Earnings summaries and quarterly performance for Brookdale Senior Living.

Research analysts who have asked questions during Brookdale Senior Living earnings calls.

Brian Tanquilut

Jefferies

4 questions for BKD

Also covers: ACHC, ADUS, AHCO +29 more

JG

Joanna Gajuk

Bank of America

4 questions for BKD

Also covers: ACHC, ADUS, AGL +21 more

Joshua Raskin

Nephron Research

4 questions for BKD

Also covers: AIRS, CI, CNC +13 more

Tao Qiu

Macquarie Group

4 questions for BKD

Also covers: ADUS, AMED, ENSG +5 more

Benjamin Hendrix

RBC Capital Markets

3 questions for BKD

Also covers: ACHC, ADUS, AHCO +25 more

Andrew Mok

Barclays

2 questions for BKD

Also covers: ACHC, ADUS, AGL +21 more

MM

Michael Murray

RBC Capital Markets

1 question for BKD

Also covers: ADUS, AHCO, AMED +7 more

Recent press releases and 8-K filings for BKD.

Brookdale Senior Living Provides 2025 Results and 2026 Outlook at Investor Day

BKD

Guidance Update

Revenue Acceleration/Inflection

New Projects/Investments

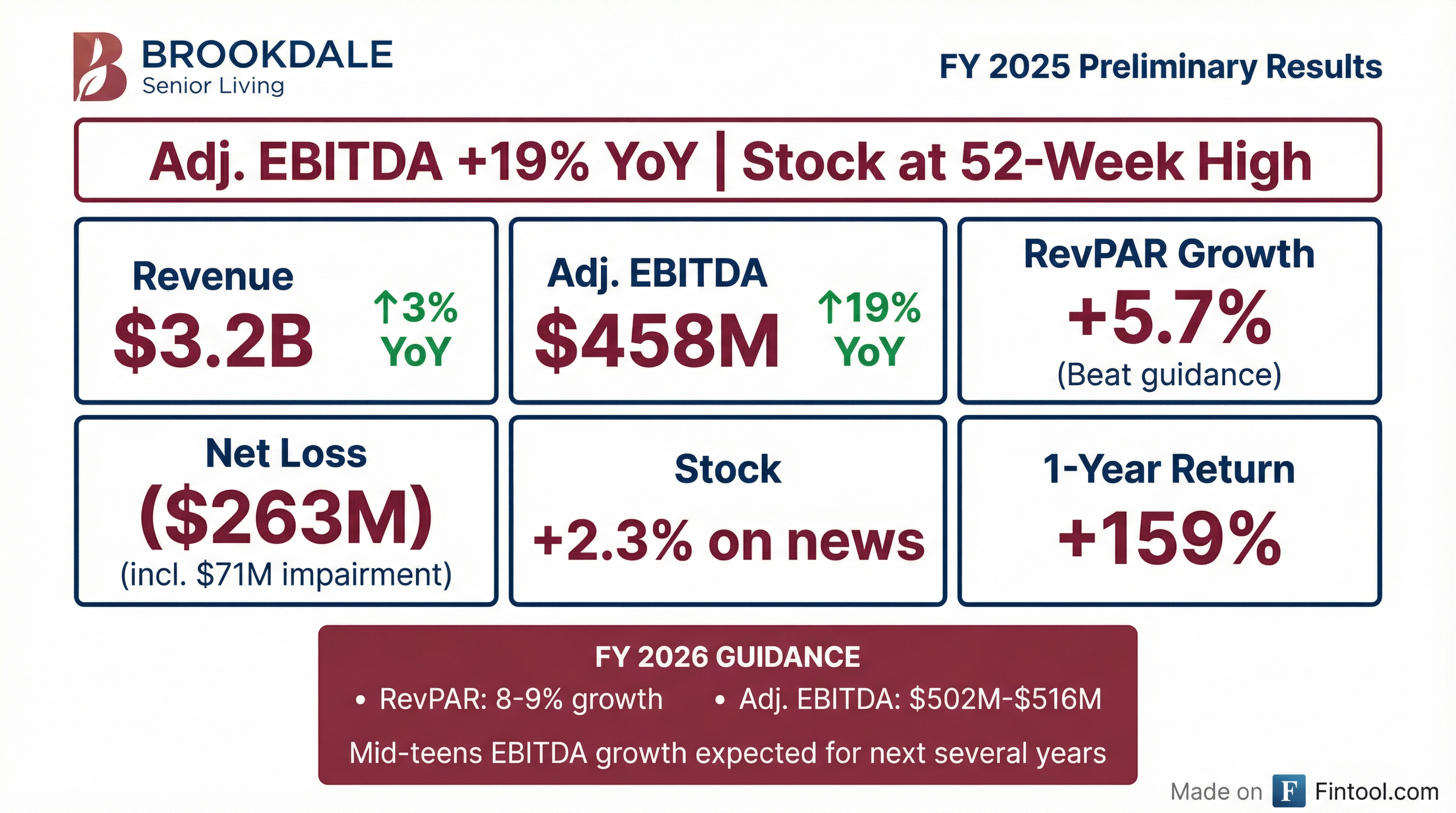

- Brookdale Senior Living reported $458 million in Adjusted EBITDA for 2025, representing a 19% increase over 2024, and achieved 83.5% fourth-quarter weighted average occupancy. The company also became adjusted free cash flow positive for the year.

- For 2026, the company guides for Adjusted EBITDA in the range of $502-$516 million and anticipates RevPAR growth of 8.0%-9.0%.

- Brookdale projects mid-teens annualized growth in Adjusted EBITDA over the next several years and aims to reduce net leverage to less than 6 turns of EBITDA by the end of 2028.

- The company has stabilized its portfolio at 517 communities and implemented a new operating structure with six regional senior living companies to enhance operational excellence and market performance.

- 94% of Brookdale's revenue is tied to private pay, emphasizing its needs-based business model.

8 days ago

Brookdale Provides 2025 Preliminary Results and 2026 Guidance at Investor Day

BKD

Guidance Update

Revenue Acceleration/Inflection

New Projects/Investments

- Brookdale reported preliminary 2025 Adjusted EBITDA of $458 million, a 19% increase over 2024, and provided 2026 Adjusted EBITDA guidance in the range of $502-$516 million.

- The company achieved 83.5% weighted average occupancy in Q4 2025, a 220 basis points increase year-over-year, and projects 8.0%-9.0% RevPAR growth for 2026.

- Brookdale plans to stabilize its portfolio at 517 communities by mid-2026 and aims to reduce net leverage to less than 6 turns of EBITDA by the end of 2028.

- The company anticipates significant demographic tailwinds, with 1 million more Americans aged 80+ annually from 2026-2028, contributing to a projected 100,000 unit shortage by 2027 in senior living supply.

- Brookdale's business model is characterized by 94% private pay revenue and estimates $23 million in NOI for every 100 basis points of occupancy gain.

8 days ago

Brookdale Senior Living Reports Strong 2025 Results and Provides Optimistic 2026 Guidance

BKD

Guidance Update

Revenue Acceleration/Inflection

New Projects/Investments

- Brookdale Senior Living reported strong 2025 results with over $3 billion in revenue and $458 million in adjusted EBITDA, exceeding the midpoint of its upgraded guidance.

- For 2026, the company projects adjusted EBITDA between $502 million and $516 million and RevPAR growth of 8.0%-9.0%.

- Brookdale anticipates mid-teen annualized adjusted EBITDA growth for several years, targeting a reduction in net leverage to below 6 times EBITDA by the end of 2028.

- This outlook is supported by favorable industry dynamics, including a 4% CAGR in the 80+ population and record low inventory growth of 0.6%, leading to a projected 100,000 unit shortage by 2027.

- The company's optimized portfolio will consist of 517 communities and 41,525 units in 2026, with almost 75% of units being owned.

8 days ago

Brookdale Senior Living Inc. Announces Preliminary Full Year 2025 Results and Full Year 2026 Guidance

BKD

Earnings

Guidance Update

- Brookdale Senior Living Inc. announced preliminary full year 2025 revenue is expected to be approximately $3.2 billion, with a net loss of approximately $263 million.

- Adjusted EBITDA for full year 2025 is expected to be approximately $458 million, representing an approximate 19% increase from the year ended December 31, 2024.

- RevPAR year-over-year growth for the year ended December 31, 2025, is expected to be approximately 5.7%.

- For the full year 2026, the company is providing guidance for RevPAR year-over-year growth of 8.0% to 9.0% and Adjusted EBITDA between $502 million and $516 million.

Jan 28, 2026, 9:17 PM

Brookdale Senior Living Announces Preliminary Full-Year 2025 Results and Full-Year 2026 Guidance

BKD

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Brookdale Senior Living announced preliminary full-year 2025 results, reporting revenue of approximately $3.2 billion, a net loss of approximately $263 million, and Adjusted EBITDA of approximately $458 million, which represents an approximate 19% increase from the prior year.

- The company expects RevPAR year-over-year growth for full-year 2025 to be approximately 5.7%.

- For full-year 2026, Brookdale introduced guidance projecting RevPAR year-over-year growth of 8.0% to 9.0% and Adjusted EBITDA between $502 million and $516 million.

- These 2025 financial results are preliminary and unaudited, with actual results potentially differing.

Jan 28, 2026, 9:15 PM

Brookdale Senior Living Inc. Reports Strong Q4 and December 2025 Occupancy

BKD

Earnings

Revenue Acceleration/Inflection

- Brookdale Senior Living Inc. reported its December 2025 occupancy and fourth quarter 2025 occupancy observations on January 12, 2026.

- The company's consolidated weighted average occupancy for Q4 2025 was 82.5%, representing a 70 basis point increase over Q3 2025 and a 310 basis point year-over-year growth.

- December 2025 month-end occupancy reached 83.7%.

- As of December 31, 2025, Brookdale operates 584 communities across 41 states, serving approximately 51,000 residents.

Jan 12, 2026, 12:34 PM

Brookdale Reports December 2025 Occupancy

BKD

Revenue Acceleration/Inflection

- Brookdale Senior Living reported its fourth quarter 2025 consolidated weighted average occupancy reached 82.5%, representing a 70 basis point increase over the third quarter of 2025 and a 310 basis point year-over-year growth.

- For December 2025, the consolidated weighted average occupancy was 82.4%, an increase of 310 basis points year-over-year.

- December month-end occupancy increased 30 basis points sequentially, and the sequential weighted average occupancy decreased by only 10 basis points, which is better than the historical seasonal trend of an approximate 30 basis point decline.

Jan 12, 2026, 12:00 PM

Brookdale Senior Living Announces Successful Refinancing of Mortgage Debt

BKD

Debt Issuance

- Brookdale Senior Living Inc. completed approximately $600 million in financing transactions in December 2025, successfully refinancing approximately $350 million of its 2026 mortgage debt maturities and approximately $200 million of its 2027 mortgage debt maturities.

- These transactions resulted in a higher proportion of fixed-rate debt, mitigating future interest rate risk, and are not expected to significantly impact annual net interest expense.

- The financing included a $245.8 million Fannie Mae mortgage loan, $146.1 million Freddie Mac mortgage loans, and a $205.0 million Capital One mortgage loan.

Jan 8, 2026, 11:17 PM

Brookdale Reports November 2025 Occupancy

BKD

Demand Weakening

Revenue Acceleration/Inflection

- Brookdale Senior Living reported consolidated occupancy of 82.5% for November 2025, which represents a 300 basis point increase year-over-year but a 10 basis point sequential decrease.

- Fourth quarter-to-date occupancy reached 82.6%, an 80 basis point increase over the full third quarter of 2025.

- Same community occupancy for November 2025 was 82.8%, reflecting a 250 basis point increase year-over-year and a 20 basis point sequential decrease.

Dec 8, 2025, 9:15 PM

Brookdale Senior Living Appoints Chief Operating Officer

BKD

Management Change

Hiring

- Brookdale Senior Living Inc. (BKD) has appointed Mary Sue Patchett as its new Chief Operating Officer (COO), effective December 1st.

- Ms. Patchett brings 40 years of senior living operations experience to the role, having previously served as Interim Executive Vice President – Community and Field Operations.

- This appointment is significant as it is the first time Brookdale has formally appointed a COO in over 10 years, with a stated focus on improving operating performance.

Nov 18, 2025, 9:15 PM

Fintool News

In-depth analysis and coverage of Brookdale Senior Living.

Quarterly earnings call transcripts for Brookdale Senior Living.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more