Earnings summaries and quarterly performance for Apellis Pharmaceuticals.

Executive leadership at Apellis Pharmaceuticals.

Cedric Francois

Chief Executive Officer

Caroline Baumal

Chief Medical Officer

David Acheson

Executive Vice President, Commercial

David Watson

General Counsel and Secretary

Jim Chopas

Vice President, Corporate Controller and Chief Accounting Officer

Mark DeLong

Chief Business & Strategy Officer

Nur Nicholson

Chief Technical Operations Officer

Pascal Deschatelets

Chief Scientific Officer

Timothy Sullivan

Chief Financial Officer and Treasurer

Board of directors at Apellis Pharmaceuticals.

Research analysts who have asked questions during Apellis Pharmaceuticals earnings calls.

Anupam Rama

JPMorgan Chase & Co.

9 questions for APLS

Douglas Tsao

H.C. Wainwright & Co.

9 questions for APLS

Jonathan Miller

Evercore ISI

9 questions for APLS

Lachlan Hanbury-Brown

William Blair & Company

9 questions for APLS

Yigal Nochomovitz

Citigroup Inc.

9 questions for APLS

Annabel Samimy

Stifel Financial Corp.

7 questions for APLS

Colleen Kusy

Robert W. Baird & Co.

7 questions for APLS

Judah Frommer

Morgan Stanley

7 questions for APLS

Biren Amin

Piper Sandler Companies

6 questions for APLS

Graig Suvannavejh

Mizuho Securities

6 questions for APLS

Lisa Walter

RBC Capital Markets

6 questions for APLS

Ryan Deschner

Raymond James Financial

6 questions for APLS

Timur Ivannikov

Raymond James

6 questions for APLS

Derek Archila

Wells Fargo

5 questions for APLS

Philip Nadeau

TD Cowen

5 questions for APLS

Salveen Richter

Goldman Sachs

5 questions for APLS

Tazeen Ahmad

Bank of America

5 questions for APLS

Divya Rao

TD Cowen

4 questions for APLS

Joe Thomas

Scotiabank

4 questions for APLS

Katherine Wang

Jefferies

4 questions for APLS

Shrunatra Mishra

Goldman Sachs

4 questions for APLS

Simone Nasroodin

Wells Fargo

4 questions for APLS

Eliana Merle

UBS

3 questions for APLS

Ellie Merrill

Barclays

2 questions for APLS

Jasmine Fels

UBS

2 questions for APLS

Jayed Momin

Stifel Financial Corp.

2 questions for APLS

Akash Tewari

Jefferies

1 question for APLS

Anthony

Raymond James

1 question for APLS

Colin Kosse

Robert W. Baird & Co.

1 question for APLS

Do Kim

Piper Sandler & Co.

1 question for APLS

Doug Kim

Mizuho Securities

1 question for APLS

Greg Harrison

RBC Capital Markets

1 question for APLS

Gregory Harrison

Scotiabank

1 question for APLS

Joseph Stringer

Needham & Company

1 question for APLS

Laura Chico

Wedbush Securities

1 question for APLS

Nicholas Econom

Raymond James

1 question for APLS

Steven Seedhouse

Raymond James

1 question for APLS

Recent press releases and 8-K filings for APLS.

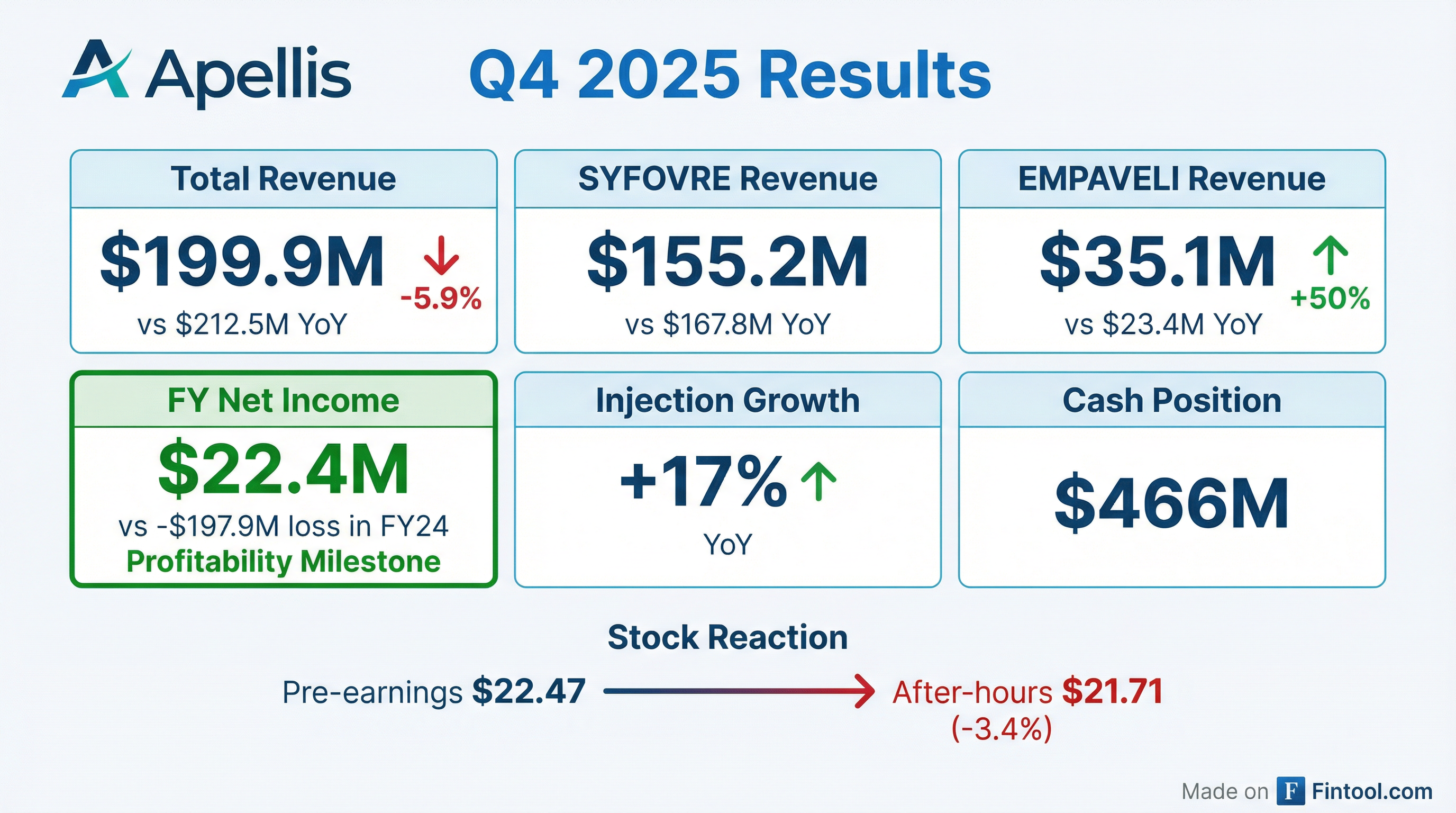

- Apellis Pharmaceuticals reported total revenue of $199.9 million for Q4 2025 and $1,003.8 million for the full year 2025, with a net loss of $58.9 million in Q4 2025 and net income of $22.4 million for the full year 2025.

- SYFOVRE U.S. net product revenue was $155.2 million in Q4 2025 and $586.9 million for FY 2025, with total injections increasing 17% year-over-year. A regulatory submission for a best-in-class prefilled syringe is planned for 1H 2026.

- EMPAVELI U.S. net product revenue reached $35.1 million in Q4 2025 and $102.4 million for FY 2025, supported by 267 cumulative patient start forms as of December 31, 2025, and over 5% penetration into the U.S. patient market. Pivotal studies are underway for new indications in FSGS and DGF.

- The company anticipates its cash, cash equivalents, and projected product revenues will be sufficient to fund the business to profitability.

- Apellis Pharmaceuticals reported Q4 2025 total revenue of $200 million and full-year 2025 total revenue of $1 billion. Syfovre net product revenue was $155 million for Q4 and $587 million for the full year, while Empaveli U.S. net product revenue was $35 million for Q4 and $102 million for the full year.

- Syfovre maintained 60% market share and saw total injections grow approximately 17% year-over-year in 2025, with initiatives like a prefilled syringe and OCTF planned to support broader growth in 2027.

- Empaveli achieved more than 5% market penetration after its first full quarter post-launch for C3G and primary IC-MPGN, with 267 cumulative patient start forms by year-end 2025, and is considered on a clear path to blockbuster status.

- The company ended 2025 with $466 million in cash and cash equivalents and is advancing its pipeline with pivotal trials for Empaveli in focal segmental glomerulosclerosis (FSGS) and delayed graft function (DGF), as well as expecting to submit an IND for its first-in-class FcRn program, APL-9099, in the second half of 2026.

- Apellis Pharmaceuticals reported total revenue of $200 million for Q4 2025 and $1 billion for the full year 2025, with Syfovre net product revenue at $155 million for Q4 2025 and $587 million for the full year 2025.

- Empaveli generated $35 million in U.S. net product revenue for Q4 2025 and $102 million for the full year 2025, achieving over 5% market penetration after its first full quarter post-launch and is considered on a clear path to blockbuster status.

- The company ended 2025 with $466 million in cash and cash equivalents and anticipates modestly higher operating expenses in 2026 due to new pivotal trials, while aiming to self-fund its pipeline to profitability.

- Pipeline advancements include ongoing pivotal trials for Empaveli in FSGS and DGF and an expected IND submission for the APL-9099 FcRn program in the second half of 2026.

- Apellis Pharmaceuticals reported total revenue of $1 billion for the full year 2025, which included a $275 million upfront payment from a royalty repurchase agreement, and $200 million for Q4 2025.

- Syfovre generated $587 million in net product revenue for FY 2025 and $155 million for Q4 2025, with total injections growing approximately 17% year-over-year in 2025, and is expected to be a stable revenue stream through 2026.

- Empaveli achieved $102 million in U.S. net product revenue for FY 2025 and $35 million for Q4 2025, demonstrating strong early adoption with over 5% market penetration after its first full quarter post-launch, and is on a clear path to blockbuster status.

- The company ended 2025 with $466 million in cash and cash equivalents, expects modestly higher operating expenses in 2026 due to pipeline investments, and aims to fund the business to profitability.

- Apellis Pharmaceuticals reported full-year 2025 net product revenues of $689 million, with SYFOVRE contributing $587 million and EMPAVELI $102 million.

- Total revenue for full year 2025 reached $1.0 billion, compared to $781.4 million in 2024, resulting in net income of $22.4 million for the full year 2025, a significant improvement from a net loss of $197.9 million in 2024.

- As of December 31, 2025, the company held $466.2 million in cash and cash equivalents, and anticipates these funds, combined with projected revenues, will be sufficient to fund operations to profitability.

- Key business highlights include a planned regulatory submission for SYFOVRE's prefilled syringe in the first half of 2026 and ongoing pivotal trials for EMPAVELI in FSGS and DGF.

- Apellis Pharmaceuticals reported preliminary full-year 2025 U.S. net product revenues of $689 million, with SYFOVRE contributing $587 million and EMPAVELI $102 million.

- As of December 31, 2025, the company held approximately $466 million in cash and cash equivalents, and expects these resources, combined with projected revenues, to fund operations to profitability.

- SYFOVRE maintained its market leadership in geographic atrophy with approximately 60% total market share in Q4 2025 and saw a 17% year-over-year growth in total injection demand.

- EMPAVELI achieved 267 new patient start forms in 2025, reaching over 5% market penetration in C3G and primary IC-MPGN post-launch, and initiated pivotal trials for two new nephrology indications.

- Apellis, a self-funded company, reported that SYFOVRE for geographic atrophy maintains approximately 60% market share with 17% year-over-year injection growth, anticipating renewed growth in 2027 driven by a prefilled syringe (filing in H1 2026) and new functional imaging capabilities.

- The launch of EMPAVELI for C3G and IC-MPGN has achieved over 5% penetration after its first full quarter, with 267 patient start forms, supported by strong efficacy and a safety profile showing zero cases of encapsulated meningococcal infection over 3,000 patient years of dosing.

- Apellis is advancing its pipeline, including APL-3007 for retina with data expected in 2027, Phase III trials for EMPAVELI in FSGS and Delayed Graft Function, and APL-9099, a gene-editing program targeting the FcRn market with an IND planned for H2 2026.

- Apellis reported estimated FY 2025 net product revenue of ~$689 million and ~$190 million for Q4 2025, with ~$466 million in cash as of year-end 2025.

- SYFOVRE maintained its market leadership in Geographic Atrophy (GA), achieving estimated ~$587 million in 2025 U.S. net product revenue and announcing 5-year GALE data.

- EMPAVELI secured FDA approval for C3G and primary IC-MPGN, generating estimated ~$102 million in FY 2025 U.S. net product revenue, and initiated pivotal trials for FSGS and DGF.

- The company is advancing its pipeline, including a Phase 2 clinical trial for SYFOVRE + APL-3007 for GA and planning an IND submission for APL-9099 in the second half of 2026.

- Apellis anticipates that existing cash and projected revenues will fund operations to profitability.

- Apellis maintains market leadership in geographic atrophy with Syfovre, holding approximately 60% of the market share and reporting 17% year-over-year injection growth. The company expects renewed growth for Syfovre in 2027, driven by the planned H1 2026 filing of a prefilled syringe and new functional imaging capabilities.

- Empaveli, approved for C3G and primary IC-MPGN, is described as one of the best launches in rare disease nephrology, achieving over 5% penetration after its first full quarter in a U.S. market of approximately 5,000 patients.

- The company is expanding Empaveli's potential with two ongoing Phase III clinical trials for focal segmental glomerulosclerosis (FSGS) and delayed graft function, which could access an additional 30,000 patients.

- Apellis's pipeline includes the APL-9099 gene-editing program, with an Investigational New Drug (IND) application planned for H2 2026, aiming to disrupt the $20 billion FCRN market.

- Apellis Pharmaceuticals is self-funded and maintains market leadership in geographic atrophy with Syfovre, holding approximately 60% market share and achieving 17% year-over-year injection growth.

- Future growth for Syfovre is anticipated in 2027, primarily driven by the planned launch of a prefilled syringe (filing in H1 2026) and advancements in imaging functional benefits.

- The launch of Empaveli for C3G and IC-MPGN shows strong initial traction, with over 5% penetration and 267 patient start forms after its first full quarter, supported by an "exquisite safety profile".

- Apellis is expanding Empaveli's reach with ongoing Phase III trials in FSGS and delayed graft function, potentially adding 30,000 patients.

- The company's pipeline includes the APL-9099 gene-editing program (IND planned for H2 2026) and the 3007 program for retina, with data expected in 2027.

Quarterly earnings call transcripts for Apellis Pharmaceuticals.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more