Earnings summaries and quarterly performance for ACCURAY.

Executive leadership at ACCURAY.

Board of directors at ACCURAY.

Research analysts who have asked questions during ACCURAY earnings calls.

Marie Thibault

BTIG

6 questions for ARAY

Also covers: ABT, ATRC, BSX +15 more

BO

Brooks O'Neil

Lake Street Capital Markets

3 questions for ARAY

Also covers: ATEC, BBNX, DYNT +11 more

YL

Young Li

Jefferies

3 questions for ARAY

Also covers: ALC, ATEC, BLCO +8 more

JW

Jason Wittes

Roth Capital Partners, LLC

2 questions for ARAY

Also covers: ALUR, ATEC, CV +13 more

Recent press releases and 8-K filings for ARAY.

Accuray Announces Q2 FY26 Results and Revised FY26 Guidance

ARAY

Earnings

Guidance Update

Demand Weakening

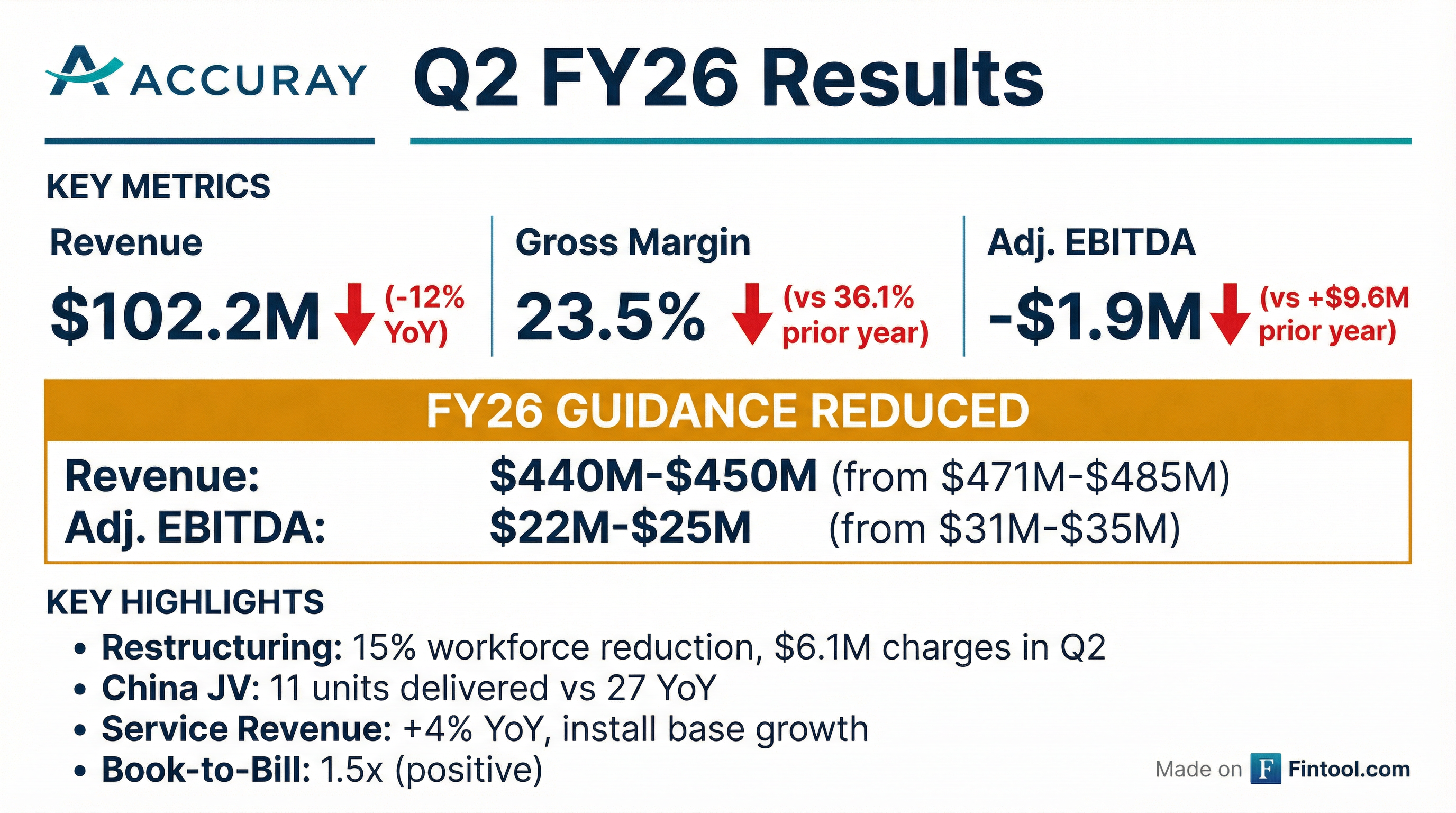

- Accuray reported Q2 FY26 revenues of $102.2 million, marking a 12% decrease year-over-year, with product revenue down 26% and service revenue up 4%.

- Adjusted EBITDA for Q2 FY26 was ($1.9 million), a 120% decrease year-over-year, and ($6.0 million) for the first half of FY26, a 147% decrease.

- The company revised its full-year FY26 guidance, lowering revenue expectations to $440 million - $450 million (from $471 million - $485 million) and Adjusted EBITDA to $22 million - $25 million (from $31 million - $35 million).

- Gross Margin for Q2 FY26 decreased by 43% year-over-year to $24.1 million, partly attributed to a tough comparison with the China JV, which delivered fewer systems compared to the prior year.

2 days ago

Accuray Reports Q2 2026 Results and Revises Full-Year Guidance

ARAY

Earnings

Guidance Update

Layoffs

- Accuray reported Q2 FY2026 net revenue of $102.2 million, a 12% decrease year-over-year, with an adjusted EBITDA loss of $1.9 million.

- The company lowered its fiscal year 2026 revenue guidance to a range of $440 million-$450 million (from $471 million-$485 million) and adjusted EBITDA guidance to $22 million-$25 million (from $31 million-$35 million), citing continued volatility in China and persistent tariff structures.

- Product gross margins significantly declined to 19.7% in Q2 FY2026, down from 43.5% in the prior year, mainly due to lower China margin releases, higher tariffs, and product mix.

- Accuray is executing a transformation plan targeting a $25 million improvement in annualized operating profitability, which includes a 15% workforce reduction and resulted in $6.1 million in restructuring charges in Q2.

2 days ago

Accuray Reports Q2 FY 2026 Results and Revises Full-Year Guidance

ARAY

Earnings

Guidance Update

Demand Weakening

- Accuray reported Q2 FY 2026 net revenue of $102.2 million, a 12% decrease year-over-year, primarily due to a 26% decline in product revenue from lower sales in China, while service revenue grew 4%.

- For Q2 FY 2026, the company recorded an Adjusted EBITDA loss of $1.9 million and an overall gross margin of 23.5%, compared to a positive $9.6 million Adjusted EBITDA and 36.1% gross margin in the prior year.

- Accuray revised its fiscal year 2026 guidance, lowering revenue expectations to $440-$450 million (from $471-$485 million) and Adjusted EBITDA to $22-$25 million (from $31-$35 million), attributing the change to continued volatility in China and persistent tariffs.

- The company is executing a strategic, operational, and organizational transformation plan that includes a 15% workforce reduction and aims for an approximately $25 million improvement in annualized operating profitability, with $10 million in restructuring charges expected across Q2, Q3, and Q4 of fiscal year 2026.

2 days ago

Accuray Reports Q2 FY2026 Results and Lowers Full-Year Guidance

ARAY

Earnings

Guidance Update

Demand Weakening

- Accuray reported net revenue of $102.2 million for Q2 FY2026, a 12% decrease year-over-year, and an Adjusted EBITDA loss of $1.9 million.

- The company revised its fiscal year 2026 guidance, lowering revenue to a range of $440-$450 million (from $471-$485 million) and Adjusted EBITDA to $22-$25 million (from $31-$35 million).

- This revision and Q2 performance were primarily attributed to continued volatility in China, persistent tariff structures, and an unstable geopolitical environment, impacting demand patterns and commercial activity.

- Accuray is implementing a transformation plan targeting an approximately $25 million improvement in annualized operating profitability, including a 15% workforce reduction, and expects $12 million of benefit in fiscal 2026.

- The company recognized $6.1 million in one-time restructuring expenses in Q2 FY2026 and anticipates $10 million in total restructuring charges across Q2, Q3, and Q4.

2 days ago

Accuray Reports Q2 Fiscal 2026 Financial Results and Updates FY2026 Guidance

ARAY

Earnings

Guidance Update

Layoffs

- Accuray reported a net loss of $13.8 million, or a diluted net loss of $0.11 per share, for the second quarter of fiscal 2026, compared to a net income of $2.5 million, or $0.02 per share, in the prior fiscal year second quarter.

- Total net revenue for Q2 fiscal 2026 decreased by 12% to $102.2 million from $116.2 million in the prior fiscal year second quarter, and Adjusted EBITDA was negative $1.9 million compared to a positive $9.6 million.

- The company initiated a restructuring plan in Q2 fiscal 2026, recording $6.1 million in charges, which is part of an expected total of approximately $13 million for fiscal year 2026, with the goal of improving annualized operating profitability by approximately $25 million.

- Accuray updated its fiscal year 2026 guidance, expecting total net revenue in the range of $440 million to $450 million and Adjusted EBITDA between $22 million and $25 million.

2 days ago

Accuray Reports Fiscal Q2 2026 Results and Updates FY2026 Guidance

ARAY

Earnings

Guidance Update

Layoffs

- Accuray reported a 12% decrease in total net revenue to $102.2 million for the second quarter of fiscal 2026, resulting in a net loss of $13.8 million or $0.11 per diluted share, compared to net income in the prior year period.

- The company initiated a strategic transformational plan, incurring $6.1 million in restructuring charges in Q2 FY2026, with total expected charges of approximately $13 million for fiscal year 2026. This plan includes workforce optimization affecting approximately 15% of employees and aims to improve annualized operating profitability by approximately $25 million.

- Accuray updated its fiscal year 2026 guidance, projecting total net revenue in the range of $440 million to $450 million and Adjusted EBITDA between $22 million and $25 million.

2 days ago

Accuray Announces First Phase of Transformation Plan

ARAY

Layoffs

Guidance Update

New Projects/Investments

- Accuray announced the first phase of a comprehensive strategic, operational, and organizational transformation plan.

- This phase is expected to improve operating profitability by approximately $25 million on an annualized, run-rate basis, with approximately $12 million anticipated to be realized in fiscal 2026.

- The plan includes organizational realignment, rightsizing the cost structure, and outsourcing, which will result in a 15% reduction in global headcount.

- Accuray expects to incur approximately $11 million in restructuring charges in its fiscal second, third, and fourth quarters related to these actions.

- The company confirmed it is maintaining its forecasts for full year fiscal 2026.

Dec 15, 2025, 10:00 PM

Accuray Reports Q1 FY2026 Results, Reiterates Guidance, and Introduces Transformation Plan

ARAY

Earnings

Guidance Update

CEO Change

- Accuray reported Q1 FY2026 net revenue of $94 million, a 7% decrease year-over-year, with product revenue down 23% to $37 million and service revenue up 7% to $57 million.

- The company recorded an Adjusted EBITDA loss of $4.1 million for Q1 FY2026, compared to an income of $3.1 million in the prior year, primarily due to product gross margin challenges.

- Accuray reiterated its fiscal year 2026 guidance, projecting revenue between $471 million and $485 million and adjusted EBITDA between $31 million and $35 million, while expecting a 40% first-half and 60% second-half revenue split.

- New CEO Steve Leneve, on his first earnings call, introduced a transformation plan targeting a high single-digit adjusted EBITDA margin as a percentage of revenue within twelve months and double-digit over the medium to long term.

Nov 5, 2025, 9:30 PM

Accuray Reports Q1 FY26 Results and Reaffirms FY26 Guidance

ARAY

Earnings

Guidance Update

Product Launch

- For Q1 FY26, Accuray reported revenues of $93.9 million, a 7% year-over-year decrease, driven by a 23% decrease in product revenue to $37.1 million, while service revenue grew by 7% to $56.8 million.

- The company's Adjusted EBITDA for Q1 FY26 was ($4.1) million, a 231% year-over-year decrease, with a reported gross margin of 28.3%.

- Accuray launched the Accuray Stellar™ Solution at ASTRO and saw a sequential increase in cash to $69.9 million (inclusive of $6.6 million of restricted cash).

- Accuray maintained its FY26 guidance, projecting revenue between $471 million and $485 million and Adjusted EBITDA between $31 million and $35 million.

Nov 5, 2025, 9:30 PM

Accuray Reports Q1 2026 Results, New CEO Outlines Transformation Plan

ARAY

Earnings

CEO Change

Demand Weakening

- Accuray reported net revenue of $94 million for the first quarter of fiscal year 2026, a 7% decrease year-over-year, with product revenue down 23% to $37 million and service revenue up 7% to $57 million.

- The company recorded an adjusted EBITDA loss of $4.1 million for the quarter, largely attributed to product gross margin challenges.

- Steven Lenehan was introduced as the new President and CEO, outlining a transformation plan aimed at achieving a high single-digit adjusted EBITDA margin within 12 months and double digits over the medium to long term.

- Accuray reiterated its fiscal year 2026 guidance, projecting revenue in the range of $471 million to $485 million and adjusted EBITDA between $31 million and $35 million, while expecting first-half revenue to be approximately 40% of the full-year guidance due to product demand shifting to the second half.

Nov 5, 2025, 9:30 PM

Quarterly earnings call transcripts for ACCURAY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more