Earnings summaries and quarterly performance for Canopy Growth.

Executive leadership at Canopy Growth.

Board of directors at Canopy Growth.

Research analysts who have asked questions during Canopy Growth earnings calls.

FG

Frederico Gomes

ATB Capital Markets

5 questions for CGC

Also covers: AAWH, ACB, AYRWF +9 more

Pablo Zuanic

Zuanic & Associates

4 questions for CGC

Also covers: ACB, AFCG, CRLBF +14 more

Aaron Grey

Alliance Global Partners

3 questions for CGC

Also covers: AFCG, AGFY, CRLBF +22 more

MB

Matt Bottomley

Canaccord Genuity Group Inc.

2 questions for CGC

Also covers: ACB, AYRWF, CURLF +7 more

ML

Michael Lavery

Piper Sandler & Co.

2 questions for CGC

Also covers: BGS, BYND, CELH +25 more

WK

William Kirk

ROTH MKM

2 questions for CGC

Also covers: ACB, ACI, CURLF +10 more

BK

Bill Kirk

Roth Capital Partners, LLC

1 question for CGC

Also covers: ACB, GO, HFFG +7 more

Recent press releases and 8-K filings for CGC.

Canopy Growth Reports Q3 Fiscal 2026 Results and Announces MTL Cannabis Acquisition

CGC

Earnings

M&A

Guidance Update

- Canopy Growth reported its narrowest Adjusted EBITDA loss to date of CAD 3 million in Q3 fiscal 2026, supported by $29 million in annualized cost savings and revenue growth across its Canadian cannabis, international cannabis, and Storz & Bickel segments.

- The company ended Q3 fiscal 2026 with a strong balance sheet, holding CAD 371 million in cash and cash equivalents and a net cash position of CAD 146 million, and completed a $150 million recapitalization post-quarter end that extended debt maturities to 2031.

- Canopy Growth announced the proposed acquisition of MTL Cannabis, which is expected to be accretive to net revenue, gross margin, and Adjusted EBITDA for the combined organization, and reiterated its goal to achieve positive Adjusted EBITDA during fiscal 2027.

15 hours ago

Canopy Growth Reports Q3 2026 Results, Narrows Adjusted EBITDA Loss, and Strengthens Balance Sheet

CGC

Earnings

M&A

Guidance Update

- Canopy Growth reported a CAD 3 million Adjusted EBITDA loss in Q3 fiscal 2026, its slimmest to date, supported by $29 million in annualized cost savings.

- The company ended the quarter with CAD 371 million in cash and cash equivalents and a net cash position of CAD 146 million, and completed a $150 million recapitalization post-quarter end extending debt maturities to 2031.

- Canopy Growth announced the proposed acquisition of MTL Cannabis, which is anticipated to be accretive and enhance its Canadian medical and adult-use market presence.

- Management reiterated its target of achieving positive Adjusted EBITDA during fiscal 2027, driven by operational improvements and the expected contributions from the MTL acquisition.

- Revenue growth was observed in key segments: Canadian Medical Cannabis increased 15% year-over-year to $23 million, Canadian adult use cannabis grew 8% year-over-year to CAD 23 million, and Storz & Bickel net revenue rose 45% sequentially to $23 million.

15 hours ago

Canopy Growth Reports Q3 Fiscal 2026 Results, Strengthens Balance Sheet, and Announces MTL Cannabis Acquisition

CGC

Earnings

M&A

Guidance Update

- Canopy Growth reported its slimmest Adjusted EBITDA loss to date of CAD 3 million in Q3 fiscal 2026, supported by $29 million in annualized cost savings.

- The company ended Q3 fiscal 2026 with a strong balance sheet, including CAD 371 million in cash and cash equivalents and a CAD 146 million net cash position, further enhanced by a post-quarter end $150 million recapitalization extending debt maturities to 2031.

- Canopy Growth announced the proposed acquisition of MTL Cannabis, expected to be accretive, strengthen its Canadian cannabis market position, and contribute to a targeted blended gross margin in the mid- to high 30s.

- The company is targeting positive Adjusted EBITDA during fiscal 2027 and reported year-over-year revenue growth in Canadian Medical Cannabis (15% to $23 million) and Canadian Adult Use Cannabis (8% to CAD 23 million), alongside sequential growth in International Cannabis (22%) and Storz & Bickel (45% to $23 million).

15 hours ago

Canopy Growth Reports Q3 FY2026 Financial Results

CGC

Earnings

M&A

Guidance Update

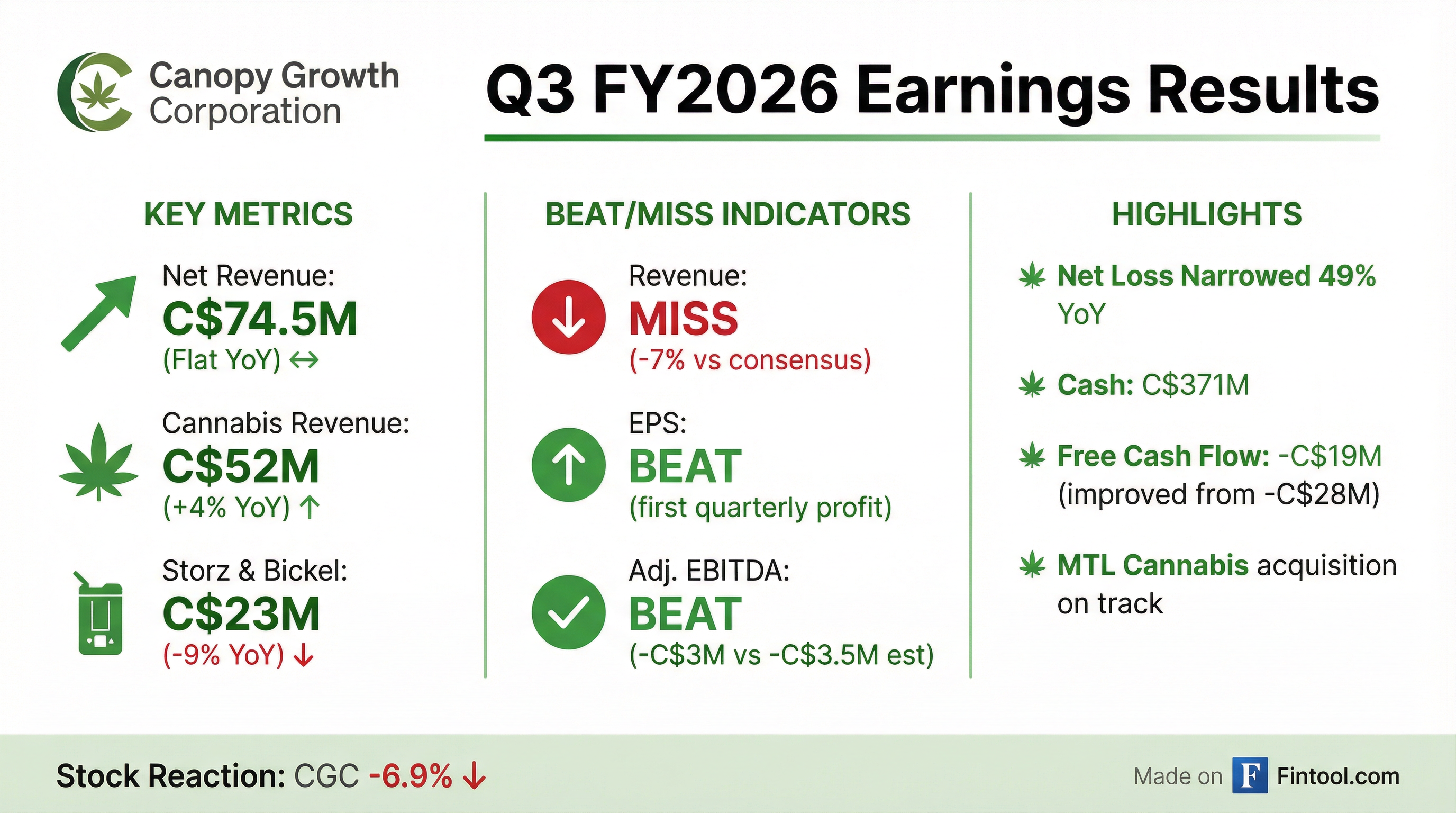

- Canopy Growth reported consolidated net revenue of $74.5 million for the three months ended December 31, 2025 (Q3 FY2026), which was flat compared to Q3 FY2025.

- The company's net loss narrowed by 49% year-over-year in Q3 FY2026, and Adjusted EBITDA loss narrowed by 17% year-over-year.

- As of December 31, 2025, Canopy Growth held $371 million in cash and cash equivalents and maintained a net cash position of $146 million.

- The acquisition of MTL Cannabis is on track to close in the current quarter, and a strategic recapitalization was completed in January 2026, extending debt maturity dates to 2031.

- Canopy Growth aims to achieve positive Adjusted EBITDA during fiscal 2027.

19 hours ago

Canopy Growth Reports Q3 Fiscal 2026 Financial Results

CGC

Earnings

M&A

Guidance Update

- Consolidated net revenue for Q3 FY2026 was $75M, flat compared to Q3 FY2025, with Cannabis net revenue increasing 4% to $52M.

- Net loss narrowed by 49% year-over-year, and Adjusted EBITDA loss narrowed by 17% to $3M in Q3 FY2026, driven by strong sales execution and SG&A cost savings.

- The company reported $371M in cash and cash equivalents and a net cash position of $146M at December 31, 2025.

- The acquisition of MTL Cannabis remains on track to close in the current quarter, and a strategic recapitalization completed in January 2026 strengthened the balance sheet by extending debt maturities to 2031.

- Canopy Growth aims to achieve positive Adjusted EBITDA during fiscal 2027.

19 hours ago

Canopy Growth Completes Strategic Recapitalization Transactions

CGC

Debt Issuance

New Projects/Investments

- Canopy Growth has completed strategic recapitalization transactions to refinance its term loan due 2027 and exchange convertible debentures due 2029.

- These transactions extend all outstanding indebtedness maturities to January 2031 at the earliest and position the company with approximately C$425 million in expected cash on hand.

- The company secured a US$150 million term loan with a decreased cash interest rate, planning to use the net proceeds to repay existing debt, support working capital, and fund potential future acquisitions.

Jan 29, 2026, 5:09 PM

Canopy Growth Strengthens Balance Sheet and Extends Debt Maturities

CGC

Debt Issuance

M&A

- Canopy Growth Corporation announced strategic recapitalization transactions to strengthen its balance sheet and extend debt maturities.

- The company secured a new Term Loan of US$150 million maturing in January 2031, which will be used to repay approximately US$101 million of existing senior secured debt due September 2027, resulting in a decrease in cash interest rate.

- These transactions are expected to extend the maturity dates of all outstanding indebtedness to January 2031 at the earliest and provide approximately C$425 million in cash on hand.

- An amendment was made on January 6, 2026, to the arrangement agreement for the acquisition of MTL Cannabis Corp., specifically concerning MTL Warrants.

Jan 8, 2026, 9:15 PM

Canopy Growth Announces Strategic Recapitalization to Strengthen Balance Sheet

CGC

Debt Issuance

Convertible Preferred Issuance

New Projects/Investments

- Canopy Growth announced strategic recapitalization transactions to strengthen its balance sheet and extend the maturity dates of all outstanding indebtedness to January 2031 at the earliest.

- Following these transactions, the company expects to have approximately C$425 million cash on hand, providing enhanced liquidity and flexibility for long-term priorities.

- The recapitalization includes a Term Loan Transaction providing US$150 million in net proceeds, maturing in January 2031, which will be used to repay existing senior secured debt of approximately US$101 million due September 2027, for working capital, general corporate purposes, and potential future acquisitions.

- A Convertible Debenture Exchange will swap approximately C$96.4 million of existing convertible debentures due May 2029 for new convertible debentures of C$55 million due July 2031, cash, common shares, and warrants.

- The Term Loan will bear interest at a decreased cash interest rate (Term SOFR + 6.25% with a 3.25% floor) compared to current senior secured debt, and the new convertible debentures will bear interest at 7.50% per annum.

Jan 8, 2026, 12:00 PM

Canopy Growth to Acquire MTL Cannabis for $125 Million

CGC

M&A

New Projects/Investments

- Canopy Growth Corporation announced a definitive agreement to acquire MTL Cannabis Corp. for approximately $125 million on a fully-diluted equity basis and $179 million on an enterprise value basis.

- Under the terms, MTL shareholders will receive 0.32 of a Canopy Growth common share and $0.144 in cash for each MTL Share, implying a value of $0.91 per MTL Share and a 45% premium based on the average 20-day VWAP as of December 12, 2025.

- The acquisition is expected to establish Canopy Growth as the leading medical cannabis provider in Canada, enhance global flower supply, and generate approximately $10 million in run-rate synergies within 18 months.

- For the six months ended September 30, 2025, MTL Cannabis reported $41,297,515 in net revenue and a net loss of $(8,366,496). The company also delivered $84 million in net revenue and $11 million in operating cash flow for the trailing twelve months ended September 30, 2025.

- The transaction is anticipated to close by the end of February 2026, following a special meeting of MTL shareholders expected in February 2026.

Dec 15, 2025, 12:15 PM

Canopy Growth to Acquire MTL Cannabis

CGC

M&A

New Projects/Investments

Guidance Update

- Canopy Growth has entered into a definitive agreement to acquire MTL Cannabis for approximately $125 million on a fully-diluted equity basis and $179 million on an enterprise value basis.

- MTL Shareholders will receive 0.32 of a Canopy Growth Share and $0.144 in cash for each MTL Share, which represents a 45% premium to the average 20-day VWAP of MTL Shares as of December 12, 2025.

- The transaction is expected to generate approximately $10 million in run-rate synergies within 18 months and is anticipated to be materially accretive to Canopy Growth's overall financial performance, supporting its goal of achieving positive adjusted EBITDA.

- For the trailing twelve-month period ended September 30, 2025, MTL Cannabis reported $84 million in net revenue, 51% gross margin before fair value adjustments, and $11 million in operating cash flow.

- The closing of the transaction is expected before the end of February 2026, subject to necessary court, MTL Shareholder, and regulatory approvals.

Dec 15, 2025, 12:00 PM

Quarterly earnings call transcripts for Canopy Growth.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more