Earnings summaries and quarterly performance for CINCINNATI FINANCIAL.

Executive leadership at CINCINNATI FINANCIAL.

Stephen Spray

President and Chief Executive Officer

John Kellington

Chief Information Officer

Michael Sewell

Chief Financial Officer

Steven Johnston

Executive Chairman of the Board

Steven Soloria

Chief Investment Officer

Teresa Cracas

Chief Risk Officer

Thomas Hogan

Chief Legal Officer and Corporate Secretary

Board of directors at CINCINNATI FINANCIAL.

Charles Schiff

Director

David Osborn

Director

Dirk Debbink

Lead Independent Director

Douglas Skidmore

Director

Edward Wilkins

Director

Gretchen Schar

Director

Jill Meyer

Director

John Steele Jr.

Director

Larry Webb

Director

Linda Clement-Holmes

Director

Nancy Benacci

Director

Peter Wu

Director

Research analysts who have asked questions during CINCINNATI FINANCIAL earnings calls.

Michael Phillips

Oppenheimer & Co. Inc.

8 questions for CINF

C. Gregory Peters

Raymond James

6 questions for CINF

Michael Zaremski

BMO Capital Markets

6 questions for CINF

Paul Newsome

Piper Sandler Companies

3 questions for CINF

Josh Shanker

Bank of America

2 questions for CINF

Mei Yao

KBW

2 questions for CINF

Meyer Shields

Keefe, Bruyette & Woods

2 questions for CINF

Mike Zaremski

BMO Capital Markets

2 questions for CINF

Dean Cristello

KBW

1 question for CINF

Grace Carter

BofA Securities

1 question for CINF

Jing Li

Keefe, Bruyette & Woods (KBW)

1 question for CINF

Jon Paul Newsome

Piper Sandler & Co.

1 question for CINF

Josh Schenker

Bank of America

1 question for CINF

Joshua Shanker

Bank of America Merrill Lynch

1 question for CINF

Mitch (on behalf of Greg Peters)

Raymond James

1 question for CINF

Recent press releases and 8-K filings for CINF.

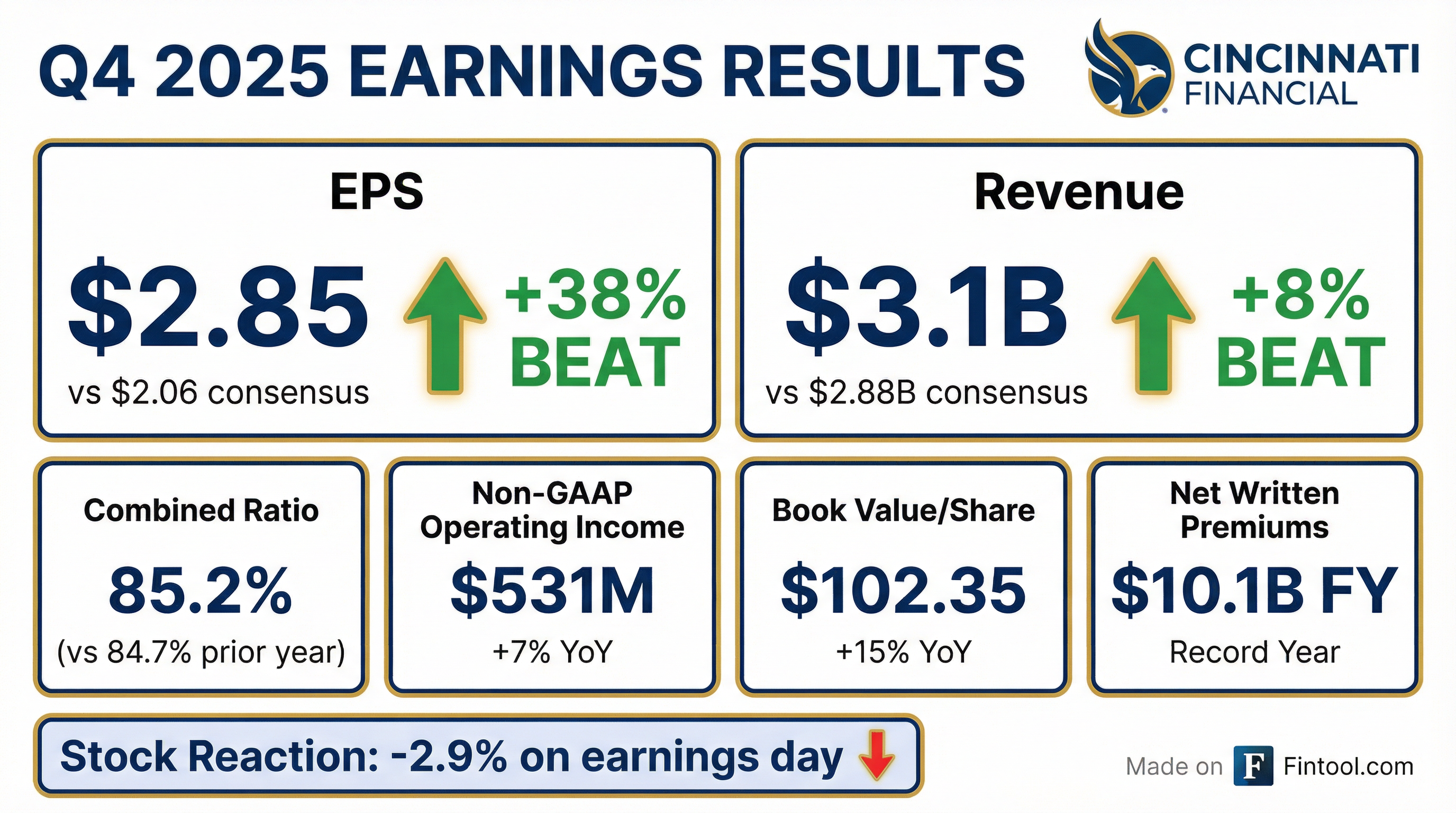

- Full year net income of $2.4 billion, up 4% year-over-year; Q4 net income of $676 million, a 67% increase that included $145 million after-tax fair value gains on equities.

- Strong underwriting with a fourth-quarter combined ratio of 85.2% and full-year combined ratio of 94.9%, despite a 1.6-point rise in catastrophe losses.

- Net written premium growth across segments: commercial lines +7%, personal lines +14%, excess & surplus +11% for full year 2025; consolidated property casualty premiums rose 5% in Q4.

- Investment income up 9% in Q4 and 14% for full year 2025; portfolio net appreciation of ~$8.4 billion; returned $730 million to shareholders via $525 million dividends and $205 million share repurchases.

- Cincinnati Financial delivered Q4 net income of $676 million (+67%) and full-year net income of $2.4 billion (+4%); Q4 non-GAAP operating income rose 7% to $531 million, and the combined ratio was 85.2% in Q4 and 94.9% for FY 2025, with net written premiums up 5% in the quarter.

- Full-year segment results: commercial lines combined ratio 91.1% (NWP +7%), personal lines 103.6% (NWP +14%), and excess & surplus 88.4% (NWP +11%); Cincinnati Re and Global also posted strong underwriting performance.

- Investment income grew 9% in Q4 and 14% year-over-year, with bond interest up 10%, a Q4 pretax average fixed-income yield of 4.92%, and Q4 pretax net gains of $181 million in equities and $24 million in bonds; total portfolio net appreciation was $8.4 billion at quarter end.

- Returned $730 million to shareholders in FY 2025—$525 million in dividends and $205 million in share repurchases (1.4 million shares at an average $151); Q4 parent cash and marketable securities were $5.6 billion, debt-to-capital under 10%, and book value reached $102.35 per share.

- The 2026 reinsurance program was renewed with similar terms; the property catastrophe treaty limit increased to $2 billion (retention $523 million vs $803 million), and ceded premiums are expected at $204 million vs $192 million in 2025.

- Q4 net income was $676 million (up 67%), and FY 2025 net income was $2.4 billion (4% increase); Q4 non-GAAP operating income reached $531 million (7% growth).

- Combined ratio of 85.2% in Q4 lowered the full-year ratio to 94.9%, with catastrophe losses up 1.6 points.

- Net written premiums grew 5% in Q4; FY 2025 segment growth: commercial lines +7%, personal lines +14%, excess & surplus +11%.

- Investment income rose 9% in Q4 and 14% for the full year; returned $730 million to shareholders via $525 million of dividends and $205 million of share repurchases.

- Cincinnati Financial reported Q4 2025 net income of $676 million ($4.29 per share), up from $405 million ($2.56) in Q4 2024, including a $145 million after-tax increase in equity securities fair value.

- Full-year 2025 net income rose to $2.393 billion ($15.17 per share) from $2.292 billion ($14.53), while non-GAAP operating income increased 5% to $1.254 billion ($7.95 per share).

- Fourth-quarter property casualty combined ratio was 85.2%, up 0.5 points year-over-year, with net written premiums growing 5% in Q4 and 9% for the full year.

- Book value per share reached $102.35 at December 31, 2025 (up 15%), delivering a value creation ratio of 18.8% for the year.

- Q4 net income of $676 million (EPS $4.29), vs. $405 million ($2.56), reflecting a $145 million after-tax equity securities fair-value gain.

- Full-year net income of $2.393 billion (EPS $15.17), up from $2.292 billion ($14.53) in 2024.

- Non-GAAP operating income of $531 million (EPS $3.37) in Q4, +7%, and $1.254 billion (EPS $7.95) for FY, +5%.

- Property casualty combined ratio of 85.2% in Q4 (vs. 84.7%) and 94.9% for FY, with net written premiums +9%.

- Book value per share of $102.35 at year-end (+15% YoY) and value creation ratio of 18.8%.

- Quarterly dividend raised 8% to $0.94 per share, payable April 15, 2026, to shareholders of record March 24, 2026.

- Incumbent directors re-elected at subsidiary shareholders’ and directors’ meetings.

- Luyang Fu named Senior Vice President & Chief Actuary; R. Phillip Sandercox appointed Senior Vice President overseeing Cincinnati Re; Andrew M. Schnell named Senior Vice President & Treasurer.

- The board declared an $0.87 per share regular quarterly cash dividend, payable January 15, 2026, to shareholders of record as of December 22, 2025.

- CEO Stephen M. Spray noted the dividend reflects the board’s confidence in the company’s capital position and operational performance.

- The board of directors declared an $0.87 per share regular quarterly cash dividend, payable January 15, 2026, to shareholders of record on December 22, 2025.

- President and CEO Stephen M. Spray noted the dividend reflects the board’s confidence in the company’s capital position and operational performance.

- Cincinnati Financial distributes business, home, and auto insurance through local independent agencies and offers complementary products such as life insurance, fixed annuities, and surplus lines coverage.

- 13.8% Value Creation Ratio on an annualized basis for YTD 9-30-25, surpassing the 10%–13% target, driven by 5.2% net income and 8.6% non-operating contributions

- Q3 ’25 EPS of $7.11 vs $5.20 in Q3 ’24; Non-GAAP operating income of $449 million, up from $224 million, and a combined ratio of 88.2%

- YTD 9-30-25 P&C net written premiums up 10% (Commercial +7%, Personal +16%, E&S +13%, Cincinnati Re +1%, Global +13%), with higher average renewal pricing across lines

- 40.3% of the investment portfolio in common stocks and $30.3 billion fair value total investments; pretax bond yield of 4.67% in 2024 and 5.6-year duration for the $17.63 billion bond portfolio

- Strong capital and risk management: 5.0% debt-to-total-capital, 1-to-1 premiums-to-surplus, and reinsurance retention of first $200 million on catastrophe losses

- Net income of $1.1 billion for Q3 2025, including $675 million after-tax equity fair-value gains; non-GAAP operating income of $449 million, more than double prior-year quarter.

- 9% growth in consolidated P&C net written premiums; combined ratio improved to 88.2% (84.7% on an accident-year basis, ex-catastrophes).

- Investment income up 14%, bond yield averaging 5.10%, with $846 million equity and $242 million bond valuation gains; portfolio net appreciation of $8.2 billion.

- Capital actions: $134 million in dividends, repurchase of 404,000 shares at $149.75 avg, record book value per share $98.76; insurer ratings upgraded to AA- by Fitch.

Quarterly earnings call transcripts for CINCINNATI FINANCIAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more