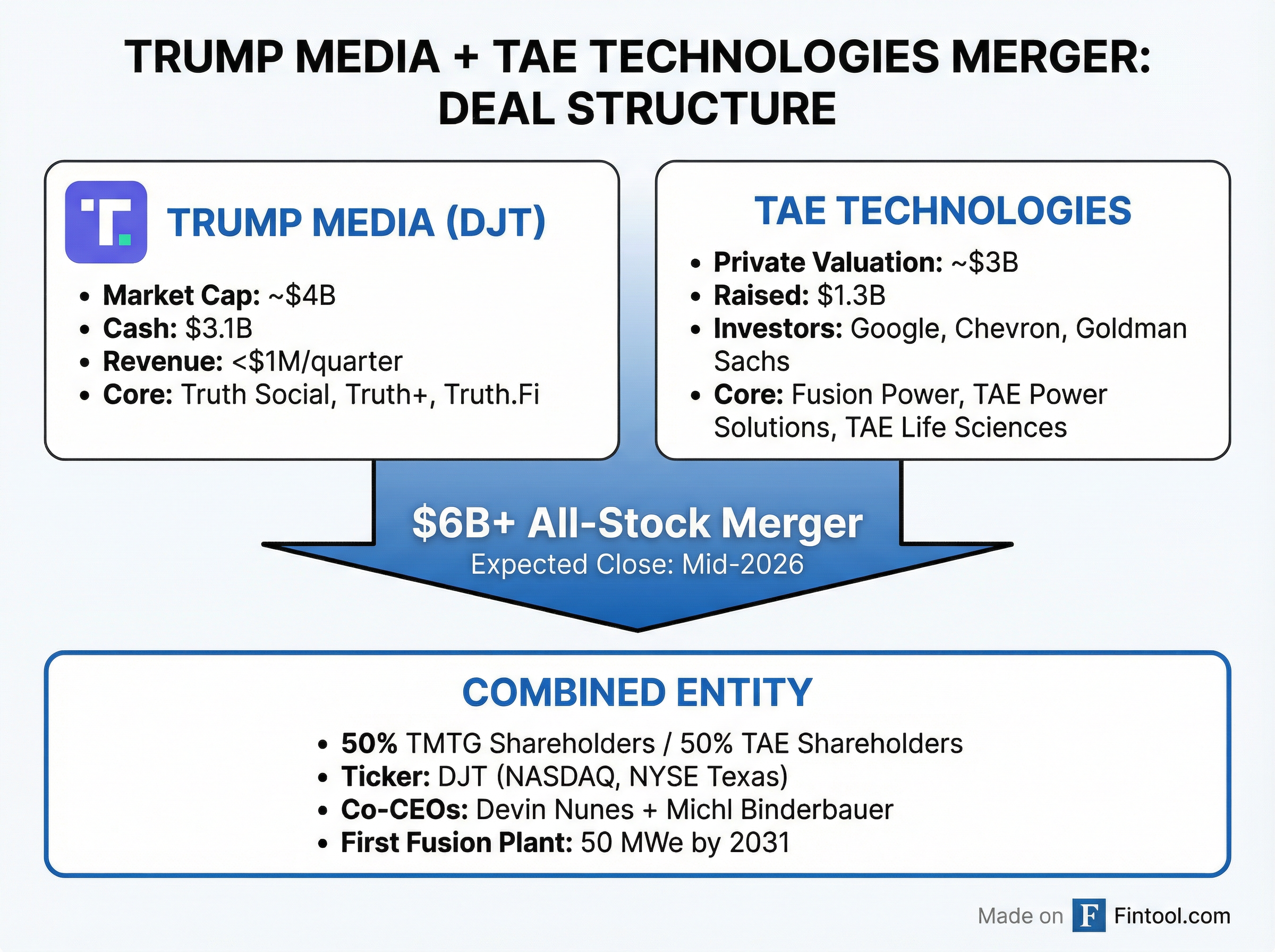

President Donald Trump's social media company is pivoting from memes to megawatts. Trump Media & Technology Group announced Thursday a $6+ billion all-stock merger with TAE Technologies, a Google-backed fusion power company that has spent 27 years and $1.3 billion trying to harness the energy source that powers the sun.

The deal—which would create one of the world's first publicly traded fusion companies—sent DJT shares soaring 35-42% in Thursday trading, erasing months of losses for a stock that had plunged more than 70% since January.

But the transaction raises immediate questions: Why is a money-losing social media company betting its $3.1 billion war chest on an industry that has never produced commercial power? And with the Trump administration's new Department of Energy fusion office actively soliciting industry input on federal funding, does the sitting President have an insurmountable conflict of interest?

Deal Terms: A 50-50 Split

Under the merger agreement, shareholders of each company will own approximately 50% of the combined entity upon closing, expected mid-2026.

Trump Media is committing up to $300 million in cash to TAE: $200 million at signing and another $100 million upon filing the Form S-4 registration statement. The combined company will trade under the ticker DJT on both NASDAQ and NYSE Texas.

The leadership structure:

| Role | Name | Background |

|---|---|---|

| Co-CEO | Devin Nunes | Former House Intelligence Chair, current Trump Media CEO |

| Co-CEO | Dr. Michl Binderbauer | TAE founder, holds 100+ patents |

| Board Chair | Michael B. Schwab | Big Sky Partners founder, 20-year TAE backer |

| Director | Donald Trump Jr. | President's son, manages Trump's trust |

Five additional independent directors will be named later.

TAE Technologies: 27 Years in the Making

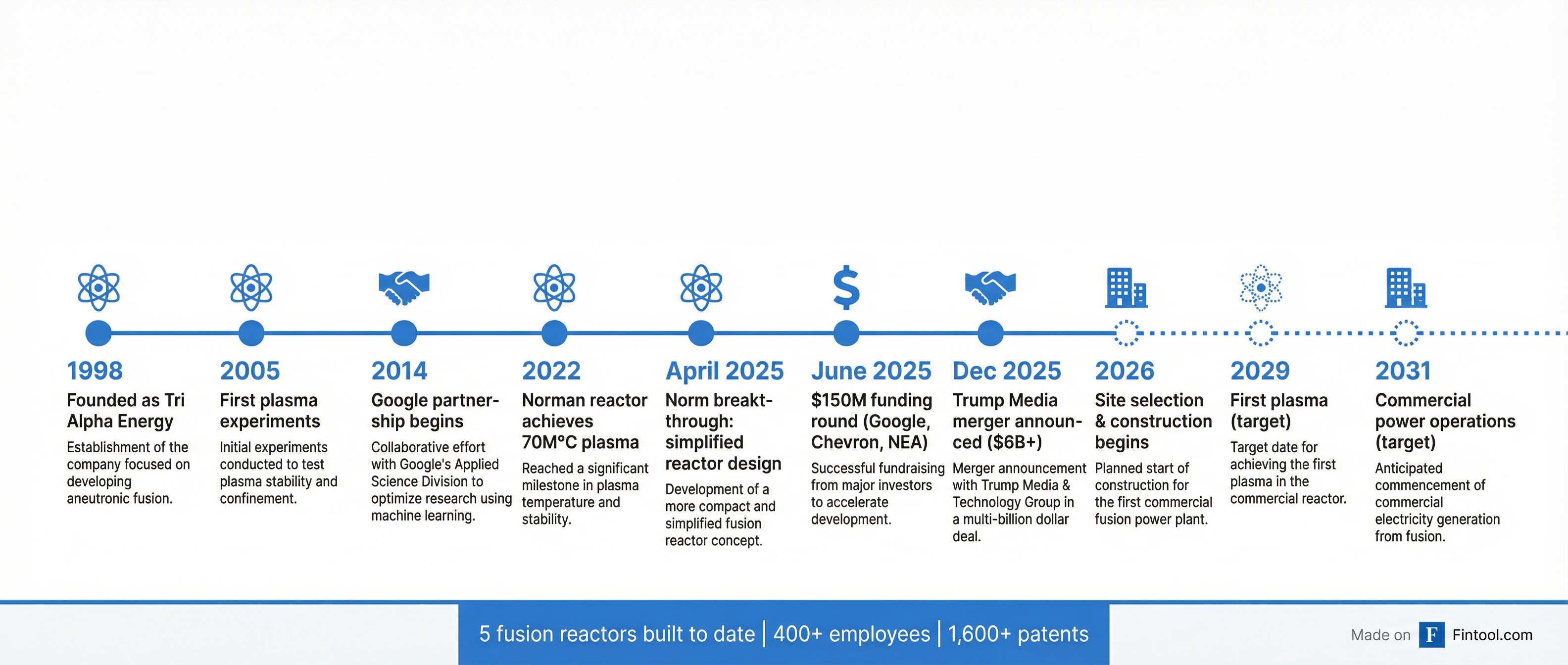

TAE isn't a startup chasing hype—it's one of the oldest and best-funded private fusion companies in existence. Founded in 1998 at UC Irvine by physicists Norman Rostoker and Michl Binderbauer, the company has built five increasingly powerful fusion reactors and raised $1.3 billion from an impressive roster of backers including Alphabet, Chevron, Goldman Sachs, NEA, Sumitomo Corporation, and Wellcome Trust.

The company's technical approach differs from the massive government-funded tokamak projects like ITER. TAE uses a compact field-reversed configuration (FRC) design that produces stable plasma at temperatures exceeding 70 million degrees Celsius—hotter than the sun's core.

A major breakthrough came earlier in 2025 when TAE's "Norm" reactor achieved stable plasma using a simplified machine design—a critical milestone for economic viability. The company says this paves the way for its "Copernicus" reactor to demonstrate net energy capability before decade's end.

Alphabet's Google Research has been deeply embedded with TAE since 2014, providing machine learning tools that accelerated plasma optimization. Google engineers worked onsite at TAE facilities to co-develop advanced plasma reconstruction algorithms.

TAE also operates two partially-owned subsidiaries: TAE Power Solutions (energy storage and power delivery for EVs and data centers) and TAE Life Sciences (biologically targeted cancer radiotherapy).

Trump Media: Cash-Rich, Revenue-Poor

The merger is an audacious pivot for Trump Media, which has struggled to build a viable business around its flagship Truth Social platform.

The company's financials tell the story of a stock untethered from fundamentals:

| Metric | Q3 2025 |

|---|---|

| Revenue | <$1 million |

| Net Loss | $54.8 million |

| Total Financial Assets | $3.1 billion |

Trump Media has consistently reported losses since inception. Yet it commands a market cap that exceeded $4 billion at Thursday's highs—a premium that reflects its status as a "meme stock" proxy for Trump's political fortunes rather than any rational business valuation.

President Trump holds approximately 114 million shares through a trust managed by Donald Trump Jr.—roughly 40% of the company. Post-merger, his stake will be diluted to approximately 20%, but the deal immediately increased the value of his holdings by an estimated $400 million to roughly $1.6 billion.

The Conflict of Interest Problem

The timing of this deal raises red flags for ethics watchdogs. Just days before the merger announcement, TAE CEO Binderbauer and other fusion industry leaders met with U.S. Department of Energy officials to urge federal funding support. The DOE recently created its first-ever Office of Fusion and launched the "Genesis Mission" to accelerate fusion development.

Representative Don Beyer (D-VA), co-chair of the Congressional Fusion Caucus and an advocate for fusion development, didn't mince words:

"The President has consistently used both government powers and taxpayer money to benefit his own financial interests and those of his family and political allies. This merger raises significant concerns about conflicts of interest and avenues for potential corruption."

Beyer called for congressional oversight "to ensure that the U.S. government and public funds are properly directed towards fusion research and development in ways that benefit the American people, as opposed to the Trump family and their corporate holdings."

Richard Painter, former White House ethics lawyer under George W. Bush, was more blunt: "He's jumping into this industry just like he jumped into cryptocurrency a couple of years ago, just as the United States government is gonna get all involved in it. And it's so obvious that there's a huge conflict of interest."

The Bull Case: AI's Insatiable Power Appetite

The merger's thesis hinges on a simple premise: artificial intelligence requires staggering amounts of electricity, and fusion offers the only path to abundant, carbon-free baseload power without the regulatory burden of traditional nuclear.

Data center electricity demand is projected to grow from 4% of U.S. power consumption to over 12% by 2040, driven by AI training and inference workloads. Tech giants including Microsoft, Meta, and Alphabet have signed power purchase agreements for nuclear and are actively exploring fusion.

"Micron's CEO said demand is substantially higher than supply for the foreseeable future," noted one analyst, referencing Micron's blowout earnings this week that sent AI-related stocks soaring. Memory shortages tied to AI data centers are already impacting supply chains.

Wedbush analyst Dan Ives called it a "major play on creating the first public nuclear fusion company in the U.S.," noting that fusion could have a relatively shorter permitting pathway than fission reactors due to the absence of meltdown risk. TAE "will clearly have major political support from President Trump in our view."

The Bear Case: Still Not Commercially Viable

For all the excitement, a sobering reality remains: no fusion reactor has ever produced net energy commercially. Despite decades of effort and tens of billions in global investment, fusion remains perpetually "30 years away."

TAE's timeline is ambitious:

| Milestone | Target Date |

|---|---|

| Site Selection & Construction Start | 2026 |

| First Plasma | 2029 |

| Net Energy Validation | 2030 |

| Commercial Power Operations | 2031 |

The first plant would generate just 50 megawatts—enough to power roughly 40,000 homes. Future plants are targeted at 350-500 MWe. For context, a single large natural gas plant produces 500-1,000 MW today.

Many physicists remain skeptical. Major hurdles include sustaining fusion reactions continuously, developing materials that can withstand constant neutron bombardment, and achieving economics competitive with wind, solar, and battery storage—all of which have seen dramatic cost declines.

What to Watch

Regulatory approvals: The deal requires shareholder votes from both companies and regulatory clearance. Closing is expected mid-2026.

Site selection: The combined company plans to announce a location for the first fusion plant by year-end 2026. CEO Nunes indicated they will "quickly seek approvals" after closing.

Congressional oversight: Expect hearings on potential conflicts of interest given the administration's active role in shaping fusion policy.

The competition: TAE isn't alone. Commonwealth Fusion Systems, Helion Energy, and other well-funded startups are racing toward the same goal. This deal gives TAE a significant capital advantage and a very visible champion—for better or worse.

Related Companies