Earnings summaries and quarterly performance for Axos Financial.

Executive leadership at Axos Financial.

Gregory Garrabrants

President and Chief Executive Officer

Andrew Micheletti

Executive Vice President, Finance

Brian Swanson

President, Head of Consumer Bank

Candace Thiele

Executive Vice President, Chief Administration Officer

David Crow

Executive Vice President, Head of Axos Clearing

David Park

President, Head of Commercial Bank

Derrick Walsh

Executive Vice President, Chief Financial Officer

Eshel Bar-Adon

Executive Vice President, Strategic Partnerships and Chief Legal Officer

John Tolla

Executive Vice President, Chief Risk Officer

Michael Watson

Executive Vice President, Head of Axos Securities

Raymond Matsumoto

Executive Vice President, Chief Operating Officer

Thomas Constantine

Executive Vice President, Chief Credit Officer

Board of directors at Axos Financial.

Edward Ratinoff

Director

James Argalas

Director

James Court

Director

Nicholas Mosich

Vice Chairman of the Board

Paul Grinberg

Chairman of the Board of Directors

Roque Santi

Director

Sara Wardell-Smith

Director

Stefani Carter

Director

Tamara Bohlig

Director

Uzair Dada

Director

Research analysts who have asked questions during Axos Financial earnings calls.

Gary Tenner

D.A. Davidson & Co.

6 questions for AX

Kelly Motta

Keefe, Bruyette & Woods

6 questions for AX

Kyle Peterson

Needham & Company

6 questions for AX

David Feaster

Raymond James

5 questions for AX

Andrew Liesch

Piper Sandler

3 questions for AX

David Chiaverini

Wedbush Securities Inc.

2 questions for AX

Edward Hemmelgarn

Shaker Investments

2 questions for AX

Recent press releases and 8-K filings for AX.

- Axos Bank, a subsidiary of Axos Financial, Inc., entered into a purchase and assumption agreement with SMBC MANUBANK on February 12, 2026, to acquire all of the United States consumer deposits of Jenius Bank.

- The acquisition involves an estimated $2.6 billion in deposits.

- Axos Bank will receive cash for the acquired deposit balances, less a negotiated premium.

- The transaction is subject to approval by the Office of the Comptroller of the Currency and is expected to close in late March 2026 or April 2026.

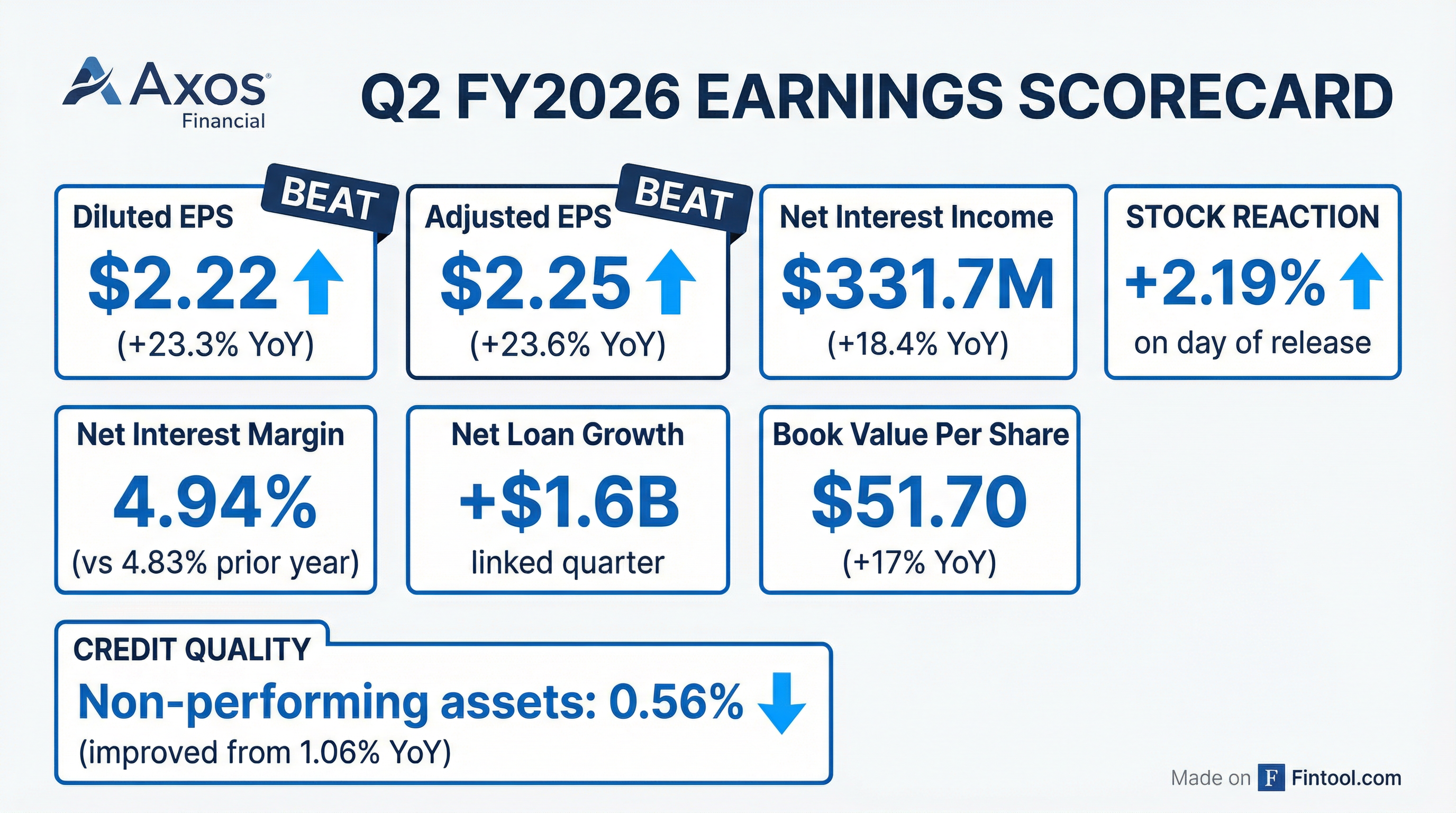

- Axos Financial, Inc. reported strong financial results for the fiscal second quarter of 2026, with diluted EPS of $2.22, a 23% increase compared to the fiscal second quarter of 2025.

- The company achieved 19% asset growth and 17% deposit growth in Q2 FY26 compared to Q2 FY25, with total deposits reaching $23.2 billion as of December 31, 2025.

- Axos Bank is positioned as a top performer among its peer group (savings banks with assets greater than $1 billion), ranking in the 92nd percentile for Return on Equity and 96th percentile for Net Interest Income as of September 30, 2025.

- The company highlighted its diversified business model, including Axos Advisor Services, which is the 7th largest RIA custodian in the U.S. and manages over $44 billion in client assets under custody and/or administration as of December 31, 2025.

- Axos Financial reported strong Q2 2026 results with net income of $128.4 million and diluted earnings per share of $2.22, marking year-over-year increases of 22.6% and 23.3% respectively, for the quarter ended December 31, 2025.

- The company experienced significant growth, including $1.6 billion in net loan growth and a 14% linked-quarter increase in net interest income to $331.6 million. The net interest margin expanded to 4.94%, up 19 basis points from the prior quarter.

- Total deposit balances reached $23.2 billion, a 44.3% linked-quarter increase, while non-interest income grew 65% to $53.4 million, with the Verdant acquisition contributing $18.9 million.

- Credit quality improved, with non-performing assets declining by $19 million linked quarter to 56 basis points of total assets, and net charge-offs to total assets at 4 basis points.

- Management reiterated expectations for annual loan growth in the low to mid-teens and projects loan growth in the $600 million-$800 million range for Q3 2026. The Verdant acquisition is anticipated to provide EPS accretion at the mid to high end of 2%-3% for fiscal 2026.

- Axos Financial reported diluted earnings per share of $2.22 for the quarter ended December 31, 2025, a 23.3% year-over-year increase, with net income of $128.4 million. The company achieved a 1.8% return on assets and over 17% return on average common equity.

- The company experienced $1.6 billion of net loan growth linked quarter and $5.6 billion in total originations (excluding single-family warehouse lending). Ending deposit balances grew to $23.2 billion, an increase of 44.3% linked quarter and 16.5% year-over-year.

- Net interest margin (NIM) was 4.94%, up 19 basis points linked quarter. Non-interest income increased 65% to $53.4 million, with the Verdant acquisition contributing $18.9 million.

- Credit quality improved, with non-performing assets declining by approximately $19 million linked quarter to 56 basis points of total assets, and the non-accrual loans to total loan ratio improving to 61 basis points.

- Axos expects low to mid-teens annual loan growth and anticipates growing loans in the $600 million-$800 million range for the next quarter. The Verdant acquisition is projected to contribute 2%-3% EPS accretion in fiscal 2026.

- Axos reported net income of $128.4 million and diluted earnings per share of $2.22 for the second fiscal quarter ended December 31, 2025.

- Total loans outstanding increased by $1,634 million from the prior quarter, reaching $24,776 million as of December 31, 2025.

- Total assets stood at $28.2 billion and total deposits were $23.2 billion as of December 31, 2025.

- The company's credit quality improved, with nonaccrual loans to total loans decreasing to 0.61% as of December 31, 2025, from 0.74% in the previous quarter.

- The Verdant Commercial Capital (VCC) acquisition contributed $3.1 million in pre-tax income for the three months ended December 31, 2025.

- Axos Financial reported strong financial results for the quarter ended December 31st, 2025, with diluted earnings per share of $2.22, a 23.3% year-over-year increase, and net income of $128.4 million, up 22.6% from the prior year's second quarter. The company achieved an over 17% return on average common equity and a 1.8% return on assets.

- The company achieved $1.6 billion of net loan growth linked quarter and saw ending deposit balances rise to $23.2 billion, an increase of 44.3% linked quarter and 16.5% year-over-year. Net interest income grew by 14% linked quarter to $331.6 million, and net interest margin expanded by 19 basis points to 4.94%.

- Credit quality showed improvement, with non-performing assets declining by approximately $19 million linked quarter, representing 56 basis points of total assets compared to 64 basis points in the prior quarter. Net charge-offs to total assets decreased to 4 basis points.

- Axos Financial projects annual loan growth in the low to mid-teens and expects to grow loans in the $600 million-$800 million range in the current quarter (Q3 2026). The net interest margin is anticipated to experience a 5-6 basis point decline in the March quarter (Q3 2026) relative to the December quarter (Q2 2026).

- The acquisition of Verdant, which closed on September 30th, 2025, contributed approximately $18.9 million to non-interest income in Q2 2026 and is expected to deliver EPS accretion at the mid to high end of 2%-3% in fiscal 2026 and 5%-6% in fiscal 2027.

- Axos Financial, Inc. reported net income of $128.4 million and diluted earnings per share (EPS) of $2.22 for the second fiscal quarter ended December 31, 2025, representing a 23.3% year-over-year increase in diluted EPS.

- Net interest income rose to $331.7 million and non-interest income surged 92.0% year-over-year to $53.4 million for the quarter ended December 31, 2025, with the latter primarily driven by the Verdant acquisition.

- The company's balance sheet showed significant growth, with total assets increasing 13.8% to $28.2 billion and total deposits reaching $23.2 billion at December 31, 2025.

- Asset quality improved, with non-performing assets to total assets decreasing to 0.56% and net annualized charge-offs to average loans at 4 basis points for the quarter ended December 31, 2025.

- Book value per share increased 17.0% to $51.70 at December 31, 2025, compared to $44.17 at December 31, 2024.

- Axos Financial reported net income of $128.4 million and diluted earnings per share (EPS) of $2.22 for the second fiscal quarter ended December 31, 2025, representing a 22.6% and 23.3% year-over-year increase, respectively.

- Adjusted EPS (non-GAAP) grew to $2.25 for the quarter ended December 31, 2025, up from $1.82 in the prior year.

- Net interest income increased 18.4% to $331.7 million for the three months ended December 31, 2025, driven by higher interest income on loans.

- Non-interest income surged 92.0% to $53.4 million for the quarter ended December 31, 2025, primarily due to the acquisition of Verdant Commercial Capital, LLC.

- Total assets increased 13.8% to $28.2 billion at December 31, 2025, and book value per share rose 17.0% to $51.70 compared to December 31, 2024.

- Axos Financial, with $26-27 billion in bank assets and nearly $50 billion in assets under custody, has raised its loan growth guidance, attributing it to improving single and multifamily lending conditions and the acquisition of Verdant.

- The Verdant acquisition is projected to add $150 million in growth and significantly boost fee income, by integrating its C&I banking operations and replacing expensive debt with deposit funding.

- The company is actively managing interest rate sensitivity through diverse deposit funding and loan syndications, anticipating that improved mortgage banking performance with lower rates will offset potential fee income reductions from the broker-dealer side.

- Axos is heavily investing in AI, with over 40% of code lines written or assisted by AI, to drive efficiency and maintain a goal of limiting personnel and professional services expense growth to less than 30% of revenue growth.

- Key product developments include the rollout of the Axos Professional Workstation for securities clients and the planned launch of crypto trading in the summer.

- Axos Financial, a full-service financial institution with $26-27 billion in bank assets and close to $50 billion in assets under custody, has raised its loan growth guidance due to its diverse lending platform, favorable market dynamics, and the acquisition of Verdant.

- The recent Verdant acquisition is expected to be a "game changer" for fee income, providing immediate profitability through deposit funding and synergistic client relationships.

- The company is heavily leveraging AI, with over 40% of code lines written or assisted by AI, and aims to cap personnel and professional services expense growth at 30% of revenue growth to drive efficiency.

- Axos is advancing product development, including the Axos Professional Workstation for securities clients and plans to roll out crypto trading in the summer.

Quarterly earnings call transcripts for Axos Financial.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more