Earnings summaries and quarterly performance for BWX Technologies.

Executive leadership at BWX Technologies.

Rex Geveden

President and Chief Executive Officer

Joseph Miller

President, Government Operations

Kate Kelly

President, BWXT Advanced Technologies

Kevin McCoy

Chief Nuclear Officer

Mike Fitzgerald

Senior Vice President, Chief Financial Officer and Chief Accounting Officer

Robert Duffy

Senior Vice President and Chief Administrative Officer

Board of directors at BWX Technologies.

Research analysts who have asked questions during BWX Technologies earnings calls.

Michael Ciarmoli

Truist Securities, Inc.

7 questions for BWXT

Scott Deuschle

Deutsche Bank

7 questions for BWXT

Andre Madrid

BTIG

6 questions for BWXT

Peter Arment

Robert W. Baird & Co.

6 questions for BWXT

Peter Skibitski

Alembic Global Advisors

6 questions for BWXT

Jeffrey Campbell

Seaport Research Partners

5 questions for BWXT

Bob Labick

CJS Securities

3 questions for BWXT

Jed Dorsheimer

William Blair & Company, L.L.C.

2 questions for BWXT

Jeff Grampp

Northland Securities, Inc.

2 questions for BWXT

Joshua Korn

Barclays PLC

2 questions for BWXT

Ronald Epstein

Bank of America

2 questions for BWXT

Thomas Sellers Meric

Stephens Inc.

2 questions for BWXT

Alexander Preston

Bank of America Merrill Lynch

1 question for BWXT

Alex Preston

Bank of America

1 question for BWXT

David Strauss

Barclays

1 question for BWXT

Jan-Frans Engelbrecht

Baird

1 question for BWXT

Jed Dersheimer

William Blair

1 question for BWXT

Jeff Gramby

Northland Securities

1 question for BWXT

Mark Shooter

William Blair

1 question for BWXT

Matt Akers

BNP Paribas

1 question for BWXT

Peter Lukas

CJS Securities

1 question for BWXT

Tate Sullivan

Maxim Group

1 question for BWXT

Will Jellison

D.A. Davidson & Co.

1 question for BWXT

Recent press releases and 8-K filings for BWXT.

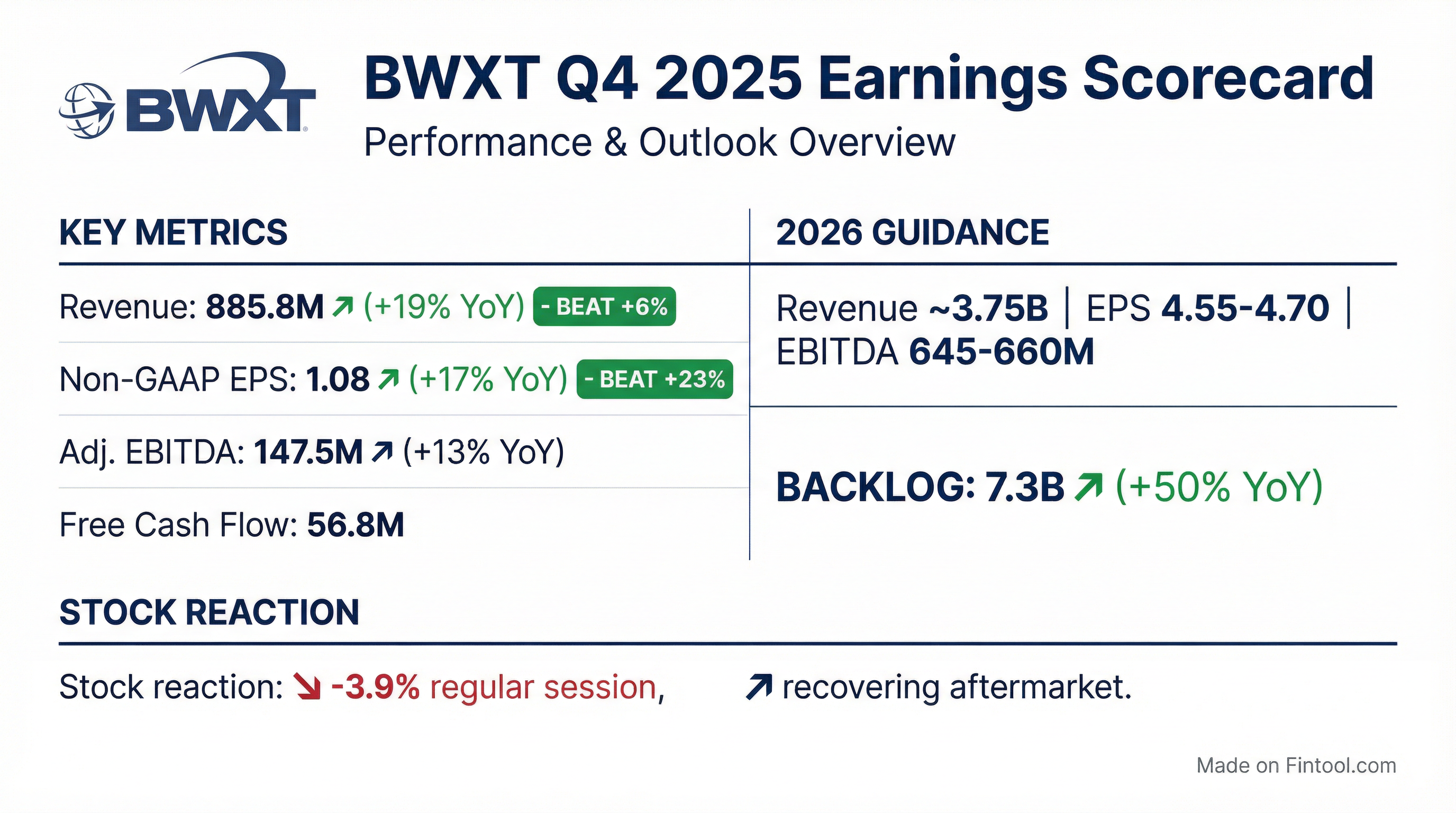

- BWX Technologies reported full year 2025 diluted non-GAAP EPS of $4.01 and adjusted EBITDA of $574.3 million, with net income of $329.9 million and free cash flow of $295.3 million. For Q4 2025, diluted non-GAAP EPS was $1.08, net income was $93.7 million, and adjusted EBITDA was $147.5 million.

- The company ended 2025 with a backlog of $7.3 billion, marking a 50% increase year-over-year.

- BWXT initiated 2026 guidance, projecting non-GAAP EPS of $4.55-$4.70, adjusted EBITDA of $645 million-$660 million, and free cash flow of $305 million-$320 million.

- A quarterly cash dividend of $0.27 per common share was declared on February 18, 2026.

- BWX Technologies closed a record 2025 with strong Q4 results, reporting $886 million in revenue (up 19% year-over-year) and $1.08 in Adjusted EPS (up 17%) for Q4 2025. For the full year 2025, revenue grew 18%, Adjusted EBITDA grew 15%, and EPS grew 20%.

- The company ended 2025 with a backlog of $7.3 billion, a 15% increase year-over-year, reflecting meaningful growth in both government and commercial segments. Commercial operations revenue grew 95% in Q4 2025, driven by 31% organic growth.

- For 2026, BWXT provided guidance including revenue of approximately $3.75 billion (up high-teens), Adjusted EBITDA of $645 million-$660 million (up low-to-mid-teens), and non-GAAP EPS of $4.55-$4.70 (up mid to high teens).

- Strategic developments in 2025 included the acquisitions of AOT and Kinectrics, securing new pricing agreements for naval propulsion, and booking initial scopes for U.S. Defense uranium enrichment and high-purity depleted uranium production expansion. The company also completed a $1.25 billion convertible debt offering to enhance financial flexibility and liquidity.

- BWX Technologies closed a record 2025, with full-year revenue growing 18%, Adjusted EBITDA 15%, earnings per share 20%, and free cash flow 16%, all exceeding initial guidance.

- The company ended 2025 with a backlog of $7.3 billion, up 15% year-over-year, and reported strong Q4 2025 revenue of $886 million (up 19%) and Adjusted EPS of $1.08 (up 17%).

- BWXT provided robust 2026 guidance, projecting revenue of approximately $3.75 billion (up high-teens), Adjusted EBITDA between $645 million and $660 million (up low-to-mid-teens), and non-GAAP EPS of $4.55-$4.70 (up mid to high teens).

- Strategic achievements in 2025 included the acquisitions of AOT and Kinectrics, significant investments in facilities, and securing major contracts for U.S. Defense uranium enrichment and high-purity depleted uranium production.

- The company enhanced its financial flexibility by completing a $1.25 billion convertible debt offering with a 0% coupon, which reduced the cost of debt and increased liquidity to $1.7 billion at year-end.

- BWX Technologies reported strong Q4 2025 financial performance, with revenue up 19%, Adjusted EBITDA up 13%, and Non-GAAP EPS up 17% year-over-year.

- For the full year 2025, the company achieved record levels in revenue of $3.2 billion, Adjusted EBITDA of $574 million, and free cash flow of $295 million, all demonstrating double-digit year-over-year growth.

- The company's backlog grew by 50% to $7.3 billion, driven by significant multi-year awards in both Government and Commercial Operations.

- BWXT initiated its 2026 guidance, projecting Adjusted EPS between $4.55 and $4.70, revenue of approximately $3.75 billion, Adjusted EBITDA between $645 million and $660 million, and free cash flow between $305 million and $320 million.

- BWX Technologies reported diluted non-GAAP EPS of $1.08 for Q4 2025 and $4.01 for the full year 2025, with full year consolidated revenue reaching $3,198.4 million, an 18% increase year-over-year.

- The company ended 2025 with a record backlog of $7.3 billion, up 50% year-over-year, driven by significant awards in naval propulsion, special materials, and commercial nuclear power.

- BWXT initiated 2026 guidance, expecting non-GAAP EPS of $4.55-$4.70, adjusted EBITDA of $645 million-$660 million, and free cash flow of $305 million-$320 million.

- A quarterly cash dividend of $0.27 per common share was declared on February 18, 2026, payable on March 27, 2026.

- BWX Technologies reported Q4 2025 revenue of $885.8 million and non-GAAP EPS of $1.08, which beat estimates by $0.20.

- For the full year 2025, the company achieved a record diluted non-GAAP EPS of $4.01, net income of $329.9 million, and adjusted EBITDA of $574.3 million.

- BWXT ended 2025 with a $7.3 billion backlog, representing a 50% year-over-year increase, and its Commercial Operations segment grew 95% in Q4 and 63% for the full year.

- The company returned capital to shareholders with $92.5 million in dividends for 2025 and announced a quarterly cash dividend of $0.27 per share.

- BWXT initiated 2026 guidance projecting non-GAAP EPS of $4.55–$4.70, adjusted EBITDA of $645–$660 million, and free cash flow of $305–$320 million.

- BWX Technologies is a key player in meeting the July 4 Executive Order criticality goal for advanced reactor designs, producing TRISO nuclear fuel compacts and high-assay low enriched uranium (HALEU).

- The company announced significant progress in producing TRISO nuclear fuel compacts for Antares Nuclear, Inc., with fabrication on track for timely completion for a July 4 criticality target.

- BWXT also shipped over 100 kilograms of purified HALEU oxide for the DOE HALEU availability program to support a second reactor developer targeting a July 4 criticality test.

- BWXT is also involved in the Project Pele demonstration reactor program and has shipped TRISO compacts to Los Alamos National Laboratory’s National Criticality Experiments Research Center.

- Antares, a nuclear fission energy company, has received U.S. Department of Energy (DOE) Preliminary Documented Safety Analysis (PDSA) approval for its Mark-0 demonstration reactor, marking a significant safety milestone.

- The Mark-0 reactor is scheduled to achieve criticality before July 4, 2026, at Idaho National Laboratory (INL) as part of the DOE's Reactor Pilot Program.

- BWX Technologies is collaborating with Antares on the fabrication of High-Assay Low-Enriched Uranium (HALEU) fuel feedstock for the project.

- Antares has secured over $130 million in funding, including a $96 million Series B round announced in December 2025, and holds over $13 million in active government contracts.

- BWX Technologies, Inc. (BWXT) has opened its Centrifuge Manufacturing Development Facility (CMDF) in Oak Ridge, Tennessee, to reestablish a fully domestic uranium enrichment capability for U.S. national security priorities.

- The CMDF is a key element of a $1.5 billion contract awarded to BWXT by the Department of Energy’s National Nuclear Security Administration (NNSA) in September for a comprehensive program supporting defense fuel needs.

- The facility will serve as BWXT’s primary hub for the design, engineering, fabrication, and testing of advanced gas centrifuge machines, aiming to move centrifuge technology from development into production readiness.

- Approximately 100 highly skilled professionals are currently working at the CMDF, with plans to expand the workforce as manufacturing activities scale.

- Keel Holdings, LLC announced a $22 million investment in four large, high-speed, precision 5-axis machining centers to enhance defense production capacity at its Merrill, MI facility.

- This investment is part of Keel's ongoing expansion, which includes a $36 million investment in 2024 for the Merrill facility and a $67 million investment underway for its South Carolina shipyard.

- The company also strengthened its leadership team with the appointment of Allen Couture as Chief Operating Officer and President, Southeast Operations, and Brian Johnson as Vice President, Quality.

Quarterly earnings call transcripts for BWX Technologies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more