Earnings summaries and quarterly performance for Axsome Therapeutics.

Executive leadership at Axsome Therapeutics.

Board of directors at Axsome Therapeutics.

Research analysts who have asked questions during Axsome Therapeutics earnings calls.

David Amsellem

Piper Sandler Companies

6 questions for AXSM

Graig Suvannavejh

Mizuho Securities

6 questions for AXSM

Jason Gerberry

Bank of America Merrill Lynch

6 questions for AXSM

Leonid Timashev

RBC Capital Markets

6 questions for AXSM

Marc Goodman

Leerink Partners

6 questions for AXSM

Myles Minter

William Blair & Company

6 questions for AXSM

Ami Fadia

Needham & Company, LLC

5 questions for AXSM

Joseph Thome

TD Cowen

5 questions for AXSM

Yatin Suneja

Guggenheim Partners

5 questions for AXSM

Ashwani Verma

UBS Group AG

4 questions for AXSM

Cerena Chen

Wells Fargo & Company

4 questions for AXSM

Joon Lee

Truist Securities

4 questions for AXSM

Charles Duncan

Cantor Fitzgerald & Co.

3 questions for AXSM

Pete Stavropoulos

Cantor Fitzgerald

3 questions for AXSM

Raghuram Selvaraju

H.C. Wainwright & Co.

3 questions for AXSM

Sean Laaman

Morgan Stanley & Co.

3 questions for AXSM

Andrew Tsai

Jefferies

2 questions for AXSM

Asim Rana

Truist Securities

2 questions for AXSM

Benjamin Burnett

Stifel, Nicolaus & Company, Incorporated

2 questions for AXSM

David Hoang

Citigroup

2 questions for AXSM

David Hong

Deutsche Bank

2 questions for AXSM

Joel Beatty

Baird

2 questions for AXSM

Ram Selvaraju

H.C. Wainwright

2 questions for AXSM

Chris Coetzee

Baird

1 question for AXSM

Eddie Hickman

Guggenheim Securities

1 question for AXSM

Linda Tsai

Jefferies

1 question for AXSM

Matthew Harrison

Bank of America

1 question for AXSM

Matthew Hershenhorn

Oppenheimer & Co. Inc.

1 question for AXSM

Matthew Hornishorn

Oppenheimer

1 question for AXSM

Matthew Kaplan

Ladenburg Thalmann

1 question for AXSM

Parth Patel

Morgan Stanley

1 question for AXSM

Poorna Kannan

Needham & Company

1 question for AXSM

Sam Beck

Deutsche Bank

1 question for AXSM

Troy Langford

TD Cowen

1 question for AXSM

Vikram Purohit

Morgan Stanley

1 question for AXSM

Recent press releases and 8-K filings for AXSM.

- Auvelity achieved over $500 million in sales in 2025 and expanded its sales force to 600 representatives to support continued growth.

- The company expects a PDUFA date of April 30th for Auvelity in Alzheimer's disease agitation (ADA), anticipating 100% coverage in the Medicare Part D channel for this indication, which will account for over 70% of total ADA scripts.

- Axsome Therapeutics maintains its peak sales estimate for Auvelity in the range of $2.5 billion to $6 billion.

- Upcoming pipeline milestones include the imminent NDA submission for AXS-12 in narcolepsy and top-line results in the second half of 2026 for the Phase III trial of solriamfetol in binge eating disorder.

- The company reaffirms its near-term sight for cash flow positivity and EPS positive outlook, with the sales force expansion not changing its financial guidance.

- Axsome Therapeutics' Auvelity achieved over $500 million in sales in 2025 and expanded its salesforce to 600 representatives to drive further uptake in MDD and prepare for the Alzheimer's disease agitation (ADA) launch.

- For Auvelity in MDD, market access stands at 86% total covered lives (78% commercial, 100% government), with Q4 GTN in the high 40s%. The company anticipates a PDUFA date of April 30th for Auvelity in ADA, expecting a better GTN per script in this indication due to significant Medicare Part D coverage.

- The company has several pipeline catalysts, including top-line Phase 3 data for solriamfetol in Binge Eating Disorder in the second half of 2026, top-line data for solriamfetol in Shift Work Disorder in 2027, and an imminent NDA submission for AXS-12 in narcolepsy.

- Axsome maintains its guidance for near-term cash flow positivity and EPS positivity on the near-term horizon, with Auvelity's peak sales estimated between $2.5 billion and $6 billion.

- Axsome Therapeutics (AXSM) has settled patent litigation with Alkem Laboratories Ltd. concerning its product SUNOSI® (solriamfetol).

- The settlement grants Alkem a license to sell a generic version of SUNOSI beginning on or after September 1, 2040, if pediatric exclusivity is granted, or March 1, 2040, if not.

- The agreement will be submitted to the U.S. Federal Trade Commission and the U.S. Department of Justice for review.

- Similar patent litigation brought by Axsome against another party related to SUNOSI remains pending.

- Axsome Therapeutics has initiated the FORWARD Phase 3 trial for AXS-14 (esreboxetine), a drug candidate for the management of fibromyalgia, with the first patient already dosed as of January 15, 2026.

- The FORWARD trial is a Phase 3, double-blind, placebo-controlled, multicenter, randomized withdrawal study designed to evaluate the time from randomization to loss of therapeutic response.

- AXS-14 is an investigational norepinephrine reuptake inhibitor being developed for fibromyalgia, a chronic neurological pain disorder that affects approximately 17 million people in the U.S. and has limited current treatment options.

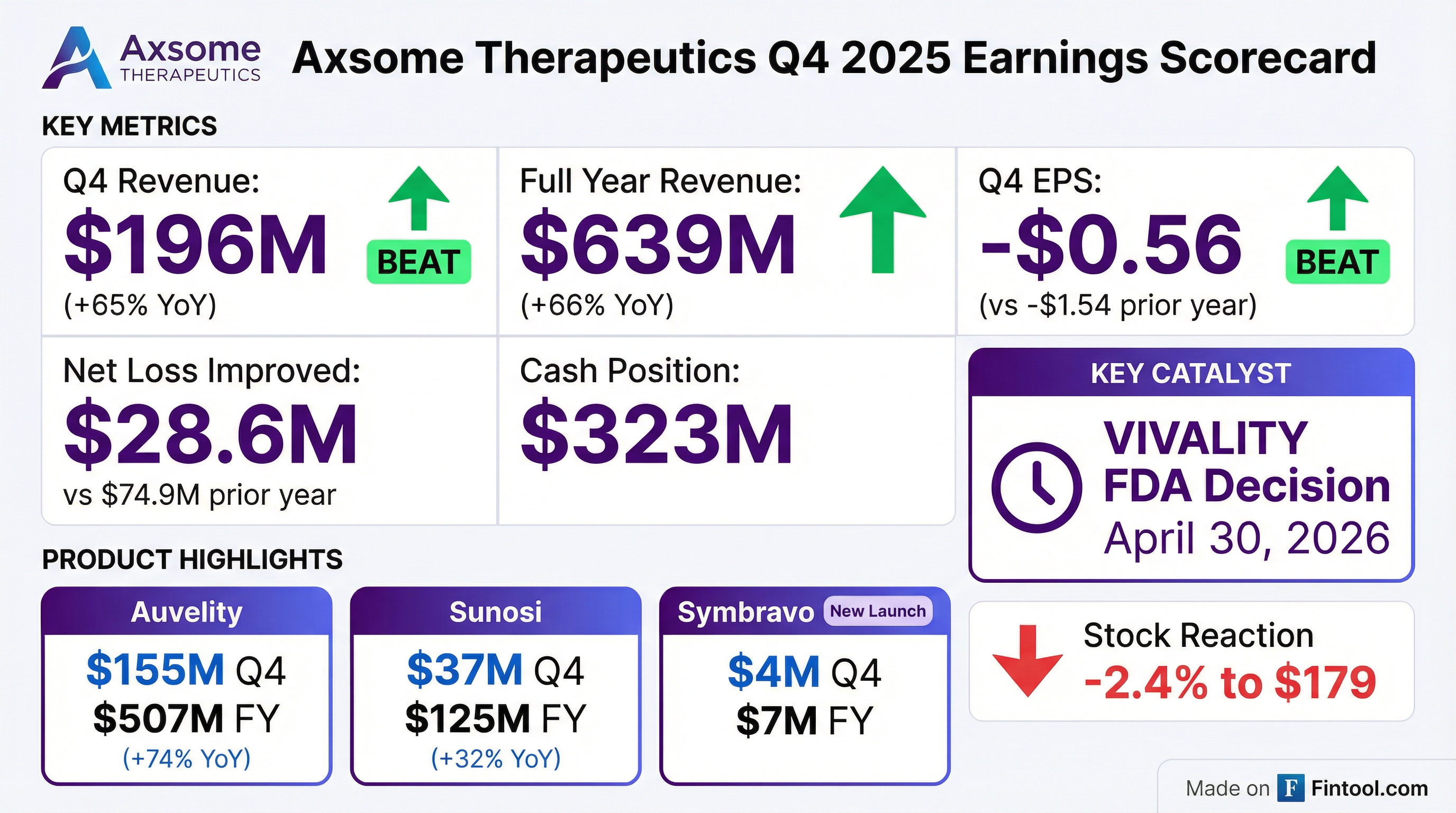

- Axsome Therapeutics, Inc. announced preliminary Fourth Quarter and Full Year 2025 net product revenue on January 12, 2026.

- Preliminary total net product revenue for Q4 2025 is expected to be approximately $196.0 million, representing 65% annual growth compared to Q4 2024.

- Preliminary total net product revenue for Full Year 2025 is expected to be approximately $638.5 million, representing 66% annual growth compared to Full Year 2024.

- Key product sales for Full Year 2025 include AUVELITY at $507.1 million, SUNOSI at $124.8 million, and SYMBRAVO at $6.6 million following its June 2025 launch.

- Axsome Therapeutics reported preliminary total net product revenue of $196.0 million for the fourth quarter of 2025, representing 65% annual growth, and $638.5 million for the full year 2025, an increase of 66% annually.

- AUVELITY preliminary net product sales were $155.1 million for Q4 2025 and $507.1 million for the full year 2025.

- SUNOSI preliminary net product revenue was $36.7 million for Q4 2025 and $124.8 million for the full year 2025.

- SYMBRAVO, which commercially launched in June 2025, generated preliminary net product sales of $4.1 million for Q4 2025 and $6.6 million for the full year 2025.

- Axsome Therapeutics received formal pre-New Drug Application (NDA) meeting minutes from the FDA for AXS-12 in narcolepsy.

- The FDA feedback confirmed that the regulatory data package is sufficient for NDA submission for AXS-12 for the treatment of cataplexy in narcolepsy.

- Axsome anticipates completing the NDA submission in January 2026.

- AXS-12 has been granted Orphan Drug Designation for narcolepsy, which may entitle Axsome to seven years of marketing exclusivity and a waiver of FDA application user fees upon approval.

- The FDA has accepted Axsome Therapeutics' supplemental New Drug Application (sNDA) for AXS-05 for the treatment of Alzheimer’s disease agitation and granted it Priority Review designation.

- The Prescription Drug User Fee Act (PDUFA) target action date for AXS-05 is set for April 30, 2026.

- This Priority Review designation indicates the FDA's goal to act on the application within 6 months, compared to the standard 10 months, for medicines that could provide significant improvements for serious conditions.

- AXS-05 previously received Breakthrough Therapy designation for Alzheimer’s disease agitation in June 2020, addressing a significant unmet medical need as agitation affects up to 76% of Alzheimer's patients.

- Axsome Therapeutics has received formal pre-New Drug Application (NDA) meeting minutes from the FDA, supporting the NDA submission of AXS-12 for the treatment of cataplexy in narcolepsy.

- The company anticipates completing the NDA submission in January 2026.

- AXS-12 has been granted Orphan Drug Designation for narcolepsy, which may entitle Axsome to seven years of marketing exclusivity in the U.S. upon FDA approval.

Fintool News

In-depth analysis and coverage of Axsome Therapeutics.

Quarterly earnings call transcripts for Axsome Therapeutics.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more