Earnings summaries and quarterly performance for AVNET.

Executive leadership at AVNET.

Board of directors at AVNET.

Research analysts who have asked questions during AVNET earnings calls.

Ruplu Bhattacharya

Bank of America

6 questions for AVT

William Stein

Truist Securities

6 questions for AVT

Joseph Quatrochi

Wells Fargo Securities, LLC

3 questions for AVT

Joe Quattrocchi

Wells Fargo & Company

2 questions for AVT

Jody Burke

Wells Fargo Securities

1 question for AVT

Joe Quatrochi

Wells Fargo

1 question for AVT

Matthew Sheerin

Stifel

1 question for AVT

Melissa Ann Dailey Fairbanks

Raymond James Financial

1 question for AVT

Melissa Dailey Fairbanks

Raymond James Financial, Inc.

1 question for AVT

Toshiya Hari

Goldman Sachs Group, Inc.

1 question for AVT

Wamsi Mohan

Bank of America Merrill Lynch

1 question for AVT

Recent press releases and 8-K filings for AVT.

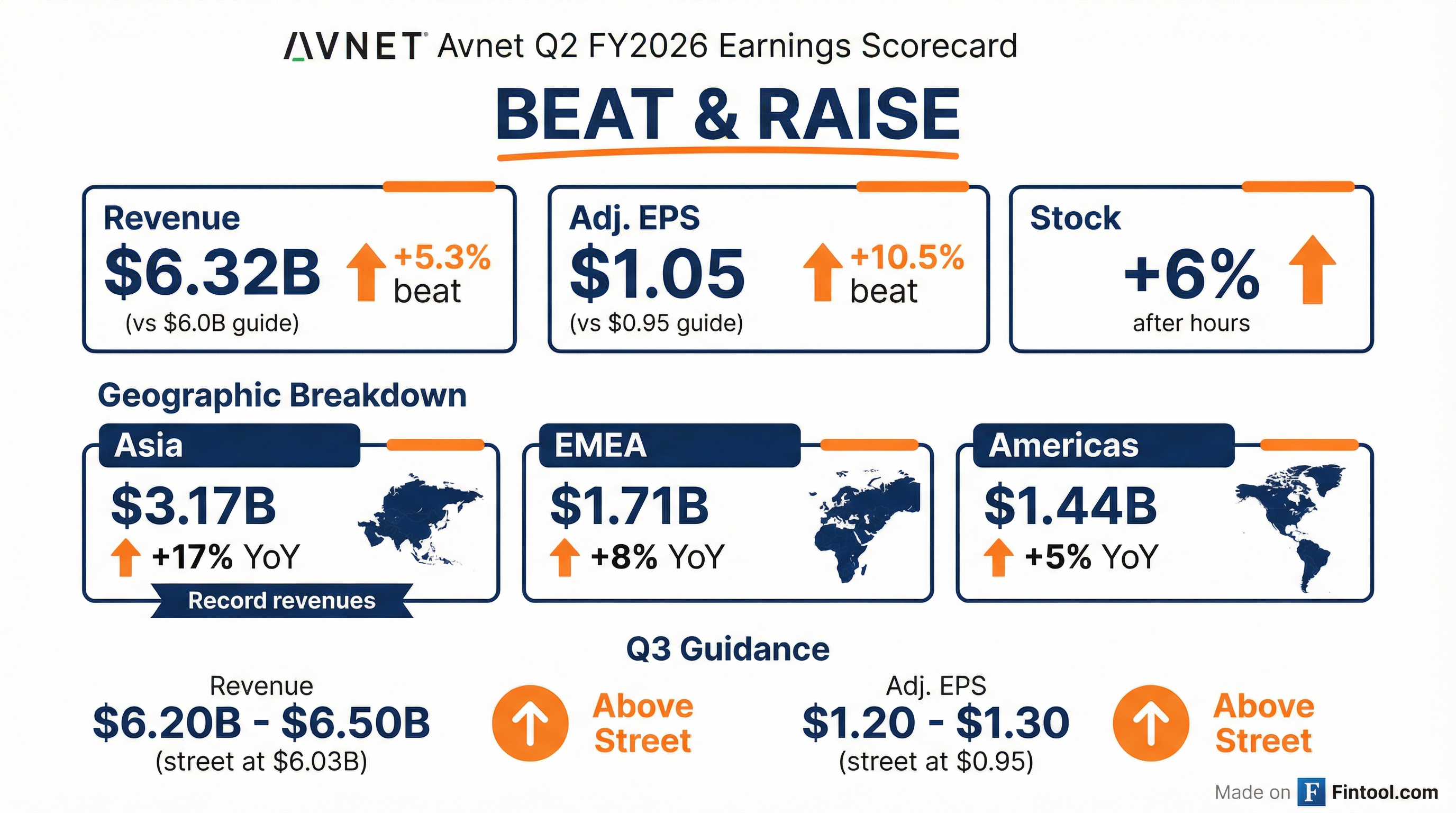

- Avnet reported Q2 FY2026 sales of approximately $6.3 billion, marking a 12% year-over-year and 7% sequential increase, and an adjusted diluted EPS of $1.05, both exceeding the high end of guidance.

- The company's operating margins for the quarter were 3.2% for Electronic Components and 4.7% for Farnell, contributing to a total adjusted operating margin of 2.7%.

- Avnet generated $208 million in cash flow from operations and reduced inventory by $126 million sequentially in Q2 FY2026, ending with 86 days of inventory.

- For Q3 FY2026, Avnet provided guidance for sales in the range of $6.2 billion to $6.5 billion and diluted EPS between $1.20 and $1.30, anticipating continued recovery in higher-margin Western regions.

- Avnet exceeded its Q2 fiscal year 2026 sales and EPS guidance, achieving sales of $6.3 billion and adjusted diluted earnings per share of $1.05.

- The company reported double-digit year-on-year sales growth, driven by record revenues in Asia (over $3 billion) and better than typical seasonal growth in the Americas, Europe, and Farnell.

- Operating margins for the Electronic Components business were 3.2% and for Farnell were 4.7% in Q2 2026.

- Avnet generated over $200 million of cash flow from operations and reduced inventory by $126 million sequentially, ending the quarter with 86 days of inventory.

- For Q3 fiscal year 2026, Avnet is guiding sales in the range of $6.2 billion to $6.5 billion and diluted earnings per share in the range of $1.20 to $1.30.

- Avnet reported Q2 fiscal year 2026 sales of $6.3 billion, a 12% year-over-year increase, and adjusted diluted earnings per share of $1.05, both exceeding the high end of guidance.

- The company generated $208 million of cash flow from operations and reduced inventory by $126 million or 2.3% sequentially, while also decreasing working capital days by 7 days to 88 days.

- Sales growth was driven by record revenues in Asia (over $3 billion) and better than typical seasonal growth in the Americas, Europe, and Farnell, with management observing robust book-to-bills and spot price increases in memory, storage, and controllers.

- For Q3 fiscal year 2026, Avnet projects sales between $6.2 billion and $6.5 billion and diluted earnings per share of $1.20 to $1.30, anticipating further recovery in higher-margin Western regions.

- AVT reported Q2 FY26 revenue of $6.3 billion, representing a 12% increase year-over-year.

- Adjusted diluted EPS for Q2 FY26 was $1.05, which is a 21% increase year-over-year and a 25% increase quarter-over-quarter.

- The company's adjusted operating margin for Q2 FY26 was 2.7%.

- For Q3 FY26, AVT anticipates sales in the range of $6.20 billion to $6.50 billion and adjusted diluted EPS between $1.20 and $1.30.

- Regional demand showed growth in Asia, the Americas, and EMEA year-over-year, and the book-to-bill ratio improved sequentially with all regions above parity.

- Avnet reported sales of $6.3 billion and adjusted diluted EPS of $1.05 for the second quarter ended December 27, 2025, exceeding guidance ranges.

- The company achieved year-over-year sales growth across all regions, including a sixth consecutive quarter of year-over-year sales growth in Asia with record revenues of $3.2 billion.

- Avnet generated $208 million of cash flow from operations and returned $28 million to shareholders in dividends during the quarter.

- For the third quarter of fiscal 2026, Avnet expects sales to be between $6.20 billion and $6.50 billion, with adjusted diluted EPS projected to be between $1.20 and $1.30.

- For the second quarter ended December 27, 2025, Avnet reported sales of $6.3 billion and adjusted diluted earnings per share of $1.05.

- The company achieved 11.6% year-over-year sales growth , with record revenues of $3.2 billion in Asia marking its sixth consecutive quarter of year-over-year growth in the region.

- Avnet generated $208 million of cash flow from operations and reduced inventories by $126 million.

- For the third quarter of fiscal 2026, Avnet anticipates sales between $6.20 billion and $6.50 billion and adjusted diluted EPS between $1.20 and $1.30.

- AVANT has announced a new strategic growth partnership with Court Square Capital Partners, alongside a reinvestment from its current partner, Pamlico Capital.

- Ian Kieninger, Co-Founder and CEO, and Drew Lydecker, Co-Founder and President, will retain significant ownership and continue to oversee AVANT's strategy and operations.

- Court Square Capital Partners, which had $10.1 billion of assets under management as of September 30, 2025, will support AVANT's continued growth.

- Pamlico Capital, which originally invested in AVANT in 2021, will remain a key investment partner and has over $5.0 billion in assets under management.

- Avnet, a Fortune 180 company with $24-$25 billion in global revenue, has seen five quarters of year-on-year growth in Asia-Pac and positive signs of recovery in Europe and the Americas, with the September quarter marking the first year-on-year growth in the Americas since 2023.

- The company emphasizes its global footprint, extensive line card (80% semiconductors), and significant digital investments as key competitive advantages.

- Avnet's Farnell division, an e-commerce platform, grew 15% year-on-year in the September quarter and contributes 20% of the company's operating income, boasting gross margins two and a half times higher than Avnet Core.

- For the December quarter, Avnet provided guidance for approximately 2% quarter-over-quarter growth and a 12% increase in EPS, driven by growth in Farnell and the Americas, indicating returning operating leverage.

- The company expresses optimism for the 2026 outlook, anticipating minimal investment needed for an upturn due to well-managed expenses, and plans to focus on reducing leverage while continuing to increase its quarterly dividend.

- Avnet is a Fortune 180 company with roughly $24-$25 billion in global revenue, operating in 43 countries and shipping to 145, with 80% of its business in semiconductors.

- The company is observing positive signs of market recovery, with Asia-Pac achieving five consecutive quarters of year-on-year growth and a record December quarter, alongside improving book-to-bills in Europe and the Americas.

- Farnell, Avnet's e-commerce division, despite being $1.6 billion of the $22 billion core business, contributes 20% of operating income and is undergoing structural changes to achieve double-digit operating margins.

- Avnet is actively involved in AI opportunities, including direct sales to hyperscalers (around 7% of revenue), supporting industrial customers in data centers, and enabling edge computing with its microcontroller line card.

- For the December quarter, Avnet guided for approximately 2% quarter-over-quarter growth and a 12% increase in EPS, driven by higher-margin regions and indicating returning operating leverage.

- Avnet reported Q1 Fiscal Year 2026 sales of $5.9 billion and adjusted diluted EPS of $0.84, exceeding or meeting the high end of guidance.

- Sales growth was driven by Asia, up 10% year-over-year, and the Americas, up 3% year-over-year, with EMEA sales remaining flat.

- The company announced a 6% increase in its quarterly dividend to $0.35 per share and repurchased approximately 2.6 million shares totaling $138 million during the quarter.

- For Q2 Fiscal Year 2026, Avnet provided guidance for sales between $5.85 billion and $6.15 billion and diluted EPS in the range of $0.90 to $1.00.

- Inventory days decreased by three days sequentially to 92 days, with management targeting a reduction to the 80s in the near future.

Quarterly earnings call transcripts for AVNET.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more