Earnings summaries and quarterly performance for BrightSpire Capital.

Executive leadership at BrightSpire Capital.

Board of directors at BrightSpire Capital.

Research analysts who have asked questions during BrightSpire Capital earnings calls.

Gaurav Mehta

Alliance Global Partners

5 questions for BRSP

Jason Weaver

Unaffiliated Analyst

4 questions for BRSP

Steven Delaney

Citizens JMP Capital

4 questions for BRSP

Chris Muller

Citizens Capital Markets

2 questions for BRSP

Gabe Poggi

Raymond James

2 questions for BRSP

John Nickodemus

BTIG

2 questions for BRSP

Matthew Erdner

JonesTrading Institutional Services

2 questions for BRSP

Randolph Binner

B. Riley Financial, Inc.

2 questions for BRSP

Timothy D'Agostino

B. Riley Securities

2 questions for BRSP

Eric Dray

Bank of America

1 question for BRSP

Matthew Howlett

B. Riley Securities

1 question for BRSP

Randy Binner

B. Riley Securities

1 question for BRSP

Stephen Laws

Raymond James

1 question for BRSP

William Catherwood

BTIG

1 question for BRSP

Recent press releases and 8-K filings for BRSP.

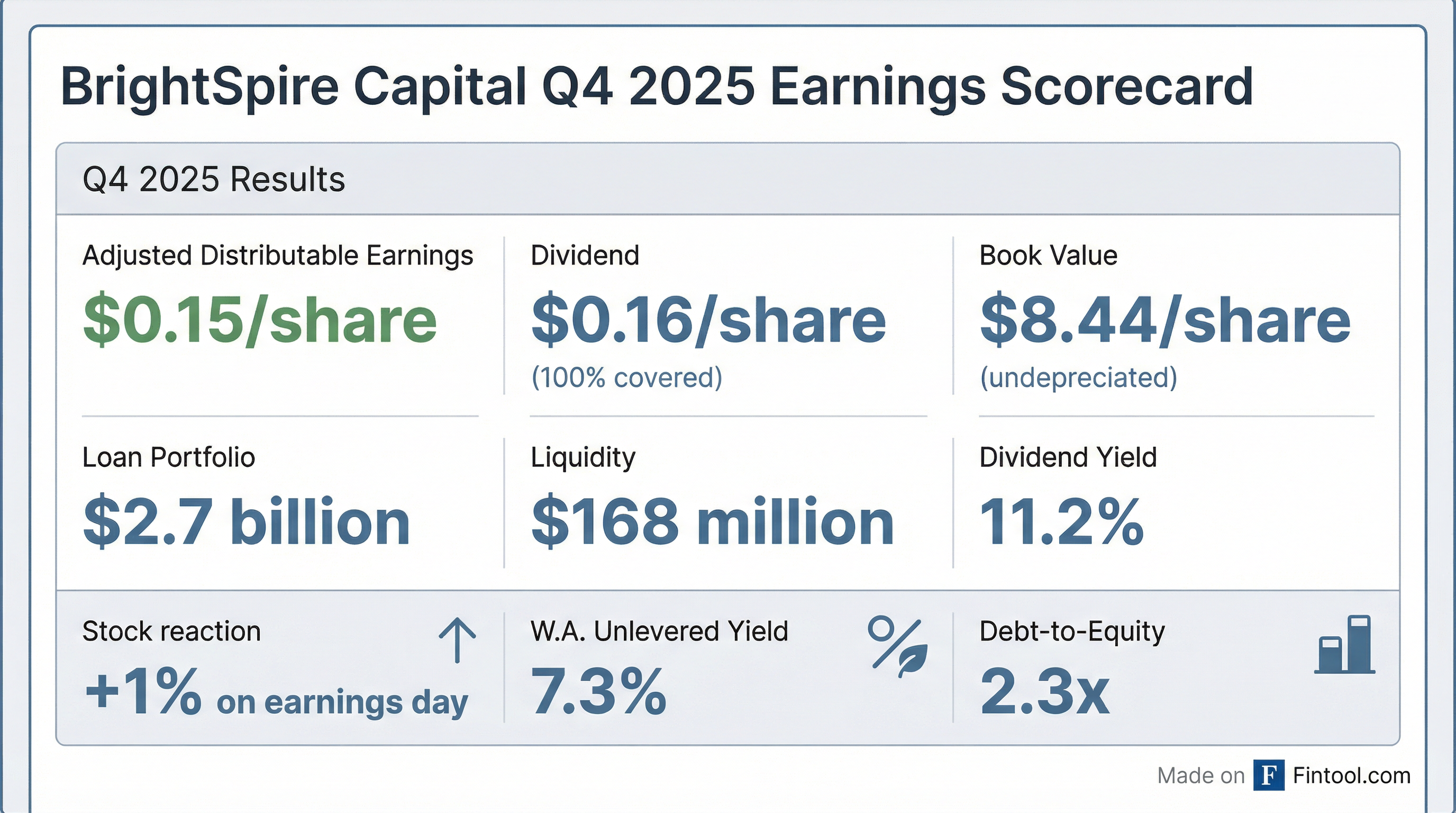

- BrightSpire Capital reported a GAAP net loss of $14.4 million or $0.12 per share and adjusted distributable earnings of $19.3 million or $0.15 per share for Q4 2025. The GAAP net book value decreased to $7.30 per share as of December 31, 2025.

- Q4 2025 was the largest funding quarter since restarting originations, with 13 new loans totaling $416 million closed, increasing the loan portfolio by $315 million to $2.7 billion. The company anticipates the loan book will grow to nearly $3 billion by mid-year and target at least $3.5 billion by year-end 2026.

- The company made significant progress in resolving watchlist loans and REO properties, aiming to reduce watchlist exposure to two loans totaling approximately $66 million and to monetize the majority of remaining REO assets in 2026. BrightSpire also closed a $955 million fourth managed CLO and repurchased approximately 1.1 million shares at an average price of $5.39 during Q4 2025.

- BrightSpire Capital reported an adjusted distributable earnings (ADE) of $0.15 per share for Q4 2025, which was $0.01 shy of breakeven for dividend coverage, although the full-year 2025 ADE of $0.64 per share fully covered the annual dividend. The company also reported a GAAP net loss of $14.4 million, or $0.12 per share, for the fourth quarter.

- The loan portfolio grew by 13% to $2.7 billion as of December 31, 2025, with $416 million in new loan commitments closed during Q4 2025, making it the most active origination quarter since restarting originations.

- Strategic acceleration of watchlist loan and REO asset resolutions led to a limited reduction in book value, with GAAP net book value at $7.30 per share and undepreciated book value at $8.44 per share as of December 31, 2025. Pro forma for anticipated sales, remaining watchlist exposure is projected to be $66 million, and REO exposure is $266 million.

- For 2026, the company's priorities include growing the loan book to approximately $3.5 billion, continuing to resolve remaining watchlist loans and monetize the majority of REO, executing a fifth CLO in the second half of the year, and reestablishing positive dividend coverage by year-end.

- BrightSpire Capital reported Q4 2025 Adjusted Distributable Earnings Per Share of $0.15 and full year 2025 Adjusted Distributable Earnings Per Share of $0.64.

- The company declared a Q4 2025 quarterly dividend of $0.16 per share, aligning with the full year 2025 dividend of $0.64 per share.

- As of December 31, 2025, total liquidity stood at $168 million, including $98 million in unrestricted cash, and the undepreciated book value per share was $8.44.

- In Q4 2025, the company repurchased 1.1 million shares for $6.0 million , and anticipates a ~70% reduction in watchlist loans and a ~15% reduction in REO assets subsequent to Q4 2025.

- BrightSpire Capital reported a Q4 2025 GAAP net loss of $14.4 million, or $0.12 per share, and adjusted distributable earnings of $19.3 million, or $0.15 per share. The full year 2025 adjusted DE of $0.64 per share fully covered the annual dividend.

- The loan portfolio grew to $2.7 billion as of December 31, 2025, driven by $416 million in new loan commitments during Q4 2025. The company aims to grow the loan book to approximately $3.5 billion by year-end 2026.

- Significant progress was made in resolving challenged assets, with the watchlist expected to reduce to two loans totaling $66 million and remaining REO to four assets totaling $266 million after anticipated sales. Approximately $200 million of equity is tied up in REO assets that the company plans to redeploy.

- BrightSpire closed its fourth managed CLO for $955 million in Q4 2025, featuring a $98 million ramp and a 2.5-year reinvestment period, enhancing lending capacity and flexibility.

- BrightSpire Capital, Inc. reported Q4 2025 Adjusted Distributable Earnings of $0.15 per share and a GAAP net loss of ($0.12) per share. For the full year 2025, Adjusted Distributable Earnings were $0.64 per share and the GAAP net loss was ($0.26) per share.

- As of December 31, 2025, the company's GAAP net book value was $7.30 per share and undepreciated book value was $8.44 per share.

- A quarterly cash dividend of $0.16 per share for Q4 2025 was declared and paid. Additionally, 1.1 million shares of Class A common stock were repurchased for $6.0 million in Q4 2025.

- The company's loan portfolio stood at $2.7 billion as of December 31, 2025. Subsequent to Q4 2025, watchlist loans are expected to decline by ~70% to $66 million and REO assets by ~15% to $266 million.

- CEO Michael J. Mazzei highlighted the strongest quarter of originations since late 2024 and successful execution of a new CRE CLO, with a strategic focus on portfolio growth and further resolution of REO and watchlist loans in 2026.

- BrightSpire Capital, Inc. reported a GAAP net loss of ($14.4) million, or ($0.12) per share, and Adjusted Distributable Earnings of $19.3 million, or $0.15 per share, for the fourth quarter of 2025. For the full year 2025, the company reported a GAAP net loss of ($31.1) million, or ($0.26) per share, and Adjusted Distributable Earnings of $83.6 million, or $0.64 per share.

- As of December 31, 2025, the GAAP net book value was $7.30 per share and the undepreciated book value was $8.44 per share. The CEO noted that the reduction in book value was largely driven by the decision to accelerate REO and watchlist resolutions and redeploy capital.

- The company had its strongest quarter of originations since late 2024, successfully executed a new CRE CLO, and made substantial progress on resolving REO and watchlist loans.

- A quarterly cash dividend of $0.16 per share for the fourth quarter of 2025 was declared and paid on January 15, 2026.

- BrightSpire Capital closed BRSP 2026-FL3, a $955 million Commercial Real Estate Collateralized Loan Obligation (CLO), on February 17, 2026.

- The CLO is collateralized by 29 first-lien floating-rate mortgages secured by 30 properties, predominantly multifamily (95%), and provides non-mark-to-market, non-recourse term financing.

- The transaction generated approximately $98 million in proceeds, which will be used for reinvestment in new loans.

- The company also intends to redeem its BRSP 2021-FL1 securitization on February 19, 2026.

- BrightSpire Capital, Inc. (BRSP) filed an 8-K on December 19, 2025, for Q3 2025, detailing an Eleventh Omnibus Amendment to a Second Amended and Restated Master Repurchase and Securities Contract Agreement with Morgan Stanley Bank, N.A..

- The original agreement with Morgan Stanley Bank, N.A. was dated April 23, 2019, and the document also references a separate Master Repurchase and Securities Contract with Wells Fargo Bank, National Association.

- Key terms include a revolving period extending to June 22, 2025, and covenants limiting the Seller's unsecured trade payables to $500,000 at any one time outstanding.

- The agreements specify maximum purchase percentages based on Loan-to-Value (LTV) ratios, for example, 80% for LTV less than or equal to 70%.

- BrightSpire Capital, Inc. (BRSP) entered into Amendment No. 1 to its Amended and Restated Credit Agreement on December 9, 2025.

- This amendment extends the Revolving Termination Date to December 8, 2028.

- The Amended Credit Agreement includes financial covenants for BrightSpire OP and its consolidated subsidiaries, requiring a minimum consolidated tangible net worth of at least $900,000,000 plus 70% of net cash proceeds from certain equity offerings after December 9, 2025.

- Other financial covenants stipulate an EBITDA plus lease expenses to fixed charges ratio of not less than 1.40 to 1.00, a minimum interest coverage ratio of not less than 3.00 to 1.00, and a consolidated total debt to consolidated total assets ratio not exceeding 0.80 to 1.00.

- BrightSpire Capital reported Adjusted Distributable Earnings of $0.16 per share and a GAAP Net Income of $0.01 per share for Q3 2025.

- The company declared and paid a quarterly dividend of $0.16 per share for Q3 2025, reflecting a 12.1% annualized dividend yield.

- As of September 30, 2025, BRSP maintained $280 million in total liquidity and reported an undepreciated book value per share of $8.68.

- The total loan portfolio was $2.4 billion with a weighted average unlevered all-in yield of 7.7%.

- During Q3 2025, BrightSpire Capital repurchased 0.2 million shares of Class A common stock for $1.0 million at a blended price of $5.33 per share.

Quarterly earnings call transcripts for BrightSpire Capital.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more