Earnings summaries and quarterly performance for BP.

Research analysts who have asked questions during BP earnings calls.

Lucas Herrmann

BNP Paribas

8 questions for BP

Paul Cheng

Scotiabank

8 questions for BP

Henry Tarr

Berenberg

7 questions for BP

Kim Fustier

HSBC

7 questions for BP

Biraj Borkhataria

Royal Bank of Canada

6 questions for BP

Christopher Kuplent

Bank of America

6 questions for BP

Doug Leggate

Wolfe Research

6 questions for BP

Irene Himona

Sanford C. Bernstein

6 questions for BP

Lydia Rainforth

UBS

6 questions for BP

Alejandro Vigil

Santander

5 questions for BP

Peter Low

Redburn Atlantic

5 questions for BP

Josh Stone

UBS

4 questions for BP

Mark Wilson

Jefferies

4 questions for BP

Maurizio Carulli

Quilter Cheviot

4 questions for BP

Michele Della Vigna

Goldman Sachs

4 questions for BP

Ryan Todd

Simmons Energy

4 questions for BP

Alastair Syme

Citigroup

3 questions for BP

Jason Gabelman

TD Cowen

3 questions for BP

Joshua Stone

UBS Group AG

3 questions for BP

Alejandro Lavin

Santander

2 questions for BP

Alice Vilma

Morgan Stanley

2 questions for BP

Al Syme

Citi

2 questions for BP

Bertrand Hodee

Kepler Cheuvreux

2 questions for BP

Chris Copeland

Bank of America

2 questions for BP

Douglas George Blyth Leggate

Wolfe Research

2 questions for BP

Giacomo Romeo

Jefferies

2 questions for BP

Jeff Nanna

TPH

2 questions for BP

Martin Ratz

Morgan Stanley

2 questions for BP

Matthew Lofting

JPMorgan

2 questions for BP

Matt Lofting

JPMorgan Chase & Co.

2 questions for BP

Roger Read

Wells Fargo & Company

2 questions for BP

Ahmed Ben Salem

ODDO BHF

1 question for BP

Joshua Eliot Stone

UBS

1 question for BP

Makeley

Goldman Sachs

1 question for BP

Makely

Goldman Sachs

1 question for BP

Martijn Rats

Morgan Stanley

1 question for BP

Recent press releases and 8-K filings for BP.

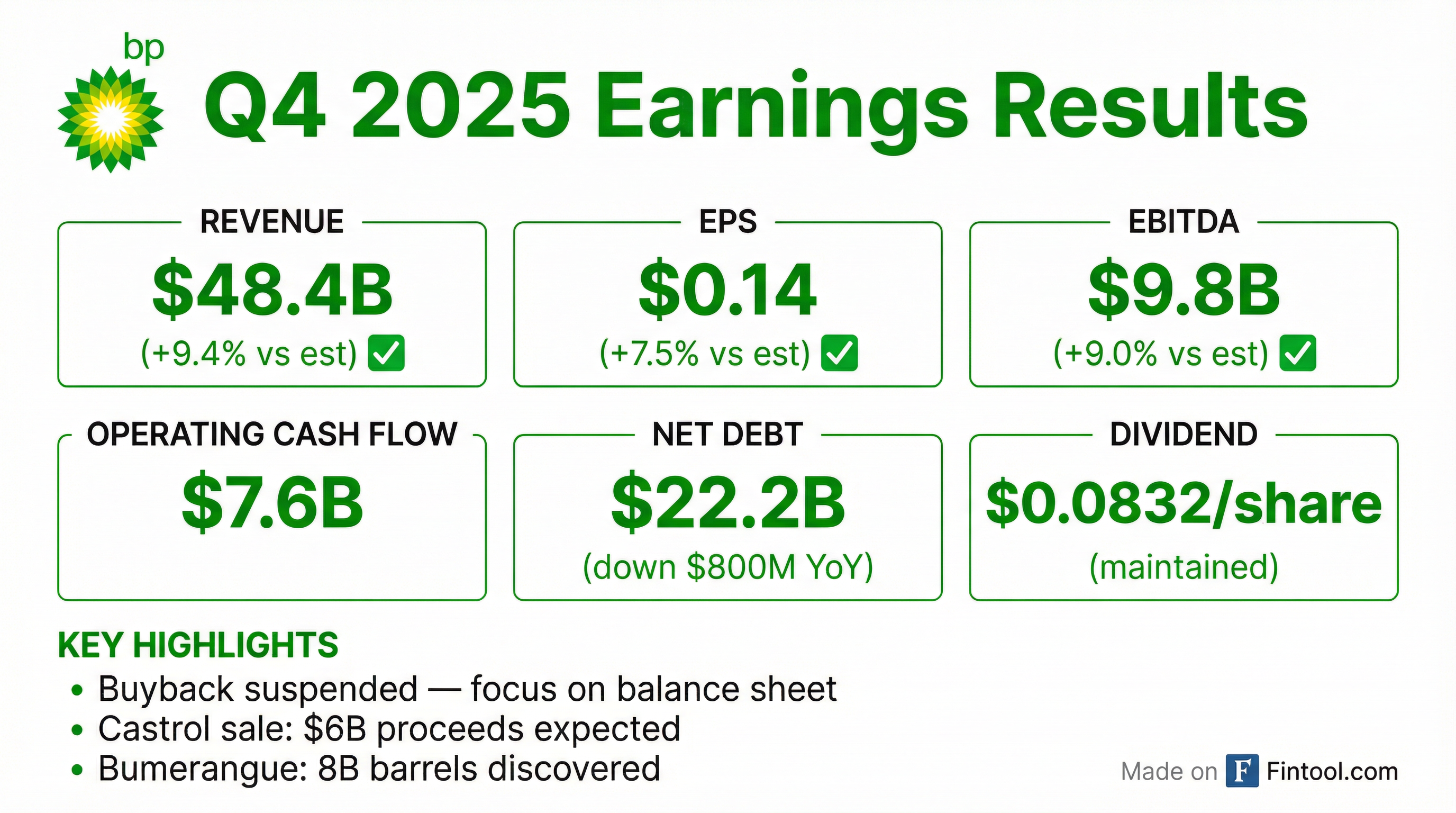

- BP reported a full year 2025 underlying replacement cost (RC) profit of $7.5 billion and operating cash flow of $24.5 billion.

- The company's net debt at the end of the fourth quarter 2025 was $22.2 billion, a decrease from $26.1 billion at the end of the third quarter 2025.

- The board decided to suspend the share buyback and fully allocate excess cash to accelerate strengthening of the balance sheet.

- BP reached an agreement to sell a 65% shareholding in Castrol at an enterprise value of $10.1 billion, with the transaction expected to complete by the end of 2026.

- The group's structural cost reduction target was increased to $5.5-6.5 billion by end 2027.

- BP reported an underlying replacement cost profit of $7.5 billion and operating cash flow of $24.5 billion for 2025, with adjusted free cash flow growing by approximately 55% on a price-adjusted basis to $13 billion.

- Net debt decreased by $800 million to $22.2 billion at the end of 2025, and the company increased its structural cost reduction target to $5.5 billion-$6.5 billion by 2027, having already achieved $2.8 billion.

- The board decided to suspend share buybacks to prioritize balance sheet strengthening, while maintaining a commitment to increase dividends by at least 4% per year.

- Operationally, BP achieved a 90% reserves replacement ratio, reduced operational emissions by 37% compared to 2019, and made 12 discoveries in 2025, including the Bumerangue find in Brazil with an initial estimate of ~8 billion barrels of liquids in place.

- The company also announced the sale of a 65% shareholding in Castrol and tightened its 2026 CapEx guidance to $13 billion-$13.5 billion.

- BP reported underlying replacement cost profit of $7.5 billion and operating cash flow of $24.5 billion in 2025. Adjusted free cash flow grew by approximately 55% on a price-adjusted basis to $13 billion in 2025.

- The company's net debt at the end of 2025 was $22.2 billion, an $800 million reduction from the end of 2024, with a target to reach $14-$18 billion by the end of 2027.

- BP has suspended share buybacks to prioritize strengthening the balance sheet and will continue to increase dividends by at least 4% per year.

- The structural cost reduction target was increased to $5.5-$6.5 billion by 2027, with $2.8 billion already delivered, including $2 billion in 2025.

- The $20 billion divestment program is progressing, with over $11 billion completed or announced, including the sale of a 65% shareholding in Castrol.

- BP reported an underlying replacement cost profit (net income) of $7.5 billion and operating cash flow of $24.5 billion for 2025.

- The company's net debt decreased by $800 million to $22.2 billion at the end of 2025, and adjusted free cash flow increased by approximately 55% in 2025 on a price-adjusted basis.

- The board decided to suspend share buybacks and fully allocate excess cash to the balance sheet, aiming for net debt between $14 billion-$18 billion by the end of 2027.

- BP increased its structural cost reduction target to $5.5 billion-$6.5 billion by 2027 (from $4 billion-$5 billion), having already achieved $2.8 billion in cumulative reductions, including $2 billion in 2025.

- For 2026, CapEx guidance is tightened to $13 billion-$13.5 billion, and the company expects to receive $3 billion-$4 billion in divestment proceeds.

- BP reported a loss attributable to shareholders of $3.4 billion for the fourth quarter of 2025, compared to a loss of $2.0 billion in the same period of 2024, with the full year 2025 profit at $55 million.

- The company's underlying replacement cost (RC) profit for Q4 2025 was $1.5 billion, an increase from $1.2 billion in Q4 2024, however, the full year underlying RC profit decreased to $7.5 billion from $8.9 billion in 2024.

- Adjusting items in Q4 2025 included a net adverse pre-tax impact of $3.9 billion, primarily due to $4.6 billion in impairments related to transition businesses in the gas & low carbon energy segment.

- Operating cash flow for Q4 2025 was $7.6 billion, and net debt stood at $22.2 billion at the end of the fourth quarter. BP also announced a dividend of 8.320 cents per ordinary share for Q4 2025 and settled $826 million in share repurchases during the quarter.

- BP reported a Q4 2025 underlying replacement cost profit of $1.5 billion and a full-year 2025 underlying replacement cost profit of $7.5 billion, with operating cash flow of $24.5 billion for the full year.

- The board has decided to suspend the share buyback and retire the previous shareholder distribution guidance, instead prioritizing the allocation of excess cash to strengthen the balance sheet.

- The company recognized $4 billion in impairments after tax in Q4 2025, largely related to its transition businesses, and reduced net debt to $22.2 billion by the end of the quarter.

- For full year 2026, BP expects capital expenditure of $13 billion-$13.5 billion and divestment proceeds of $9 billion-$10 billion, including $6 billion from the Castrol transaction.

- BP's total underlying replacement cost profit for 2025 was $7.5 billion, with operating cash flow at $24.5 billion.

- The board has suspended the share buyback and retired the 30%-40% operating cash flow distribution guidance to prioritize strengthening the balance sheet.

- The company completed and announced over $11 billion in divestments in 2025, progressing towards its $20 billion disposal program, and increased its structural cost reduction target to $5.5 billion-$6.5 billion by 2027.

- For Q4 2025, BP reported an IFRS loss of $3.4 billion, primarily due to approximately $4 billion in after-tax impairments related to transition businesses.

- For full year 2026, capital expenditure is projected to be $13 billion-$13.5 billion, and divestment proceeds are expected to be $9 billion-$10 billion, with net debt anticipated to increase in the first half before falling significantly in the second half.

- BP reported Q4 2025 underlying replacement cost profit of $1.5 billion and full-year 2025 underlying replacement cost profit of $7.5 billion, with full-year operating cash flow of $24.5 billion.

- The board suspended the share buyback program to prioritize balance sheet strengthening, retiring the previous shareholder distribution guidance, and reduced net debt to $22.2 billion by the end of Q4 2025.

- BP announced the sale of a 65% shareholding in Castrol for approximately $6 billion, with proceeds to be fully used to reduce net debt, contributing to over $11 billion in divestments towards a $20 billion program.

- The company recognized Q4 2025 impairments of around $4 billion after tax, mainly in transition businesses, and set 2026 capital expenditure guidance at $13 billion-$13.5 billion.

- BP p.l.c. continued its share buyback program, announced on 4 November 2025, by purchasing its ordinary shares on the London Stock Exchange and Cboe (UK).

- Between January 5, 2026, and January 30, 2026, the company purchased a total of 57,361,426 ordinary shares.

- These purchased shares are intended to be transferred into treasury.

- Separately, Norges Bank's total voting rights in BP p.l.c. decreased from 3.995550% to 2.999070% as of January 2, 2026.

- BP anticipates post-tax adjusting items relating to impairments in the range of $(4) to (5) billion for the fourth quarter of 2025, primarily within its transition businesses in the gas and low carbon energy segment.

- Net debt at the end of Q4 2025 is expected to be $22 to 23 billion, a reduction from $26.1 billion at the end of Q3 2025, driven by divestment proceeds of approximately $3.5 billion in Q4, bringing the full year total to around $5.3 billion.

- The underlying effective tax rate for full year 2025 is now projected to be around 42%, an increase from the previous guidance of around 40%.

- For Q4 2025, reported upstream production is expected to be broadly flat compared to the prior quarter, with realizations in the oil production & operations segment and gas & low carbon energy segment expected to have negative impacts of $(0.2) to (0.4) billion and $(0.1) to (0.3) billion, respectively.

Fintool News

In-depth analysis and coverage of BP.

BP Halts Buybacks for First Time Since 2020 as Oil Major Pivots to Balance Sheet Repair

BP Writes Off $5 Billion on Green Energy as Activist-Backed Pivot to Fossil Fuels Accelerates

BP Sells Majority Stake in Castrol to Stonepeak for $6B in Landmark Divestiture

Harbour Energy Enters Gulf of America With $3.2 Billion LLOG Acquisition

Quarterly earnings call transcripts for BP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more