Earnings summaries and quarterly performance for Amrize.

Research analysts who have asked questions during Amrize earnings calls.

Pujarini Ghosh

AB Bernstein

5 questions for AMRZ

Tom Zhang

Barclays Capital

5 questions for AMRZ

Yassine Touahri

On Field Investment Research

5 questions for AMRZ

Adrian Huerta

JPMorgan Chase & Co.

4 questions for AMRZ

Arnaud Lehmann

Bank of America

4 questions for AMRZ

Keith Hughes

Truist Financial Corporation

4 questions for AMRZ

Cedar Ekblom

Morgan Stanley

3 questions for AMRZ

Antony Pesimari

Cementir Holding

2 questions for AMRZ

Bryan Blair

Oppenheimer

2 questions for AMRZ

Carlos Caburrasi

Kepler Cheuvreux

2 questions for AMRZ

Glynis Johnson

Jefferies

2 questions for AMRZ

Julian Radlinger

UBS

2 questions for AMRZ

Julia Radlinger

UBS Group AG

2 questions for AMRZ

Martin Hüsler

Zürcher Kantonalbank

2 questions for AMRZ

Timna Tanners

Wolfe Research

2 questions for AMRZ

Trey Grooms

Stephens Inc.

2 questions for AMRZ

Will Jones

Keefe, Bruyette & Woods (KBW)

2 questions for AMRZ

Asher Sohnen

Citigroup

1 question for AMRZ

Asher Stone

Citigroup Inc.

1 question for AMRZ

Elodie Rall

JPMorgan Chase & Co.

1 question for AMRZ

Ephrem Ravi

Citigroup

1 question for AMRZ

Harry Dow

Rothschild & Co Redburn

1 question for AMRZ

John Bell

Deutsche Bank

1 question for AMRZ

Luis Prieto

Kepler Cheuvreux

1 question for AMRZ

Marcus Cole

UBS Group

1 question for AMRZ

Martin Hüsler

ZKB

1 question for AMRZ

Paul Roger

BNP Paribas

1 question for AMRZ

Recent press releases and 8-K filings for AMRZ.

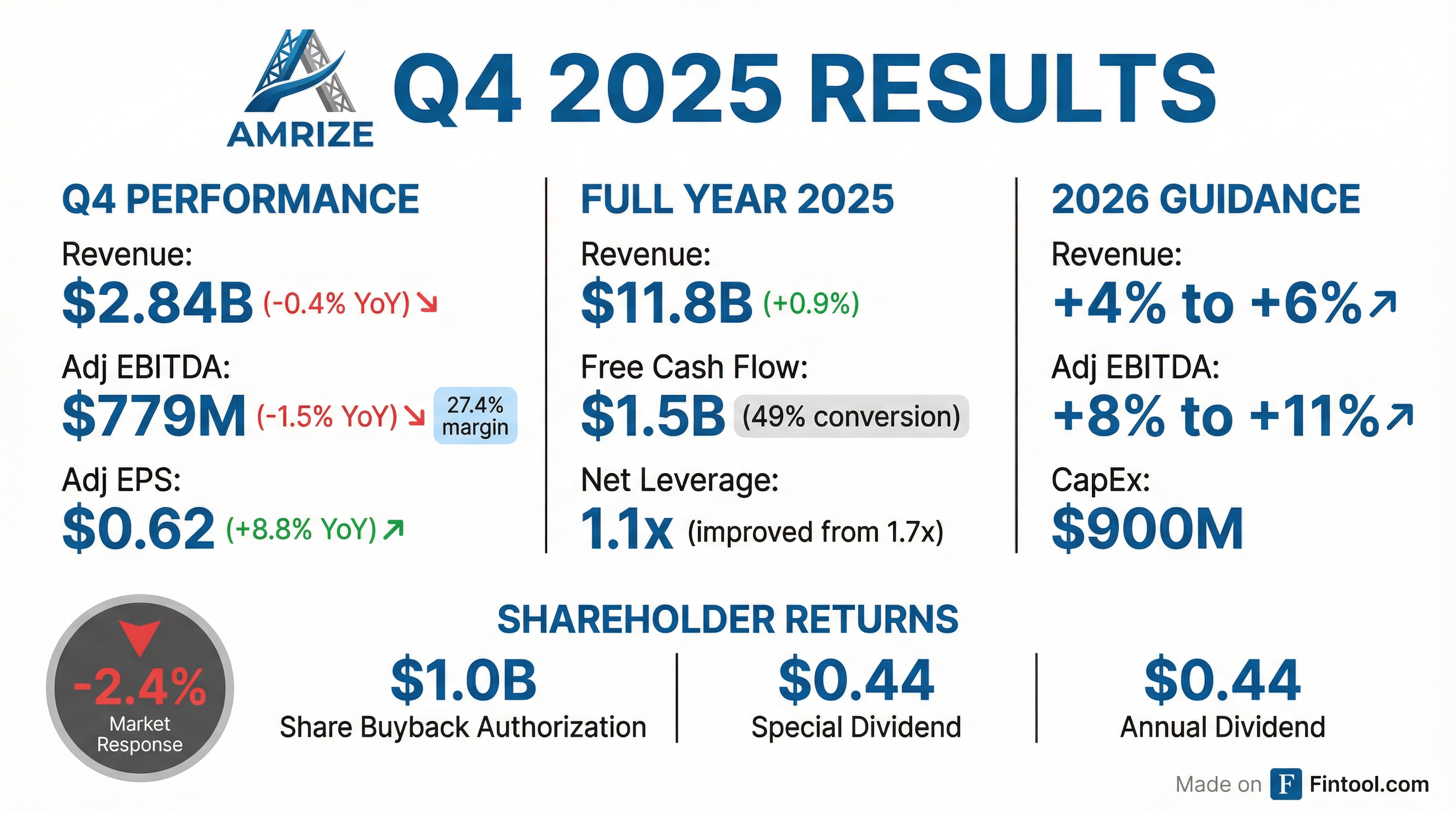

- Amrize reported full-year 2025 revenues of $11.8 billion, an increase of 0.9%, and adjusted EBITDA of $3 billion, with a net leverage ratio of 1.1x.

- For 2026, the company provided guidance for revenue growth of 4%-6% and adjusted EBITDA growth of 8%-11%, anticipating accelerating customer demand.

- The board approved a $1 billion share repurchase program and proposed a special one-time dividend of $0.44 per share, along with an annual ordinary dividend of $0.44 per share.

- Strategic initiatives include increasing investments to $900 million in 2026, the acquisition of PB Materials (expected to add over $180 million in annual revenue), and the Aspire program targeting 70 basis points of margin expansion in 2026.

- For the full year 2025, Amrize increased revenues by 0.9% to $11.8 billion, generated $3 billion in adjusted EBITDA, and produced $1.5 billion in cash flow. The company ended the year with a net leverage ratio of 1.1 times.

- Amrize has set its 2026 guidance, reflecting accelerating customer demand and profitable growth, including 4%-6% growth in revenues and 8%-11% growth in Adjusted EBITDA.

- The company announced a $1 billion share repurchase program and proposed a special one-time dividend of $0.44 per share, along with an annual ordinary dividend of $0.44 per share.

- Amrize plans to increase investments to $900 million in 2026 and expects the acquisition of PB Materials, which adds over $180 million in annual revenue, to close in the first quarter of 2026. The Aspire program is targeting 70 basis points of margin expansion in 2026.

- Amrize reported full-year 2025 revenues of $11.8 billion, a 0.9% increase, with $3 billion in adjusted EBITDA and $1.5 billion in cash flow, ending the year with a net leverage ratio of 1.1 times.

- For Q4 2025, total company revenues were slightly lower by 0.4%, but the Building Materials segment saw revenues grow 3.9% and Adjusted EBITDA margins expand by 60 basis points.

- The company issued 2026 guidance, projecting revenue growth of 4%-6% and Adjusted EBITDA growth of 8%-11%, including contributions from the PB Materials acquisition.

- Amrize announced a $1 billion share repurchase program and proposed both a special one-time dividend of $0.44 per share and an annual ordinary dividend of $0.44 per share.

- Strategic initiatives include the acquisition of PB Materials and the Aspire program, which targets 70 basis points of margin expansion in 2026 and $250 million in total synergies by 2028.

- Amrize reported full-year 2025 revenues of $11.8 billion and Adjusted EBITDA of $3.0 billion, delivering Free Cash Flow of $1.5 billion and achieving a Net Leverage Ratio of 1.1x as of December 31, 2025.

- For full-year 2026, the company projects revenues to increase by 4-6% (to $12.29 billion to $12.52 billion) and Adjusted EBITDA to grow by 8-11% (to $3.25 billion to $3.34 billion).

- The Board proposed a shareholder return plan including a $1.0 billion share repurchase authorization and an annual ordinary dividend of $0.44 per share, alongside a special one-time dividend of $0.44 per share.

- Amrize increased CapEx to $788 million in 2025 and plans to further increase it to $900 million in 2026, while also announcing the acquisition of PB Materials to strengthen its aggregates footprint.

- Amrize reported strong revenue growth of 6.6% in Q3 2025, driven by continued infrastructure demand and an improving commercial market.

- The company generated $674 million in free cash flow, an increase of $221 million from the prior year, and reduced net debt to approximately $5 billion, bringing the net leverage ratio to under 1.7x.

- Building Materials revenue increased 8.7%, with 6% cement volume growth and 10.1% aggregates pricing growth, though adjusted EBITDA was impacted by a $50 million temporary equipment outage.

- The Building Envelope segment delivered substantial margin expansion of 190 basis points to an adjusted EBITDA margin of 24.1%, attributed to operational efficiencies and lower raw material costs.

- Amrize raised its revenue guidance for 2025 and confirmed its EBITDA and net leverage ratio targets, with savings from the ASPIRE program expected to begin in Q4.

- Amrize reported strong revenue growth of 6.6% in Q3 2025, driven by continued infrastructure demand and an improving commercial market, with Building Materials revenue increasing 8.7% to $2.8 billion and Building Envelope revenue increasing 0.7% to $901 million.

- The company generated strong free cash flow of $674 million, an increase of $221 million from the prior year, and reduced net debt by $612 million to approximately $5 billion, bringing the net leverage ratio to under 1.7 times.

- Adjusted EBITDA for Building Materials was $902 million with a 32.5% margin, while Building Envelope achieved $217 million with a 24.1% margin, representing a 190 basis points increase due to operational efficiencies and lower raw material costs.

- Amrize is raising its 2025 revenue guidance to a range of $11.7 to $12 billion and confirming its adjusted EBITDA guidance of $2.9 to $3.1 billion, with an expected net leverage ratio below 1.5 times for the full year.

- A temporary equipment outage in the cement network resulted in approximately $50 million of higher costs in Q3, but repairs are complete and plants are operating normally, with some lost production expected to be recovered in Q4.

- Amrize reported Q3 2025 revenue growth of 6.6%, driven by strong performance in its Building Materials segment, which saw an 8.7% increase in revenue, with 6% higher cement volumes and 3.3% higher aggregates volumes.

- The company's Building Envelope segment achieved a 190 basis point increase in Adjusted EBITDA margin, reaching 24.1%, due to operational efficiencies and lower raw material costs.

- A temporary equipment outage in the cement network resulted in approximately $50 million in higher manufacturing and distribution costs during Q3 2025, but the issue has been resolved, and plants are operating normally.

- Amrize raised its full-year 2025 revenue guidance to a range of $11.7 to $12 billion and confirmed its Adjusted EBITDA guidance of $2.9 to $3.1 billion.

- The company generated strong free cash flow of $674 million, an increase of $221 million from the prior year.

- Amrize reported Q3 2025 revenue of $3,675 million, a 6.6% increase year-over-year, and generated Free Cash Flow of $674 million, up $221 million from Q3 2024.

- Segment performance was mixed, with Building Materials revenue growing 8.7% but Adjusted EBITDA impacted by a $50 million temporary cement network equipment outage, while Building Envelope Adjusted EBITDA increased 9.0% with 190 basis points of margin expansion.

- The company raised its 2025 Revenue guidance to $11.7 billion - $12.0 billion and confirmed its Adjusted EBITDA guidance of $2.9 billion - $3.1 billion and Net Leverage Ratio guidance of under 1.5x by year-end 2025.

- Amrize improved its financial position, reducing Net Debt to $4,985 million and its Net Leverage Ratio to 1.7x at the end of Q3 2025.

- Amrize completed its 100% spin-off from Holcim and began trading as an independent, publicly traded company on the NYSE and SIX Swiss Exchange under the ticker symbol "AMRZ" on June 23, 2025.

- In 2024, Amrize generated $11.7 billion in revenue, $3.2 billion in Adjusted EBITDA, and $1.7 billion in Free Cash Flow.

- The company aims to be the partner of choice for North America's professional builders, operating with over 1,000 sites and 19,000 teammates across the U.S. and Canada.

- Amrize entered into several definitive agreements with Holcim on June 20, 2025, to govern their relationship post-spin-off, including a Separation and Distribution Agreement and a Tax Matters Agreement.

- Amrize Ltd and Holcim Finance US LLC completed previously announced exchange offers for certain debt securities on June 18, 2025.

- The exchange involved six series of notes, with aggregate principal amounts tendered ranging from $50,000,000 for the 4.200% Guaranteed Notes due 2033 (100.00% tendered) to $553,505,000 for the 4.750% Guaranteed Notes due 2046 (93.81% tendered).

- New notes were issued in exchange for the tendered original notes, and these new notes are fully and unconditionally guaranteed by Amrize Ltd.

Quarterly earnings call transcripts for Amrize.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more