Earnings summaries and quarterly performance for BLACK HILLS CORP /SD/.

Executive leadership at BLACK HILLS CORP /SD/.

Board of directors at BLACK HILLS CORP /SD/.

Research analysts who have asked questions during BLACK HILLS CORP /SD/ earnings calls.

AW

Andrew Weisel

Scotiabank

9 questions for BKH

Also covers: AEP, CEG, CMS +14 more

CE

Chris Ellinghaus

Siebert Williams Shank

6 questions for BKH

Also covers: CPK, CTRI, IDA +6 more

Ross Fowler

Bank of America

3 questions for BKH

Also covers: AEP, D, EMRAF +11 more

AC

Anthony Crowdell

Mizuho Financial Group

2 questions for BKH

Also covers: AEE, AEP, AES +30 more

BR

Brian Russo

Jefferies

2 questions for BKH

Also covers: AEE, ALE, AVA +9 more

CE

Christopher Ellinghaus

Siebert Williams Shank & Co., LLC

2 questions for BKH

Also covers: CPK, CTRI, ECG +12 more

Julien Dumoulin-Smith

Jefferies

1 question for BKH

Also covers: AEE, AEP, AES +60 more

Recent press releases and 8-K filings for BKH.

Black Hills Corporation Announces Merger with NorthWestern Energy Group

BKH

M&A

- Black Hills Corporation (BKH) entered into an all-stock Merger Agreement with NorthWestern Energy Group, Inc. (NorthWestern) on August 18, 2025, which was unanimously approved by both boards.

- Upon completion, NorthWestern will become a direct wholly-owned subsidiary of Black Hills, and the combined entity will assume the new corporate name Bright Horizon Energy Corporation.

- Each share of NorthWestern common stock will be converted into the right to receive 0.98 shares of Black Hills common stock. The estimated merger consideration is approximately $4.4 billion.

- For the year ended December 31, 2025, the unaudited pro forma combined financial statements show $3,921 million in revenue, $429 million in net income available for common stock, and $3.21 in diluted earnings per share.

- The merger is subject to various conditions, including clearance under the Hart-Scott Rodino Act, shareholder approvals, and regulatory approvals from state commissions and the Federal Energy Regulatory Commission.

Feb 19, 2026, 9:11 PM

Black Hills Corp. Files South Dakota Rate Review Application

BKH

New Projects/Investments

Legal Proceedings

- Black Hills Corp. has filed a rate review application with the South Dakota Public Utilities Commission (PUC).

- The company is seeking $50.6 million in new annual revenue to recover approximately $523 million of critical investments made since its last rate review in 2014, which were focused on strengthening the electric grid, maintaining reliability, and reducing wildfire risk.

- The request is based on a capital structure of 53.2% equity and 46.8% debt, with a requested return on equity of 10.5%.

- Interim rates are sought to be effective 180 days after the filing, with new rates expected to be finalized in the first quarter of 2027.

Feb 19, 2026, 1:45 PM

Black Hills Reports 2025 Adjusted EPS, Provides 2026 Guidance, and Updates on NorthWestern Energy Merger

BKH

Earnings

Guidance Update

M&A

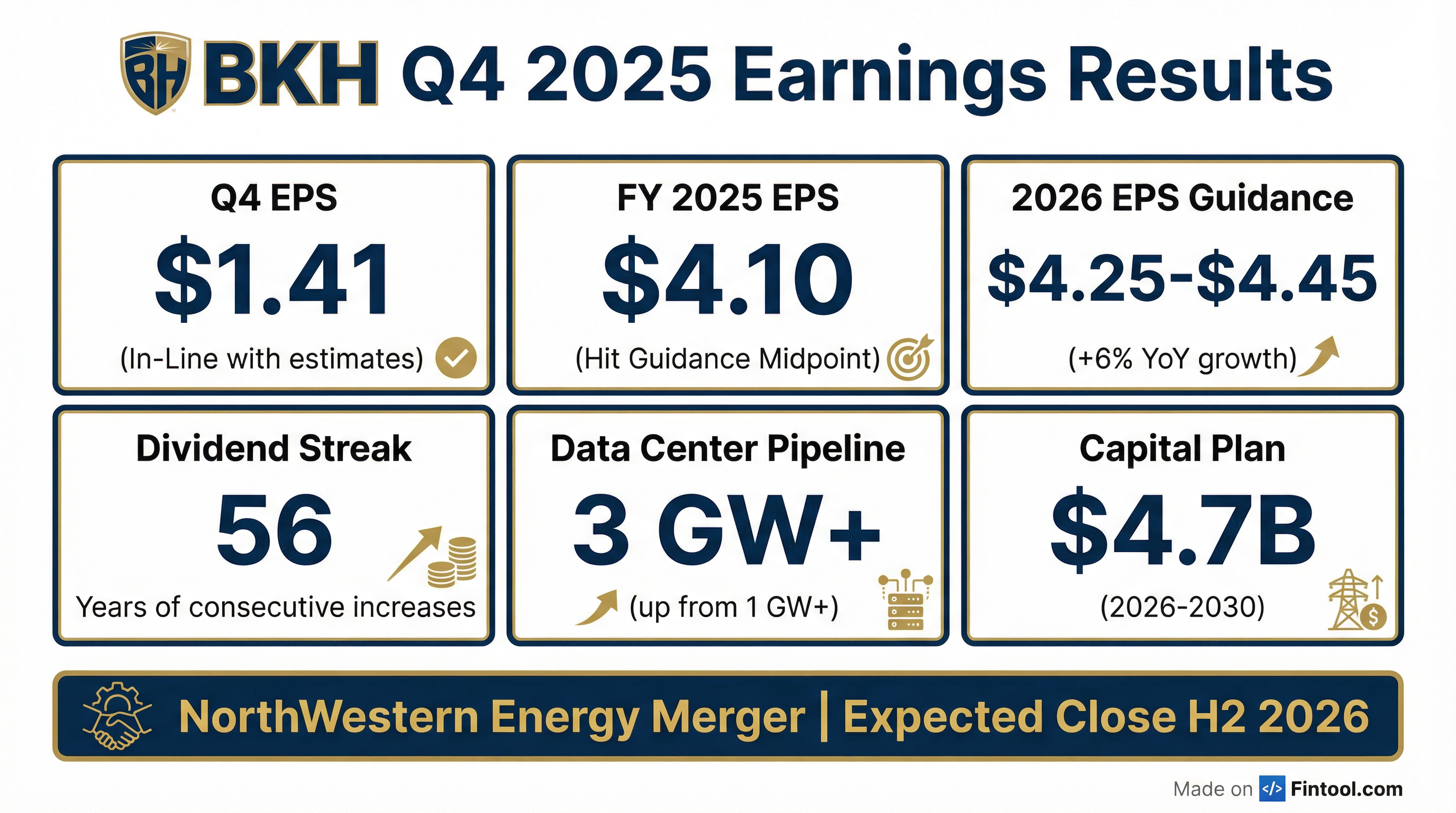

- Black Hills achieved the midpoint of its earnings guidance and long-term growth target for 2025, reporting an Adjusted EPS of $4.10.

- The company initiated 2026 Adjusted EPS guidance in the range of $4.25 to $4.45, representing 6% growth over 2025, and targets long-term EPS growth of 4% to 6% for 2026-2030.

- Black Hills provided an update on its tax-free, all-stock merger with NorthWestern Energy, noting joint regulatory applications were filed in Q4 2025 and shareholder votes are scheduled for April 2, 2026. The merger is projected to increase the combined company's target EPS growth rate to 5-7%.

- The company forecasts $4.7 billion in capital investment from 2026 to 2030 and extended its dividend increase track record to 55 consecutive years in 2025, with a projected 56th year in 2026.

- The data center pipeline has grown to 3 GW+ of load requests, with demand expected to contribute 10%+ of growing consolidated EPS beginning in 2028.

Feb 5, 2026, 4:00 PM

Black Hills Corporation Reports Q4 2025 Results, Issues 2026 Guidance, and Progresses Merger and Data Center Growth

BKH

Earnings

Guidance Update

M&A

- Black Hills Corporation (BKH) reported adjusted EPS of $4.10 for full-year 2025, marking a 5% increase compared to 2024, and successfully achieved the midpoint of its earnings guidance.

- For 2026, the company initiated adjusted earnings guidance in the range of $4.25-$4.45 per share, representing 6% growth at the midpoint over 2025, and anticipates a significantly lower equity need of $50 million-$70 million.

- The strategic merger with NorthWestern Energy, announced in August 2025, is progressing with all joint applications submitted to regulators, and the company intends to finalize the merger within the second half of 2026.

- Black Hills tripled its data center pipeline to over 3 gigawatts in 2025, with existing demand from Meta and Microsoft expected to contribute more than 10% of consolidated EPS starting in 2028. The company also extended its industry-leading dividend track record to 56 consecutive years in 2026.

Feb 5, 2026, 4:00 PM

Black Hills Corporation Reports Q4 2025 Results, Issues 2026 Guidance, and Provides Merger Update

BKH

Earnings

Guidance Update

M&A

- Black Hills Corporation reported adjusted EPS of $4.10 for the full year 2025, marking a 5% increase from $3.91 in 2024, and achieved the midpoint of its earnings guidance.

- For 2026, the company initiated adjusted earnings guidance in the range of $4.25-$4.45 per share, anticipating 6% growth at the midpoint over 2025 and aiming for the upper half of its 4%-6% long-term growth target.

- The strategic merger with NorthWestern Energy is progressing, with joint applications submitted to regulators and an S-4 filing made, targeting finalization in the second half of 2026.

- Black Hills expanded its data center pipeline to over 3 GW in 2025, with 600 MW of demand from existing customers (Meta and Microsoft) projected by 2030 to contribute more than 10% of consolidated EPS starting in 2028. The company also increased its dividend for the 56th consecutive year.

Feb 5, 2026, 4:00 PM

Black Hills Corp. Reports Q4 and Full-Year 2025 Results and Initiates 2026 Earnings Guidance

BKH

Earnings

Guidance Update

M&A

- Black Hills Corp. reported 2025 GAAP EPS of $3.98 and adjusted EPS of $4.10, meeting the midpoint of its earnings guidance range.

- The company initiated 2026 adjusted EPS guidance in the range of $4.25 to $4.45, reflecting 6% growth over 2025, and targets the upper half of its 4% to 6% long-term adjusted EPS growth off 2023.

- A capital investment of $4.7 billion is forecasted from 2026 to 2030, with plans to serve a data center pipeline exceeding 3 GW, including 600 MW in the five-year plan.

- Black Hills Corp. extended its track record of dividend increases to 56 consecutive years.

- The merger with NorthWestern Energy, announced on August 19, 2025, is anticipated to close in the second half of 2026.

Feb 4, 2026, 9:28 PM

Black Hills Corp. Reports 2025 Full-Year Results and Initiates 2026 Guidance

BKH

Earnings

Guidance Update

Dividends

- Black Hills Corp. reported 2025 GAAP EPS of $3.98 and adjusted EPS of $4.10, achieving the midpoint of its earnings guidance range and reflecting approximately 5% growth over 2024 adjusted EPS.

- The company initiated its 2026 adjusted EPS guidance in the range of $4.25 to $4.45, representing 6% growth over 2025, excluding costs related to the pending merger with NorthWestern Energy.

- Black Hills Corp. extended its track record of dividend increases to 56 consecutive years and approved a quarterly dividend of $0.703 per share payable on March 1, 2026.

- The company is advancing plans to serve a data center pipeline of more than 3 GW, including 600 MW in its five-year plan, and plans to invest $4.7 billion of capital from 2026 through 2030.

Feb 4, 2026, 9:15 PM

Black Hills Corp. Completes Ready Wyoming Electric Transmission Project

BKH

New Projects/Investments

- Black Hills Corp. has completed construction and energized its 260-mile, $350 million Ready Wyoming electric transmission expansion project.

- The final phases of the project were placed in service on schedule in December 2025, interconnecting the company's electric systems in South Dakota and Wyoming.

- This project is expected to maintain long-term cost stability for customers, enhance system resiliency, and provide expanded access to energy markets.

- Approximately $300 million of the total transmission investment will be recovered through the Wyoming Transmission Rider, with the remaining $50 million expected through base rates during the next rate review.

Jan 7, 2026, 10:13 PM

Black Hills Corp. Nebraska Gas Utility Receives Rate Approval

BKH

New Projects/Investments

Guidance Update

- Black Hills Corp.'s natural gas utility subsidiary in Nebraska received approval for new rates from the Nebraska Public Service Commission, allowing for the recovery of over $453 million in system investments since 2020.

- The approved settlement agreement is projected to generate a total annual base rate revenue increase of $42.4 million, effective January 1, 2026.

- The new rates are based on a return on equity of 9.85% and a capitalization structure of 50.5% equity and 49.5% debt.

Dec 9, 2025, 9:15 PM

Black Hills Corporation Reaffirms 2025 EPS Guidance and Provides Merger Update

BKH

Guidance Update

M&A

New Projects/Investments

- Black Hills Corporation (BKH) reaffirmed its full-year 2025 adjusted earnings guidance range of $4.00 to $4.20 and reported Q3 2025 adjusted earnings per share of $0.45. The company targets 4% to 6% long-term EPS growth, expecting to deliver in the upper half of this range starting in 2026.

- The company forecasts $4.7 billion in capital investments from 2025 to 2029, including $1 billion in 2025. These investments support strategic initiatives such as a growing data center pipeline of 3 GW+, with 500 MW of data center load by 2029 expected to contribute 10%+ to EPS beginning in 2028. The Ready Wyoming transmission expansion project is also on track for completion by year-end 2025.

- The proposed merger with NorthWestern Energy Group, Inc. is progressing, with regulatory applications filed in Montana, Nebraska, and South Dakota, and an expected FERC filing in Q4 2025. The merger is anticipated to close in Q4 2026.

Nov 6, 2025, 4:00 PM

Quarterly earnings call transcripts for BLACK HILLS CORP /SD/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more