Earnings summaries and quarterly performance for Enact Holdings.

Executive leadership at Enact Holdings.

Board of directors at Enact Holdings.

DS

Debra Still

Detailed

Director

DA

Dominic Addesso

Detailed

Chairperson of the Board

EM

Elizabeth Mitchell

Detailed

Director

JU

Jerome Upton

Detailed

Director

JF

John Fisk

Detailed

Director

MB

Michael Bless

Detailed

Director

RR

Robert Restrepo Jr.

Detailed

Director

SH

Sheila Hooda

Detailed

Director

TM

Thomas McInerney

Detailed

Director

WT

Westley Thompson

Detailed

Director

Research analysts who have asked questions during Enact Holdings earnings calls.

Bose George

Keefe, Bruyette & Woods

7 questions for ACT

Also covers: AGM, AGNC, BETR +25 more

DH

Douglas Harter

UBS

7 questions for ACT

Also covers: ACRE, AGNC, AOMR +42 more

MB

Mihir Bhatia

Bank of America

6 questions for ACT

Also covers: AFRM, AXP, BFH +12 more

RS

Richard Shane

JPMorgan Chase & Co.

5 questions for ACT

Also covers: ABR, ACRE, AGNC +19 more

RS

Rick Shane

JPMorgan Chase & Co.

1 question for ACT

Also covers: ABR, AGNC, AXP +9 more

Recent press releases and 8-K filings for ACT.

Enact Reports Strong Q4 and Full-Year 2025 Results, Announces 2026 Capital Return Expectations

ACT

Earnings

Share Buyback

Guidance Update

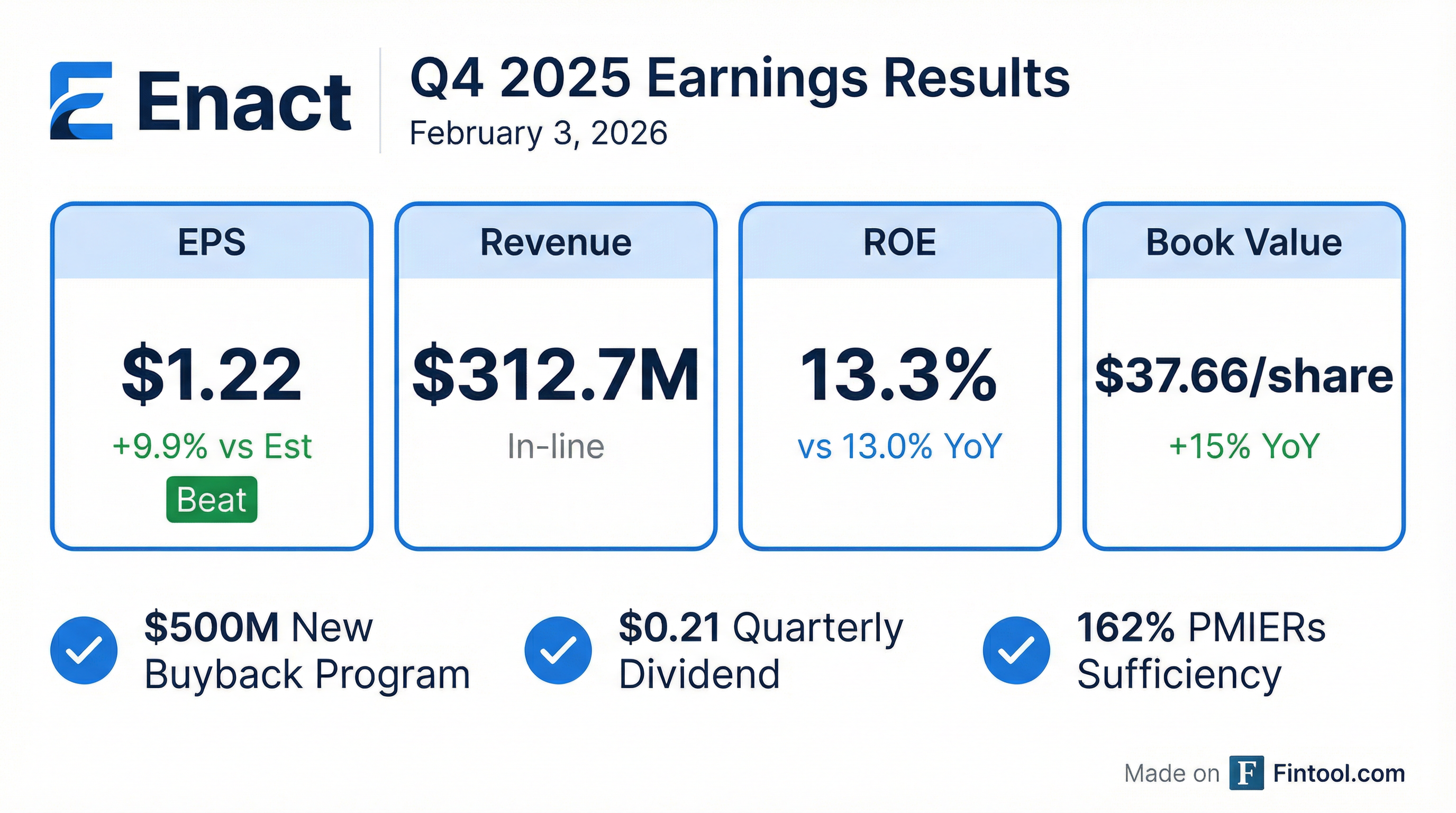

- Enact reported adjusted operating income of $179 million or $1.23 per diluted share for Q4 2025, and $688 million or $4.61 per diluted share for the full year 2025, with year-end adjusted book value per share increasing 11% to $37.87.

- The company ended 2025 with a record insurance in force of $273 billion and generated $14 billion of new insurance written in Q4 2025.

- Enact returned $503 million to shareholders in 2025 and announced expectations to return approximately $500 million in 2026, supported by a new $500 million share repurchase program and a PMIER sufficiency ratio of 162%.

- Credit performance continued to outperform expectations, leading to a net reserve release of $60 million in Q4 2025, and the company projects a 10%-15% increase in the mortgage insurance market for 2026.

3 days ago

ACT Reports Q4 2025 Financial Results

ACT

Earnings

- For Q4 2025, ACT reported total revenues of $312.7 million and net income of $177.2 million.

- The company's balance sheet as of December 31, 2025, showed total assets of $6,893.5 million and total liabilities of $1,538.3 million.

- ACT's capital position for Q4 2025 included combined statutory capital of $5,319 million, a combined risk-to-capital ratio of 10.1, and a PMIERs Sufficiency Ratio of 162%.

- The investment portfolio's fixed maturity securities available-for-sale totaled $6,050.5 million at December 31, 2025, with an average book yield of 4.1%.

3 days ago

Enact Holdings Inc. Reports Strong Q4 and Full-Year 2025 Results, Announces 2026 Capital Return Expectations

ACT

Earnings

Dividends

Share Buyback

- Enact Holdings Inc. reported strong financial results for Q4 2025, with adjusted operating income of $179 million or $1.23 per diluted share, contributing to a full-year 2025 adjusted operating income of $688 million or $4.61 per diluted share. The year-end adjusted book value per share increased 11% to $37.87.

- The company returned over $500 million of capital to shareholders in 2025 and has set a 2026 capital return expectation of approximately $500 million. This includes a new $500 million share repurchase program authorized by the board and a declared quarterly dividend of $0.21 per common share.

- Enact generated $14 billion of new insurance written in Q4 2025, ending the year with a record insurance in force of $273 billion. The insurance in-force portfolio demonstrated resilience with a risk-weighted average FICO score of 746 and a loan-to-value ratio of 93%.

- Credit performance continued to outperform expectations, leading to a net reserve release of $60 million in Q4 2025. The company maintains a strong capital position with a PMIER sufficiency ratio of 162%.

- For 2026, Enact anticipates operating expenses between $215 million-$220 million and projects the mortgage insurance market to increase by approximately 10%-15% from 2025.

3 days ago

Enact Holdings Inc. Reports Strong Q4 and Full Year 2025 Results, Announces 2026 Capital Return Expectations

ACT

Earnings

Guidance Update

Share Buyback

- Enact Holdings Inc. reported adjusted operating income of $179 million or $1.23 per diluted share for Q4 2025, and $688 million or $4.61 per diluted share for the full year 2025, achieving a 13.5% adjusted return on equity in Q4.

- The company returned over $500 million to shareholders in 2025 and expects to return approximately $500 million in 2026, supported by a newly authorized $500 million share repurchase program.

- New insurance written (NIW) for Q4 2025 was over $14 billion, contributing to a record year-end insurance in force of $273 billion.

- Credit performance was strong, resulting in a net reserve release of $60 million in Q4 2025, driven by favorable cure performance and a claim rate reduction from 9% to 8%.

- For 2026, Enact anticipates operating expenses between $215 million-$220 million (excluding reorganization costs) and projects a 10%-15% increase in the mortgage insurance market from 2025 levels.

3 days ago

Enact Holdings, Inc. Reports Strong Q4 and Full Year 2025 Results, Announces New Share Repurchase Program and Quarterly Dividend

ACT

Earnings

Share Buyback

Dividends

- Enact Holdings, Inc. reported Q4 2025 GAAP Net Income of $177 million, or $1.22 per diluted share, and Adjusted Operating Income of $179 million, or $1.23 per diluted share.

- For the full year 2025, the company returned over $500 million of capital to shareholders.

- The Board of Directors authorized a new $500 million share repurchase program and declared a quarterly dividend of $0.21 per common share, payable on March 19, 2026.

- Primary Insurance in-force increased 2% year-over-year to $273 billion, and PMIERs Sufficiency was 162%, or approximately $1.9 billion above requirements.

3 days ago

Enact Holdings Reports Fourth Quarter and Full Year 2025 Results

ACT

Earnings

Share Buyback

Dividends

- Enact Holdings reported GAAP Net Income of $177 million, or $1.22 per diluted share, for the fourth quarter of 2025, and $674 million for the full year 2025.

- The company achieved Adjusted Operating Income of $179 million, or $1.23 per diluted share, in Q4 2025, with a full-year 2025 Adjusted Operating Income of $688 million.

- The Return on Equity for Q4 2025 was 13.3%, and the Adjusted Operating Return on Equity was 13.5%.

- Enact returned over $500 million of capital to shareholders in 2025, comprising $121 million in quarterly dividends and $382 million in share repurchases.

- The Board of Directors approved a new $500 million share repurchase program and a quarterly dividend of $0.21 per share.

3 days ago

Enact Holdings Announces New Share Repurchase Program and Quarterly Dividend

ACT

Share Buyback

Dividends

- Enact Holdings' Board of Directors authorized a new $500 million share repurchase program.

- This new authorization is in addition to the company’s current $350 million share repurchase program, of which $30 million remained as of January 30, 2026.

- The Board also declared a quarterly dividend of $0.21 per common share, payable on March 19, 2026, to shareholders of record on February 26, 2026.

- Enact's President and CEO, Rohit Gupta, stated that the new share repurchase program reflects the strength of the company's balance sheet and confidence in its long-term performance, reinforcing its commitment to returning excess capital to shareholders.

3 days ago

ACT Reports Q3 2025 Results

ACT

Earnings

Dividends

Share Buyback

- ACT reported Net Income of $163 million and Diluted Net Income Per Share of $1.10 for Q3 2025, with Adjusted Operating Income at $166 million and Diluted Adjusted Operating Income Per Share at $1.12. These figures represent a 3% to 4% sequential decrease.

- The company returned $136 million to shareholders in Q3 2025, consisting of $31 million in quarterly dividends and $105 million from its share buyback program, and now anticipates a total capital return of approximately $500 million for 2025.

- Primary Insurance in-Force reached $272 billion, driven by New Insurance Written of $14.0 billion and a persistency rate of 83% in Q3 2025.

- ACT maintained a robust PMIERs sufficiency of $1.9 billion or 162%. The delinquency rate increased to 2.5% and the new delinquency rate to 1.4% in Q3 2025, primarily due to seasonality, resulting in a loss ratio of 15%.

Nov 6, 2025, 1:00 PM

Enact Reports Q3 2025 Results and Raises Capital Return Guidance

ACT

Earnings

Guidance Update

Dividends

- Enact reported adjusted operating income of $166 million or $1.12 per diluted share for Q3 2025, with an adjusted return on equity of 13%.

- The company increased its 2025 capital return expectation to approximately $500 million, up from prior guidance of $400 million, and entered a new $435 million revolving credit facility. During Q3 2025, $31 million was paid out in dividends.

- New insurance written exceeded $14 billion, driving a 2% year-over-year increase in insurance in force to $272 billion. Operating expenses for Q3 2025 were $53 million, and the full-year 2025 expense forecast was reduced to approximately $219 million.

- Moody's upgraded Enact's MI rating to A2 from A3 and Enact Holdings' ratings to Baa2 from Baa3, with AM Best moving its outlook to positive.

Nov 6, 2025, 1:00 PM

Enact Holdings, Inc. Reports Strong Third Quarter 2025 Results and Increased Capital Return Guidance

ACT

Earnings

Dividends

Share Buyback

- Enact Holdings, Inc. reported GAAP Net Income of $163 million, or $1.10 per diluted share, and Adjusted Operating Income of $166 million, or $1.12 per diluted share, for the third quarter of 2025.

- The company increased its full-year capital return guidance to approximately $500 million and declared a quarterly dividend of $0.21 per share.

- During the quarter, Enact repurchased approximately 2.8 million shares for a total of approximately $105 million.

- Primary insurance in-force grew to $272 billion, a 2% year-over-year increase, and the company maintained a strong capital position with PMIERs Sufficiency of 162%, or approximately $1.9 billion.

Nov 5, 2025, 9:25 PM

Quarterly earnings call transcripts for Enact Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more