Earnings summaries and quarterly performance for Alpha Metallurgical Resources.

Executive leadership at Alpha Metallurgical Resources.

Charles Andrew Eidson

Detailed

Chief Executive Officer

CEO

DH

Daniel Horn

Detailed

Executive Vice President, Chief Commercial Officer

JT

J. Todd Munsey

Detailed

Executive Vice President and Chief Financial Officer

JW

Jason Whitehead

Detailed

President and Chief Operating Officer

MM

Mark Manno

Detailed

Executive Vice President, General Counsel and Secretary

Board of directors at Alpha Metallurgical Resources.

Research analysts who have asked questions during Alpha Metallurgical Resources earnings calls.

Recent press releases and 8-K filings for AMR.

Alpha Metallurgical Resources Reports Q4 2025 Results and Provides 2026 Commitments

AMR

Earnings

Guidance Update

New Projects/Investments

- Alpha Metallurgical Resources reported Adjusted EBITDA of $28.5 million and 3.8 million tons shipped for the fourth quarter of 2025.

- The company secured 4.1 million tons in domestic sales commitments for 2026 at an average price of $136.30.

- As of December 31, 2025, Alpha Metallurgical Resources had $366 million in unrestricted cash and $524.3 million in total liquidity.

- Development of the Kingston Wildcat Low-Vol Mine is progressing, with an expected production of approximately 500,000 tons in 2026 and a full productivity capacity of nearly 1 million tons per year.

- Metallurgical coal markets experienced varied movements in Q4 2025, with the Australian Premium Low-Vol Index increasing 14.6% to $218 per metric ton by December 31st, while U.S. East Coast low-vol rose 4.5%.

9 hours ago

Alpha Metallurgical Resources Reports Q4 2025 Results and Provides 2026 Outlook

AMR

Earnings

Guidance Update

Demand Weakening

- Alpha Metallurgical Resources reported Adjusted EBITDA of $28.5 million and 3.8 million tons shipped for Q4 2025, ending the year with $524.3 million in total liquidity as of December 31st.

- For 2026, the company has secured 4.1 million tons in domestic sales commitments at an average price of $136.30, with 37% of its metallurgical tonnage committed and priced at an average of $134.02.

- Management noted continued market weakness, especially in high-vol coal, and a significant divergence between Australian and U.S. East Coast indices. The new Kingston Wildcat Low-Vol Mine is expected to produce approximately 500,000 tons in 2026.

- The company is maintaining a strong balance sheet, continuing its share buyback program, and actively evaluating M&A opportunities.

9 hours ago

Alpha Metallurgical Resources Reports Q4 2025 Results and Provides 2026 Outlook

AMR

Earnings

Guidance Update

New Projects/Investments

- Alpha Metallurgical Resources reported Adjusted EBITDA of $28.5 million and 3.8 million tons shipped for Q4 2025. The company ended the quarter with $366 million in unrestricted cash and $524.3 million in total liquidity.

- For 2026, AMR has 4.1 million tons in domestic sales commitments at an average price of $136.30. Additionally, 37% of its Met segment tonnage is committed and priced at an average of $134.02, with 53% committed but unpriced.

- The Kingston Wildcat Low-Vol Mine is expected to produce approximately 500,000 tons in 2026, with a full productivity capacity of nearly 1 million tons per year.

- The company noted continued market weakness, especially for high-vol coal, and significant volatility between Australian and Atlantic indices. Management plans to continue a share buyback program and is evaluating M&A opportunities.

10 hours ago

Alpha Metallurgical Resources reports Q4 2025 financials and strategic update

AMR

Earnings

Share Buyback

Guidance Update

- Alpha Metallurgical Resources (AMR) accounted for 1/5 of total U.S. metallurgical coal production in 2025, with 15.3 million tons sold and a diverse portfolio serving global steel markets.

- 2025 revenue was $2.13 billion, with Adjusted EBITDA of $121.9 million and free cash flow of -$20.4 million, reflecting a challenging market environment and lower realized prices per ton compared to prior years.

- The company has reduced its outstanding shares by ~31% since March 2022 through a $1.1 billion share repurchase program, emphasizing flexible capital returns.

- AMR maintains a strong balance sheet, targets minimum liquidity of $250–$300 million, and continues disciplined capital allocation, prioritizing maintenance capex and shareholder returns.

12 hours ago

Alpha Metallurgical Resources reports Q4 and FY 2025 financial results

AMR

Earnings

Share Buyback

Demand Weakening

- Reported a net loss of $17.3 million for Q4 2025, compared to a net loss of $5.5 million in Q3 2025 and $2.1 million in Q4 2024. Adjusted EBITDA for Q4 was $28.5 million, down from $41.7 million in Q3 2025 and $53.2 million in Q4 2024.

- Coal revenues for Q4 2025 were $519.1 million for the Met segment, with 3.8 million tons sold at a realized price of $115.31 per ton. Operating cash flow for the quarter was $19.0 million.

- The company’s liquidity as of December 31, 2025, was $524.3 million, including $366.0 million in cash and cash equivalents, and it had no borrowings under its credit facility.

- As of February 20, 2026, Alpha had repurchased approximately 6.9 million shares at a cost of $1.1 billion, with 12,792,685 shares outstanding.

13 hours ago

Alpha Metallurgical Resources reports Q4 2025 results

AMR

Earnings

Share Buyback

Demand Weakening

- Revenue for FY 2025 was $2.13 billion, with Q4 revenue calculated at $0.38 billion, reflecting a continued decline from prior years as coal prices and volumes softened.

- Adjusted EBITDA for FY 2025 was $121.9 million, with Q4 Adjusted EBITDA at $(13.6) million, indicating a significant margin compression to 6% for the year and a negative margin in Q4.

- Free Cash Flow for FY 2025 was $(20.4) million, with Q4 FCF at $(69.5) million, marking a reversal from positive cash generation in previous years.

- The company continued its share repurchase program, reducing outstanding shares by approximately 31% since March 2022, with $1.1 billion spent on buybacks as of February 2026.

13 hours ago

Alpha Metallurgical Resources announces Q4 and FY 2025 results

AMR

Earnings

Share Buyback

Demand Weakening

- Reported a net loss of $17.3 million for Q4 2025, compared to a net loss of $2.1 million in Q4 2024, and a full-year net loss of $61.7 million for 2025 versus net income of $187.6 million in 2024.

- Adjusted EBITDA for Q4 2025 was $28.5 million, down from $53.2 million in Q4 2024; full-year Adjusted EBITDA was $121.9 million, a significant decrease from $407.8 million in 2024.

- Coal revenues for Q4 2025 were $519.1 million, with Met segment coal sales realization at $115.31 per ton and cost of coal sales at $101.43 per ton.

- The company had total liquidity of $524.3 million as of December 31, 2025, including $366.0 million in cash and cash equivalents.

- As of February 20, 2026, Alpha repurchased approximately 6.9 million shares for about $1.1 billion under its $1.5 billion share repurchase program.

13 hours ago

Alpha Metallurgical Resources Announces Preliminary Q4 2025 Results

AMR

Earnings

Share Buyback

Demand Weakening

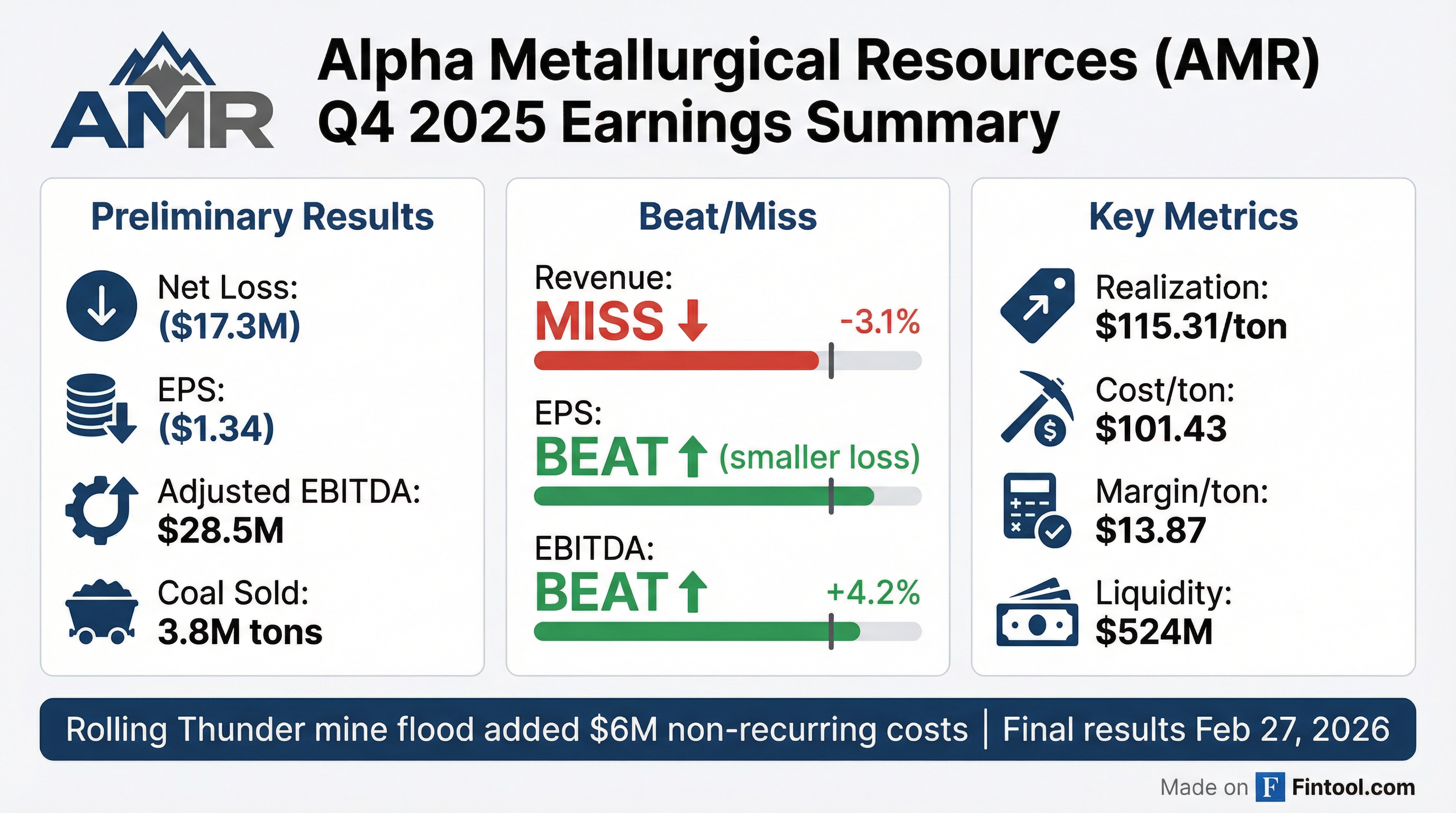

- Alpha Metallurgical Resources, Inc. reported preliminary, unaudited Q4 2025 results including a net loss of $17.3 million and net loss per diluted share of $1.34.

- Adjusted EBITDA for Q4 2025 was $28.5 million , reflecting a challenging met coal market environment that persisted through most of 2025.

- The Met Segment sold 3.8 million tons of coal in Q4 2025, with a net realized pricing of $115.31 per ton.

- As of December 31, 2025, the company maintained total liquidity of $524.3 million, including $366.0 million in cash and cash equivalents.

- The company repurchased approximately 113,000 shares for $20 million during Q4 2025, contributing to a total of 6.9 million shares acquired for $1.1 billion under its share repurchase program.

Jan 30, 2026, 1:03 PM

Alpha Metallurgical Resources Announces Preliminary Q4 2025 Results

AMR

Earnings

Share Buyback

Demand Weakening

- Alpha Metallurgical Resources reported preliminary, unaudited financial results for the fourth quarter ended December 31, 2025, including a net loss of $17.3 million and Adjusted EBITDA of $28.5 million.

- For Q4 2025, the company sold 3.8 million tons of coal, with the Met Segment achieving a non-GAAP coal sales realization of $115.31 per ton and non-GAAP cost of coal sales of $101.43 per ton.

- As of December 31, 2025, Alpha had total liquidity of $524.3 million, including $366.0 million in cash and cash equivalents, and total long-term debt of $13.4 million.

- During Q4 2025, the company repurchased approximately 113,000 shares for $20 million, contributing to a total of approximately 6.9 million shares acquired for $1.1 billion since the share repurchase program began.

- CEO Andy Eidson noted that the preliminary results reflect a challenging met coal market environment throughout most of 2025, with pricing improvements largely impacting Q1 2026, but highlighted strong Q4 cost performance.

Jan 30, 2026, 1:00 PM

Alpha Metallurgical Resources, Inc. Issues 2026 Guidance Expectations

AMR

Guidance Update

New Projects/Investments

Demand Weakening

- Alpha Metallurgical Resources, Inc. (AMR) released its 2026 guidance expectations on December 12, 2025, projecting total sales volumes between 15.1 million and 16.5 million tons, comprising 14.4 million to 15.4 million metallurgical tons and 0.7 million to 1.1 million tons of incidental thermal coal.

- The company anticipates cost of coal sales for 2026 to range from $95.00 to $101.00 per ton.

- Capital expenditures are forecast to be between $148 million and $168 million in 2026, which includes development capital for the Kingston Wildcat mine.

- Other key financial expectations for 2026 include SG&A costs between $53 million and $59 million and depreciation, depletion and amortization (DD&A) between $160 million and $174 million.

Dec 12, 2025, 9:17 PM

Quarterly earnings call transcripts for Alpha Metallurgical Resources.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more