Earnings summaries and quarterly performance for COLONY BANKCORP.

Executive leadership at COLONY BANKCORP.

T. Heath Fountain

Chief Executive Officer

Daniel Rentz

Chief Information Officer

Derek Shelnutt

Chief Financial Officer

Ed Canup

Chief Banking Officer

Edward Bagwell III

Chief Risk Officer and General Counsel; Corporate Secretary

Kimberly Dockery

Chief of Staff

Laurie Senn

Chief Administrative Officer

Leonard Bateman Jr.

Chief Credit Officer

Roy Dallis Copeland Jr.

President

Board of directors at COLONY BANKCORP.

Research analysts who have asked questions during COLONY BANKCORP earnings calls.

Christopher Marinac

Janney Montgomery Scott LLC

3 questions for CBAN

David Bishop

Hovde Group

3 questions for CBAN

Christopher Marinak

Janney

2 questions for CBAN

Dave Bishop

Hovde

1 question for CBAN

Kyle German

Huff Group

1 question for CBAN

Recent press releases and 8-K filings for CBAN.

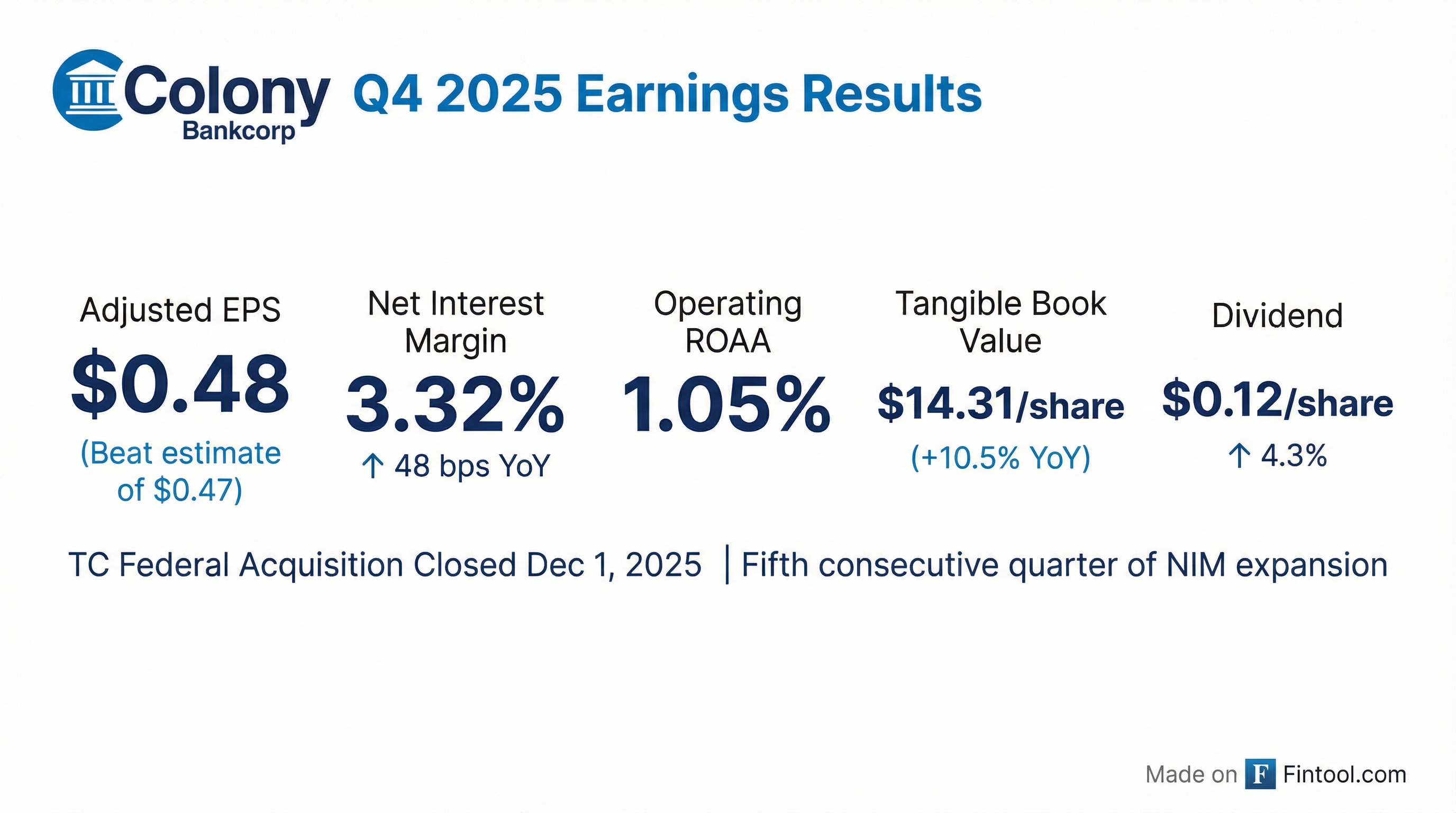

- Colony Bank reported a strong Q4 2025 with operating net income increasing by $675,000 compared to the third quarter, and achieved a 1% operating Return on Assets (ROA) for the 2025 fiscal year. The company projects a 1.20% ROA on a quarterly basis starting in Q2 2026 and for the full year 2026.

- Net Interest Margin (NIM) increased 15 basis points to 3.32% in Q4 2025, and is projected to increase at a modest pace throughout 2026. Core loan growth for 2025 was 10.5%, and the outlook for 2026 is positive, trending towards the 8% end of the 8%-12% long-term target.

- The legal close of the TC Federal merger occurred in December, with systems conversion expected in Q1 2026 and the majority of remaining cost savings to be realized in Q2 2026. The tangible book value earnback period is now expected to be less than 2.5 years, better than the original forecast of less than 3 years.

- The board declared an increase to the quarterly dividend to $0.12 per share. The company is actively pursuing M&A opportunities and expects to announce another transaction at some point in 2026.

- Colony Bankcorp achieved a 1% operating Return on Assets (ROA) for the 2025 fiscal year and aims for a 1.20% ROA on a quarterly basis starting in the second quarter of 2026 and for the full year 2026. The company projects a modest increase in net interest margin and expects non-interest income to be slightly better throughout 2026.

- The company reported core loan growth of 10.5% in 2025 (excluding the TC Federal acquisition) and anticipates 2026 organic loan growth to be closer to 8%. Total deposits increased due to the TC Federal merger, with organic deposit growth of $24.3 million in the fourth quarter of 2025.

- The earnback period for the TC Federal merger is now expected to be less than 2.5 years, an improvement from the original forecast of less than 3 years. Operating expenses were higher in Q4 2025 due to the merger but are expected to decrease after the systems conversion in mid-Q1 2026, targeting a net non-interest expense to average assets of 1.45% in Q2 2026.

- The board declared an increase to the quarterly dividend of $0.12 per share.

- Colony Bankcorp reported a strong fourth quarter of 2025, with operating net income increasing by $675,000 compared to the third quarter, and achieved a 1% operating ROA for the 2025 fiscal year. Net interest margin increased 15 basis points to 3.32% in the quarter.

- The legal close of the TC Federal merger occurred in December, with systems conversion on track for the first quarter of 2026, and financial targets for the deal are on track or better than expected. The majority of expected cost savings from the acquisition are anticipated to be realized in the second quarter of 2026 and going forward.

- The company projects achieving a 1.20% ROA on a quarterly basis starting in the second quarter of 2026 and for the full year 2026. Loan growth for 2026 is expected to be closer to 8%, and margin is projected to increase at a modest pace throughout 2026.

- The board declared an increase to the quarterly dividend to $0.12 per share, which is an annualized increase of $0.02. Total share repurchases during the quarter amounted to $47,000 at an average price of $16.50.

- Colony Bankcorp is actively pursuing M&A opportunities and expects to announce another transaction at some point in 2026, focusing on Georgia and contiguous states.

- Colony Bankcorp reported net income of $7.8 million, or $0.42 per diluted share, for the fourth quarter of 2025, an increase from $5.8 million, or $0.33 per diluted share, in the third quarter of 2025.

- The company's total assets reached $3.7 billion as of December 31, 2025 , with total loans increasing by $344.2 million to $2.38 billion and total deposits increasing by $483.2 million to $3.07 billion during Q4 2025.

- Net interest margin expanded to 3.32% for the fourth quarter of 2025, up from 2.84% in the fourth quarter of 2024, and operating return on average assets was 1.05%.

- The Board of Directors declared an increased quarterly cash dividend of $0.12 per share.

- The merger with TC Federal was completed on December 1, 2025, contributing to increases in nonperforming assets and the credit loss reserve, which included a $4.6 million initial allowance for credit losses related to the acquired loan portfolio.

- Colony Bankcorp reported net income of $7.8 million, or $0.42 per diluted share, for the fourth quarter of 2025.

- The company increased its quarterly cash dividend to $0.12 per share.

- Total loans, excluding loans held for sale, were $2.38 billion at December 31, 2025, an increase of $344.2 million, or 16.90%, from the prior quarter.

- Total deposits reached $3.07 billion at December 31, 2025, an increase of $483.2 million from September 30, 2025.

- The primary driver for increases in assets, loans, and deposits was the acquisition of TC Bancshares, Inc. (TC Federal), which closed on December 1, 2025.

- Colony Bankcorp, Inc. (CBAN) and TC Bancshares, Inc. jointly announced on November 17, 2025, that they have received all required regulatory and shareholder approvals for their previously announced merger.

- The merger, initially announced on July 23, 2025, is a combined stock-and-cash transaction valued at approximately $86.1 million.

- The transaction is expected to close on or about December 1, 2025, subject to the satisfaction of customary closing conditions.

- Upon completion, the combined company is projected to have approximately $3.8 billion in total assets, $3.1 billion in total deposits, and $2.4 billion in loans.

- Colony Bankcorp reported improved operating performance in Q3 2025, with operating net income increasing $252,000 from the prior quarter, and operating ROA improving to 1.06% from 0.81% in Q3 2024.

- The company experienced net interest margin expansion of five basis points in Q3 2025, contributing to a 53 basis point expansion since Q3 2024. Loan growth moderated to an annualized 9% for the quarter, with full-year 2025 growth projected to be around the 8%-12% long-term target.

- Credit quality remained relatively stable, though charge-offs were higher primarily due to variability in the SBA portfolio. Operating non-interest expenses were up $624,000 quarter-over-quarter, but operating net non-interest expense to average assets improved four basis points to 1.48%.

- The merger with TC Bancshares and TC Federal Bank is progressing as planned, with regulatory applications filed and shareholder approval expected in November, targeting a Q4 2025 close.

- Tangible book value per share increased to $14.20 from $12.76 a year ago, and the TCE ratio stood at 8% at quarter-end, up from 7.43% a year ago. The board declared a quarterly dividend of $0.115 per share.

Quarterly earnings call transcripts for COLONY BANKCORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more