Earnings summaries and quarterly performance for BANCO SANTANDER CHILE.

Research analysts who have asked questions during BANCO SANTANDER CHILE earnings calls.

Neha Agarwala

HSBC

8 questions for BSAC

Daniel Mora

Credicorp Capital

4 questions for BSAC

Ernesto Gabilondo

Bank of America Merrill Lynch

4 questions for BSAC

Lindsey Shema

The Goldman Sachs Group, Inc.

4 questions for BSAC

Daniel Mora Ardila

Credicorp

3 questions for BSAC

Tito Labarta

Goldman Sachs

3 questions for BSAC

Yuri Fernandes

JPMorgan Chase & Co.

3 questions for BSAC

Andrew Garry

Morgan Stanley

2 questions for BSAC

Beatriz Bomfim de Abreu

Goldman Sachs Group, Inc.

2 questions for BSAC

Ernesto María Gabilondo Márquez

Bank of America

2 questions for BSAC

Ewald Stark

BICE

2 questions for BSAC

Pietro Nobili Ruz

BTG Pactual Chile

2 questions for BSAC

Alonso Aramburú

BTG Pactual

1 question for BSAC

Eric Ito

Bradesco BBI

1 question for BSAC

Olavo Arthuzo

UBS Group AG

1 question for BSAC

Paulo Gonzalez

Banchile Inversiones

1 question for BSAC

Recent press releases and 8-K filings for BSAC.

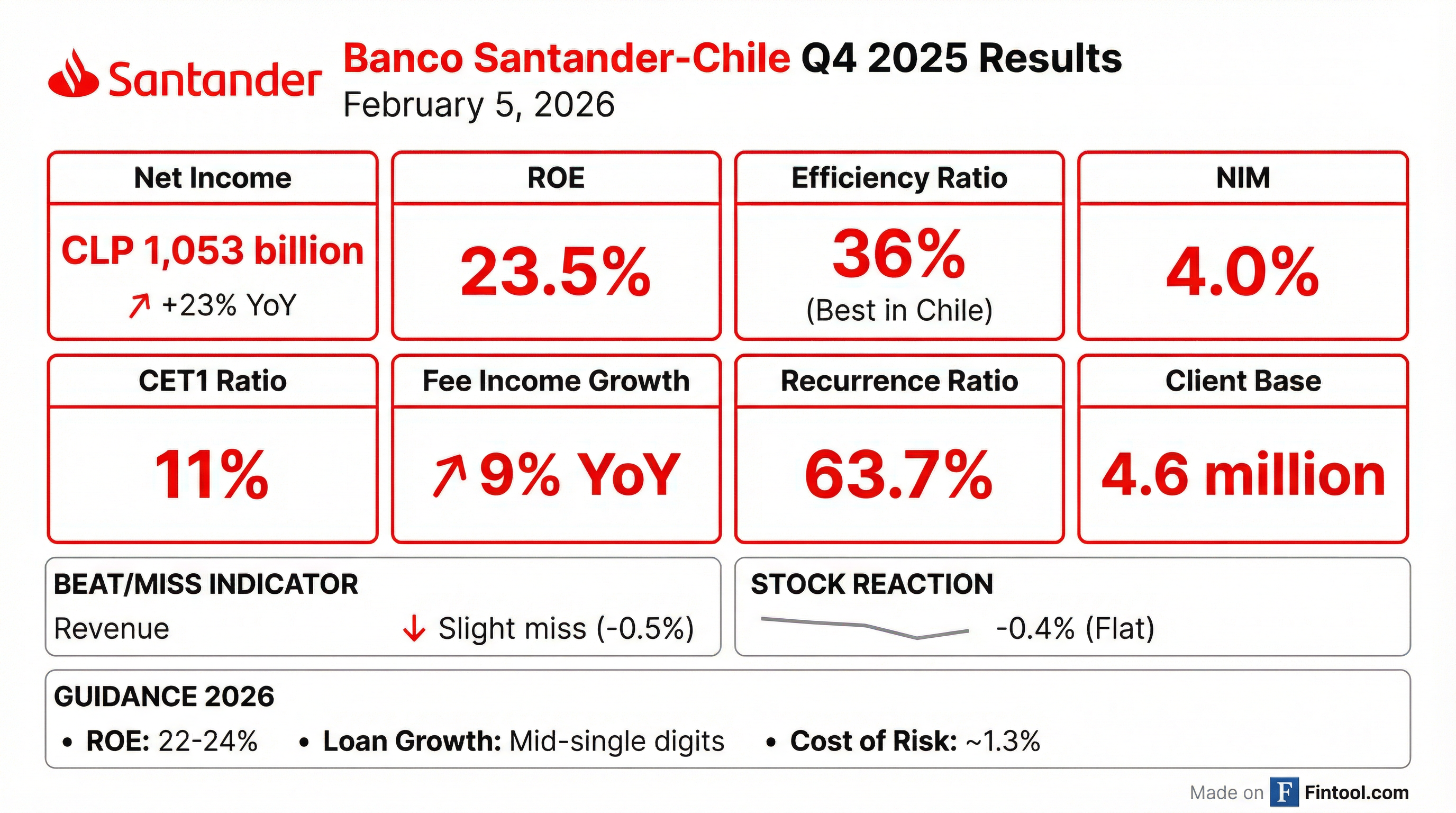

- BSAC reported net income of CLP 1,053 billion, a 23% year-over-year increase, with a Return on Average Equity (ROE) of 23.5% and an efficiency ratio of 36% for the full year 2025.

- The company provided 2026 guidance, anticipating an ROE between 22%-24%, mid-single-digit loan growth, and NIMs sustained at 4%, supported by an improving Chilean macroeconomic environment with projected GDP growth of a low 2%.

- Strategically, BSAC aims for over 5 million clients by 2026, maintaining its mid-30s efficiency ratio, and provisioned a 60% dividend payout from 2025 profits, backed by a robust CET1 ratio of 11%.

- Banco Santander-Chile reported a 23% year-over-year increase in net income to CLP 1,053 billion for 2025, achieving a return on average equity (ROE) of 23.5% and an efficiency ratio of 36%.

- The bank expects an ROE between 22%-24% for 2026, with mid-single-digit loan growth, sustained NIMs at 4% levels, and mid to high single-digit growth in fees and financial transactions. The cost of credit is projected to improve to around 1.3%.

- Chile's economy expanded by 2.3% in 2025 and is projected to grow between 2.1% and 2.4% in 2026, supported by improving business confidence and a more market-friendly policy environment, including potential corporate tax rate reductions.

- For the full year 2025, Banco Santander-Chile reported a net income of CLP 1,053 billion, an increase of 23% year-over-year, achieving a Return on Average Equity (ROE) of 23.5% and an efficiency ratio of 36%.

- The bank's 2026 guidance projects an ROE within the range of 22%-24%, with mid-single-digit loan growth, NIMs sustained at 4% levels, and fees and financial transactions expected to grow mid to high single digits.

- In December 2025, the bank's CET1 ratio reached 11%, significantly above its minimum requirement of 9.08%, and a 60% dividend payout for 2025 profits is provisioned.

- The bank completed the sale of a minority stake in Getnet Chile, receiving an initial payment of CLP 68 billion and securing a service agreement for 10% of net operating revenues for the next 7 years, with an automatic extension for an additional 3 years.

- Chile's macroeconomic environment improved in 2025, with business confidence moving into optimistic territory in early 2026; the new administration, taking office in March 2026, may propose reducing the corporate tax rate from 27% to 23%, subject to congressional approval.

- Banco Santander-Chile signed a purchase agreement to sell 49.99% of the shares of its subsidiary, Sociedad Operadora de Tarjetas de Pago Santander Getnet Chile S.A., to Getnet Payments, S.L..

- A service agreement was also signed between Banco Santander-Chile and the subsidiary.

- These actions were approved at an extraordinary shareholders' meeting held on January 27, 2026.

- Banco Santander-Chile reported a net income of 1,069,612 million Chilean pesos (MCh$) for the period ending December 31, 2025.

- The company's total operating income reached 2,878,872 MCh$, with net interest income contributing 2,016,696 MCh$.

- As of December 31, 2025, total assets were 68,094,956 MCh$.

- The financial information is unaudited and prepared in accordance with accounting principles issued by the Financial Market Commission (FMC), which are substantially similar to IFRS but with some exceptions.

- Banco Santander-Chile issued a USD 500,000,000 bond on January 8, 2026, with a settlement date of January 15, 2026.

- The bond matures on November 20, 2030, and has a coupon rate of 4.55% and an issue rate of 4.558%.

- The issue rate represents an 82 basis point margin over the 5-year United States Treasury bond.

- Net income attributable to shareholders for the nine months ended September 30, 2025, increased to Ch$797,869 million (U.S.$829,688 thousand) from Ch$581,109 million (U.S.$590,810 thousand) in the prior year period.

- Basic earnings per share for the nine months ended September 30, 2025, rose to Ch$4.23, up from Ch$3.08 for the same period in 2024.

- Return on average equity improved to 23.0% in 2025 from 17.6% in 2024, and the Net interest margin increased to 3.9% from 3.2%.

- Non-performing loans as a percentage of total loans decreased to 3.07% in 2025 from 3.17% in 2024, and the operating expenses to operating revenue ratio improved to 35.9% from 40.0%.

- Shareholders approved a dividend distribution of Ch$3.18571574 per share, representing 70% of the net income for the year, at the Ordinary Shareholders’ Meeting on April 22, 2025.

- Banco Santander-Chile's Board of Directors resolved on December 23, 2025, to call an extraordinary shareholders' meeting for January 27, 2026, to address a significant transaction.

- The transaction involves an offer from Getnet Payments, S.L. to purchase 49.99% of the shares of the subsidiary Sociedad Operadora de Tarjetas de Pago Santander Getnet Chile S.A. for 68,000 million Chilean pesos.

- Additionally, the meeting will consider a service contract between Banco Santander Chile and the subsidiary, with an estimated value ranging from 55,465 to 79,999 million Chilean pesos.

- The total valuation of the subsidiary, Sociedad Operadora de Tarjetas de Pago Santander Getnet Chile S.A., is close to 187,000 million Chilean pesos.

- Banco Santander-Chile released its unaudited consolidated financial information as of November 30, 2025, covering results accumulated for the period ending November 2025.

- The company reported a net income for the period of 976,927 million Chilean pesos (MCh$).

- As of November 30, 2025, total assets were 68,013,755 MCh$.

- The financial information was prepared using the Compendium of Accounting Standards for Banks issued by the Financial Market Commission (FMC), which are largely similar to IFRS but take precedence in case of discrepancies.

- On November 20, 2025, Banco Santander-Chile placed dematerialized and bearer bonds in the local market.

- The bonds, identified as Series BI BSTBI0525, were issued for a total amount of Ch$ 2,500,000,000.

- These bonds have a maturity date of May 1, 2028, and were placed at an average rate of 5.24%.

Quarterly earnings call transcripts for BANCO SANTANDER CHILE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more