Earnings summaries and quarterly performance for Bullish.

Research analysts who have asked questions during Bullish earnings calls.

Brian Bedell

Deutsche Bank

7 questions for BLSH

Chris Brendler

Rosenblatt Securities

7 questions for BLSH

Joseph Vafi

Canaccord Genuity - Global Capital Markets

7 questions for BLSH

Bill Papanastasiou

Keefe, Bruyette & Woods (KBW)

5 questions for BLSH

Brett Knoblauch

Cantor Fitzgerald & Co.

5 questions for BLSH

Peter Christiansen

Citigroup Inc.

5 questions for BLSH

Dan Fannon

Jefferies & Company Inc.

4 questions for BLSH

Kenneth Worthington

JPMorgan Chase & Co.

3 questions for BLSH

Ed Engel

Compass Point

2 questions for BLSH

Gareth Gacetta

Cantor Fitzgerald

2 questions for BLSH

Guru (on for Owen Lau)

Oppenheimer

2 questions for BLSH

Guruwan Farinah

Oppenheimer & Co. Inc.

2 questions for BLSH

Ken Worthington

JPMorgan

2 questions for BLSH

Madeline Daleiden

JPMorgan Chase & Co.

2 questions for BLSH

Owen Lau

Oppenheimer & Co. Inc.

2 questions for BLSH

Pete Christiansen

Citi

2 questions for BLSH

Rayna Kumar

Oppenheimer & Co. Inc.

2 questions for BLSH

Daniel Fannon

Jefferies Financial Group Inc.

1 question for BLSH

Recent press releases and 8-K filings for BLSH.

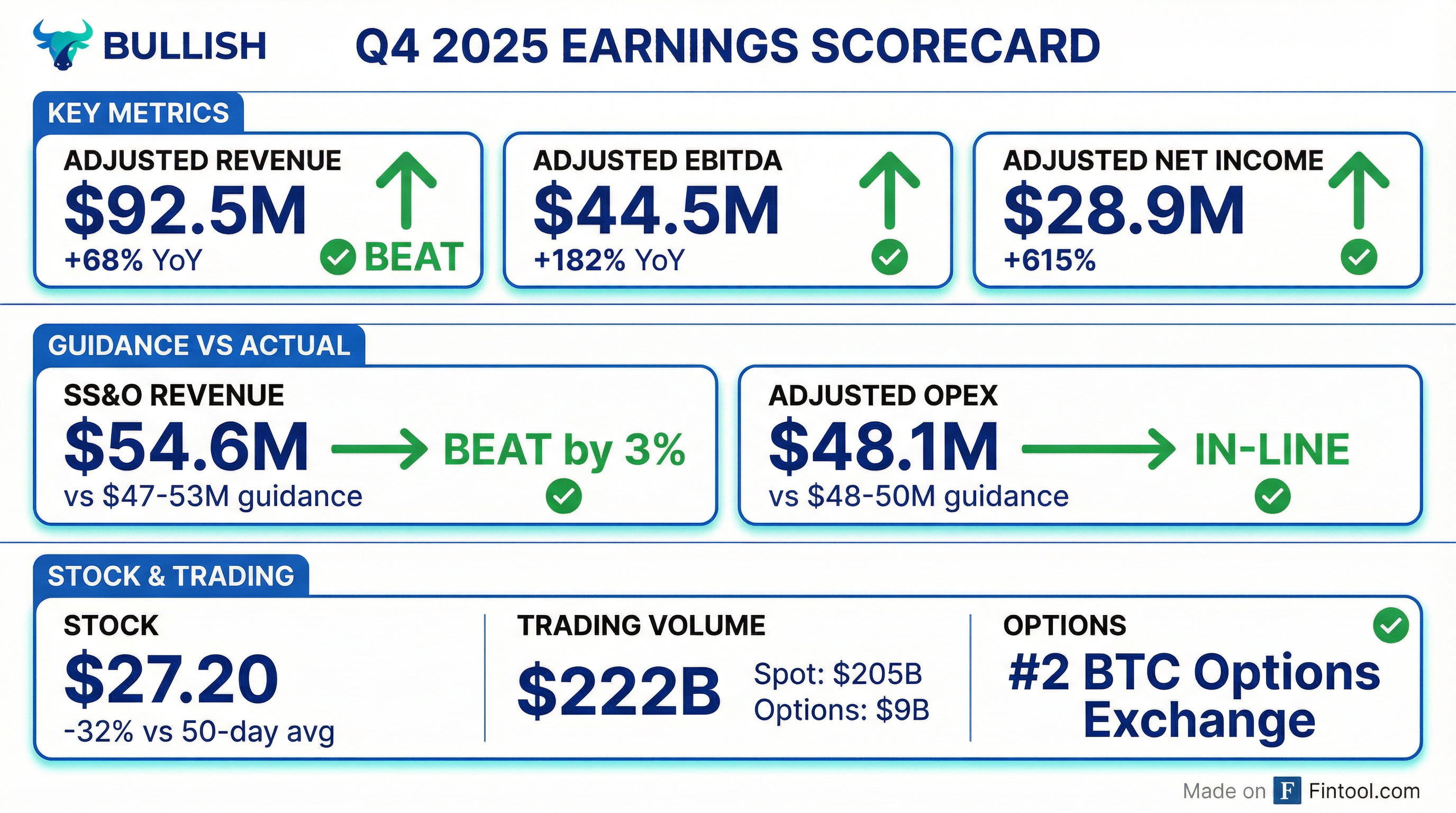

- Bullish (BLSH) reported Adjusted Revenue of $92.5 million for Q4 2025 and $288.5 million for the full year 2025, marking record growth.

- Adjusted EBITDA reached $44.5 million in Q4 2025 and $94.3 million for FY 2025, with Adjusted Net Income at $28.9 million for the quarter and $38.8 million for the full year.

- The company's options trading volume surpassed $9 billion and reached an open interest high of $4 billion by January 31, 2026, positioning Bullish as the #2 exchange for BTC options open interest.

- Bullish achieved a key U.S. regulatory milestone by securing transfer agent registration in December 2025, and CoinDesk Indices became the #1 indexer by market share for digital assets in Q4 2025.

- For 2026, the company provided guidance projecting Subscription, Services and Other Revenue between $220.0 million and $250.0 million and Adjusted Operating Expenses between $210.0 million and $230.0 million.

- Bullish reported strong financial performance for Q4 and full year 2025, with record SS&O revenue of $54.6 million in Q4, an increase of 284% year-over-year, and Adjusted EBITDA of $44.5 million, up 181% year-over-year. Full year 2025 total adjusted revenue reached $288.5 million, representing 35% growth.

- The company issued 2026 guidance, expecting SS&O revenue between $220 million and $250 million, reflecting approximately 50% year-over-year growth at the midpoint, and adjusted operating expenses between $210 million and $230 million.

- Bullish is strategically focused on expanding its market leadership in real-world asset tokenization and liquidity services, growing its regulated institutional derivatives market presence, and accelerating its digital assets indices and insights businesses, as evidenced by CoinDesk Indices serving 30 single-token ETFs in 2025.

- The company is actively pursuing opportunities for organic growth and M&A, leveraging its position at the intersection of increasing regulatory clarity, growing traditional finance adoption, and expanding tokenization use cases, and is optimistic about the potential passage of a U.S. Market Structure Bill.

- Bullish reported record SS&O revenue of $54.6 million in Q4 2025, an increase of 284% year-over-year, contributing to full year 2025 SS&O revenue of $157.7 million, up nearly 160% from 2024. Adjusted EBITDA reached $44.5 million in Q4 2025, a 55% quarter-over-quarter and 181% year-over-year increase, with full year 2025 Adjusted EBITDA at $94.3 million.

- The company launched options trading in Q4 2025, achieving over $2 billion in open interest by quarter-end and reaching a high of 29% volume market share earlier in 2026. Bullish also secured Tier 1 licenses, including the New York BitLicense, MiCA in Europe, and authorizations from Hong Kong's SFC and Germany's BaFin.

- For 2026, Bullish expects SS&O revenue between $220 million and $250 million and adjusted operating expenses between $210 million and $230 million. The company's priorities include continued growth in its exchange, establishing market leadership in tokenization of real-world assets, and accelerating positions in digital assets indices and insights.

- Bullish reported strong financial results for Q4 and full year 2025, with record SS&O revenue of $54.6 million in Q4, an increase of 284% year-over-year, and Adjusted EBITDA of $44.5 million, up 181% year-over-year. For 2026, the company expects SS&O revenue between $220 million-$250 million and adjusted operating expenses between $210 million-$230 million.

- The company successfully launched options trading in Q4 2025, achieving over $2 billion in open interest by quarter-end and reaching a high of $4 billion earlier in 2026, securing its position as the number two Bitcoin options platform globally by open interest.

- Bullish expanded its regulatory footprint by obtaining Tier 1 licenses, including the New York BitLicense, MiCA in Europe, and additional authorizations from Hong Kong's SFC and Germany's BaFin.

- The liquidity services business continued its growth, adding several new partners in Q4 2025, and CoinDesk Indices served as the benchmark data provider for 30 single-token ETFs launched in 2025, including 15 of 39 new digital asset ETFs in Q4. A partnership with Intercontinental Exchange (ICE) for futures benchmarked to CoinDesk Indices is expected to launch next week.

- Bullish released its January 2026 monthly metrics on February 5, 2026, which include trading volume, average trading spread, and volatility for Bitcoin and Ethereum.

- For January 2026, the Total Trading Volume was $52.2 billion.

- The Spot Average Trading Spread for January 2026 was 1.74 bps.

- Monthly Average Volatility for January 2026 was 33% for Bitcoin and 46% for Ethereum.

- The metrics provided are unaudited and preliminary.

- Bullish reported record Adjusted revenue of $92.5 million, Adjusted EBITDA of $44.5 million, and Adjusted net income of $28.9 million for Q4 2025, with record Adjusted revenue growth for the Full Year 2025.

- The company posted a Net loss of $(563.6) million for Q4 2025 and a Net loss of $(785.5) million for Full Year 2025.

- Bullish's options trading surpassed $9 billion in volume and reached an open interest high of $4 billion, establishing it as the #2 exchange for BTC options open interest.

- For the full year 2026, the company provided guidance of Subscription, services & other revenue of $220.0 million to $250.0 million and Adjusted operating expense of $210.0 million to $230.0 million.

- Bullish (NYSE: BLSH) released its November 2025 monthly metrics on December 4, 2025, which include trading volume, average trading spread, and measures of volatility for Bitcoin and Ethereum.

- For November 2025, the total trading volume was $80.8 billion, with spot trading volume accounting for $75.3 billion.

- The average trading spread for November 2025 was 1.85 bps, while monthly average volatility was 45% for Bitcoin and 68% for Ethereum.

- Bullish reported record financial results for Q3 2025, with adjusted revenue of $76.5 million, adjusted EBITDA of $28.6 million, and adjusted net income of $13.8 million.

- The company fully launched its options franchise on October 31, trading over $1 billion in volume in just over two weeks with $1 billion in open interest, and also launched its U.S. exchange business, onboarding major retail and institutional brokers.

- Liquidity services, identified as Bullish's fastest-growing business, saw its active partner count increase by 100% sequentially in Q3 2025 and expanded its Layer 1 blockchain relationships.

- For Q4 2025, Bullish anticipates SS&O revenue between $47 million and $53 million and adjusted operating expenses between $48 million and $50 million, expecting materially higher transaction revenue compared to Q2 and Q3 2025.

- Bullish reported record Q3 2025 adjusted revenue of $76.5 million, marking a 34% sequential and 72% year-over-year increase, alongside record adjusted EBITDA of $28.6 million and adjusted net income of $13.8 million.

- The company fully launched its options franchise in late October, quickly achieving over $1 billion in trading volume and $1 billion in open interest in just over two weeks, and also launched its U.S. exchange business, onboarding marquee customers faster than anticipated.

- Liquidity services emerged as Bullish's fastest-growing business, with its active partner count increasing 100% sequentially in Q3, and the company has submitted an application to the SEC for regulatory approval as a transfer agent to bolster its tokenization strategy.

- For Q4 2025, Bullish anticipates materially higher transaction revenue and has provided guidance for SS&O revenue between $47 million and $53 million, with adjusted operating expenses projected to be between $48 million and $50 million.

- Bullish reported record Q3 2025 results, with adjusted revenue of $76.5 million, adjusted EBITDA of $28.6 million, and adjusted net income of $13.8 million. Total adjusted revenue increased 34% sequentially and 72% year-over-year, exceeding the high end of guidance.

- The company's liquidity services business is its fastest-growing segment, adding a record number of partners in Q3 2025, resulting in a 100% sequential increase in active partner count. Bullish also expanded its layer one blockchain relationships by adding Canton, Cardano, Midnight, and VeChain.

- Bullish fully launched its options franchise and U.S. exchange business in Q4 2025, with the options exchange trading over $1 billion in volume and achieving approximately $1 billion in open interest in just over two weeks. The company also actively onboarded new U.S. customers, including major retail and institutional brokers.

- For Q4 2025, Bullish expects SS&O revenue to be between $47 million and $53 million and adjusted operating expenses between $48 million and $50 million, anticipating materially higher transaction revenue compared to Q2 and Q3 2025.

Quarterly earnings call transcripts for Bullish.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more