Earnings summaries and quarterly performance for BEL FUSE INC /NJ.

Executive leadership at BEL FUSE INC /NJ.

Farouq Tuweiq

President and Chief Executive Officer

Joseph Berry

President of Magnetic Solutions

Kenneth Lai

Vice President of Asia Operations

Lynn Hutkin

Chief Financial Officer

Peter Bittner III

President of Bel Connectivity Solutions

Stephen Dawson

President of Bel Power Solutions

Suzanne Kozlovsky

Global Head of People

Board of directors at BEL FUSE INC /NJ.

Research analysts who have asked questions during BEL FUSE INC /NJ earnings calls.

Theodore O'Neill

Litchfield Hills Research

6 questions for BELFA

Hendi Susanto

Gabelli Funds

5 questions for BELFA

Christopher Glynn

Oppenheimer & Co. Inc.

4 questions for BELFA

James Ricchiuti

Needham & Company, LLC

4 questions for BELFA

Robert Brooks

Northland Capital Markets

4 questions for BELFA

Bobby Brooks

Northland Capital Markets

2 questions for BELFA

Danny Eggerichs

Craig-Hallum Capital Group LLC

2 questions for BELFA

Jacob Parsons

Needham & Company

2 questions for BELFA

Luke Junk

Robert W. Baird & Co.

2 questions for BELFA

Greg Palm

Craig-Hallum Capital Group LLC

1 question for BELFA

Recent press releases and 8-K filings for BELFA.

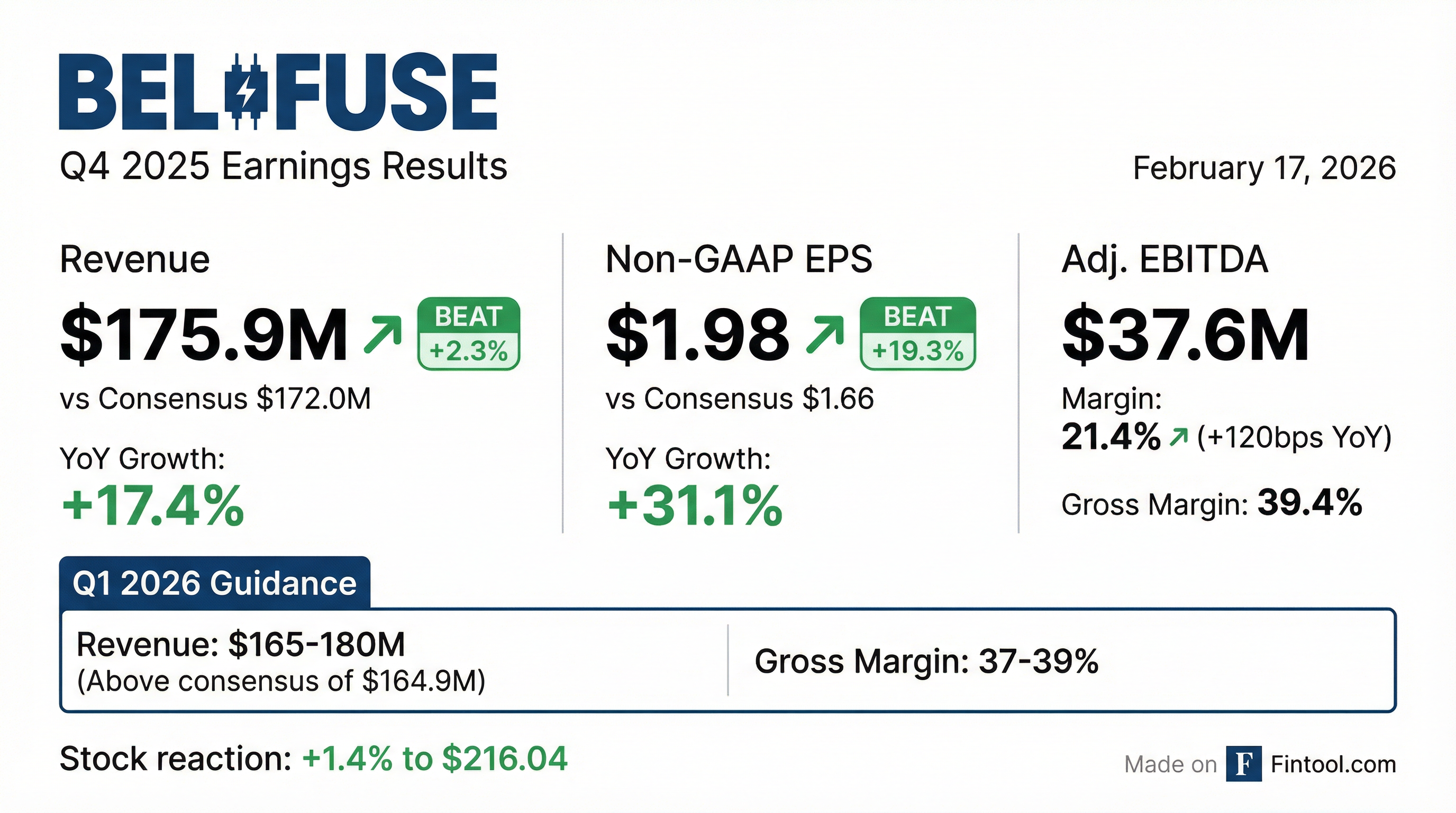

- Bel Fuse Inc. achieved record revenue and EBITDA for fiscal year 2025, with net sales of $675.5 million, marking a 26.3% increase over 2024, and record GAAP and non-GAAP EPS.

- For Q4 2025, sales reached $175.9 million, an increase of 17.4% year-over-year, while gross margins expanded to 39.4% for the quarter and 39.1% for the full year 2025.

- The company's growth in 2025 was significantly driven by Aerospace and Defense, which accounted for 38% of consolidated sales, alongside recovery in the networking end market and growth in AI applications, resulting in a full-year book-to-bill ratio of 1.1.

- Bel Fuse strengthened its balance sheet by paying down $90 million in debt during 2025 and anticipates continued growth in aerospace, defense, space, and AI in 2026.

- Management expects headwinds in 2026 from increased raw material input costs (gold, copper, and PCBs) and unfavorable FX movements (Peso, Renminbi, and Shekel), which will require proactive pricing actions and are expected to lead to margin pressures.

- Bel Fuse Inc. achieved record revenue and EBITDA in 2025, with net sales of $675.5 million, a 26.3% increase over 2024, and record GAAP and non-GAAP EPS. Fourth quarter 2025 sales reached $175.9 million, up 17.4% year-over-year, with gross margins expanding to 39.1% for the full year and 39.4% in Q4 2025.

- Growth in 2025 was primarily driven by strong performance in aerospace and defense, which accounted for 38% of consolidated sales, as well as recovery in the networking end market and growth in AI applications. All three product segments delivered organic growth in Q4 2025.

- The company significantly strengthened its balance sheet by paying down $90 million in debt during 2025, reducing total debt outstanding to $197.5 million at December 31, 2025. Cash flows from operations for the full year 2025 were $80.6 million.

- For Q1 2026, Bel Fuse Inc. expects sales to be in the range of $165 million-$180 million and gross margin between 37%-39%. The company anticipates continued growth in aerospace, defense, space, and AI, but also foresees headwinds from increased raw material input costs and unfavorable foreign exchange movements.

- Bel Fuse Inc. reported record net sales of $675.5 million for the full year 2025, a 26.3% increase over 2024, with Q4 2025 sales reaching $175.9 million, up 17.4% year-over-year. The company also achieved record GAAP and non-GAAP EPS for the full year.

- Gross margins expanded to 39.1% for the full year 2025 and 39.4% in Q4 2025, reflecting strong execution and operational discipline.

- Key growth drivers in 2025 included Aerospace and Defense, which accounted for 38% of consolidated sales, as well as recovery in the networking end market and growth in AI applications, with AI-specific customer sales reaching $4 million in Q4 2025.

- The company strengthened its balance sheet by paying down $90 million in debt during 2025, reducing total debt outstanding to $197.5 million at year-end.

- For Q1 2026, Bel Fuse Inc. expects sales to be in the range of $165 million-$180 million and gross margin between 37%-39%, anticipating continued growth in aerospace, defense, space, and AI.

- Bel Fuse Inc. reported strong financial results for Q4 2025, with net sales of $175.9 million, up 17.4% from Q4 2024, and full-year 2025 net sales of $675.5 million, a 26.3% increase from 2024.

- Despite a GAAP net loss of $5.4 million in Q4 2025 due to a $13.1 million non-cash impairment, the company achieved Non-GAAP net earnings of $24.9 million for the quarter.

- Adjusted EBITDA was $37.6 million (21.4% of sales) for Q4 2025 and $142.9 million (21.2% of sales) for the full year.

- The company provided Q1 2026 guidance, expecting net sales between $165 million and $180 million and a gross margin of 37% to 39%.

- Tom Smelker joined the leadership team, bringing experience in the aerospace and defense sectors, as Pete Bittner transitions into retirement.

- Bel Fuse Inc. anticipates recording a pre-tax impairment charge of up to approximately $14 million in the fourth quarter of 2025 due to the potential full loss of its investment in Innolectric AG and related notes receivable.

- This charge follows the initiation of insolvency proceedings by Innolectric AG, a Germany-based e-Mobility technology company, on November 26, 2025.

- Bel acquired a noncontrolling one-third minority stake in Innolectric in February 2023 but decided against further investment due to persistent weakness in the global electric vehicle sector and continued operating losses for Innolectric.

- Bel had previously recorded losses of $0.4 million from its Innolectric interest for the nine months ended September 30, 2025, and $0.6 million for the year ended December 31, 2024.

- Bel Fuse Inc. reported net sales of $179.0 million for the third quarter of 2025, marking a 44.8% increase from $123.6 million in Q3 2024.

- The company's gross profit margin improved to 39.7% in Q3 2025, up from 36.1% in Q3 2024.

- GAAP net earnings attributable to Bel shareholders rose significantly to $22.3 million in Q3 2025, compared to $8.1 million in Q3 2024.

- Adjusted EBITDA for Q3 2025 was $39.2 million (21.9% of sales), an increase from $21.5 million (17.4% of sales) in Q3 2024.

- For Q4 2025, Bel Fuse Inc. estimates net sales between $165 million and $180 million and expects gross margin to be in the 37% to 39% range.

- Bel Fuse Inc. announced preliminary net sales of $179.0 million for the third quarter of 2025, marking a 44.8% increase from Q3 2024.

- The company achieved a gross profit margin of 39.7% and GAAP net earnings attributable to Bel shareholders of $22.3 million in Q3 2025.

- Adjusted EBITDA for Q3 2025 was $39.2 million, which is 21.9% of sales.

- For the fourth quarter of 2025, Bel estimates net sales to be between $165 to $180 million and expects the gross margin to be in the 37 to 39 percent range.

- Management transitions effective May 27, 2025: Farouq Tuweiq is promoted from CFO to President and CEO, Daniel Bernstein becomes non-executive Chairman, and Lynn Hutkin is named CFO and Principal Accounting Officer.

- The 2025 Annual Meeting also resulted in an expanded Board to ten directors with Mr. Tuweiq joining the Board and Executive Committee.

- Shareholders approved key proposals including director elections, auditor ratification, and executive compensation, with detailed vote outcomes recorded.

- Bel Fuse announced significant leadership changes, with CFO Farouq Tuweiq elevated to President and CEO effective after the 2025 Annual Meeting, and Ms. Hutkin appointed as the new CFO, including details of her employment agreement and compensation package.

- The board approved an expansion to ten directors and enhanced the Executive Committee by adding Mr. Tuweiq, reflecting a broader governance update.

- Detailed executive compensation provisions were disclosed, covering base salary, variable pay, long-term performance awards, and severance benefits under the new employment agreements.

- Total revenue reached $152.2 million, reflecting an 18.9% increase year-over-year with the A&D segment contributing 38% of global sales.

- The Magnetics and Connectivity Solutions segments delivered strong double-digit growth, while AI and Space showed robust performance ($4.6M and $2.3M respectively), offsetting declines in consumer, e-mobility, and rail markets.

- Gross margins improved to 38.6% in Q1 2025 from 37.5% in Q1 2024, driven by favorable product mix and cost efficiency initiatives despite challenges from tariffs.

- The recent acquisition of Enercon is performing well, further diversifying the business and generating optimism for future revenue synergies in defense and beyond.

Quarterly earnings call transcripts for BEL FUSE INC /NJ.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more