Earnings summaries and quarterly performance for CREDIT ACCEPTANCE.

Executive leadership at CREDIT ACCEPTANCE.

Vinayak R. Hegde

Chief Executive Officer and President

Andrew K. Rostami

Chief Marketing and Product Officer

Arthur L. Smith

Chief Analytics Officer

Daniel A. Ulatowski

Chief Sales Officer

Douglas W. Busk

Chief Treasury Officer

Erin J. Kerber

Chief Legal Officer, Chief Compliance Officer and Secretary

Jay D. Martin

Chief Financial Officer

Jonathan L. Lum

Chief Operating Officer

Nicholas J. Elliott

Chief Alignment Officer

Ravi Mohan

Chief Technology Officer

Wendy A. Rummler

Chief People Officer

Board of directors at CREDIT ACCEPTANCE.

Research analysts who have asked questions during CREDIT ACCEPTANCE earnings calls.

Moshe Orenbuch

TD Cowen

7 questions for CACC

John Rowan

Janney Montgomery Scott

5 questions for CACC

Robert Wildhack

Autonomous Research

5 questions for CACC

John Hecht

Jefferies

3 questions for CACC

Kyle Joseph

Jefferies

2 questions for CACC

Jordon Hymowitz

Philadelphia Financial

1 question for CACC

Ryan Shelley

Bank of America

1 question for CACC

Recent press releases and 8-K filings for CACC.

- Credit Acceptance Corporation reported adjusted earnings per share growth for Q4 2025, despite declines in loan performance and loan volume.

- The company financed nearly 72,000 contracts and collected $1.3 billion in Q4 2025, while its loan portfolio increased 1% year-over-year on an adjusted basis.

- Loan performance for 2023 and 2024 vintages moderately declined by 0.4% and 0.2% respectively, though the rate of decline in forecasted net cash flows narrowed to 0.3% in Q4 2025 from 0.5% in Q3 2025.

- Market share in the core subprime used vehicle segment was 4.5% for the first two months of Q4 2025, down from 5.4% for the same period in 2024, leading to the rollout of a new contract origination experience for franchise and large independent dealers.

- New CEO Vinayak Hegde, in his first earnings call, affirmed a long-term, conservative approach to lending and credit scoring, and stated there would be no change to the company's capital allocation strategy, which includes stock repurchases.

- Credit Acceptance Corporation reported growth in adjusted earnings per share for Q4 2025, despite facing declines in loan performance and volume.

- While loan unit volume declines narrowed to 9.1% and loan dollar volume declines narrowed to 11.3% year-over-year, market share in the subprime used vehicle segment decreased to 4.5% for the first two months of Q4.

- New CEO Vinayak Hegde, who assumed the role nearly 90 days prior, outlined a strategy focused on customer-centricity, data-driven decisions, artificial intelligence, and a digital-first approach to drive growth, including a new contract origination experience for dealers.

- The company's capital allocation strategy remains consistent, prioritizing funding new originations, managing leverage, and executing stock repurchases, which were active in Q4.

- Credit Acceptance Corporation reported growth in adjusted earnings per share for Q4 2025, despite moderately declining loan performance and narrowing year-over-year declines in loan unit and dollar volumes.

- The company's market share in the subprime used vehicle segment was 4.5% for the first two months of Q4 2025, down from 5.4% in the same period of 2024, with new CEO Vinayak Hegde outlining strategic initiatives including a new contract origination experience to address dealer friction and improve market position.

- Loan performance was impacted by high inflation on subprime consumers, with 2023 and 2024 vintages declining 0.4% and 0.2% respectively, though the rate of decline in forecasted future net cash flows improved sequentially.

- Leverage remains at the higher end of an acceptable range, and the company's capital allocation strategy, including share repurchases, remains unchanged.

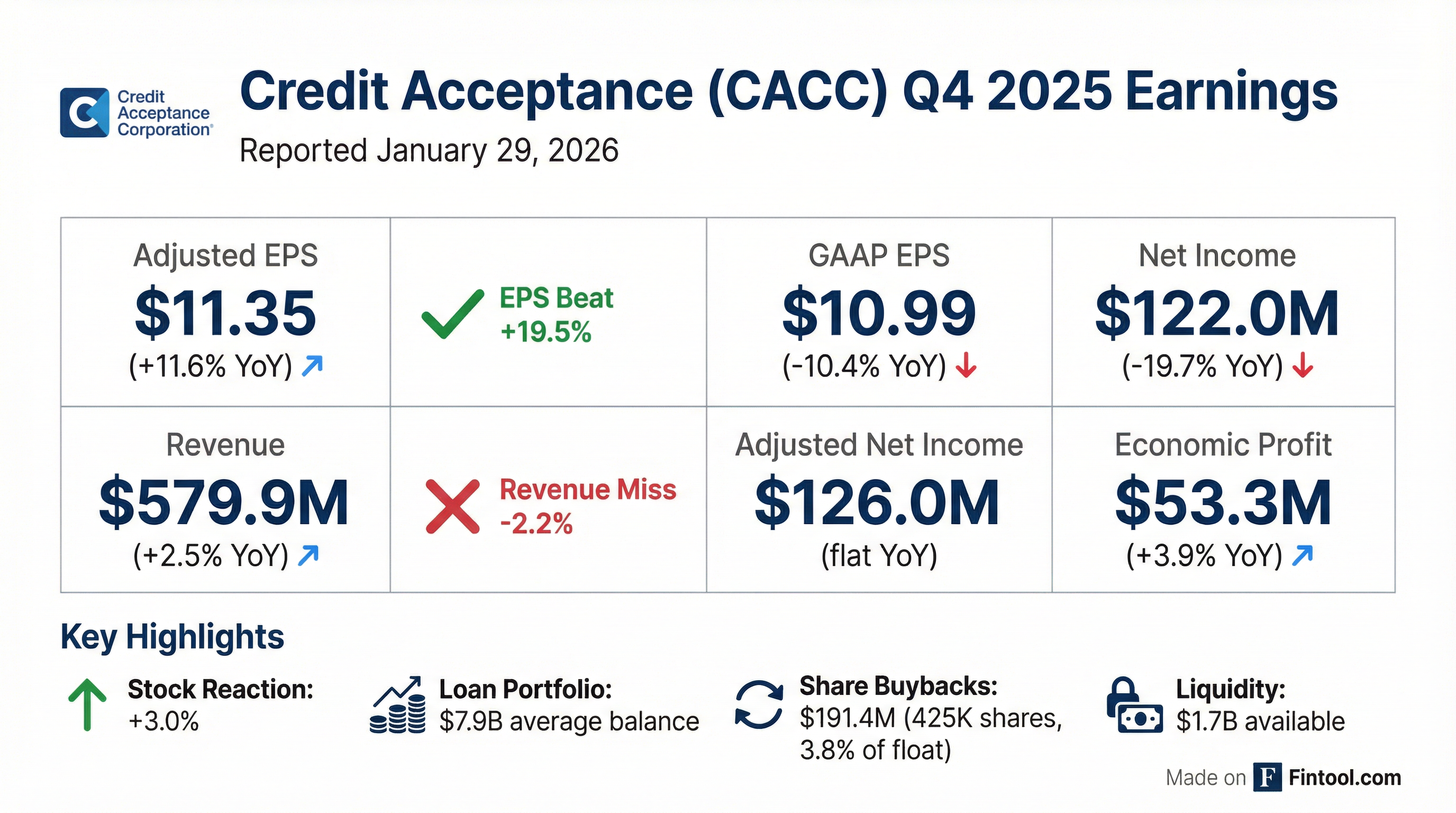

- Credit Acceptance Corporation reported GAAP net income of $122.0 million, or $10.99 per diluted share, and adjusted net income of $126.0 million, or $11.35 per diluted share, for the three months ended December 31, 2025.

- CEO Vinayak Hegde highlighted sequential growth in financial results for Q4 2025, despite declines in loan volumes and loan performance.

- For the fourth quarter of 2025, the company's loan portfolio had an average balance of $7.9 billion, with 71,731 Consumer Loan assignment unit volume and $821.3 million in dollar volume.

- Credit Acceptance repurchased approximately 425,000 shares for $191.4 million during the quarter.

- A $35.8 million contingent loss related to previously disclosed legal matters was recognized in Q4 2025, contributing to cumulative contingent losses of $82.6 million through the end of the quarter, which includes a potential $75.5 million cash payment for multi-state and New York Attorney General legal matters.

- Credit Acceptance reported GAAP net income of $122.0 million, or $10.99 per diluted share, for the three months ended December 31, 2025. Adjusted net income for the same period was $126.0 million, or $11.35 per diluted share.

- The company repurchased approximately 425,000 shares for $191.4 million during the fourth quarter of 2025, representing 3.8% of the shares outstanding at the beginning of the quarter.

- Consumer Loan assignment unit volume was 71,731 and dollar volume was $821.3 million for the fourth quarter of 2025. Unit and dollar volumes declined 9.1% and 11.3%, respectively, year-over-year for Q4 2025.

- A $35.8 million contingent loss related to previously disclosed legal matters was recognized in the fourth quarter of 2025, contributing to a 33.5% increase in operating expenses compared to the same period in 2024.

- Credit Acceptance Corporation announced the extension of its $100.0 million asset-backed non-recourse secured financing, known as Term ABS 2021-1.

- The date on which the financing will cease to revolve has been extended from February 17, 2026 to January 18, 2028.

- The interest rate on borrowings under the financing has been decreased from the Secured Overnight Financing Rate (SOFR) plus 220 basis points to SOFR plus 140 basis points.

- Credit Acceptance Corporation announced the extension of its $100.0 million asset-backed non-recourse secured financing, referred to as Term ABS 2021-1.

- The date on which the financing will cease to revolve has been extended from February 17, 2026, to January 18, 2028.

- The interest rate on borrowings under the financing has been decreased from the Secured Overnight Financing Rate (SOFR) plus 220 basis points to SOFR plus 140 basis points.

- Credit Acceptance Corporation completed a $500.0 million asset-backed non-recourse secured financing on November 13, 2025.

- This financing involved conveying $625.2 million in consumer loans to a wholly owned special purpose entity.

- The financing issued three classes of notes: Class A for $284,610,000 at 4.50% interest, Class B for $104,570,000 at 4.87% interest, and Class C for $110,820,000 at 5.38% interest.

- The expected average annualized cost of the financing is approximately 5.1%, including upfront fees and other costs, and the proceeds will be used to repay higher cost outstanding indebtedness and for general corporate purposes.

- This transaction represents the company's 60th term securitization since 1998 and its lowest-cost ABS transaction since late 2021.

- Credit Acceptance Corporation (CACC) completed a $500.0 million asset-backed non-recourse secured financing on November 13, 2025, by conveying loans valued at approximately $625.2 million.

- The financing has an expected average annualized cost of approximately 5.1% and will be used to repay higher cost outstanding indebtedness and for general corporate purposes.

- This transaction represents Credit Acceptance's 60th term securitization since 1998 and its lowest-cost ABS transaction since late 2021.

- Following the financing, the company maintains approximately $2.0 billion in unused and available borrowing capacity on its revolving credit facilities and unrestricted cash.

- Credit Acceptance Corporation's loan performance declined in Q3 2025, with 2022, 2023, and 2024 vintages underperforming expectations, resulting in a 0.5% or $59 million decline in forecasted net cash flows. Despite this, the adjusted loan portfolio reached a record high of $9.1 billion, an increase of 2% from Q3 2024.

- The company's market share in its core subprime auto financing segment decreased to 5.1% for the first eight months of 2025, down from 6.5% in the same period of 2024. This decline, along with reduced unit and dollar volumes, was attributed to a Q3 2024 scorecard change and increased competition.

- CEO Ken Booth announced his retirement after 22 years with Credit Acceptance Corporation, effective after the Q3 2025 earnings call. He will continue to serve as a board member, and current board member Vinayak will transition into a new role.

- General and Administrative (G&A) expense for Q3 2025 included an additional $15 million contingent legal loss, following a $23.4 million contingent legal loss in Q2 2025. The company has just over 2 million shares authorized for repurchase, and its adjusted leverage is at the high end of its historical two to three times adjusted debt to equity range.

Fintool News

In-depth analysis and coverage of CREDIT ACCEPTANCE.

Quarterly earnings call transcripts for CREDIT ACCEPTANCE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more