Earnings summaries and quarterly performance for A10 Networks.

Executive leadership at A10 Networks.

Board of directors at A10 Networks.

Research analysts who have asked questions during A10 Networks earnings calls.

Hamed Khorsand

BWS Financial

5 questions for ATEN

Christian Schwab

Craig-Hallum Capital Group

4 questions for ATEN

Gray Powell

BTIG

4 questions for ATEN

Anja Soderstrom

Sidoti & Company, LLC

2 questions for ATEN

Hendi Susanto

Gabelli Funds

2 questions for ATEN

Michael Romanelli

Mizuho Securities

2 questions for ATEN

Anya Soderstrom

Sidoti & Company LLC

1 question for ATEN

Simon Leopold

Raymond James

1 question for ATEN

Trevor Rambo

BTIG

1 question for ATEN

Victor Chiu

Raymond James

1 question for ATEN

Recent press releases and 8-K filings for ATEN.

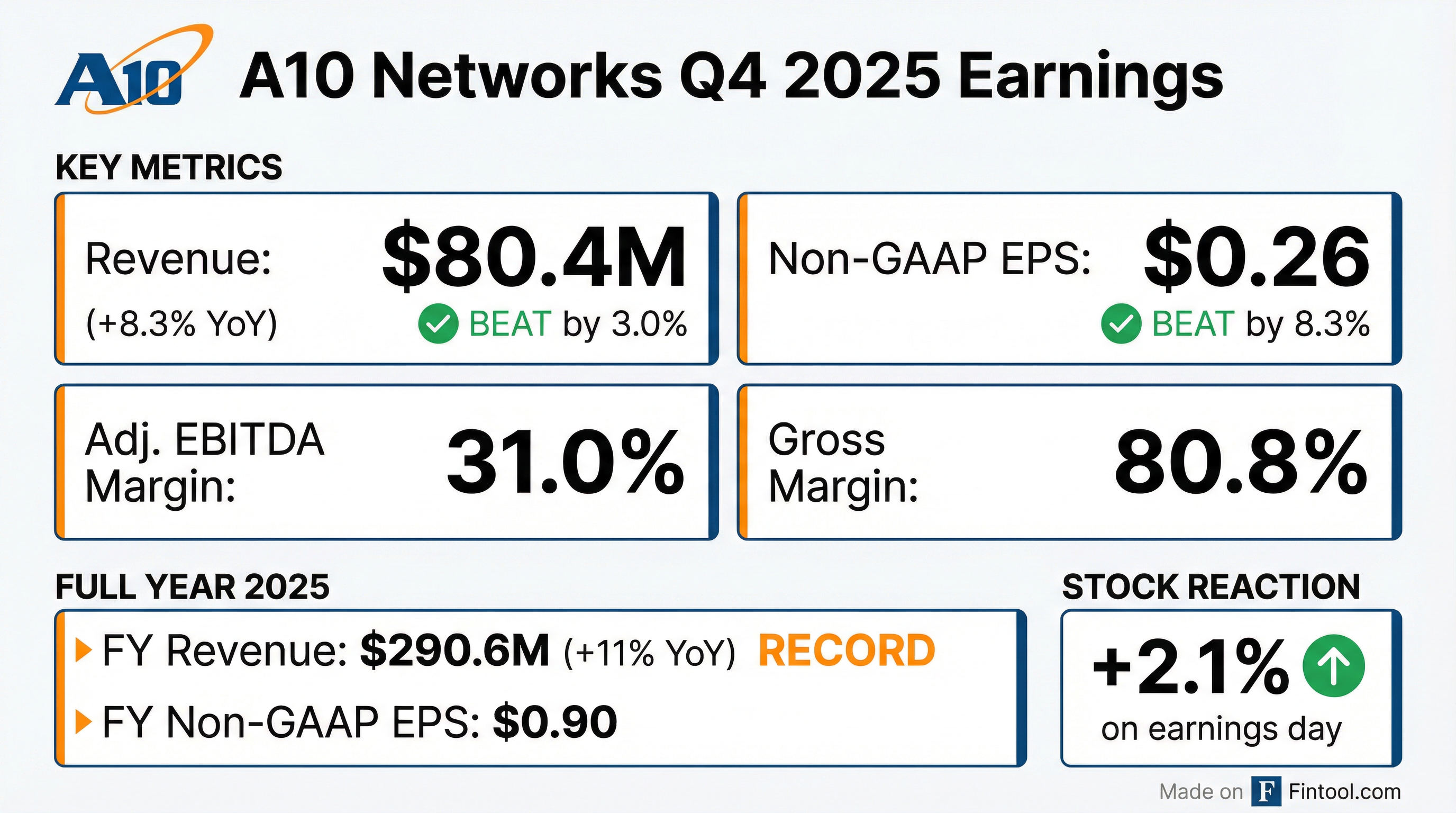

- A10 Networks reported record quarterly revenue of $80.4 million in Q4 2025, marking an 8.3% increase year-over-year.

- For the full year 2025, the company achieved record full-year revenue of $290.6 million, an 11% increase year-over-year.

- Non-GAAP diluted EPS for Q4 2025 was $0.26, with an Adjusted EBITDA margin of 31%.

- Full-year 2025 Non-GAAP diluted EPS was $0.90, and the Adjusted EBITDA margin reached a record 29.7%.

- The company's long-term debt stood at $218.8 million as of December 31, 2025, primarily from $225 million Convertible Senior Notes issued in March 2025.

- A10 Networks reported record quarterly revenue of $80.4 million in Q4 2025, an 8.3% year-over-year increase, and record full-year 2025 revenue of $290.6 million, up 11% year-over-year.

- For the full year 2025, the company achieved record adjusted EBITDA of $86 million, representing 29.6% of revenue.

- Security-led solutions reached their long-term goal, accounting for 65% of total revenue in Q4 2025 and 72% for the full year. Growth was also driven by investments in AI-driven workloads and strong performance in the Americas region, which saw a 30% increase in revenue for the year.

- A10 Networks returned $86.3 million to shareholders in 2025 through $17.4 million in cash dividends and $68.9 million in share repurchases. The board approved a quarterly cash dividend of $0.06 per share to be paid on March 2, 2026.

- For the full year 2026, the company anticipates revenue growth of 10%-12% over 2025 levels, with non-GAAP gross margins of 80%-82%, and EPS growth exceeding the revenue growth rate.

- A10 Networks reported record Q4 2025 revenue of $80.4 million and record full-year 2025 revenue of $290.6 million, marking 11% year-over-year growth.

- Full-year 2025 results included record adjusted EBITDA of $86 million, representing 29.6% of revenue, and non-GAAP EPS of $0.90 per share.

- The company's security-led solutions comprised 72% of total revenue for the full year 2025, with significant growth in the Americas, and continued investment in AI-related solutions.

- For 2026, A10 Networks expects revenue growth of 10%-12% over 2025 levels, with non-GAAP gross margins of 80%-82% and EPS growth exceeding revenue growth.

- In 2025, the company returned $86.3 million to shareholders through $17.4 million in cash dividends and $68.9 million in share repurchases.

- A10 Networks reported record quarterly revenue of $80.4 million for Q4 2025 and record annual revenue of $290.6 million for the full year 2025, representing an 11.0% increase year-over-year.

- For Q4 2025, GAAP net income was $9.9 million ($0.14 per diluted share) and non-GAAP net income was $19.1 million ($0.26 per diluted share). For the full year 2025, GAAP net income was $42.1 million ($0.57 per diluted share) and non-GAAP net income was $66.3 million ($0.90 per diluted share), with record non-GAAP Adjusted EBITDA of $86.0 million.

- The company returned $86.3 million to investors in 2025, including $68.9 million for share repurchases and $17.4 million in cash dividends. As of December 31, 2025, A10 held $377.8 million in cash, cash equivalents, and marketable securities, and had $218.8 million in long-term debt from convertible senior notes issued in March 2025.

- For 2026, management expects full-year revenue growth of 10-12% and EPS growth of 12-14% year-over-year, with non-GAAP gross margin anticipated to be 80-82%.

- A10 Networks reported record full-year 2025 revenue of $290.6 million, an 11.0% increase year-over-year compared to $261.7 million in 2024, and record quarterly revenue of $80.4 million for Q4 2025.

- For full-year 2025, GAAP net income was $42.1 million ($0.57 per diluted share) and non-GAAP net income was $66.3 million ($0.90 per diluted share).

- The company returned $86.3 million to investors in 2025, repurchasing 3.67 million shares for $68.9 million and paying $17.4 million in cash dividends.

- As of December 31, 2025, A10 Networks held $377.8 million in cash, cash equivalents, and marketable securities, an increase from $195.5 million as of December 31, 2024.

- For 2026, management expects full-year revenue growth of 10-12% and EPS growth exceeding revenue growth, representing 12-14% year-over-year.

- A10 Networks reported Q3 2025 revenue of $74.7 million, an increase of 12% year-over-year, driven by 17% product revenue growth and 6% service revenue growth. The company achieved strong profitability with non-GAAP operating margin expanding to 24.7% and Adjusted EBITDA at 29.3% of revenue.

- Growth was significantly influenced by AI-related deployments and the Americas region, which contributed 65% of global revenue in Q3 and increased 25% on a trailing 12-month basis. Security-led revenue also exceeded the long-term target of 65% of total revenue.

- The company expects a full-year growth rate of 10% for 2025 and aims for high single-digit growth (8%-10%) in 2026, targeting EBITDA margins of 26%-28%. Additionally, A10 Networks announced the appointment of Michelle Karan as the new Chief Financial Officer and approved a quarterly cash dividend of $0.06 per share.

- A10 Networks reported Q3 2025 revenue of $74.7 million, representing an 11.9% increase year-over-year.

- The company achieved a Non-GAAP gross margin of 80.7% and Non-GAAP EPS of $0.23 for Q3 2025.

- Adjusted EBITDA for Q3 2025 was $21.9 million.

- As of September 30, 2025, A10 Networks held $370.9 million in cash and marketable securities and had $218.5 million in long-term debt.

- A new Chief Financial Officer (CFO) was announced.

- A10 Networks reported revenue of $74.7 million for the third quarter of 2025, marking an 11.9% increase year-over-year compared to $66.7 million in the third quarter of 2024.

- For Q3 2025, GAAP net income was $12.2 million, or $0.17 per diluted share, while non-GAAP net income was $16.7 million, or $0.23 per diluted share.

- The company returned $15.3 million to investors during the quarter, repurchasing 634,000 shares for $11.0 million and paying $4.3 million in cash dividends. The Board of Directors also approved a quarterly cash dividend of $0.06 per share.

- The CEO noted that AI infrastructure buildouts are key catalysts, with the company's offerings aligning with trends in AI-driven workloads and cybersecurity.

- A10 Networks reported revenue of $74.7 million for the third quarter ended September 30, 2025, marking an 11.9% increase year-over-year compared to $66.7 million in Q3 2024.

- GAAP net income for Q3 2025 was $12.2 million, or $0.17 per diluted share, which is comparable to $12.6 million, or $0.17 per diluted share, in Q3 2024.

- Non-GAAP net income increased to $16.7 million, or $0.23 per diluted share, in Q3 2025, up from $15.9 million, or $0.21 per diluted share, in Q3 2024.

- The company returned $15.3 million to investors during the quarter, including $11.0 million for share repurchases and $4.3 million in cash dividends.

Quarterly earnings call transcripts for A10 Networks.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more