Earnings summaries and quarterly performance for BRANDYWINE REALTY TRUST.

Executive leadership at BRANDYWINE REALTY TRUST.

Gerard H. Sweeney

President and Chief Executive Officer

Daniel Palazzo

Senior Vice President, Chief Accounting Officer and Treasurer

George D. Johnstone

Executive Vice President, Operations

H. Jeffrey DeVuono

Executive Vice President, Senior Managing Director, Life Sciences

Shawn Neuman

Senior Vice President, General Counsel and Secretary

Thomas E. Wirth

Executive Vice President and Chief Financial Officer

William D. Redd

Executive Vice President and Senior Managing Director for the Austin and Metro DC Regions

Board of directors at BRANDYWINE REALTY TRUST.

Research analysts who have asked questions during BRANDYWINE REALTY TRUST earnings calls.

Dylan Burzinski

Green Street Advisors, LLC

8 questions for BDN

Anthony Paolone

JPMorgan Chase & Co.

6 questions for BDN

Upal Rana

KeyBanc Capital Markets

6 questions for BDN

Michael Lewis

Truist Securities, Inc.

5 questions for BDN

Seth Bergey

Citi

5 questions for BDN

Steve Sakwa

Evercore ISI

5 questions for BDN

Omotayo Okusanya

Deutsche Bank AG

3 questions for BDN

Manus Ebbecke

Evercore ISI

2 questions for BDN

Michael Griffin

Citigroup Inc.

2 questions for BDN

Gabrielle Horvath

KeyBanc Capital Markets Inc.

1 question for BDN

Magnus Ebeck

Evercore ISI

1 question for BDN

Seth Berge

Citigroup

1 question for BDN

Upal Dhananjay Rana

KeyBanc Capital Markets Inc.

1 question for BDN

Recent press releases and 8-K filings for BDN.

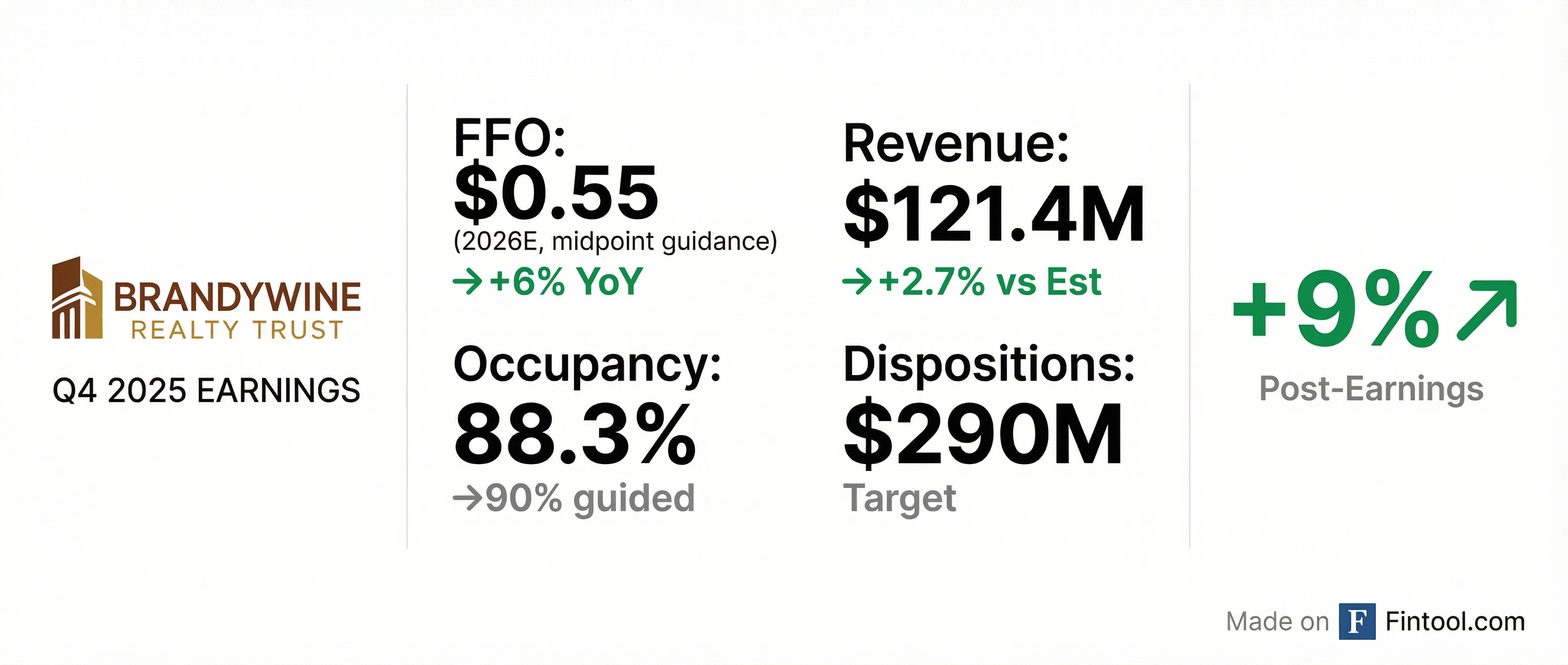

- Brandywine Realty Trust (BDN) reported a net loss attributable to common shareholders of $(36.9) million, or $(0.21) per share, and Funds from Operations (FFO) of $14.6 million, or $0.08 per diluted share, for Q4 2025. These results include a $(12.2) million, or $(0.07) per share, charge related to a loss on the early extinguishment of debt. For the full year 2025, the company reported a net loss of $(179.5) million, or $(1.03) per share, and FFO of $93.4 million, or $0.52 per diluted share.

- The company initiated 2026 FFO guidance in the range of $0.51 to $0.59 per diluted share and a loss per share guidance of $(0.66) to $(0.58) per share. Key assumptions for 2026 include property sales activity of $280.0 - $300.0 million and a tenant retention rate range of 46-48%.

- BDN's liquidity remains strong with no borrowings on its $600 million unsecured line of credit as of December 31, 2025, and no bond maturities until November 2027. The company had $32.3 million of cash and cash equivalents on hand as of December 31, 2025.

- For Q4 2025, the core portfolio was 88.3% occupied and 90.4% leased. Same Store Net Operating Income (NOI) increased 2.4% on an accrual basis and 3.2% on a cash basis, with a rental rate mark-to-market of 20.9% on an accrual basis.

- Brandywine Realty Trust reported a net loss of $36.9 million, or $0.21 per share, and FFO of $0.08 per diluted share for Q4 2025, which was in line with consensus estimates.

- The company provided 2026 FFO guidance in the range of $0.51-$0.59 per share, with a midpoint of $0.55, representing a 5.8% increase over 2025 FFO.

- Brandywine plans $280 million to $300 million in asset sales in 2026, primarily in the first half, with proceeds largely used to reduce debt. The company also intends to recapitalize its One Uptown and Solaris joint ventures in Austin during the second half of 2026.

- The company ended Q4 2025 with no outstanding balance on its $600 million unsecured line of credit and $32 million of cash on hand. It projects year-end 2026 core net debt to EBITDA to be between 8-8.4 times and fixed charge coverage between 1.8 and 2.0.

- Brandywine Realty Trust (BDN) reported a Q4 2025 net loss of $36.9 million, or $0.21 per share, and FFO of $14.6 million, or $0.08 per diluted share, which was impacted by a $12.2 million ($0.07 per share) one-time charge for the early extinguishment of a CMBS loan.

- For 2026, the company provided FFO guidance of $0.51-$0.59 per share, with a midpoint of $0.55, representing a 5.8% increase over 2025 FFO. The projected net loss for 2026 is $0.62 per share at the midpoint.

- BDN plans $280 million to $300 million in asset sales in 2026, primarily in the first half, at an average cap rate of approximately 8%, with proceeds mainly used for debt reduction. The company also anticipates share repurchases due to the stock's undervaluation, while prioritizing deleveraging to achieve a Net Debt to EBITDA in the low to mid-sevens.

- Operational highlights for Q4 2025 include a wholly owned core portfolio that is 88.3% occupied and 90.4% leased, with a tenant retention rate of 64%. For 2026, property level GAAP NOI is expected to increase by $13 million to $292 million, and year-end occupancy is projected to improve by 120 basis points from 2025 levels.

- Brandywine Realty Trust reported Funds From Operations (FFO) of $0.52 per diluted share for 2025 and issued 2026 FFO guidance of $0.51-$0.59 per share.

- The company completed a $300 million offering of 6.125% guaranteed notes due 2031 and repaid a $245 million Secured Term Loan, incurring a $12.2 million ($0.07 per share) loss on debt extinguishment in Q4 2025.

- In Q4 2025, GAAP Same Store Net Operating Income (NOI) Growth was 2.4% and Cash Same Store NOI Growth was 3.2%, with a combined GAAP Rental Rate Mark to Market of 20.9%.

- Brandywine acquired its partner's preferred equity interest in 3025 JFK for $70.5 million, consolidating its $178 million secured construction loan and making it a wholly-owned asset.

- Brandywine Realty Trust (BDN) reported a Q4 2025 net loss of $36.9 million, or $0.21 per share, and FFO of $14.6 million, or $0.08 per diluted share, which was impacted by a $12.2 million one-time charge for the early extinguishment of a CMBS loan.

- The company's wholly owned core portfolio was 88.3% occupied and 90.4% leased at the end of Q4 2025, with new leasing mark-to-market at 13% on a GAAP basis.

- BDN provided 2026 FFO guidance of $0.51-$0.59 per share, with a midpoint of $0.55, representing a 5.8% increase over 2025 FFO.

- The company plans an accelerated sales program targeting $280 million-$300 million in asset sales in 2026, at an average cap rate of 8%, with proceeds primarily intended for debt reduction and potential share repurchases.

- Brandywine Realty Trust reported a net loss attributable to common shareholders of $(36.9) million, or $(0.21) per share, and Funds from Operations (FFO) of $14.6 million, or $0.08 per diluted share, for the fourth quarter of 2025. For the full year 2025, the company reported a net loss of $(179.5) million, or $(1.03) per share, and FFO of $93.4 million, or $0.52 per diluted share.

- The company initiated its 2026 guidance, projecting FFO to be in the range of $0.51 to $0.59 per diluted share and a loss per share between $(0.66) and $(0.58).

- As of December 31, 2025, the core portfolio was 88.3% occupied and 90.4% leased. Same Store Net Operating Income (NOI) increased 2.4% on an accrual basis and 3.2% on a cash basis for the fourth quarter of 2025.

- Brandywine Realty Trust maintains strong liquidity with no borrowings on its $600 million unsecured line of credit and no bond maturities until November 2027. The company issued $300 million of 6.125% guaranteed notes due 2031 in October 2025, using the net proceeds to repay a $245 million secured loan.

- Brandywine Realty Trust (BDN) and Nuveen Green Capital announced the closing of $87.3 million in C-PACE financing for 3151 Market Street in Philadelphia.

- This transaction represents the largest C-PACE financing in Pennsylvania's history and the first for a publicly traded REIT.

- The financing includes $30 million allocated for future tenants and enables Brandywine to preserve conventional debt capacity for the LEED® Platinum certified lab and office building.

- Brandywine Realty Trust reported a Q3 2025 net loss of $26.2 million or $0.15 per share and FFO of $28 million or $0.16 per diluted share.

- The company executed over 99% of its spec revenue target and achieved a 68% tenant retention rate for the quarter, with occupancy at 88.8% and leased at 90.4%.

- BDN successfully issued $300 million of bonds due January 2031 at an effective yield of 6.125%, using $245 million of the proceeds to repay a secured CMBS loan due in 2028, and has no unsecured bonds maturing until November 2027.

- The company adjusted its 2025 guidance with a 10% midpoint reduction, primarily due to $0.07 per share in transaction costs from the CMBS loan repayment and $0.04 per share from delays in development project recapitalization.

- The board decided to reduce the dividend to conserve $50 million of cash flow, aiming for a sustainable payout ratio given the high cost of external capital and shareholder support for capital conservation.

- Brandywine Realty Trust reported a net loss of $26.2 million or $0.15 per share and Funds From Operations (FFO) of $28 million or $0.16 per diluted share for Q3 2025.

- The board lowered the quarterly dividend from $0.15 per share to $0.08 per share, aiming for a more sustainable CAD payout ratio and to generate $50 million of internal capital for reinvestment.

- The company issued $300 million of bonds at an effective yield of 6.125% and used $245 million of the proceeds to repay a secured CMBS loan due in 2028, with no unsecured bonds maturing until November 2027.

- Q3 2025 operational highlights included a 68% tenant retention rate, 343,000 sq ft of leasing activity, and ending the quarter 88.8% occupied and 90.4% leased.

- BDN exceeded its 2025 asset sales target, selling $73 million of properties at an average cap rate of 6.9%.

- Brandywine Operating Partnership, L.P. closed an underwritten public offering of $300 million of its 6.125% guaranteed notes due 2031 on October 3, 2025.

- The offering generated approximately $296.3 million in net proceeds after deducting underwriting discount and estimated transaction expenses.

- The Operating Partnership intends to use these proceeds to repay its consolidated secured debt and for general corporate purposes, which may include the repayment or retirement of other indebtedness.

Quarterly earnings call transcripts for BRANDYWINE REALTY TRUST.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more