Earnings summaries and quarterly performance for Ceribell.

Executive leadership at Ceribell.

Board of directors at Ceribell.

Research analysts who have asked questions during Ceribell earnings calls.

Joshua Jennings

TD Cowen

7 questions for CBLL

Stephanie Piazzola

Bank of America

6 questions for CBLL

Robert Marcus

JPMorgan Chase & Co.

5 questions for CBLL

William Plovanic

Canaccord Genuity

4 questions for CBLL

Bill Plovanic

Canaccord Genuity

3 questions for CBLL

Brandon Vazquez

William Blair & Company, L.L.C.

3 questions for CBLL

Macauley Kilbane

William Blair & Company

3 questions for CBLL

Travis Steed

Bank of America

3 questions for CBLL

Brian

TD Cowen

2 questions for CBLL

Elena

Raymond James & Associates

2 questions for CBLL

Jeffrey Cohen

Ladenburg Thalmann

2 questions for CBLL

Jon Young

Canaccord Genuity Group Inc.

2 questions for CBLL

Lilia-Celine Lozada

JPMorgan Chase & Co.

2 questions for CBLL

Lily

JPMorgan Chase & Co.

2 questions for CBLL

Marie Thibault

BTIG

2 questions for CBLL

Recent press releases and 8-K filings for CBLL.

- Ceribell projects 25%-29% top-line growth for 2026, with gross margins expected to remain in the mid-80% range.

- Key growth initiatives for 2026 include the maturation of a sales force expansion (from ~35 to ~55 territories) and the launch of the first cohort of VA system customers.

- The company plans a full launch of neonate and pediatric monitoring in Q2 2026, expanding the Total Addressable Market by $400 million, and a commercial pilot for the $1+ billion delirium indication in Q2 2026.

- Ceribell highlights its competitive differentiation as the first and only seizure detection algorithm for preterm to adult and the first and only device to monitor delirium, noting competitors lack similar in-house AI development capabilities.

- An initial decision on the USITC patent litigation is anticipated by November 19th (2026), with a final decision around March (2027).

- Ceribell reported strong performances since its late 2024 IPO and provided a 2026 top-line growth outlook of 25%-29%.

- The company expects 2026 gross margins to remain in the mid-80% range, noting a decline to 87% in Q4 2025 due to tariffs, with potential upside from a Supreme Court decision.

- Key growth drivers for 2026 include increased productivity from a sales force expansion (from 35 to 55 territories), access to the VA hospital system following FedRAMP High clearance, and the launch of neonate and pediatric monitoring (full launch later in 2026, NICU in Q2).

- Ceribell plans a commercial pilot for its delirium indication in Q2 2026, with a potential full launch in Q4 2026 or Q1 2027, which could expand its U.S. total addressable market by $1+ billion.

- The company highlighted its competitive advantage as the first and only device with a seizure detection algorithm for preterm to adult and for monitoring delirium, with a USITC patent litigation initial decision expected by November 19th.

- Ceribell has reported strong performance since its IPO in late 2024 and provided a 2026 top-line growth outlook of 25%-29%.

- The company anticipates maintaining gross margins in the mid-80% range for 2026, supported by manufacturing efficiency improvements and a new facility in Vietnam.

- Key growth drivers for 2026 include increased sales force productivity, expansion into the VA hospital system, and the full launch of neonate and pediatric monitoring in Q2 2026, which is expected to expand the Total Addressable Market (TAM) by approximately $400 million.

- Ceribell is also pursuing a delirium indication, with a commercial pilot in Q2 2026, targeting a $1+ billion US market opportunity. The company highlights its competitive advantage as the first and only device for neonatal seizure detection and delirium monitoring.

- Ceribell achieved $89 million in revenue for 2025, representing 36% year-over-year growth, with 88% gross margins, and has demonstrated 31 consecutive quarters of sequential growth.

- The company is significantly expanding its total addressable market (TAM) from an initial $2 billion U.S. seizure market to $3.5 billion through new indications, including neonates/pediatrics and delirium detection, for which it received FDA clearance in November last year.

- Ceribell plans to fully launch delirium detection by late this year or Q1 next year, and received FDA breakthrough designation for stroke in January this year, further expanding its product pipeline and market opportunities.

- With only 3% penetration in the U.S. seizure market and presence in 647 hospitals out of approximately 6,000, the company sees substantial upside opportunity for deeper penetration and account acquisition.

- Ceribell delivered $89 million in revenue for 2025, marking a 36% year-over-year growth rate with 88% gross margins.

- The company's novel point-of-care EEG system has achieved 31 quarters of sequential revenue growth.

- Ceribell expanded its total addressable market (TAM) to $3.5 billion in 2025 by adding indications for neonate and pediatric patients and delirium detection, with delirium alone representing a $1 billion TAM expansion.

- The launch of the pediatric and neonate algorithm is planned for Q2 2026, and the full launch of delirium detection is expected in late 2026 or Q1 2027.

- To drive further growth, Ceribell expanded its sales team from 35 territories in mid-2024 to 55 by Q3 2025, aiming to increase its 3% penetration in the U.S. seizure market across its 647 hospital install base.

- Ceribell reported $89 million in revenue for 2025, representing a 36% year-over-year growth rate, with 88% gross margins. The company has achieved 31 quarters of sequential growth and maintains a strong capital position of $159 million post-IPO.

- The total addressable market (TAM) expanded to $3.5 billion in 2025, with the U.S. seizure market alone at $2 billion. Ceribell is currently in 647 hospitals but has only 3% penetration in the U.S. seizure market, indicating significant growth potential.

- Key product milestones include FDA clearance for delirium detection in November 2025, representing a $1 billion TAM expansion, and FDA breakthrough designation for stroke in January 2026. A launch for pediatric and neonate indications is planned for Q2 2026, adding a $400 million market expansion opportunity.

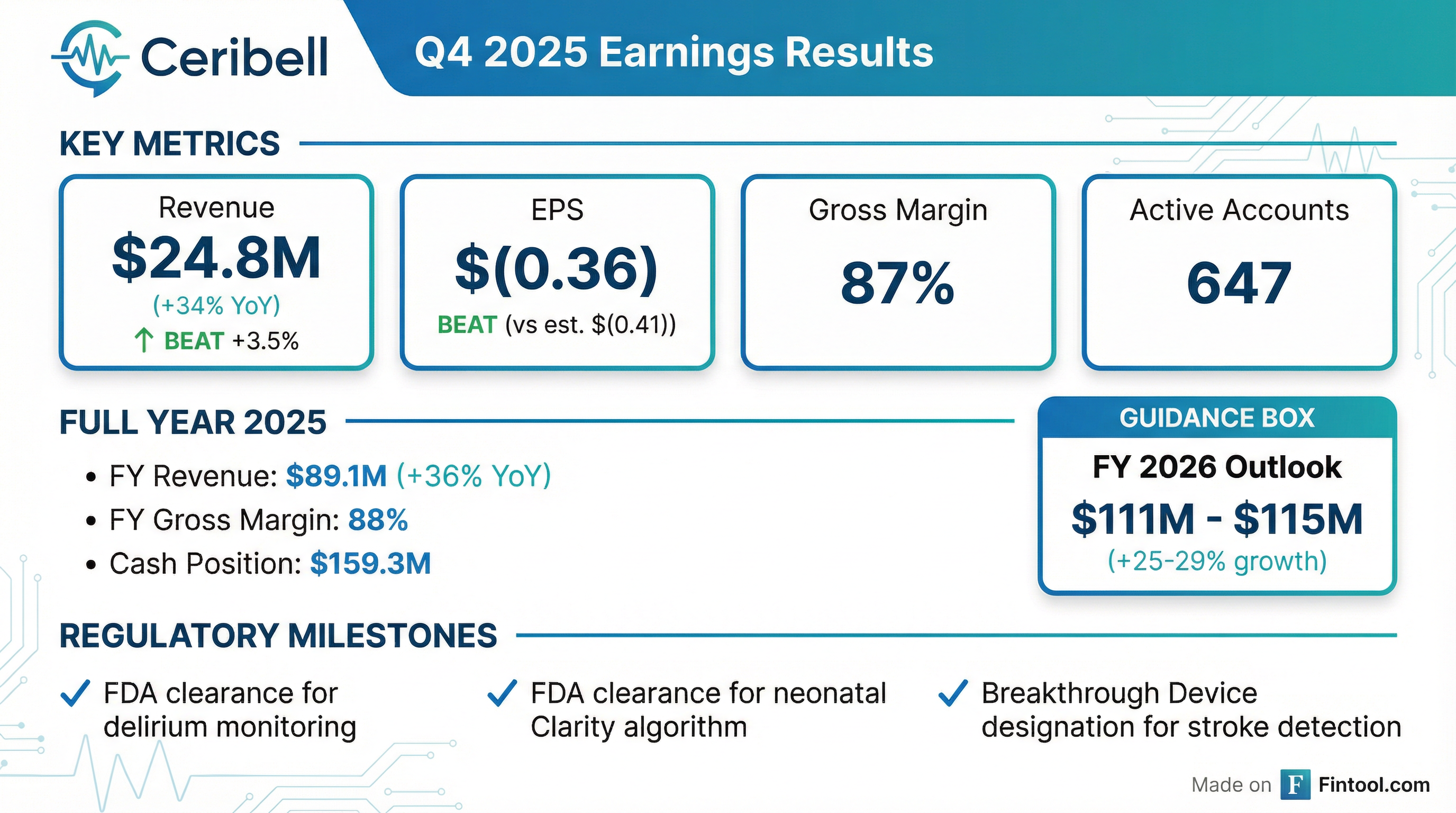

- Ceribell reported Q4 2025 revenue of $24.8 million, a 34% increase over the same period last year, and full-year 2025 revenue of $89.1 million, representing 36% growth over 2024. The company ended 2025 with 647 active accounts.

- For full-year 2026, Ceribell expects total revenue to be in the range of $111 million-$115 million, indicating 25%-29% annual growth over 2025. Gross margins are projected to be in the mid-80% range throughout 2026.

- The company expanded its total addressable market from $2 billion to over $3.5 billion. This expansion was driven by FDA clearance for neonatal and pediatric seizure detection in Q4 2025, and FDA 510K clearance for its delirium algorithm in December 2025.

- Ceribell also received FDA breakthrough device designation for LVO stroke monitoring in January 2026. A full commercial launch for neonate and pediatric products is anticipated in Q2 2026, with delirium expected in Q4 2026 or Q1 2027.

- Ceribell reported Q4 2025 revenue of $24.8 million, a 34% increase year-over-year, and full-year 2025 revenue of $89.1 million, a 36% increase over 2024, with gross margins of 87% and 88% respectively.

- The company ended 2025 with 647 active accounts and $159.3 million in cash, equivalents, and marketable securities as of December 31st, 2025.

- For full-year 2026, Ceribell expects total revenue to be in the range of $111 million to $115 million, representing 25%-29% annual growth over 2025.

- Ceribell significantly expanded its total addressable market to over $3.5 billion through FDA 510(k) clearance for its delirium algorithm in December 2025 and breakthrough device designation for LVO stroke monitoring in January 2026. The full launch of neonate and pediatric products is expected in Q2 2026.

- The company is also pursuing a new technology add-on payment (NTAP) for delirium, with a preliminary decision expected in April 2026 and potential effectiveness in October 2026.

- Ceribell reported Q4 2025 revenue of $24.8 million, a 34% increase year-over-year, and full-year 2025 revenue of $89.1 million, up 36% from 2024. Gross margins were 87% for Q4 2025 and 88% for the full year 2025. The company ended 2025 with 647 active accounts, adding 118 throughout the year.

- The total addressable market expanded from $2 billion to over $3.5 billion in 2025, driven by FDA clearance for seizure detection in neonate and pediatric patients and FDA 510K clearance for its delirium algorithm in December 2025.

- For full-year 2026, Ceribell expects total revenue in the range of $111 million to $115 million, representing 25%-29% annual growth over 2025. The company plans a full launch of its neonate and pediatric products in Q2 2026 and a delirium pilot in 2026, with a full commercial launch anticipated in Q4 2026 or Q1 2027. An NTAP for delirium was submitted in late 2025, with a preliminary decision expected in April 2026.

- CeriBell, Inc. reported total revenue of $24.8 million in the fourth quarter of 2025, a 34% increase compared to the same period in 2024, and $89.1 million for the full year 2025, a 36% increase over the prior year.

- The company achieved a gross margin of 87% in Q4 2025 and 88% for the full year 2025.

- CeriBell reported a net loss of $13.5 million, or $0.36 net loss per share, for the fourth quarter of 2025, and a net loss of $53.4 million, or $1.46 net loss per share, for the full year 2025.

- Key regulatory achievements in Q4 2025 included FDA 510(k) clearance for a continuous monitoring solution for delirium and for the use of the Clarity algorithm for neonates, as well as FDA Breakthrough Device Designation for a large vessel occlusion (LVO) stroke detection and monitoring solution.

- For the full year 2026, Ceribell expects revenue to be in the range of $111 million to $115 million, representing growth of approximately 25% to 29% over the prior year.

Quarterly earnings call transcripts for Ceribell.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more